CopyFX for Investor: How to Use? How to Choose Traders?

7 minutes for reading

In this article, we will discuss how to become an investor on the popular copy-trading platform CopyFX. The platform allows you to make a profit on trading on financial markets, using the experience and skills of professional traders who demonstrate high results in trading.

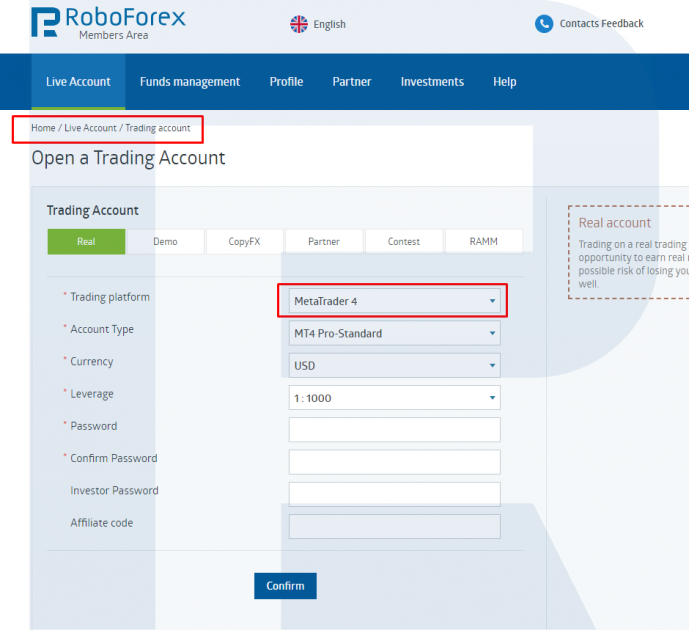

Opening a trading account

To invest on CopyFX, you need to open a trading account on MetaTrader 4 via your Personal Members Area on the RoboForex website. The following account types suit for investing: ProCent, Pro, ECN and Prime. The system of cross-copying allows for the correct connection of various account types of traders and investors.

However, if the trader and the investor have different account types, the results of trading may vary slightly due to the difference in the conditions of trading. The size of the spread, the broker fee, the leverage or the number of available instruments may differ. If the trader's instrument is unavailable on the investor's account, the trades will not be copied.

For exacter copying, it is better to open a type of account with a maximal number of instruments available and the biggest leverage. If you are interested in investing only, you can avoid installing the MT4 terminal: with an active subscription, the trades are copied automatically, the statistics of the copied trades are reflected in the PMA. You can use copying in addition to your own trading on the account — the trader does not get any fees for the trades that the trader carries out themselves.

Choosing a trader from the rating

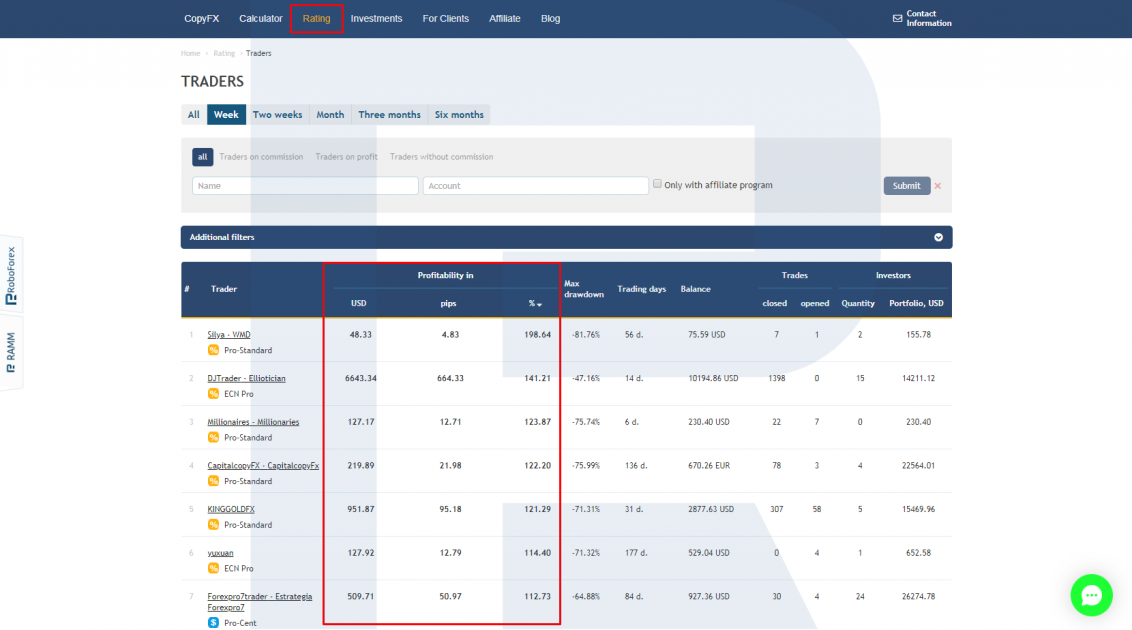

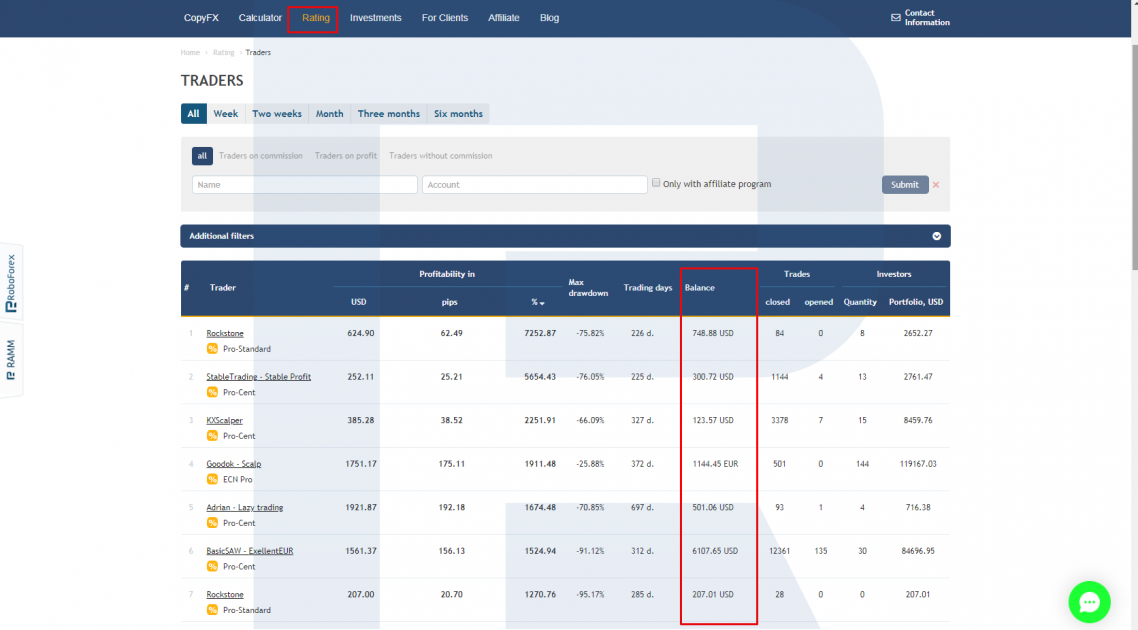

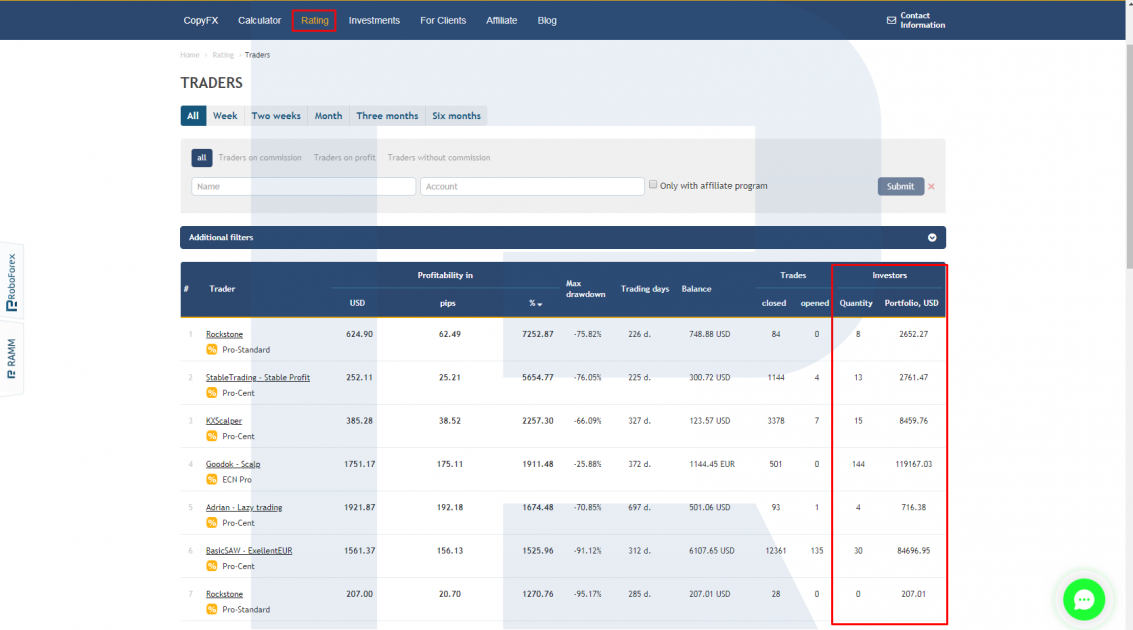

To compare and evaluate the work of traders, there exists a special instrument called the rating of traders. In the rating, the main statistics of the traders' work is reflected, helping investors make their choice for the subscription. The rating is available in the PMA and on the CopyFX website.

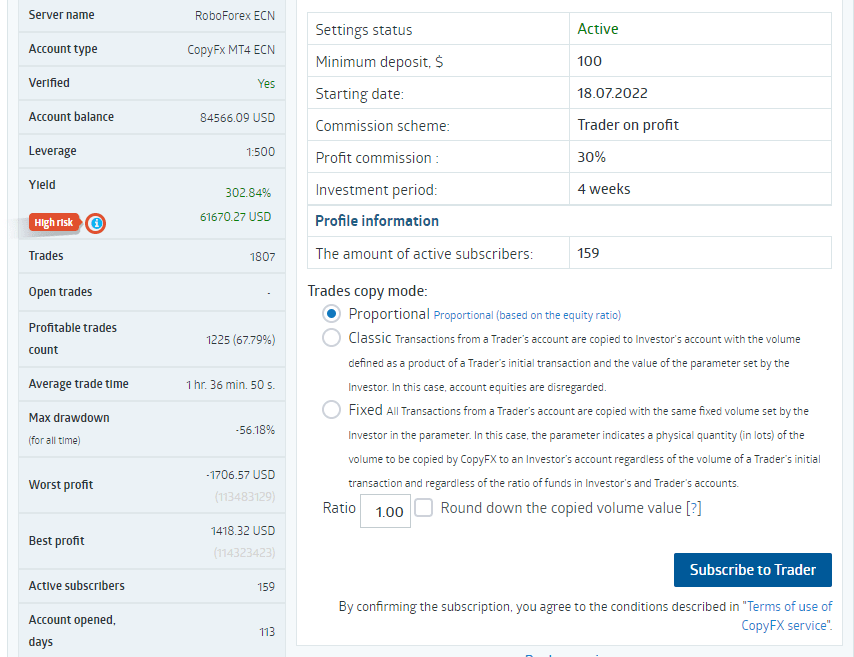

Each trader has a personalized participant card accessible from the rating. To choose a trader, the following basic parameters are to be assessed:

Profitability of trading

This is the main indicator of the trader's work. It shows the percentage of the trader's profit from the moment of the creation of the account or the loss of all funds on the account (if this has ever happened). High profitability is good but it is directly connected to the risk.

Maximal profitability, as a rule, entails high risk — up to a loss of the whole capital. That is why profitability is better assessed together with the risks. To my mind, the highest profitability is not worth choosing, it is better to be moderate, as long as risks are also moderate.

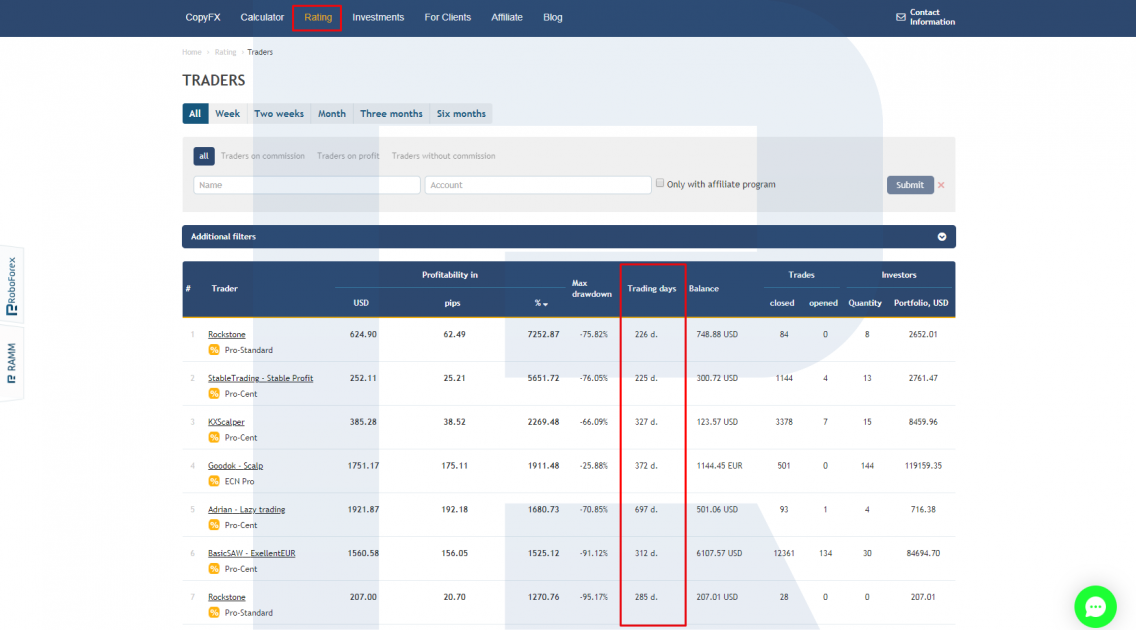

The length of trading

Shows the number of days during which the trader has been registered on CopyFX (except the weekend: Saturdays and Sundays). Traders with a long history are to be paid maximal attention to. A long history of trading without losing the whole deposit or critical drawdowns shows the stability of trading. I would recommend choosing traders working for no less than 3 months, better 6 months.

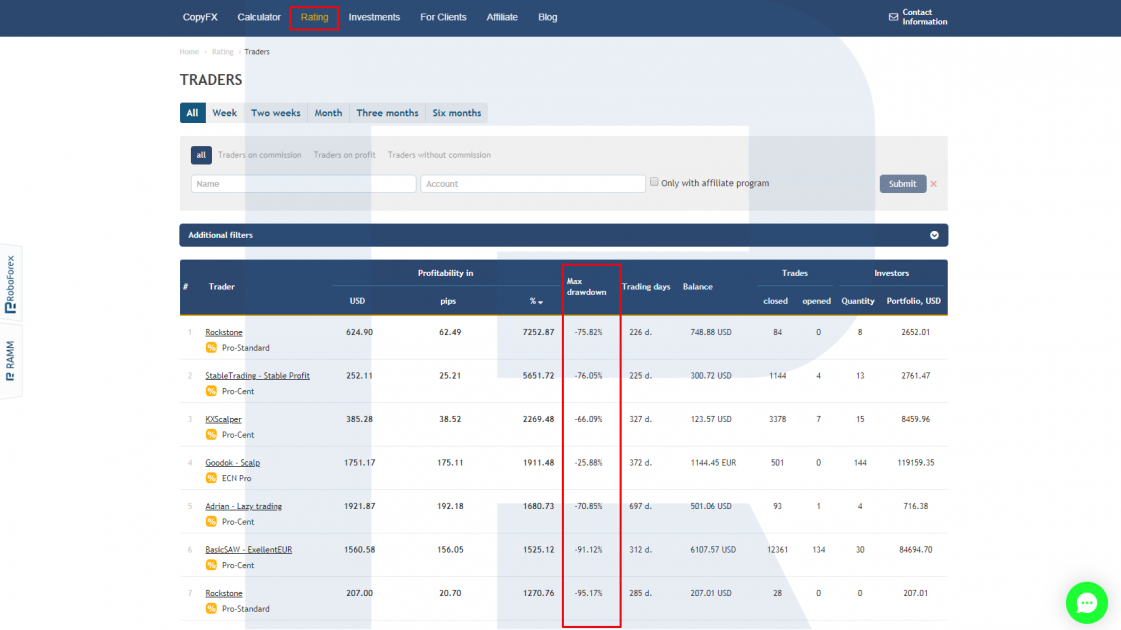

Maximal drawdown

Shows the maximal drawdown of the equity in percent, compared to the deposit. It lets us know what is the real risk of the trader's work. The larger the value, the riskier the work. Trading with a maximal drawdown of 30% may be called conservative, moderate risks mean a 50% drawdown, while high risks entail a drawdown over 50%.

Deposit size

Shows the trader's capital on the account in the currency of the deposit. Indirectly indicates the seriousness of the trader. If the balance is minimal, around $100, the trader might be aiming at high-risk trading, unwilling to invest much. The more serious the trader, the bigger the sums. I recommend accounts with a balance of over $1000.

Investors subscribed

A separate line of the rating shows the number of investors subscribed to the trader and their aggregate portfolio (USD). This indicates the investors' interest to the trader. The better and more stably they trade, the more investors will subscribe.

Setting up the copying

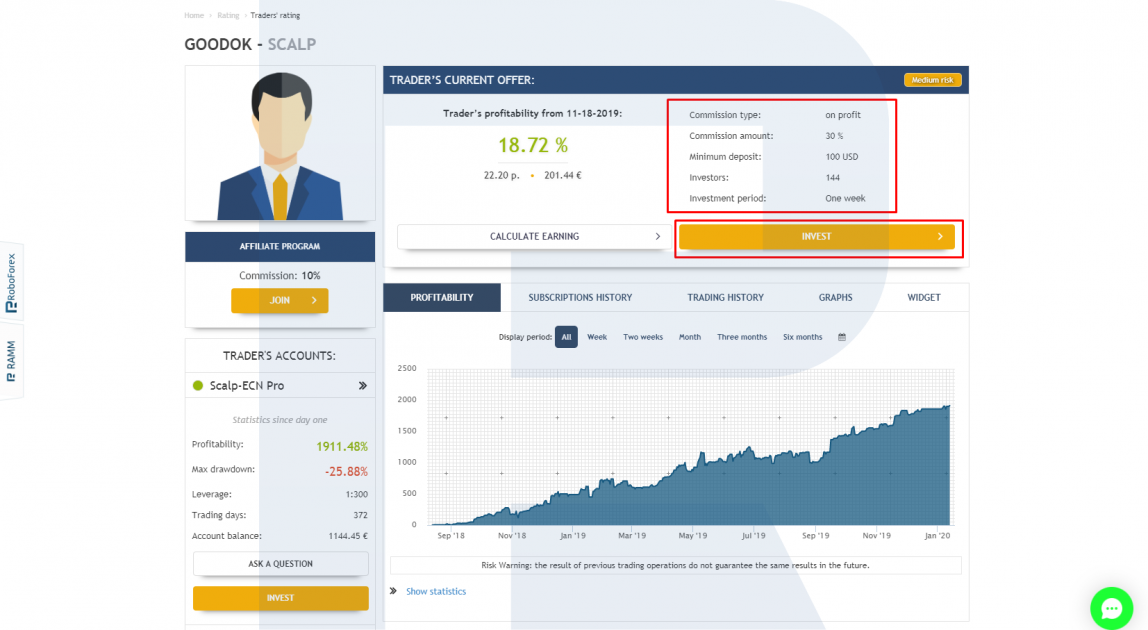

After you have chosen your trader based on the rating and your preferences, you need to set up the subscription for copying the trading. For this, we access the trader's card and check the subscription conditions. They are as follows:

The type of commission fees — the reward the trader gets (for the profit, on commission fees, without commission fees).

- The size of the trader's fee is the % of the profit or a fixed fee for profitable trades.

- The minimal deposit is the minimal sum that must be on your account for the subscription.

- Investors — the number of investors already signed up for the trader.

- The investment period is the period by the end of which the commission fee will be withdrawn from your account (Saturdays, from 01:00 server time).

If you agree to all the parameters, click "Invest" and go to your PMA to complete the customization of the subscription.

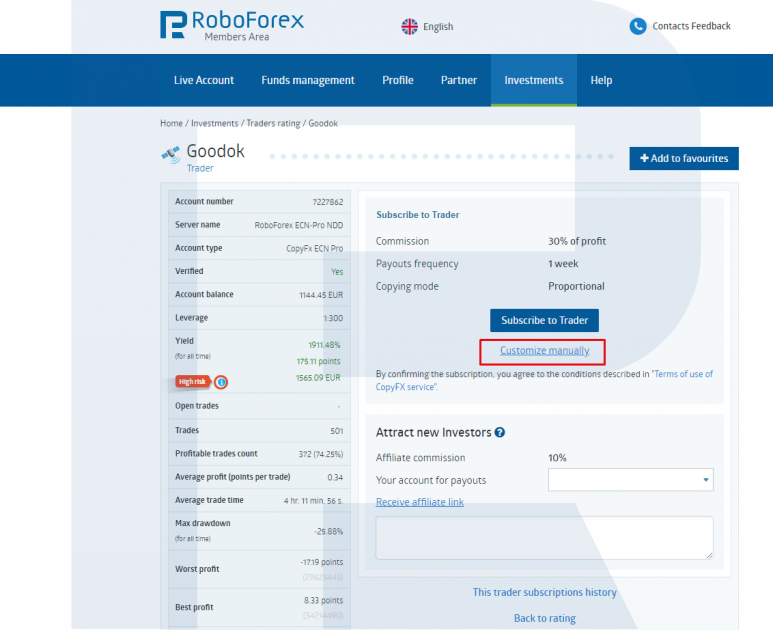

In the PMA on the left, there will be the parameters and the statistics of the work of the trader's account. On the right, your account will be shown. If you have several suitable accounts, choose one for copying. In the center of the PMA page, there will be two buttons: "Subscribe to the trader" and "Set up subscription manually". Click the latter.

In the menu, you can choose one of the three modes of copying:

- Proportional mode allows for copying the trader's work in the proportion, automatically calculated as the ratio of the trader's and the investor's deposits. The proportion may be increased or decreased by a special coefficient.

- Classic — transactions from a Trader's account are copied to Investor's account with the volume defined as a product of a Trader's initial transaction and the value of the parameter set by the Investor. In this case, account equities are disregarded.

- Fixed — all Transactions from a Trader's account are copied with the same fixed volume set by the Investor in the parameter. In this case, the parameter indicates a physical quantity (in lots) of the volume to be copied by CopyFX to an Investor's account regardless of the volume of a Trader's initial transaction and regardless of the ratio of funds in Investor's and Trader's accounts.

After choosing the required mode, click "Subscribe to trader", and the subscription will be complete. All active subscriptions will be reflected in the PMA, in "Investments" - "CopyFX settings" - "Your subscriptions". If you plan to subscribe to several traders, you must keep in mind the size of your deposit — it must not be smaller than the aggregate deposit of the traders you plan to copy.

How to stop copying

To switch of copying temporarily, there is a "Pause" mode in the PMA on the page of active subscriptions. When you activate it, new trades of the trader will not be copied to your account. However, you will remain among the subscribers of your trader, and all previously copied positions will stay open on your account, able to be closed at the trader's signal.

At any moment, you can cancel the subscription to the trader. In an hour after you do so, all the fees will be transferred from your account to the trader's one. The fee will be calculated for all closed trades on your account, copied from the trader.

To cancel the subscription, in the PMA you choose "Investments" - "CopyFX settings" - "Subscriptions", choose the subscription and press the red icon to cancel. Then on the page with the description of the subscription conditions, you choose "Unsubscribe" and confirm your choice.

Bottom line

For successful investing, you must choose the trader very carefully. You will need to study statistics carefully, assess all the indicators, the profitability, and maximal drawdown charts. If everything looks good to you — subscribe; at the start, you better test the trading (say, for a month) with small volumes, choosing the Test or Flexible copying mode.

After you subscribe, you should keep tracking the trader's work as past successes do not guarantee success in the future. You must always control risks, and if the trader's drawdown is too large, unsubscribe. Investing in trading means high risk, so you should be prepared morally for both profit and losses.