How to Trade Trend Lines on Forex?

8 minutes for reading

Trendlines pertain to classic tech analysis. Many traders add such lines to their strategy, using them not only on the price charts but also on the indicator graphs. We can say that a trendline is one of the simplest instruments used for chart analysis. At the same time, regardless of its simplicity, this instrument is highly efficient.

Trendlines can show where to enter in the direction of the trend and where the current trend might end. The analysis of the price chart itself is a good advantage: there is an opinion that signals from the indicator are lagging, and it is the price that is of special importance. However, we must keep it in mind that all trading options must be customized, and various ways of using both graphic analysis instruments and indicator signals should be tried.

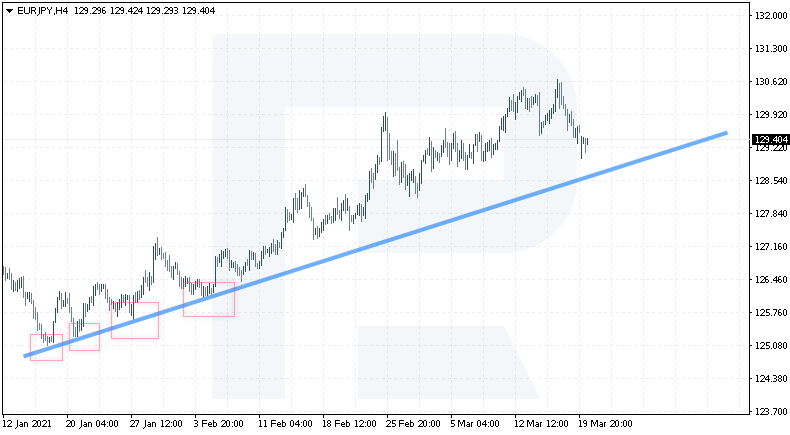

Ascending trendline

An ascending trendline is a line drawn through the lows from left to right. The second low must be higher than the first one. To draw the line, two points suffice.

Many authors single out the third point as the confirmation that the trendline has been drawn right. However, at the moment when the price touches the line, many traders try buying already, not waiting for the confirmation. As a rule, buying at a bounce off the trendline always happens with a small Stop Loss, so the risk is not that high. That is why most traders somewhat neglect the confirmation.

As an example, let us look at the trendline on the chart of the EUR/JPY. To draw it, we take two marginal lows and draw a line through them. It is important to extend the line to the right so that we could see the moment of testing this line by the price. In our example, at the moment of testing the trendline, the price bounces and goes on growing. We can say that the uptrend continues until the trendline is broken.

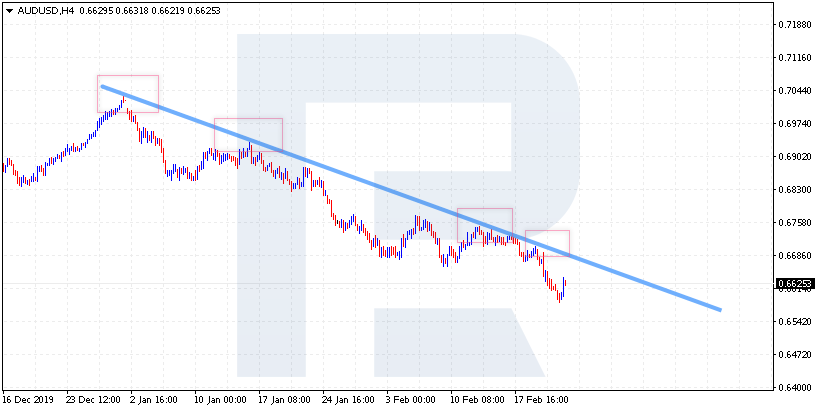

Descending trendline

A descending trendline is drawn through highs. To draw it, we need two points on the chart, the second one being lower than the first one.

Here, we should also remember that it is wise to wait for the third line to form and confirm that the descending trendline has been drawn right. Anyway, we should remember that drawing trendlines is an art and thus subjective. That is why different traders can draw different lines that are important to them. The more experienced the trader is, the better they draw the lines.

As an example, let us take the last chart of the AUD/USD pair. As we see, there is a downtrend developing. To draw the trendline, we take two marginal highs and try to extend the line as much down as possible. At the moment of the test, the price bounces and keeps declining. Moreover, after the third test, there happened the fourth one, after which the prices bounced and went down.

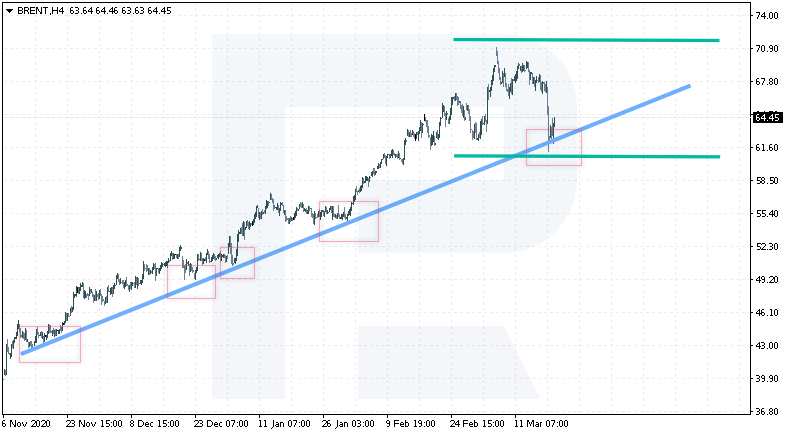

How to use trendlines?

The easiest option is to trade bounces off the trendline. In our example of an ascending trendline on the Brent chart, you can open a buying trade at the price of about 61.60 at the moment of the fifth test. Place a Stop Loss below 60.00. As for the Take Profit, place it above the previous high because the trend is ascending, and the price is likely to go on growing.

Alternatively, we can do without placing a TP, moving our SL after the price. With such a strategy, we do not limit the profit, we let it grow, which is recommended by many experts in tech analysis.

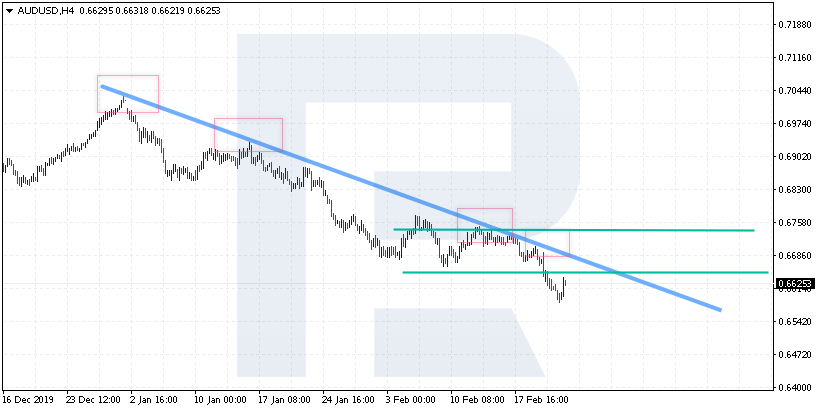

In the example of the AUD/USD pair, we should consider a selling trade at the moment of another test of the trendline. We can say that in this case, the trendline acts as the resistance line. A selling trade could be open at 0.6745, the SL in is placed above 0.6760.

Here, we can count on a breakout of the nearest low. That is why the TP is placed at 0.6630 or move the SL after the price chart. If the buyers manage to push the price above the trendline, we should consider the end of the current trend and a possible reversal of the trend to the ascending one.

It should be noted that this is the simplest option of trading the trendline but at the same time — the most efficient one because the trader enters the market at the moment of the correction development, and it is highly probable that we catch the best price on the market.

Channel line

Many traders add a channel line to the trendline. Such a line is drawn parallel to the trendline. It is thought that the price will be moving inside the channel for some time until it breaks through its upper or lower border; after that, the channel line can be re-drawn.

If we are talking about an ascending channel, we should buy from the lower border of the channel and close the trade near its upper border. We can also try selling from the upper border, however, it is important to realize that in such a case we will be working against the trend, we risk seeing a breakout of the channel border and strong growth in the direction of the breakout.

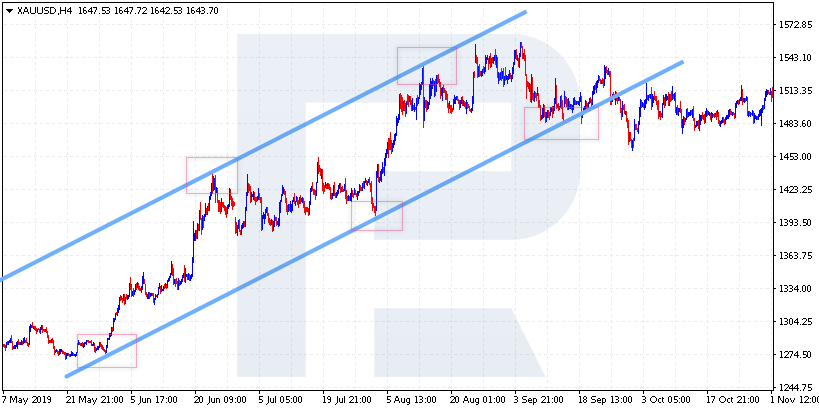

In the example with the price chart of Gold, we see the prices bounce off the upper border of the channel and head for testing the lower border, from which they bounce upwards. With the breakout of the lower border of the channel, the trend changes for a flat.

However, there is a trick here. As a rule, the prices may go from the point of the breakout to the width of the channel. Also, if the upper border of the channel is broken upwards, this can be interpreted as a strong signal of the trend continuation. And if the prices, as in our example, have broken the channel downwards, this is a weak signal, because the trend reverses here.

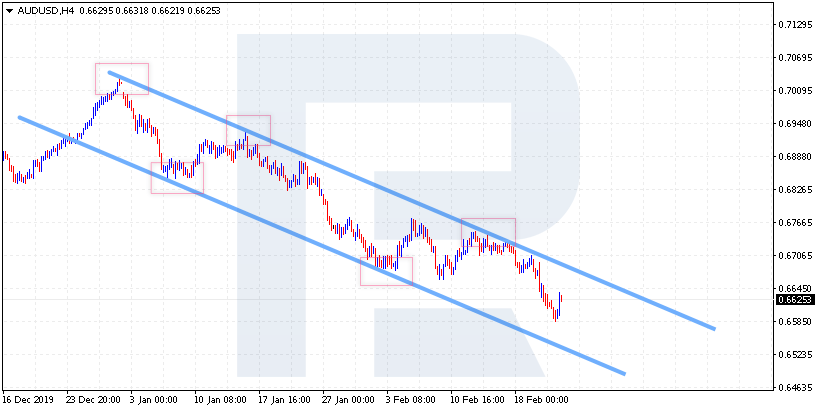

In the example with the descending channel of AUD/USD, we also see a bounce off the lower border of the channel and the growth of the prices to its upper border. We drew such a channel beforehand and got the last two signals after it had been drawn. At present, the prices remain inside the channel, and the chances are that the falling will continue after another test of the upper border of this channel. If the prices escape it, we can speak about a change of the current trend to a bullish one.

Breakout of the trendline

Trendlines behave like horizontal support and resistance levels — at the moment of a breakout, they just swap places. Same with trendlines: if the price is above the line, this line is the support. If the price is below the trendline, the latter acts as the resistance line.

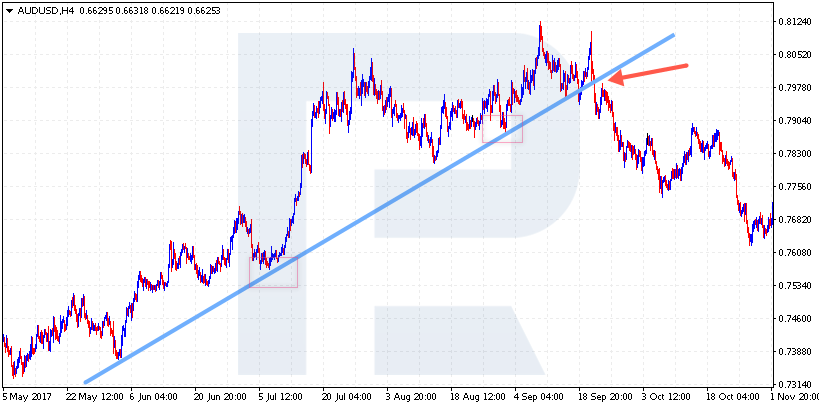

In the example with the AUD/USD chart, we see a strong bullish trend. The prices push off the ascending trendline and at a certain moment, this line is broken. However, we should not hurry to sell, we should wait for the prices to return to the broken trendline and enter the selling trade only after that. The SL, in this case, is placed above the trendline or behind the local high. The TP can be placed at the nearest support level, or we can simply follow the chart, moving the SL. In our case, the support and resistance lines have swapped places.

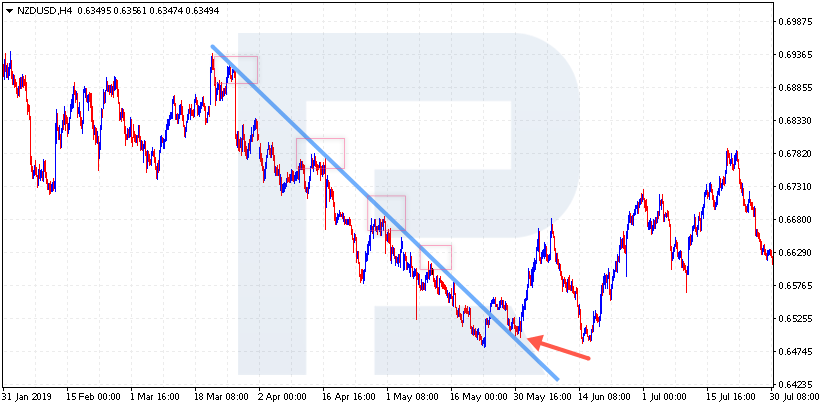

In the next example with NZD/USD, we see the prices, after a breakout of the descending trendline, test it from above and only then go up. In this case, we can also wait for the price to return to the broken line and only after that consider entering a buying trade.

Summary

In the article, we have discussed the simplest ways of trading trendlines. They are one of the oldest instruments of tech analysis but graphic traders use them all the time, including them into their trading systems. A breakout of such a line may signal the end of a strong trend or simply a confirmation of a reversal graphic pattern forming. The lines are also drawn right on the indicator charts, such as the RSI.

As we see, there are plenty of options for trading trendlines, so we should not stick to the classical approach only: try and create unique methods of trading with simple instruments of tech analysis.