Alibaba, Inc.: The Best Option in a Bearish Market

6 minutes for reading

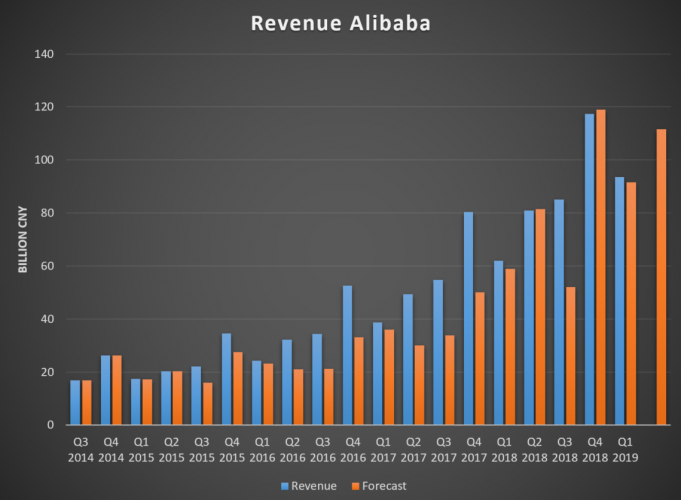

Alibaba (NYSE: BABA) released its quarterly report on May 15, where both the earnings and the EPS exceeded Bloomberg's expectations. The earnings hit CNY 93.50B, or $13.60B, 50.60% more than a year before, while the net profit rose by 250%, reaching CNY 25.83B, or $3.72B. The EPS climbed, too: CNY 8.57 ($1.23) against CNY 5.73 ($0.82) in May 2018. This heavy rise was backed by both the steadily working commercial units and the new income sources, such as cloud computing, logistics, and consumer services.

Over the last 12 months, Alibaba managed to boost its trading turnover by 35%, with the commission income rising by 30%, logistic services income, by 35%, and the cloud services bringing +76%.

Meanwhile, Alibaba's customer base rose to 654M active shoppers, which means the advert income is going to get boosted, too. According to some sources, the company is to get around $30B from ads in 2019; if this is the case, it is going to be third to just Alphabet (NASDAQ: GOOG) and Facebook (NASDAQ: FB), with $102.40B and $67.20B, respectively.

Since the IPO in 2014, Alibaba's quarterly earnings rallied from $2.40B to $13.60, failing to beat analysts' expectations only twice.

Once the report got released, the stock rose by 1.50%, but currently it is already 15% down, probably because of the bearish outlook and the large investors cashing out and waiting.

Alibaba: What to Expect

Alibaba is currently not competing against Tencent (NYSE: TME), a Japanese company that now works on QR code standard harmonization alongside with the Jack Ma's company.

Mobile payment industry is growing rapidly around the world, and there are over 10 providers in Japan alone. The point is that each provider may use its own QR code standard, which leads to payment issues on the customer side. This is why arriving to a unified standard is important. On the other hand, it will also boost sales, and, in its turn, Alibaba's earnings.

Meanwhile, in China, Alibaba is negotiating to become a shipping provider for Luckin Coffee (NASDAQ: LK), a fast-growing coffee shop chain and a Starbucks (NASDAQ: SBUX) competitor. Luckin has currently only one shipping contractor, and partnering with Alibaba will help it diversify risks, while Alibaba is going to get yet another income source.

While Alibaba is constantly expanding its business through working with other companies and acquiring some startups, this may both boost its earnings and expenses. How this will reflect in the stock price, yet remains to be seen: on the one hand, the shares are rising steadily, but any strategic error may prevent them from doing so in the future. In India, for instance, Alibaba was a failure and has now to reconsider its strategy, avoiding large investments and planning only small ones. This is because some Indian companies Alibaba acquired were unable to be competitive and resulted only in losses. Taking all that into account, one may assume Alibaba's contracts are not always a positive sign.

There's yet another thing to pay attention to. China has around 1.40 billion people. The Sino-US trade wars are sure to slow down the local economy, and, in order to get it afloat, the government is already turning to the domestic demand.

A similar thing happened to Portugal that had been an 'outcast' in the EU for years, but is currently showing great results in economic growth, precisely because of the high local demand. Therefore, with China getting import-oriented, one should still remember Alibaba has not conquered the local market yet. Over the last year, there were over 100M new active consumers, with about 70% of them being from small cities and towns. Such clients are usually very cautious in making their first purchases, but once they get sure, they start shopping much more actively. This is the so-called delayed demand that has a great positive potential. With +102M new shoppers in 2018, the effect is highly likely to be there in 2019. Add to that the possible government's stimuli, and you'll get to the fact that the investors undervalue Alibaba. See now, the current low price may prove a great entry point for a long term position.

What Are the Risks

While doing well in China, the company is not that successful in the EU. Thus, during Viva Tech (Paris, France), an Alibaba co-founder said the region is so much 'obsessed' with technical regulation that it might get well behind other economies in the future. He added both China and the US allow the companies to go global thanks to mild regulation, while very few EU-based companies, such as Alphabet and PayPal, were able to achieve the same.

The point is that Alibaba has to face EU customers' complains on the dispute resolution policy. According to Alibaba's terms, the customers, in case of a dispute, may file an action to the Hong Kong court, while the EU-based shoppers want to deal with their local judicial authorities instead. With Alphabet suffering a nearly $10B penalty because of the EU regulation violations, Alibaba's presence in the EU market may cost the company some good deal of money as well.

Alibaba Tech Analysis

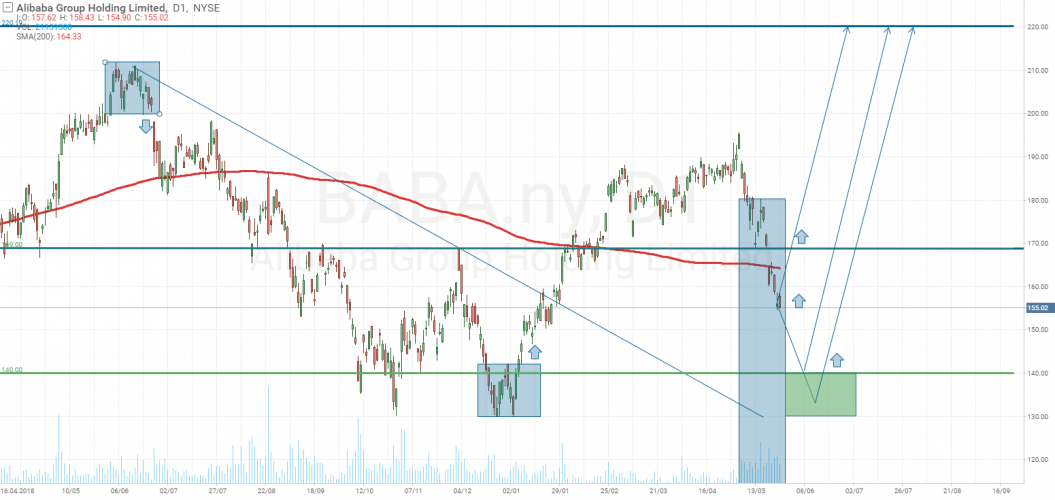

The stock had been downtrending since 2018, when a double top formed at $210, but then the price formed a double bottom and reversed, breaking out the 200-day MA and rising to $195.

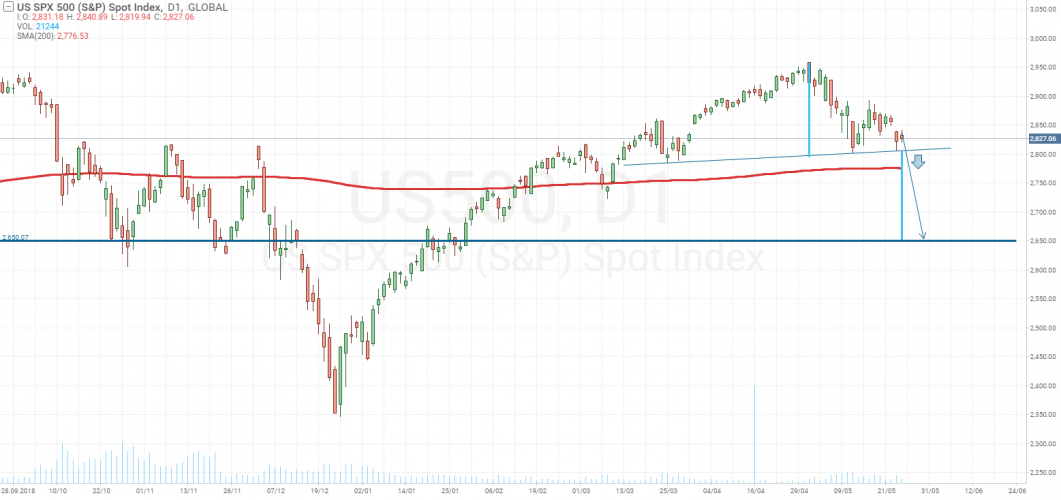

This newly born uptrend could well go on, but the S&P500 started going down after reaching 2,958 on May 1 and then falling by 1.20% by the end of the trading session.

The negative market sentiment sent the Alibaba stock down as well, which started on May 6. According to the charts, however, not all traders agreed to it: while the stock often opened with a gap headed down, it managed to somewhat recover by the end of the session. After the Q1 report the shares rallied for three days in a row, but the overall bearish outlook took the stock down from $180 to $155.

Conclusion

Long term wise, the stock looks very promising for investment, with the financial data quite alright and the Chinese government support probably becoming a very good driver (the investors tend to overlook the latter). Meanwhile, the ongoing trade wars are already something that could be priced, and the overall bearish outlook is a great option to take a long position at a good price, especially once the stock is between $130 and $140.

A good tip for reversal could be a double bottom, which, according to the historical data, often proves to be a good signal, as well as the rising volume.

To invest in Alibaba with RoboForex, open an R StocksTrader account with 1:1 leverage, in which case you will not incur swaps. Unluckily, Alibaba does not pay dividends, and the shareholders only get profit on the price difference. In order to boost the share flow, Alibaba scheduled a buyout program, with shares on $6M being bought in the course of two years.