Situational Vs. Systematic Trading: Which One is More Efficient?

7 minutes for reading

To be successful on financial markets, you need a neat trading system that will give you a clear understanding of how to enter and exit the market either with a profit or a loss. The rules of money management are also worth sticking to as they will psychologically prepare you for a series of losing trades as well as profitable ones.

Trading with a high-quality system is different from trading without one is also better in the sense that you do not need to think about whether the situation on the market is good enough to enter. You simply follow the rules and open or close trades, moving along the price chart.

Unfortunately, no one can tell if the current pattern will be executed or you will have to close it at the Stop Loss. To find out, you just have to trade the chosen method. Of course, you can use certain lifehacks and take measures to increase the probability of the execution of the signal, such as trading on a demo account until you receive two losing positions and only then moving to a real one. There are plenty of ways and methods of trading in the world, and every day millions of traders try to conquer the market.

In this article, we shall have a look at the pros and cons of both systematic and situational trading, discuss their differences, and speak about the practicability of each of them.

Systematic trading

Here, we are talking about a simple indicator-based system that will give the same signals to a dozen of different traders. As a rule, systematic trading does not allow for more than one opinion about the current market situation; the trader just needs to open a position and wait or to wait for a signal to enter the market.

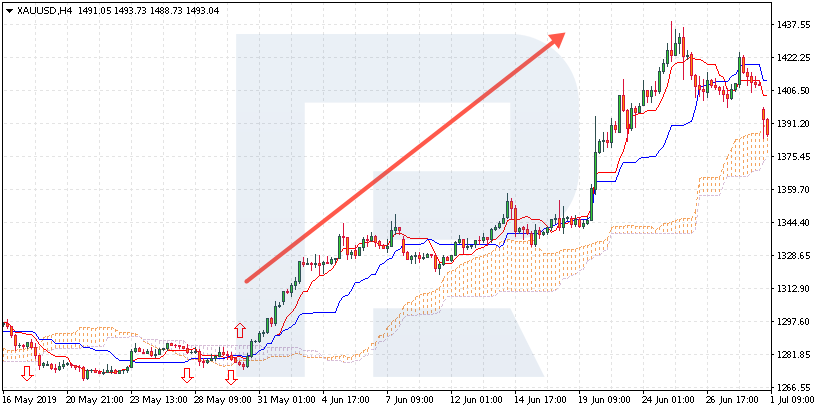

In one of our posts, we spoke about the Ichimoku indicator. At first glance, it seems too complicated, but it boils down to trading the trend and waiting for the entrance signal to form. After that, we open a position and wait for the signals to form. For example, if the price breaks through the Ichimoku Cloud bottom-up, then you can buy.

If the price breaks through the Cloud top-down, the trend is likely to be descending, so you can sell. You do not need much time to make a decision, following the rules is enough.

Sure, in the times of a flat, you will be getting the breakaways all the time and either be opening and closing too many positions bringing no profit or suffering a series of insignificant losses. However, as soon as a trend begins, the market will be bringing the prices farther and farther from the entrance point. In such a case, you simply need to move the SL and hold the profit until the market reverses and closes your position.

Pros of trading along with the rules

It can often be heard that a good system is no more than 20% of success on the market while the remaining 80% is the ability to follow the rules of money management and stick to your own rules in the hard times, which will happen periodically.

As Victor Niederhoffer used to say: "In investments, as well as in life, the question is not whether you will be knocked down but when it will happen and whether you will manage to get up and keep fighting. The risk of failure is an essential part of human experience which is especially visible on financial markets dominated by speculation, which is the readiness to accept commercial risks".

A huge advantage of such an approach is the easiness of market analysis and decision-making. The lines have crossed — we sell, the lines have crossed back — we close the position and open a new one. If we hand the method to other traders, they will see the same crossings and will sell the same way due to the signal lines crossing. What is more, the trader feels less emotional pressure as he leaves decision-making to the system.

A drawback here is the behavior of the system in a flat. In such a situation, the prices remain in place, while the trader receives signals both to buy and to sell, constantly locking in losing positions.

Situational trading

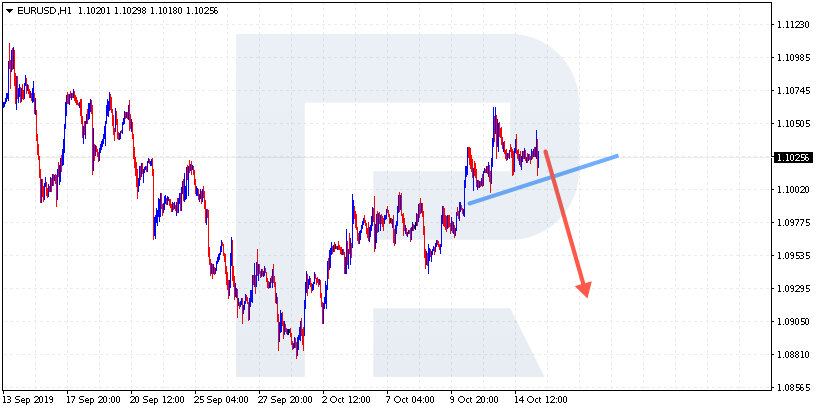

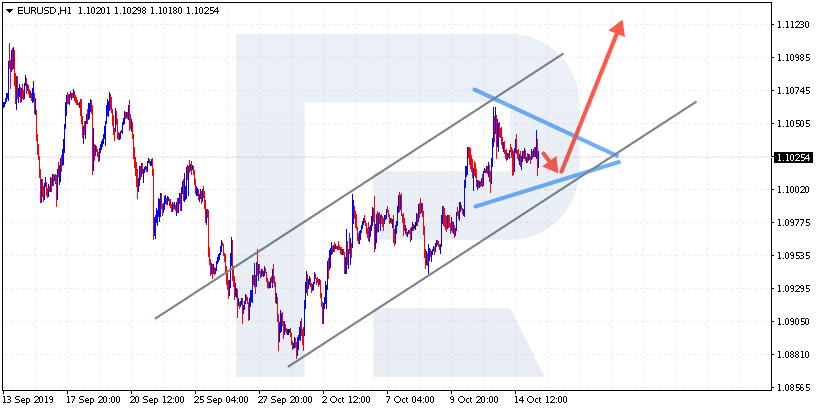

This approach to trading and market analysis is different from the systematic one. In most cases, situational trading is graphic analysis where traders look for various patterns, such being, for example, Head and Shoulders, the Wolfe Waves, or any other pattern of technical analysis.

The difficult part here is that on D1 the Head and Shoulders pattern may be inversed, while on H1 it may be normal, and this is perplexing. What is more, if other graphic traders look at the very same chart, in the same lines they might see a Triangle or any other pattern, or simply say that it is not worth entering against the trend here.

What is more, those traders may be put down by the size of the Stop Loss or a lack of the overall "beauty" of the pattern. Even experienced traders sometimes doubt which pattern to trade and in which direction.

Pros and cons of situational trading

It must be admitted that an experienced trader can show a better result in trading graphic patterns than someone who has just seen a pattern and is trying to use it. In other words, experience is critical here. If you practice situational trading, you will have to think a lot and sometimes make hard decisions, which is lacking in the systematic approach to trading on financial markets.

So, analyzing charts regularly on different timeframes and sticking to your own rules of trading, sometimes postponing open positions due to low volatility, may be very hard in the long run. What should the trader choose?

How to choose an approach for a trader?

If the trader is new to the market, systematic trading by strict rules might be the best option. It will spare them from excessive market entries without good signals as well as decrease emotional pressure during a series of losing positions. In the process of trading, the beginner will be moving along the stages of a trader's development to the top where they can use their experience for situational trading, getting rid of some strict signals of the system that has shown the worst results.

We should not forget that a good system is just 20% of the overall result: you have to master risk control and feel confident suffering losses and locking in profit. A sports car will not make a racer out of an ordinary driver; same way, for situational trading you need experience and knowledge.

Summary

Both situational and systematic trading have pros and cons. A situational trader may skip good entry signals based on some subjective criteria of their analysis. We may enter the market with a larger volume if we feel that the pattern is along with the trend; we can change the rules on-the-go. However, it is considered that in the long run, such trading will not yield good results, which is a serious problem for a situational trader.

Systematic trading makes you trade absolutely all signals of the system and move along with the trend even if the situation looks absurd. On the other hand, the trader will feel less emotional pressure here as they rely on the set of rules rather than their skills.

Any of the options require certain experience on the market and due risk management. No matter how good the signal might be, no system can guarantee its execution for sure, that is why you should not assume excessively high risks, compromising your deposit.