AT&T: Great Investment for a Couple of Years

12 minutes for reading

Looking back, you realize that for making a profit on the stock market it is not necessary to have an education in economy, to know how to read financial reports or to forecast the future. It is enough to be patient. Woking without leverage and having good patience is 90% of success, you only have to make the right choice.

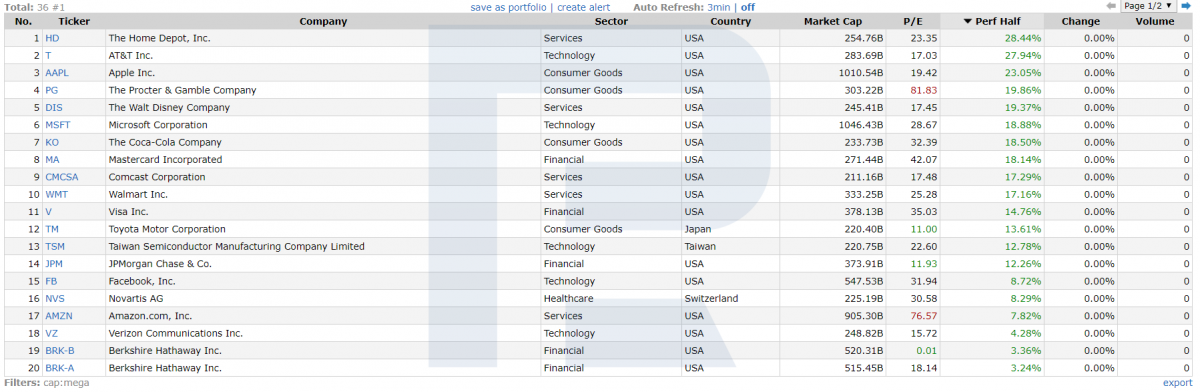

However, in the experiment with an ape, carried out by the Finance journal in 2008, a portfolio of 9 stocks, chosen by a monkey, turned out to be more efficient than that gathered by heads of investment funds (the profitability was compared after 10 years). In our case, we should discuss the investment period of the last 9 months, paying attention to the companies with the capitalization over 200 billion USD and positive net profit. This information is public, available even to beginner traders.

The scanner on the finviz.com website suggests 36 companies with the capitalization over 200 billion USD. The leader among them is Home Depot (NYSE: HD), which stock price has grown by 28%. However, the most vivid interest here is provoked by AT&T (NYSE: T). The stocks of this company are also in an uptrend, which has recently sped up significantly. Imagine someone says that this company is the most underpriced of all giants and its stocks should cost 60 USD each. First, a question emerges, who said this; second, if they have bought any stocks of the company themselves. Today, we will discuss why this company is considered underpriced and who has bought its stocks for more than 3 billion USD.

About AT&T

AT&T is an American transnational telecommunication company, the largest supplier of mobile communication and the second-largest mobile services provider in the USA. 20% of its income the company receives from military contracts with the US Ministry of Defense. AT&T is the 18th largest mobile operator in the world.

Currently, the company consists of 4 departments. AT&T Communications provides communication services to US users and almost 3 million companies all over the world. In 2018, the income of this department amounted to 144 billion USD.

AT&T Latin America works as a mobile services provider in Mexica and provides paid television services in South America and the Caribbean. In 2018, its income reached 7 billion USD. WarnerMedia, including WarnerMedia Entertainment, WarnerMedia News & Sports, and Warner Bros, generated 33 billion USD of income in 2018.

Xandr provides ready-made advertising decisions, based on the client database information of AT&T, to marketing companies. In 2018, this department generated more than 7 billion USD.

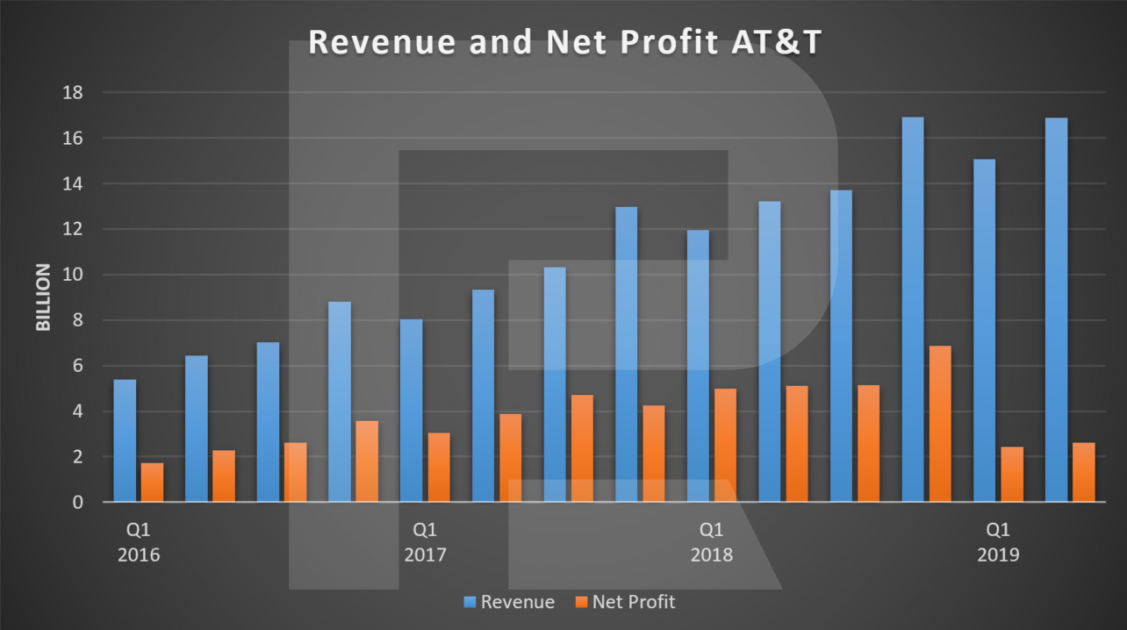

AT&T finance

The profitability chart of the company looks as attractive as its stocks have been looking recently.

Its net profit has declined in the last two quarters due to several factors. First, the company reduced its spendings on the marketing advertising of cable television, which led to an outflow of 900 million subscribers. This was no surprise to the management, they had warned of a possible decrease in the client base. Second, the company bought Time Warner, which increased its debt load by 170 billion USD, and the expenses on its integration led to a decrease in net profit. All in all, its net profit is positive, its income is growing; more detailed financial information does not reveal any problems either. However, this is the data from the past, giving us no promises for the future. What is worth paying attention to is the direction of the company's development and the reason for the stocks to be stuck in place for so long while the income and the net profit have been growing constantly.

AT&T under Ed Whitacre

Till 2007, the company was managed by Ed Whitacre. At that time, AT&T had a clear development strategy. Each merged company had its role in the whole structure as yet another piece of the puzzle, meant for increasing the company's presence on the market. The company's stocks in the times of Ed Whitacre (1984-2007) grew by more than 2000%, its profitability turning out higher than the S&P500 index and the stocks of its main rival Verizon (NYSE: VZ).

Change of strategy

After Whitacre resigned, the AT&T management introduced another strategy of development, which let to mergings for some 200 billion USD. The result was a diversified conglomerate working on several markets simultaneously, and the company turned from a telecommunication enterprise into a gathering of entities, each developing its own sphere. However, those entities shared the management. As a result, smaller companies were faster to introduce novelties, enhance service quality and drive subscribers away from AT&T. A couple of examples will be enough to realize how hulking the company has become.

AT&T decided against introducing the 4G LTE network, which situation was immediately used by its rival Verizon. The latter demonstrated good results in this direction, earning a reputation of a company providing super high-quality services — and making a profit of 20 billion USD.

In the end, Verizon became the leader in terms of the network quality; T-Mobile (NASDAQ: TMUS) started experimenting with tariff plans, offering unlimited and family packages. It so happened that Verizon took up the premium segment, T-Mobile occupied the niche of those looking for advantageous suggestions, while the third rival Sprint (NYSE: S) aimed at the population with lower income. AT&T kept earning money on its name, suggesting nothing new. As a result, AT&T lost 40% of its share of the market during the last 10 years, while T-Mobile managed to increase its share by 60%.

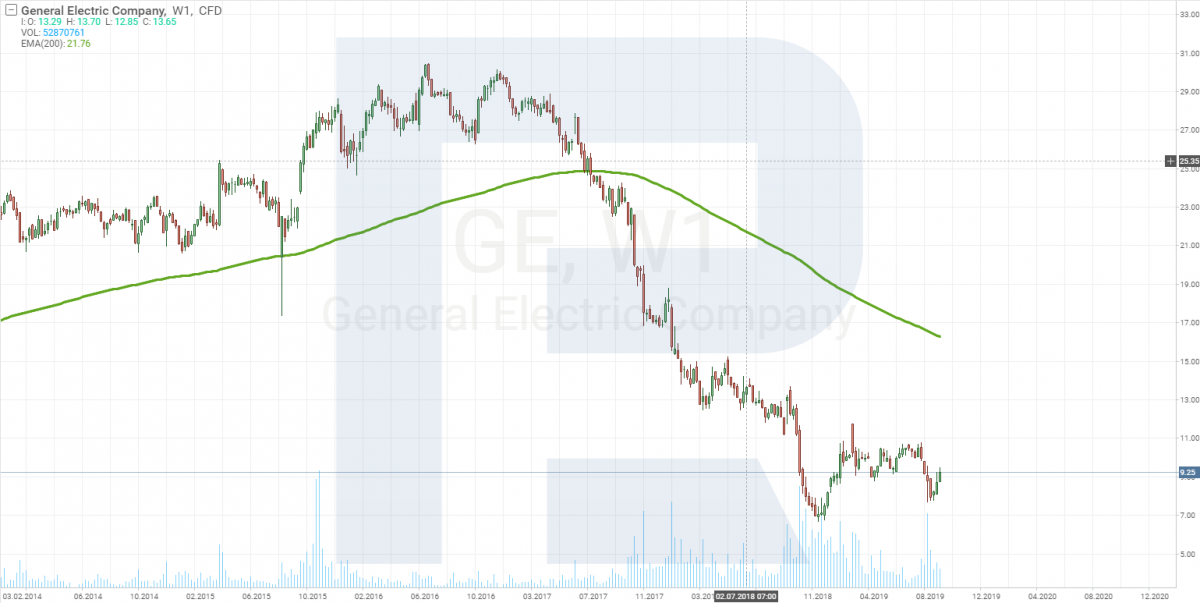

AT&T turns out to be sort of a ticking bomb: its stock price is crawling upwards but, in fact, it may drop at once. It is enough to bring up an example of General Electric (NYSE: GE) which diversified its income so much that nowadays its debts are two times higher than its assets. Investors, of course, reacted on this strategy by selling General Electric stocks. In the end, the company is reducing its expenses and getting rid of losing enterprises.

However, for AT&T not everything is lost yet. They have a chance and time to change their strategy and keep increasing their income, attracting investors by decent dividends. Only, in order to do this, they will have to admit the mistakes of certain mergings and, perhaps, even to get rid of certain departments. A change of strategy will prevent the company from repeating the fate of General Electric.

Paul Singer

It was Paul Singer, the head of a hedge fund and a billionaire, who suggested changing the strategy of development of AT&T. He is sure that the company is currently underpriced, and the risks connected to the diversification of the business are overestimated. Investors used to treat the company with too much caution and did not rush at putting their money in it, which led to such a long stagnation of the stock price. To confirm his viewpoint, Singer bought AT&T stocks for 3 billion USD, pointing at the perspective of their growth to 60 USD.

So, who is Paul Singer and why did the stock price grow swiftly after the news that Singer's hedge fund invested its money in AT&T?

Paul Elliot Singer is an American investor and the head of the Management Corporation Elliot hedge fund; his own capital is 3.5 billion USD. Its fund specializes in buying bonds of troublesome countries and debts of bankrupt firms. Then the fund persecutes the debtor countries that avoid fulfilling their engagements. The Fortune journal calls Singer one of the cleverest and toughest money managers; others call him "vulture capitalist". Some criticize him for his methods of earning money as such actions lead the debtor country to bankruptcy. All help from other countries is spent on paying off the debts on the bonds with higher percents. Singer explains that this way he fights frauds and corrupt officials that drive the country into debts and do not give the investors back their money, looking for the ones to blame instead. By his policy, he advises everyone to make balanced decisions and think of consequences in advance.

Paul Singer’s strategy of development

With such an investor, AT&T has no right for a mistake. In the USA, there is a widespread judicial practice of claiming damages, entailed by a decrease in the stock price, from companies. The court procedures are launched in case of a loss of more than 100 thousand USD; the companies are accused of disinforming investors or revealing just partial information about their plans and activities. I.e. any company may be written off by such accusations; keeping in mind Singer's experience, it will not be a problem for him. I might be exaggerating the importance of Singer, but his fund addressed the management of AT&T with its view of the future development of the company, and the management agreed (imagine that someone comes to your company with the capitalization of 275 billion USD telling you how to work, and you agree obediently). One of the suggestions is to get rid of losing assets and return to the previous way of development.

The fashion for conglomerates has passed, and companies are not eager to enhance their influence on all market segments as this way the main business suffers, earning less money for the development of new projects. Buying Time Warner might have possibly been a mistake; it was bought almost at the very peak. And now, through this company AT&T is planning to master broadcasting, competing with Apple (NASDAQ: AAPL), Disney (NYSE: DIS) and Netflix (NASDAQ: NFLX).

This time the company is counting on the existing client base that may use this service. Anyway, launching HBO Max (the broadcasting service by AT&T) is planned for 2021, and by this moment its rivals will secure on the market, while AT&T will be a newcomer. The investor skepticism is explained by the actions of the company's management as well. It still has its doubts about how to use Time Warner. Initially, the company was counting on Warner Brothers, then they changed their mind and are paying maximum attention to HBO Max now. However, this is not it: a year after the merging, all the Time Warner management left the company, and now AT&T, working in the field of telecommunication, has to learn how to manage a company providing news and entertainment.

AT&T perspectives

As we may see, all the problems of the company may be explained by buying Time Warner. The investors did not understand what AT&T needed the company for, while the AT&T management could not make its mind how to use the company until 2019. All in all, in 2016, when the purchase of Time Warner was announced, the stocks reached its peak and started a two-year-long decline.

The investors started buying the stocks after AT&T counted banks on HBO Max. Though the net profit was declining, the investors were buying the stocks for the future. Time Warner, later renamed as WarnerMedia, is one of the leading world franchises in the field of movie production and television. Thanks to well-known brands and the leading content in the field, this department — in the case of talented management — may significantly increase the company's income.

The 4G network is already missed, but the 5G technology is at the threshold, and here AT&T feels more than free. Using its employees and modern equipment, the company may become the leader of the 5G networks, attracting new users by new services.

Another strong side of the company is its high dividend return, which is around 6% per annum, which is much higher than that of the US treasury bonds. The company has been paying dividends for more than 35 years, and if Paul Singer has invested 3 billion USD into the company, by 2021 (when Singer is expecting the stock price to reach 60 USD) its fund will have received some 180 billion USD dividends.

Presently, perhaps, the management of AT&T will stop merging and focus on the existing assets. In this case, the free money may be spent on paying off debts and repurchasing its stocks. This will enhance its financial indicators and lead to the growth of the stock price.

Summary

The news about Singer buying AT&T stocks has induced investors' interest in the company, which, in its turn, made the stock price grow to 39 USD. However, it is unwise to share the general euphoria and buy the stocks at the current price. The fund has an investment horizon of several years, and they had bought the stocks before everyone found out. A part of speculators will decide to lock in the quick profit, which may entail price correction. Moreover, such stocks are paid attention to by those who make a profit on the decrease in price. So, we should soon expect a decline in the price to 36 USD.

This price will be optimal for buying. If you have an investment horizon of 2-3 years, then there is no big difference where to buy. Dividends of 6% per annum will allow making a profit even if the price remains around 35 USD by 2021. The question is whether you have enough patience to wait.

In order to buy AT&T stocks and not to pay the overnight fee, you need to open your account with 1:1 leverage, the platform provided for free. In this case, your expenses will be the fees for opening and closing your position. Your income will be the dividends and stock price growth.