Top Most Profitable Stocks in 2019

7 minutes for reading

The year 2019 on the stock market started with a decline of the S&P 500 stock index by more than 20%. As a result, the time was good for entering the market for the traders opening long positions. Though during 2019 in the media there have been lots of warnings about an upcoming global crisis, the investments in S&P 500 brought 25% profit, which is much more than bank deposits can bring, and neither each hedge fund may boast such profitability.

To receive more than 25% profit in 2019, the trader should have invested in the stocks of certain companies. The risk could be decreased by choosing companies with substantial capitalization.

The companies with the Market Cap over 200 billion USD

On the whole, on the stock market, it is thought that the higher the company's capitalization, the lower the risk of investing in it. Among the companies with the capitalization of over 200 billion USD, there are three leaders.

Apple

Number one is known-by-all Apple (NASDAQ: AAPL). At the beginning of 2019, its stocks were, so to say, at the bottom, which was an ideal entry point. The growth per annum was over 70%. In other words, each 10,000 USD invested would bring more than 7,000 USD profit. This is more than 2 times larger profit than in the case of the S&P 500.

MasterCard Inc and Microsoft

Number two is MasterCard Inc (NYSE: MA), which stocks are coming to 300 USD. Its profitability in 2019 reached 58%. Bill Gates's Microsoft (NASDAQ: MSFT) is coming on its heels with the profitability of 55%.

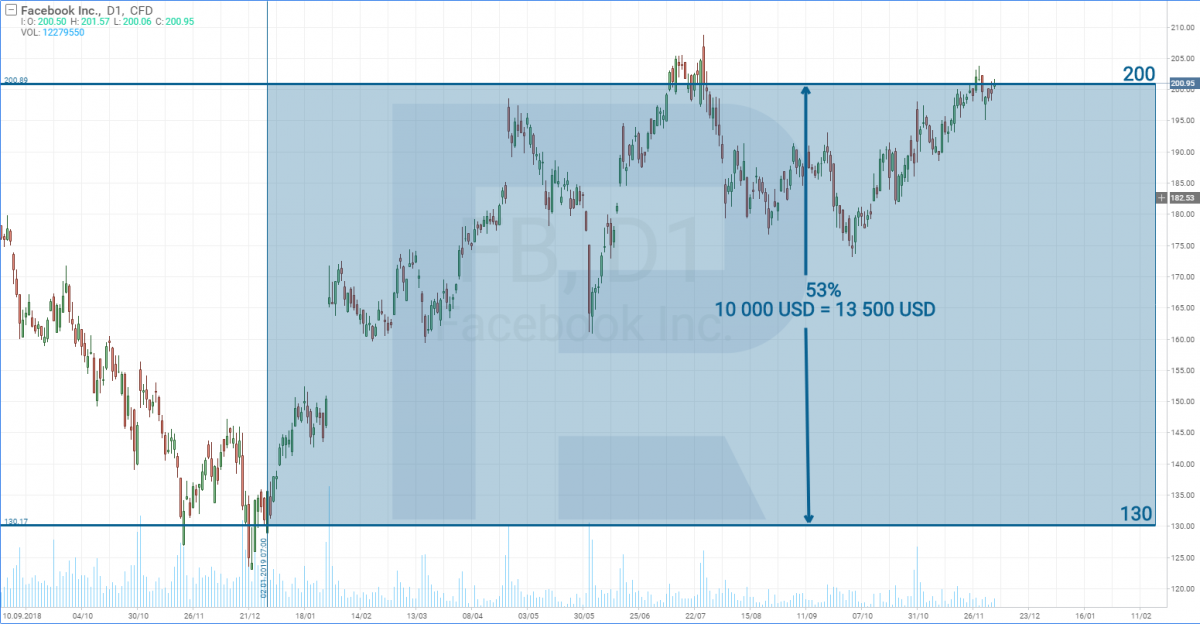

The social network Facebook (NASDAQ: FB) turned out to be number four with its profitability over 55%.

The stocks of Alphabet (NASDAQ: GOOG) also demonstrated profitability higher than that of the S&P 500 index, which was 28%.

On the other hand, the company of the world's richest man Jeff Bezos Amazon failed to impress the investors. Its stocks grew in price by just 16%. However, in summer, its stocks were trading at 2,000 USD, which was 36% higher than the price on January 1st, 2019.

Most often, for the companies whose stocks have overcome 1,000 USD, it is hard to demonstrate profitability higher than that of the stock indices as the higher the stock price, the less potential investors there are.

For example, to buy 100 stocks of Apple, an investor would need 27,000 USD, and in the case of Amazon 175,100 USD. In other words, the stock price limits the number of potential investors, and the growth of the stocks slows down.

The companies with the Market Cap from 10 to 200 billion USD

As we know, the stock market is full of surprises, and the simple way is to buy the stocks of a company with large capitalization and have a good chance to make a profit at the end of the year. However, this year attention could be paid to the companies with the capitalization from 10 to 200 billion USD. Their stocks showed three-digit profitability, and not just as a surge but as months-long trends.

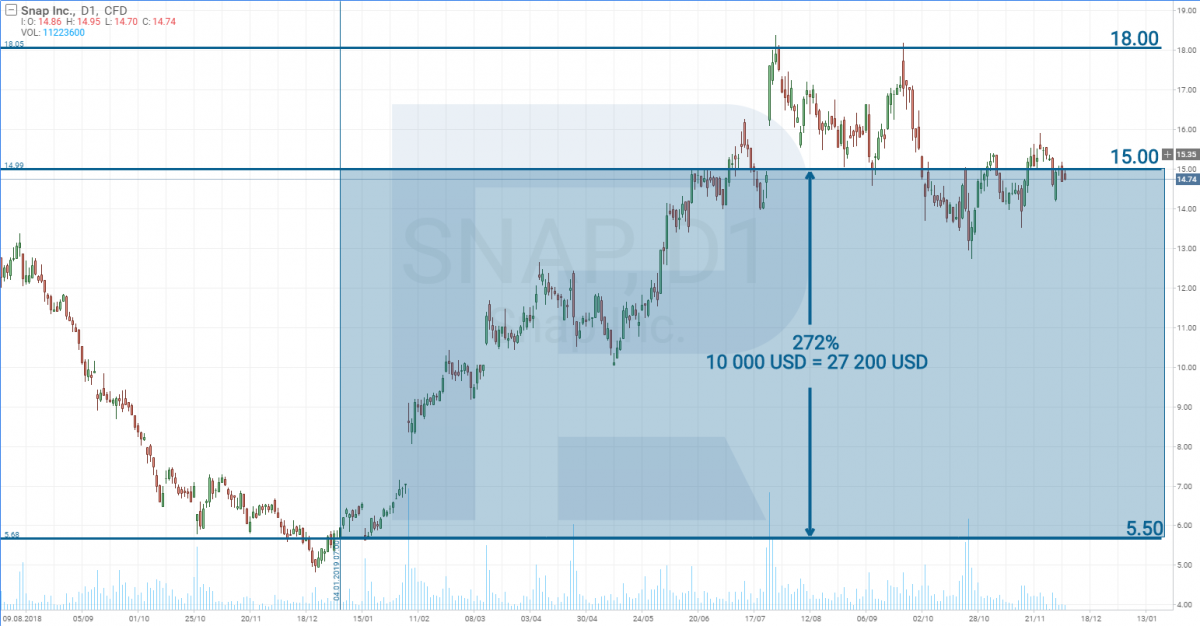

Snap Inc

For example, Snap Inc (NYSE: SNAP ) gave a nice surprise to its investors. The company is known worldwide thanks to its messenger Snapchat. In 2017, it managed to attract 33 billion USD during an IPO, which was the largest initial public offer among tech companies in history after Facebook.

The Snap stocks were available even to beginner investors owning a modest sum of money. At the beginning of the year, they cost 5 USD per stock, so, having just 1,000 USD on your account, you could buy 200 stocks.

During the year, the price once grew to 18 USD, which increased the investments more than 3 times. Currently, the stocks are traded at 15 USD per one, which means that an investment as large as 10,000 USD can bring a 20,000 USD profit.

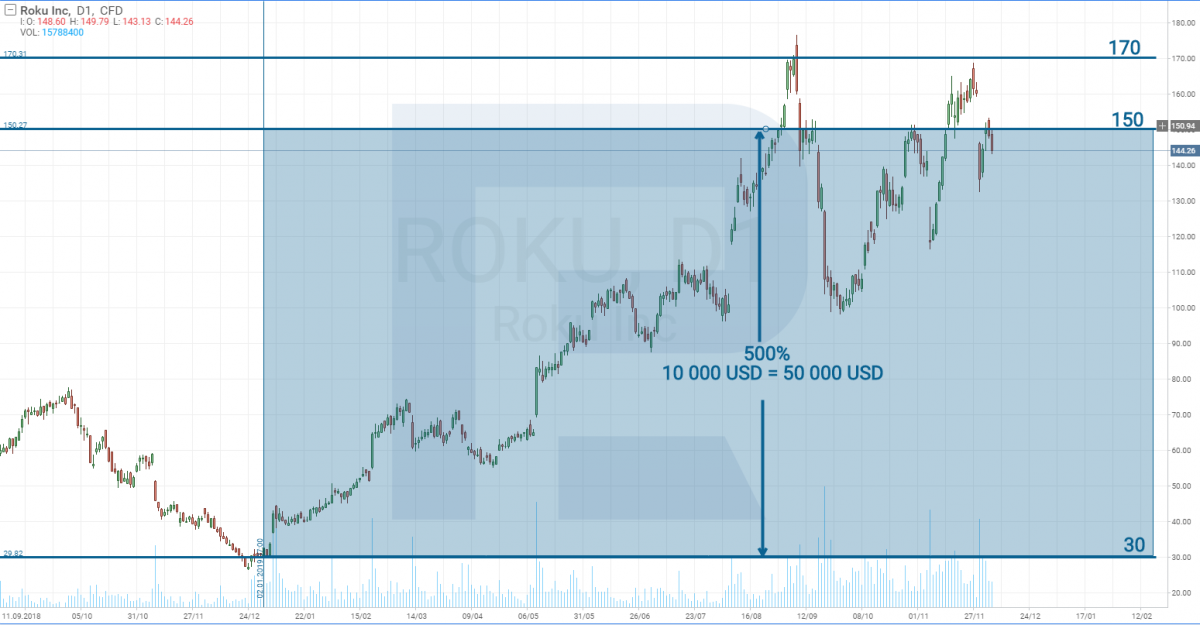

Roku Inc

In 2019, the attention of such giant companies as Disney (NYSE: DIS), Apple (NASDAQ: AAPL), AT&T (NYSE: T), and Netflix (NASDAQ: AAPL) was attracted to the broadcasting service. And if Netflix has long been on this market, for Disney and Apple this sphere is new, and they see a huge potential in it. The rivalry on the market has allowed decreasing the price of the subscription for the clients. To subscribe to Apple TV+ costs less than 4 USD a month, while a year ago it cost 11 USD to subscribe to a basic Netflix package, and now it costs 9 USD.

To provide access to its services, the company needs certain equipment. And one of the companies producing such equipment is Roku, traded on NASDAQ under the ticker ROKU.

At the beginning of the year, its stocks cost 30 USD per stock, and by September it has increased to 170 USD. Currently, the profitability is about 500%, so that 10,000 USD invested would bring 40,000 USD of net profit.

Biotech companies

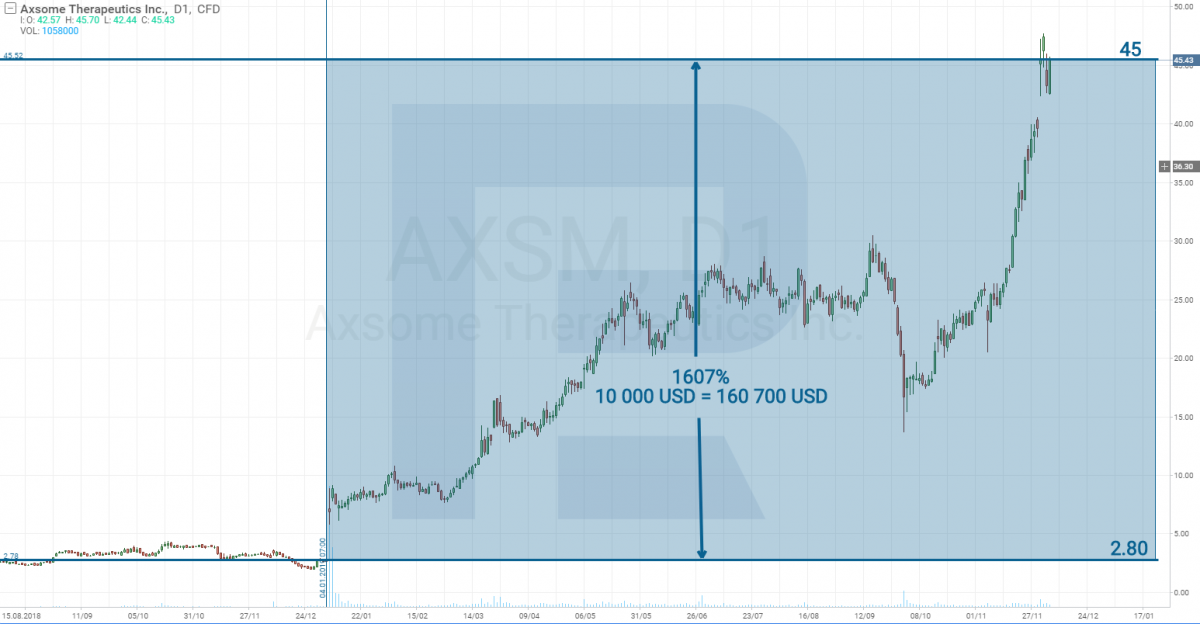

However, all mentioned above seems insignificant compared to the biotech sector. Most often, their stocks are traded cheaper than 5 USD per stock. Some never take trading such stocks seriously. Anyway, the company with the largest profitability in 2019 was Axsome Therapeutics Inc (NASDAQ: AXSM) from the biotech sector.

At the beginning of the year, one of its stock cost 3 USD. Currently, traders pay 45 USD per stock. Thus, 10,000 USD invested in the company would bring over 160,000 USD.

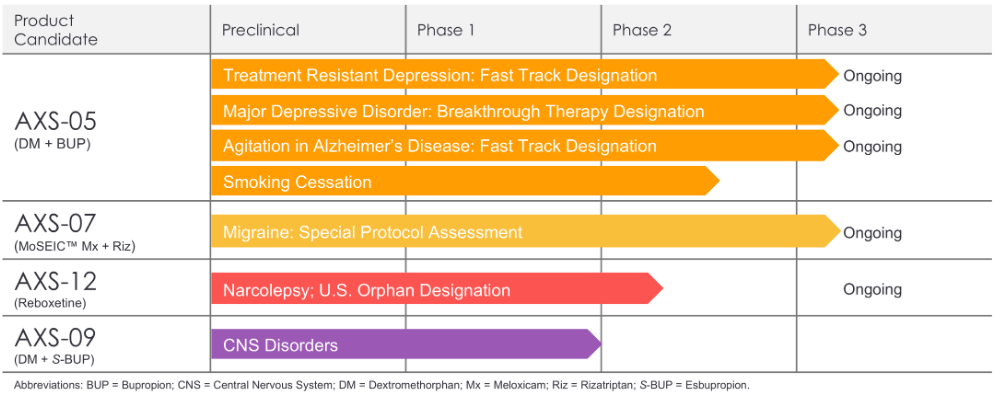

For those who keep an eye on the sector, it was easy to forecast the growth of these stocks. The company had all the reasons for it. On its website, there is a table demonstrating which drugs are under which approbation procedure (in more detail, you can read about the FDA trials here).

From the table, we can figure out that 4 medicines are coming to the end of the trials. Thus, the investors counted on these drugs and were never mistaken.

Something similar may happen in 2020 to the stocks of Sorrento Therapeutics Inc (NASDAQ: SRNE), which larger pharmaceutical companies have got interested in (in more detail, about Sorrento you can read here).

The companies with the Market Cap from 10 million USD

If we look at all the stocks traded at the American stock market, among 5 leaders of this year in terms of profitability there are 4 biotech and 1 financial company.

- The leader is Axsome Therapeutics Inc (NASDAQ: AXSM) with the profitability of over 1,500%.

- Number two is Constellation Pharmaceuticals (NASDAQ: CNST) with the profitability of 990%.

- Number three is Enlivex Therapeutics Ltd (NASDAQ: ENLV), which stocks grew in price by 920%.

- Number four is Kodiak Sciences (NASDAQ: KOD). With it, the investors earned over 808%. All these companies are traded in the biotech sector and develop drugs.

- Number five is a company from the financial sector Everquote Inc (NASDAQ: EVER), which stocks grew in price by 802%.

Thus, we can say that the traders who invested in the biotech sector in 2019 did not only manage to receive more profit than with stock indices but also reach the highest profitability on the stock market.

What to expect in 2020?