What to Expect from Google, McDonald’s and Starbucks This Week?

8 minutes for reading

This week investor attention on the market will be attracted to the reports of such widely known companies as Alphabet (NASDAQ: GOOG), McDonald’s (NYSE: MCD) and Starbucks (NASDAQ: SBUX). Let us have a look at these companies and study the market expectations about them.

Alphabet Inc. stock analysis

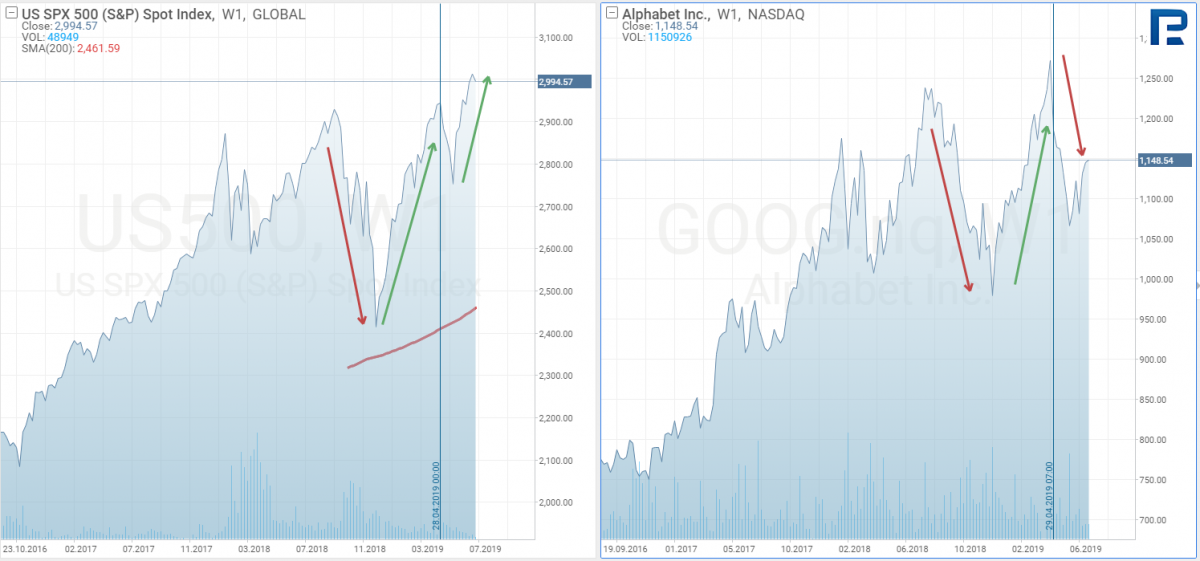

For the last six months Alphabet stocks have been trading in the price range between 1,000 and 1,300 USD. The April crush of the stock market S&P500 influenced the stocks of Google as well: they fell in price by 24%. However, the index managed to recuperate and even renewed the record maximums, while Google stocks failed to recover and are now trading in the middle of the range at 1,150 USD.

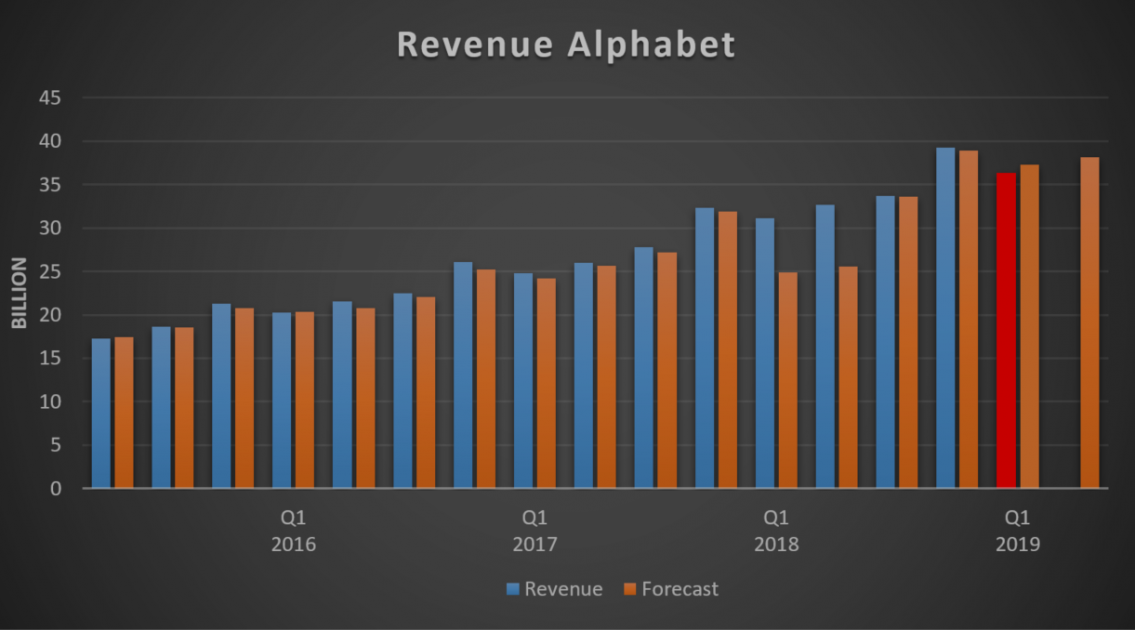

Such investor behavior is quite explicable here, as the company failed to meet the expectations about the income, which even dropped by more than 3 billion USD compared to the previous quarter. It is the first time in the company’s history that the income fell so dramatically. Yet another factor of pressure became a decline of the net profit as well, taking place during the last two quarters. In the 3rd quarter of 2018 the company made a record profit of 9.2 billion USD, while the first quarter of 2019 ended up with a 6.6 billion USD profit.

Naturally, these events made the investors think that Alphabet has reached its current climax in terms of profit, so a decline may follow. Thus, there emerged not so many people willing to buy the stocks for more than 1,000 USD, which led to a weak increase in the stock prices after the decline. However, if we look at the income diagram for the last 4 years, we shall see that every year the company’s income declined in the first quarter, in comparison with the previous one; the only difference would be that the income did not surplus the forecasts, and in total the decline of the net profit and the expectations not met led to a decrease of the stock price.

Presently, the income from the Google browser makes the most part of the profit; thus Alphabet generates a strong money flow, amounting to 30 billion USD, which lets the company make investments into its other businesses. This way Google diversifies its profile, so that in future it will not depend on the browser that much; such a business model, in its turn, will attract new investors to Alphabet. The recent scandal, when Trump blamed the management of Alphabet in the partnership with China, had little influence on the stock prices.

In 2016 the company began work on development of a browser Dragonfly, that would become a prototype of a search service in China; the information became public after Alphabet signed a military contract with the USA; the project became a target for acute critics of the Pentagon, so the company had to scrap the project. This year all employees were fired from the Dragonfly project, and July 16th Alphabet vice president for public and government relations Karan Bhatia declared that the project was completely closed. This is the reason that the Google stocks survived the scandal with such ease. Anyway, this news will have no influence upon the financial results of the 2nd quarter of 2019.

As for the forecasts about the 2nd quarter, the analysts interviewed by the Bloomberg expect growth to 38.17 billion USD, which is 16% more than during the same period of the previous year; however, the return on a stock may decline to 11.48 cents, which is a 2.3% decline, compared to the 2nd quarter of 2018.

Currently, the Forward P/E index of the company is 25.23, which is a discount in comparison with the rest of the branch. 86% of the analysts interviewed by the Bloomberg recommend to buy the stocks, 14% advise to hold the stocks in the portfolio and no one tells to sell. Of course, everything will depend on the financial report, as the views of the analysts may change abruptly after its publication. The income of Alphabet my grow; however, what is worth paying attention here is the net profit as it keeps declining for the second quarter in a row; if the trend continues, it will signal a possible correction of the stocks, perhaps resulting in a test of 1,000 USD.

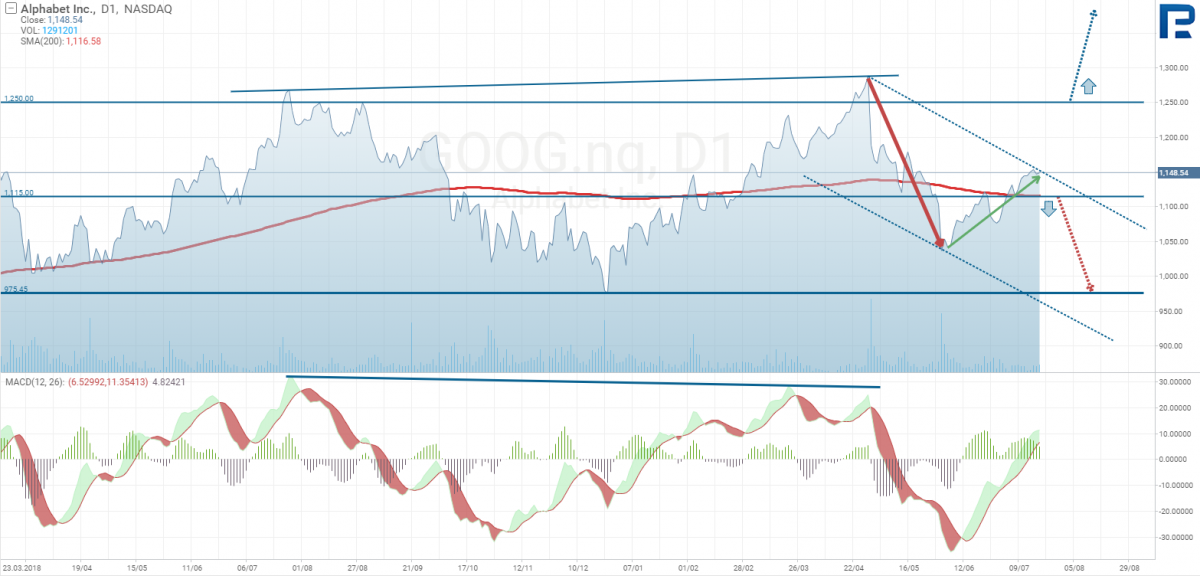

The technical analysis of Google does not look that appealing. On D1 the price is trading around the 200-day Moving Average, which is the trend indicator. In the present situation it demonstrates a lack of any directed movement, i.e. the market players are doubtful about what to do next. A divergence hints a possible further decline, while the current growth of the price looks more like a correction of the possible descending trend. That is why a breakthrough of 1,115 USD may provoke a decline to the support at 975 USD. The Fed hints on a decrease of the interest rate on one of the upcoming sessions, which will weaken the dollar in relation with the other currencies; this should enhance export to the US and increase profit of companies. So, investors take this decision of the Fed positively, which may entail an increase in the hunger for risk, changing the market situation completely. Google stocks may take the wave of optimism, renew their maximums and grow to 1,500 USD.

McDonald’s Corporation stock analysis

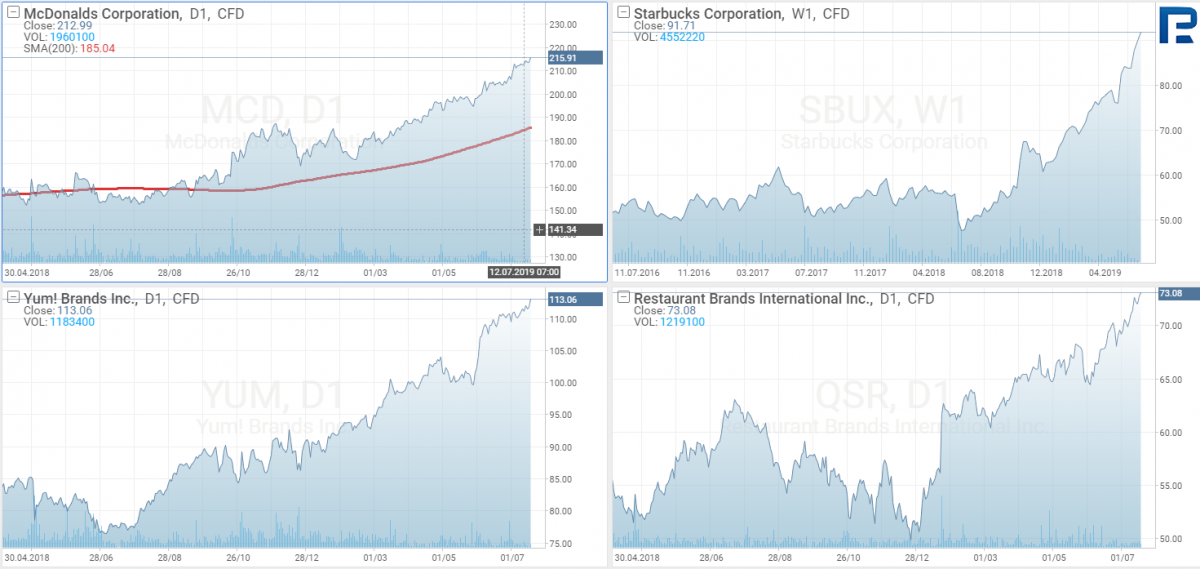

McDonald’s stocks feel better than ever. While before I suggested that there would be a correction before growth, now it is obvious that investors are ready to buy the stocks at any price, and virtually every week results in price growth. The April decline of stock indices had no influence on McDonald’s stocks at all. However, it turned out that they are not the only ones trading at their maximums - the company’s major rivals are also taking new heights. It seems that in the developed countries people have decided to stop wasting their time on cooking and instead order food delivery or have their meals at restaurants.

McDonald’s is cooperating with a number of food delivery services already; as for the partnership with DoorDash, the clients subscribed to this company will have their food delivered for free. In fact, there has been little change on the fast food market globally, people have not given up traditional meals for fast food. The point is that the delivery of meals from fast food restaurants has pushed people to prefer, say, a McDonald’s lunch to a delivered pizza. This tendency can be seen on the corresponding charts.

On July 16th Domino’s Pizza (NYSE: DPZ) has published its financial report for the 2nd quarter of 2019; the forecast income had been 836 million USD, but in fact it turned out 25 million less. Such news dropped the stock price for 13%. Next, Papa John’s (NASDAQ: PZZA) stocks declined for 4%. Though the company will publish the financial report only on August 7th, investors try to act in advance and are taking short positions already. According to Reuters, investment funds are cutting on their positions in the company’s stocks, and the Short Float index has already overcome 22%.

Out of the fast food restaurants the first ones to publish their reports will be McDonald’s and Starbucks, issuing their results on July 25th. McDonald’s profit is expected to be around 5.32 billion USD, which is only 0.5% less than in the 2nd quarter of 2018, while the return on stock is expected to grow from 1.99 USD to 2.05 USD.

Starbucks has much higher expectations than McDonald’s. In the 2nd quarter of 2019 its income is forecast to grow from 6.31 to 6.67 billion USD, while the return on stock may grow from 0.62 to 0.72 USD. Investors will keep an eye on the reports of this company as they will serve as a landmark for the income of the companies Restaurant Brands International Inc. (NYSE: QRS), that will publish its report on July 31st, and YUM! Brands Inc. (NYSE: YUM), that will publish its data on August 3rd.

Summary

Presently, it is rather hard to find a suitable company to invest in at the current prices. Trump’s administration is urging the Fed to decrease the interest rate, which, in Trump’s opinion, should support the US economy and enhance its further development. In fact, we see that the market reacted on the Fed’s plans by a short-term decline of the dollar in relation with other major currencies, but the USD resumed its growth on Friday. Investment funds have reduced their positions on the stock market to the minimums of 2008; some fund managers consider the market overbought, thus the decrease of the interest rate will make the bubble inflate.

Cheap dollar may lead to the growth of the hunger for risk among investors; however, the S&P500 index demonstrates that as soon as the hunger becomes maximal, those eager to support the market with their purchases disappear. All this looks very much like an artificial attempt of the US government to support the market, which brings about an idea that we have reached a climax, and from now on a substantial correction of stock indices is to be expected, followed by a correction of other stocks. By September, most reports will be published, and investors will be able to look at the whole picture. This month will, perhaps, become a turning point, as it has happened before, but now there is still a chance to make several jumps up thanks to good reports.