Will Netflix Keep Its Subscribers?

8 minutes for reading

On August 6th Walt Disney Company (NYSE: DIS) submitted its financial report for the second quarter of 2019. According to the report, the company's income has reached record levels, amounting to 20.25 billion USD; however, it has not matched the forecast level of 21.46 billion USD, which led to a steep decline of the stock price by 5%.

There were other factors influencing the decisions of the investors. The return on stock decreased to 1.35 USD, which is 28% less than the same period last year; net profit fell from 2.916 billion USD to 1.760 billion USD. The company connects its current decrease of profit to the integration of 21st Century Fox (NASDAQ: FOXA) (21CF), a small reduction, by 3%, of the number of visits to thematic Disney parks, as well as the reduction of the volume of broadcasting.

21th Century Fox stocks analysis

Disney was first heard to purchase 21CF in November 2017, when the CNBC channel announced The Walt Disney Company to negotiate with Rupert Murdoch about buying a part of 21st Century Fox, including 20th Century Fox, FX Networks and National Geographic Partners. The reason for Disney to make this step was the purchase of the young BAMTech Media in 2015, which dealt with streaming services and was later renamed into Disney Streaming Services. According to Disney director-general Robert Iger, they were not as much interested in the production capacities of 21CF; their main goal was to purchase its movies and television libraries in order to enhance the broadcasting of Disney Streaming Services.

However, the management did not expect 21CF inside Walt Disney to close the second quarter with an operational loss of 170 million USD, while in the same quarter of the previous year the operational profit of the same department reached 180 million USD. In the end, Disney forecast a decline of the return on stock by 0.35 USD in the second quarter, while in reality, it turned out 0.6 USD. All in all, the situation influenced the resulting return on the stock in the second quarter of 2019.

However, the current decline may be considered temporary, because merging with FOX will let Disney increase the monetization of the products purchased and develop its own streaming service to become a serious rival of Netflix (NASDAQ: NFLX).

Media conglomerate 21st Century Fox provoked the interest of not only Walt Disney: telecommunication conglomerate, represented by Comcast Corp also intended to buy it, but Walt Disney suggested better conditions, paying partly in stocks instead of cash. The purchase was also important for Disney because they already owned 40% of the streaming service Hulu, while 21CF held 30 more percent of this company; as a result, the purchase let increase the Disney part in Hulu up to 70%; the remaining 30% belongs to Comcast (NASDAQ: CMCSA); Disney agreed with Comcast for a purchase by 2024.

Netflix stocks analysis

Walt Disney has announced its plans by November 12th, 2019 to launch paid subscription on Disney+, Hulu and ESNP+ for 12.99 USD, which is the price of the most popular Netflix (NFLX) package. This increases the probability of Netflix subscribers to opt for Walt Disney, which movement may become visible in the results of the 4th quarter of 2019. However, investors always go ahead, that is why Netflix stocks may soon fall in price. According to the financial report of Netflix for the 2nd quarter of 2019, the number of paid international subscribers was 2.83 million against the forecast 4.81 million. It is, of course, no fault of Walt Disney; however, there are going to emerge several rivals for Netflix soon, such as AT&T (NYSE: T), Comcast and Apple (NASDAQ: AAPL), the letter also planning to enter the market of broadcasting with its service Apple TV+.

Netflix itself explains the results by the seasonal decline; nonetheless, the latest news shows that the company is merely losing profitable content. For example, movies and shows of such brands as National Geographic, Marvel, Star Wars and Pixar are going to be broadcast on Disney+ only. TV series Friends and The Office, which Netflix spent 100 million USD on, are returning to WarnerMedia in 2019, the latter hoping to bring some 70 million subscribers to their broadcasting service, HBO Max. The only difference of Netflix from other broadcasting services remains the absence of commercials, and the management is quite sure they are not going to appear on the service soon. Another ace in the hole turned out to be The Game Of Thrones creators David Benioff and D. B. Weiss that Netflix managed to attract to their team, though Disney, Apple, Comcast and AT&T had been fighting over such figures. Well, Netflix won here. The loss of the popular series may be compensated for by new shows by The Game Of Thrones creators.

Thus, 2020 is going to be tough for Netflix. Creation of a show will require large investments, the launch of a broadcasting service by Disney may increase the outflow of users, some of which will follow their favorite shows — all together will be a risk for the investors willing to put their money into the company's stocks. Their price already declined by 19% last month, while the latest decline of stock indices has not influenced the stock price significantly, which means there are inner problems in the company. Short Float is now at 4.26%, and this index also needs to be kept an eye on, as its increase will signify the investor attitude to Netflix.

In order to assess the company's position on the market, its comparison with the rivals will be useful. Of course, currently it is not fair to compare Apple with Netflix: they will, indeed, contest on the broadcasting market, but this field is not the main source of revenue for Apple and is not likely to become so in future. For this reason, the table below features only the companies similar to Netflix in their activities.

| Netflix | CBS Crp | AT&T | Comcast | Walt Disney | |

|---|---|---|---|---|---|

| Stock price ($B) | 315 | 50 | 34 | 42.66 | 138 |

| Capitalization ($B) | 138.6 | 19.13 | 252.59 | 194.93 | 248.41 |

| Stocks in circulation | 437.834 | 374.812 | 7307.00 | 4544.985 | 1801.379 |

| Net profit ($B) | 0.270 | 1.583 | 3.713 | 3.125 | 1.760 |

| Income ($B) | 4.923 | 4.167 | 44.957 | 26.858 | 20.245 |

| Operational income ($B) | 0.706 | 1.22 | 7.5 | 5.35 | 2.79 |

| Cash available ($B) | 5.004 | 0.5 | 8.423 | 3.91 | 10.10 |

| All commitments ($B) | 24.06 | 19.72 | 352.833 | 178.72 | 110.00 |

| Gross assets ($B) | 30.171 | 24.07 | 546.914 | 256.55 | 214.34 |

| P/E | 127.17 | 6.44 | 15.19 | 16.07 | 15.51 |

| Short Float (%) | 4.26 | 3.65 | 1.39 | 1.66 | 0.95 |

What is visible at once is the huge difference in the income of Netflix and the companies that are planning to enter the broadcasting market and become rivals of Netflix. The latter has the highest P/E and Short Float of all companies in the table. Its net profit is 6 times less than that of CBS, the latter having 7 times less capitalization than Netflix does. We may suppose that the stocks are overpriced, costing 335 USD per stock. And if we keep it in mind that such large companies as the mentioned above are entering the market, we will naturally have our doubts whether to buy the stocks at the current levels.

Netflix stocks tech analysis

Netflix stocks are trading below the 200-t daily Moving Average, which signifies possible development of a downtrend. Yet another signal of decline is the fact that the stocks used to trade in the range between 340 and 380 USD, and now the price has escaped the range top-down, which means the prevalence of short positions in the stock. The next support level for the stocks is going to be 250 USD. This forecast may change abruptly in case the price breaks away 340 USD. In this case, the uptrend may resume with the aim at the resistance of 420 USD.

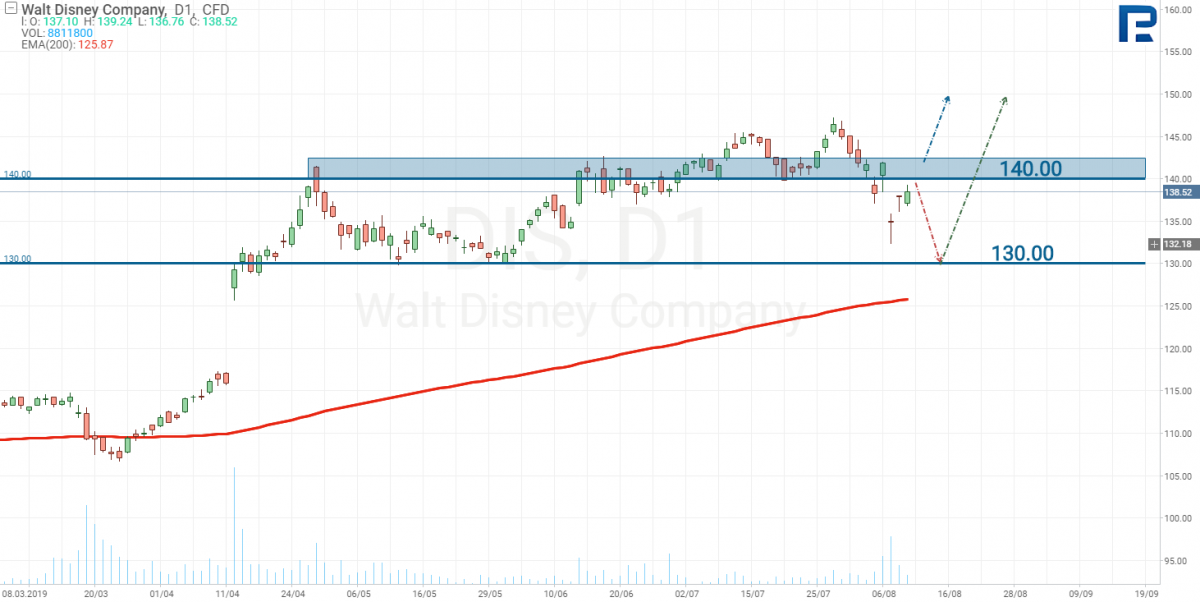

Walt Disney Corp stocks tech analysis

Disney stocks are currently trading in an uptrend, which is also confirmed by fundamental indices showing record revenue and the historical maximum of the price. The recent decline provoked by the quarterly reports may be used by investors as a good opportunity for buying. However, a more conservative entrance would be a bounce off 130 USD. Another wave of the decline of stock indices may pull Walt Disney stocks down to this level. However, if this does not happen, the signal for future growth may be the breakaway of the resistance at 140 USD. The closest aim of growth may be the psychologically important level of 150 USD.

Summary

Currently, Netflix has more than 130M subscribers all over the world; in the 2000s Walmart (NYSE: WMT), Blockbuster Video and Amazon (NASDAQ: AMZN) tried to compete with it, but Netflix won the race. However, the situation has changed. While previously the rivals spread only their own content or that purchased under license and fought just over the client, today they are taking their content away from Netflix or raise the price of the license, so that it becomes unprofitable for Netflix to keep that content. This is what happened to the licenses for Friends and The Office.

Last year Netflix paid 30 million USD for the license, but this year the price grew up to 100 million USD. Disney is acquiring the movies of Marvel and Star Wars that are going to be demonstrated on Disney+ only. For the subscribers, the increase of rivalry will mean a decrease in the price of the service and the enhancement of its provision. Conversely, for the investor it means risk, as there is some uncertainty about who is going to be the winner; keeping in mind the fact that Netflix rivals will be not only Disney but other major companies, it would be a too risky decision to buy Netflix stocks at the current levels. Walt Disney stocks look a much more attractive investment.