Uber: Failure of IPO. Reasons and Consequences

8 minutes for reading

On May 10th, 2019 NYSE hosted the IPO of well-known Uber (NYSE: UBER). This event was watched closely by the financial world as this IPO was considered one of the largest ones in 2019. Apart from all media being concentrated on the event, the company notified its drivers all over the world, giving them bonuses for the stock purchase. Thus, this IPO should have become not only the largest but the most successful one.

First trading session of the Uber stocks

In reality, the IPO passed virtually unnoticed. The company was preparing the IPO with a net loss of $1.012 billion. Trading started at the level of $42 per stock. The price was growing during the first two hours but the session closed with a minus. The next day, the stock price fell by 12%.

This price might have seemed appealing to the investors as the stock price started recovering from the level of $37.

The lockup period and “naked short”

As we know, normally there is a lockup period three months after the IPO which means that selling the company's stocks is forbidden. The investors may either buy the stocks or do nothing while the company itself and the company's owners act as sellers (attracting money for the company and themselves).

For example, Mark Zuckerberg sold Facebook (NASDAQ: FB) stocks for $1.13 billion on the second day of the Facebook IPO. The lockup period turned out to prevent a serious decline in the stock price.

Besides, there were rumors that one of the underwriters used the "naked short" technic. It means that the underwriter sold more stocks than it had been planned and then started buying them from the market, thus creating demand and forming a support level on the price. In the end, the stock price remained above $42 until August.

The decline of the Uber stocks

Then the time for a quarterly report came, which the investors anticipated so much. Their expectations were as follows: if the income turned out higher than expected, the stocks would go on growing, while if the income was lower than forecast, many would be eager to make money on the price decline. In such a situation, those who bought the stocks earlier start selling them. What is more, the lockup period is ending, and the number of those willing to sell the stocks is growing.

The report turned out to be surprisingly negative. The income failed to meet the expectations: instead of the forecast $3.32 billion, the company earned $3.17 billion. The company's losses grew from $1.012 billion to $5.236 billion. The stock price headed downwards. By September, it had reached $29 which was 31% lower than the IPO price. The position of those who wanted to make a profit on the Uber decline reached the volume of 36 million stocks, or $1.5 billion.

This was the result of one of the largest IPOs in 2019. Fairly speaking, we should note that the IPO of the Uber rival Lyft (NASDAQ: LYFT) also turned out a failure. The current price of the Lyft stock is 54% lower than the price of its IPO.

Does Uber have any chance to restore the trust of its investors and break the downtrend on the chart? To figure it out, let us check if the company has any promising projects.

Uber perspectives

To begin with, let us have a look at the loss of $5.2 billion in a quarter. This is a truly huge loss, especially if we keep in mind the fact that the income generated during the same quarter was $3.17 billion. In fact, we should take $3.9 billion away from those $5.2 billion as they were used for compensating the stocks after the IPO. Thus, the factual loss amounted to $1.3 billion. Unfortunately, it was more than the previous quarter, though not as much as $5.2 billion.

When you say Uber, you recall a taxi service; in fact, nowadays it is much more than this. It unites Uber Freight, Uber Eats, Uber Health, Uber Works, and the launch of Uber Air is planned.

Uber Freight is an application that helps freight carriers find the freight that needs transportation from A to B at the specified price. As soon as the order is closed, the carrier gets paid by Uber in 3 or 4 days. The risks are assumed by the company so that the carrier will always get paid even if the client does not pay the company. The service is now available in the USA only, however, it has perspectives for coming to the international market.

Uber Eats is meant for ordering meals from the places that do not have their delivery service. Particularly, Uber have cooperated with McDonald's. Uber Eats is available in Europe, Asia, North and South America.

Via Uber Health, medical workers can order for their patients a taxi that will take them to the examination and back. The service is meant for senior patients that have trouble getting to the clinic by public transport. The service is paid for by insurance companies.

With Uber Works, you can find a task to be done by a certain time for certain payments. In this case, a company or a physical person leaves an order, ex. for mowing a lawn, and those ready to take this order do the task. The service is being tested in Chicago.

In collaboration with NASA, Uber is developing Uber Air. This is a service of air taxi planned to be launched in 2020 in Los Angeles.

As you may guess, Uber remains a developing company regardless of its presence virtually all over the globe. Taxi service is just the first step in global development. Having an opportunity to get finances from the open market Uber is trying to increase its presence in all spheres. When you use one Uber service, it becomes highly probable that you will use other ones.

Risks

Among the risks, we can name the problems of the taxi service. The company has two ways of increasing the profit in this sphere: increasing the price for the clients or decreasing payments for the drivers. Severe rivalry on the market does not let the company use any of the options.

Quite often, Uber drivers organize strikes, demanding an increase in the payments. In certain countries such as Turkey, the Uber service is illegal because local taxi services cannot compete with it. In the USA, lawmakers are trying to make Uber hire its drivers as official employees which will entail additional expenses. As you may see, all this is to deal with the taxi service, though in the sphere of cargo delivery the company may equally face serious resistance from local carriers; however, Uber will manage to capture its share of the market until this happens.

Uber stock price tech analysis

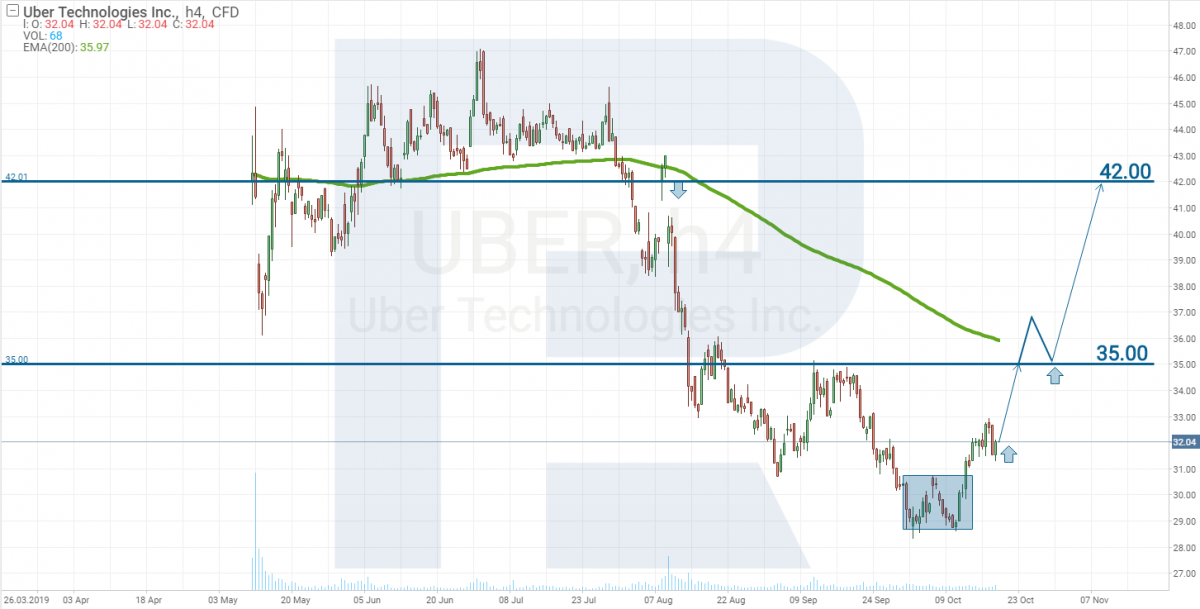

Uber stocks are trading in a downtrend. This is confirmed by the Moving Average with a period 200. However, at the beginning of October, there formed a Double Bottom pattern near $30, which suggests the end of the downtrend; if so, the stock price will go test the first resistance level of $35.

Summary

Most often, stock IPOs turn out a failure if the underwriters overprice the placement. Later the market just finds the "true price" where it stops falling. Uber IPO turned out to be a failure, which supposition is confirmed by the actions of the stockholders: particularly, they made the director-general of Uber Travis Kalanick leave his office after the IPO.

At the moment, technical analysis shows that the stocks have hit the bottom, from where they might start growing. Fundamentally, the company remains losing but the quarterly report may change everything. The technical analysis normally forecasts such events, showing an uptrend forming. So, Uber stocks have a potential for growth, only there is one circumstance.

American stock indices are now trading near their historical maximums. Large investment funds do not open long positions on stocks, considering companies to be overpriced.

The next year, there will be presidential elections, and history shows that at such events stock indices trade in a range because the investors do not know who is going to be the next president and what policy they are going to carry out.

This year, a record number of companies have performed IPOs, the general sum of their stocks amounting to more than $10 billion. Most of the companies have been losing. We could see a similar situation in the year 2000 before the Dotcom crisis. Such companies ran ahead of the stock indices in terms of profitability, so now the stocks still may grow.

However, the situation hints on another global crisis coming which is likely to be called Debt.

The interest rates of many countries are around zero which helps companies take cheap loans, increasing their debts. Companies with large debts become vulnerable to any disturbance. As soon as one of them declares a default, panic begins. Investors will turn to cash, selling stocks. Central banks will lose the opportunity to manipulate the market by low rates, sustaining losing companies; only the strongest ones will survive. Everything might start with WeWork. International investors have put 60 million GBP on the company's inability to pay off the debt on the sold bonds and its default.

Can you buy the Uber stocks after all said above! Yes, you can but the investment period should be lowered to several weeks or a couple of months, and the market situation is to be watched closely. No one knows when the decline will start, so buys should be careful and without leverage.