How to Find Stocks for Long-Term Investments?

7 minutes for reading

Nowadays, many investors are perplexed by the choice of stocks for long-term investments. It is important to take your time as no one knows whether we have already hit the market bottom or are in the middle of the decline.

You can always buy the stocks of well-known companies such as Apple (NASDAQ: AAPL), Amazon (NASDAQ: AMZN) or Facebook (NASDAQ: FB). Most likely, you will make a profit. However, there are other ways of finding companies for investments, and in this article, we will discuss one such way. This method is very simple, and you will easily repeat it.

1. Find and define the sector of the economy

First, make up your mind about the sector of the economy in which you will be looking for a company for investing.

Go to the website Finviz.com and proceed to Groups. In this section, we will find the economic sectors that suffer from the crisis less than others.

Healthcare sector

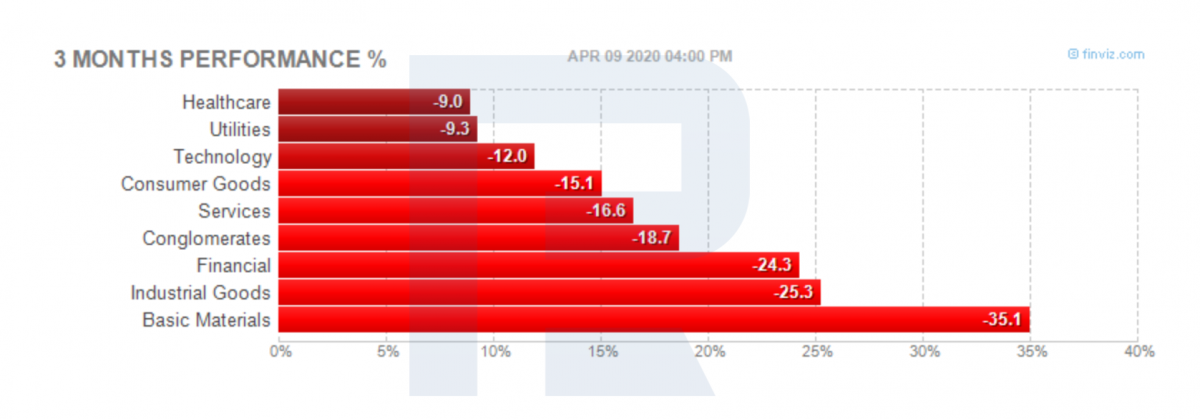

As long as the coronavirus started spreading in December 2019, we will need information for the last three months: this is the period during which stocks demonstrated the most dramatic decline.

On the diagram, we see that the healthcare sector has suffered the least of all. However, this is simply because the crisis affected the healthcare system, and the money was allocated to the development of the vaccine. This is the reason for which the sector has been affected less than others, as the companies got a mighty inflow of money. What is remarkable is that during the crisis, pharmaceutical companies started carrying out IPOs, considering now the best time for it.

However, as soon as the pandemics are over, the money may leak out of this sector, so we will not reap the expected harvest in the future. That is why healthcare is a risky sector for long-term investments: you have to guess which company will invent the vaccine. However, even if you guess right, it does not guarantee you a profit because scientists all over the world are busy inventing the vaccine, As a result, there might appear more than one vaccine, and each country will promote its own. Hence, I advise you to pay attention to all the first three sectors of the economy and look for the companies for investments there.

Strange as it may seem, Utilities are the second least affected sector as this is something that will feature high demand at any time. The third leading sector is Technology. We will be looking for companies from the second and third sectors.

2. Check the financial results of the companies

Utilities

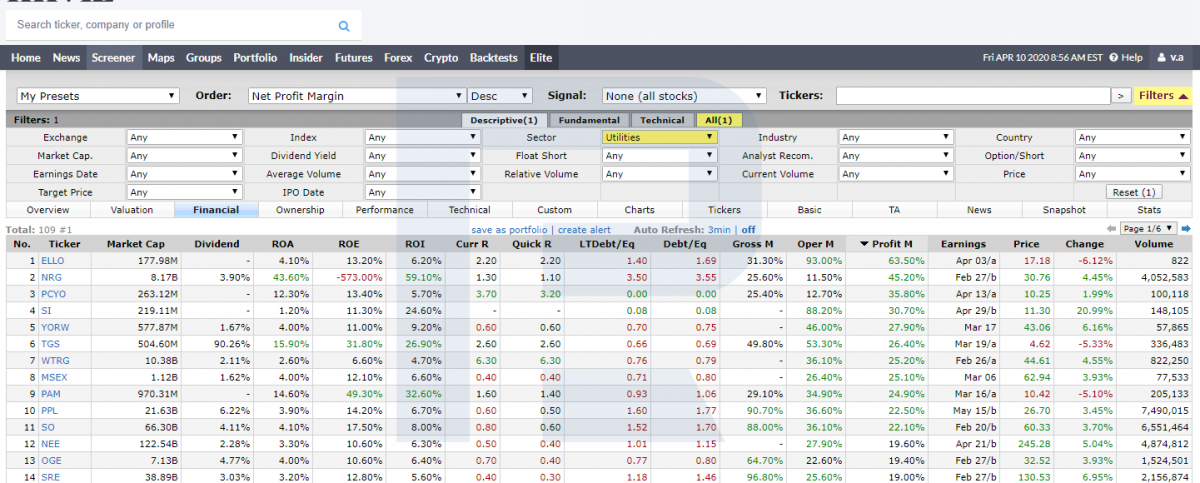

Next, go to "Screener", choose "Sector" - "Utilities" and study the information.

What is of interest to us first hand?

The crisis pushed many countries to introduce quarantine, which left a large part of the population without income. The companies that have not fired their employees have to pay them wages even when they do not go to work.

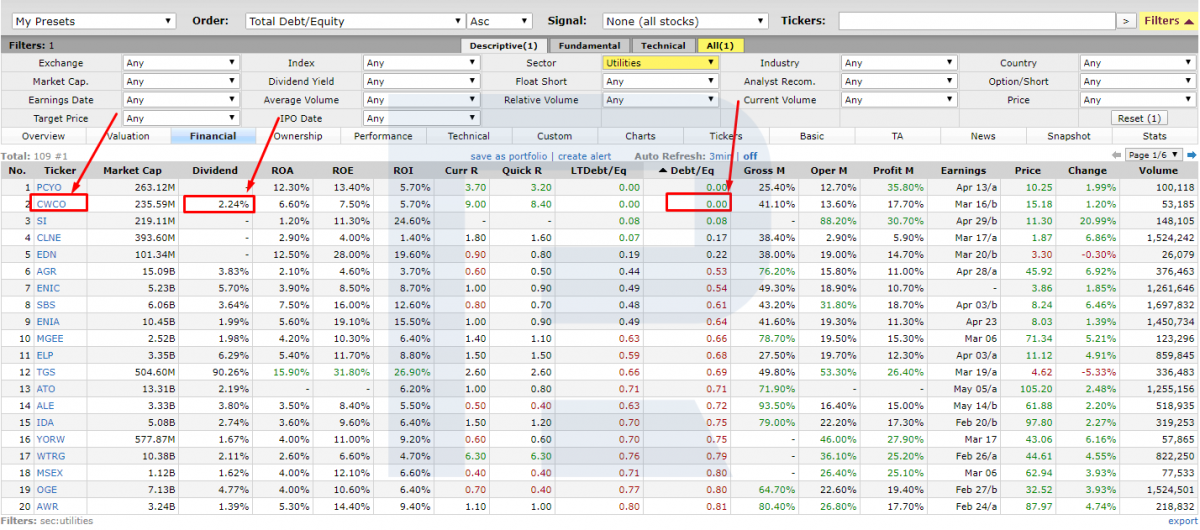

Apart from paying to the employees, companies have financial bonds to their creditors. Of course, creditors may grant a delay of payment but the companies will have to pay anyway, and the very same sum. Thus, you should choose from a company that has small or no debts at all.

To do so, proceed to "Financial" and story the line "Debt/Eq", featuring the debt-to-equity rate. 0.00 means that the company has no debts, hence it has the smallest risk of bankruptcy and problems in the future.

In the end, in Utilities, we get only two companies without debts. However, as we are aiming at long-term investments, the dividend profitability is also of interest to us, so we should check if the companies are profitable.

Consolidated Water Co. Ltd.

So, we have just one company left - Consolidated Water Co. Ltd. (NASDAQ: CWCO).

It creates and installs water purifying equipment. Purified water is supplied to both final consumers and commercial or state clients.

The net profit of Consolidated Water in the fourth quarter of 2019 amounted to just 1.79 million USD, moreover, it has no aggregate of money which it might use in the case of financial problems. Thus, the stocks of this sector do not suit for investments, by these simple criteria.

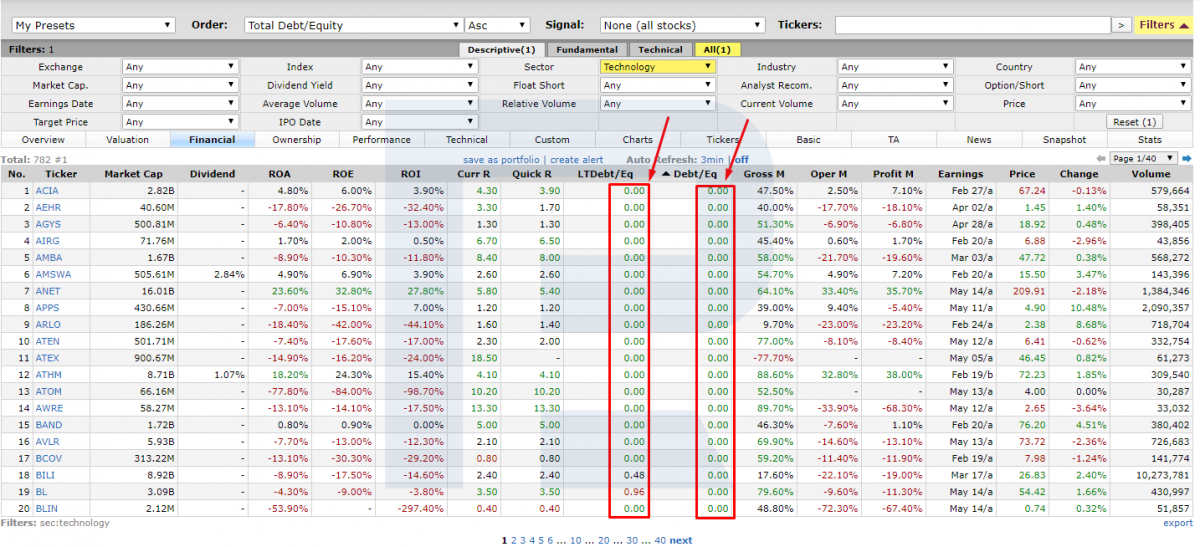

Technology sector

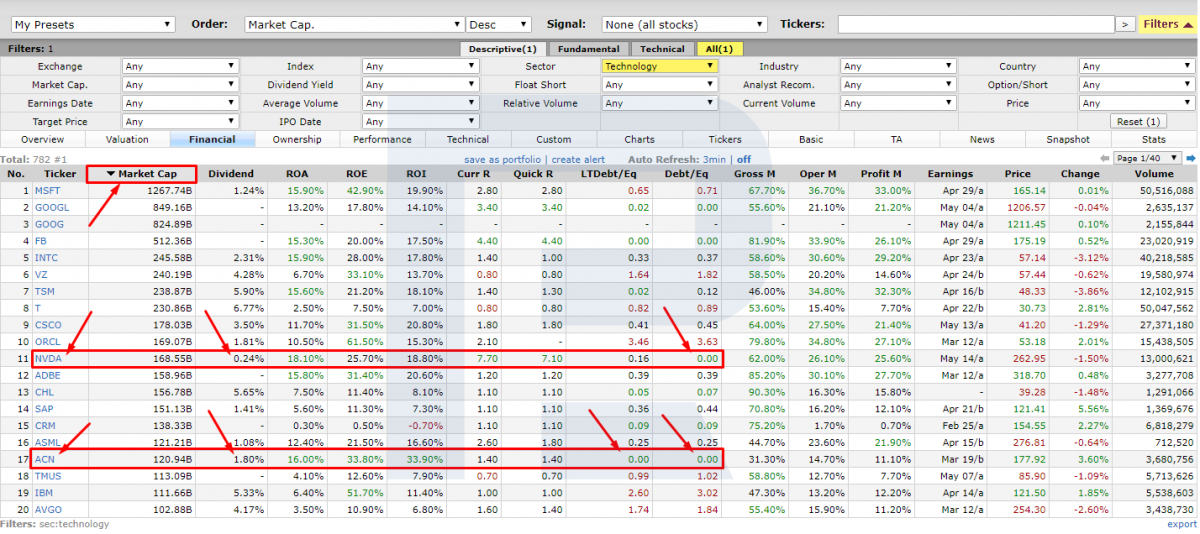

Let us proceed to the stocks of the technology sector. In "Screener", choose "Technology" and get a list of companies. Note that in this sector, many companies have no debts.

Hence, to minimize the probability of a mistake, you should pay attention to the largest issuers in the sector.

To pick them up, sort the results by "Market cap" (capitalization) and choose the companies that pay dividends.

NVIDIA Corporation

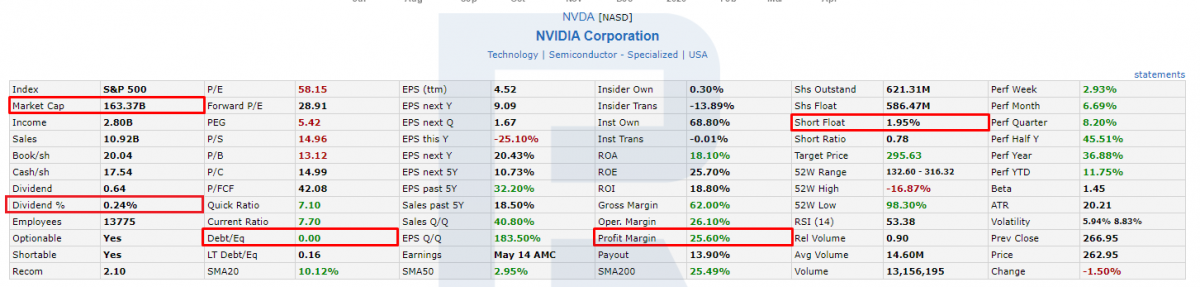

The first company to have no debts and pay dividends would be NVIDIA Corporation (NASDAQ: NVDA).

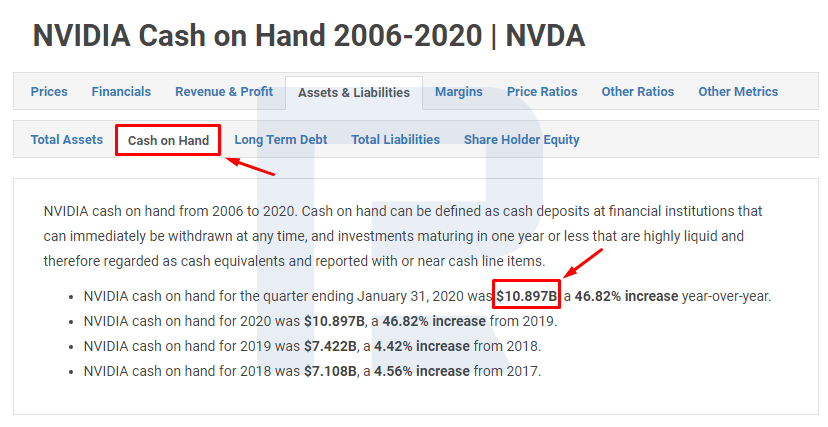

Its net profit in the fourth quarter of 2019 amounted to 951 million USD, its free cash volume reached 10.897 billion USD, which was 10% more than in the preceding quarter of 2019. The profitability of its business is 25.6%, and Short Float is very low, amounting to 1.54%.

Accenture Plc

The second company on the list is Accenture Plc (NYSE: ACN).

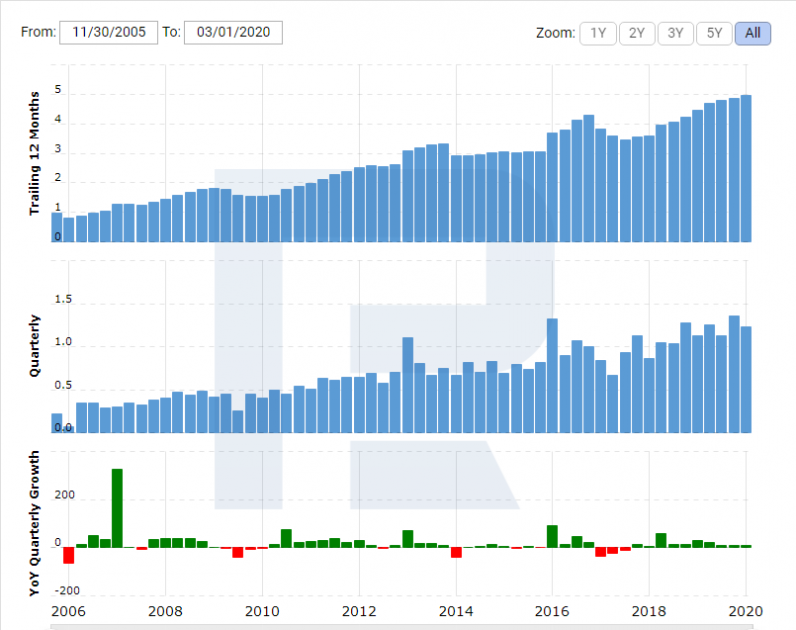

Accenture Plc provides consulting, technological, and outsourcing services all over the world. Its net profit in the fourth quarter of 2019 amounted to 1.235 billion USD. Note that since 2005, the company's average p[profit has been growing constantly.

The company's free cash volume is over 5.4 billion USD, the profitability of the business is at 11.1%, and Short Float is below 1.2%.

Cognizant Technology Solutions Corporation

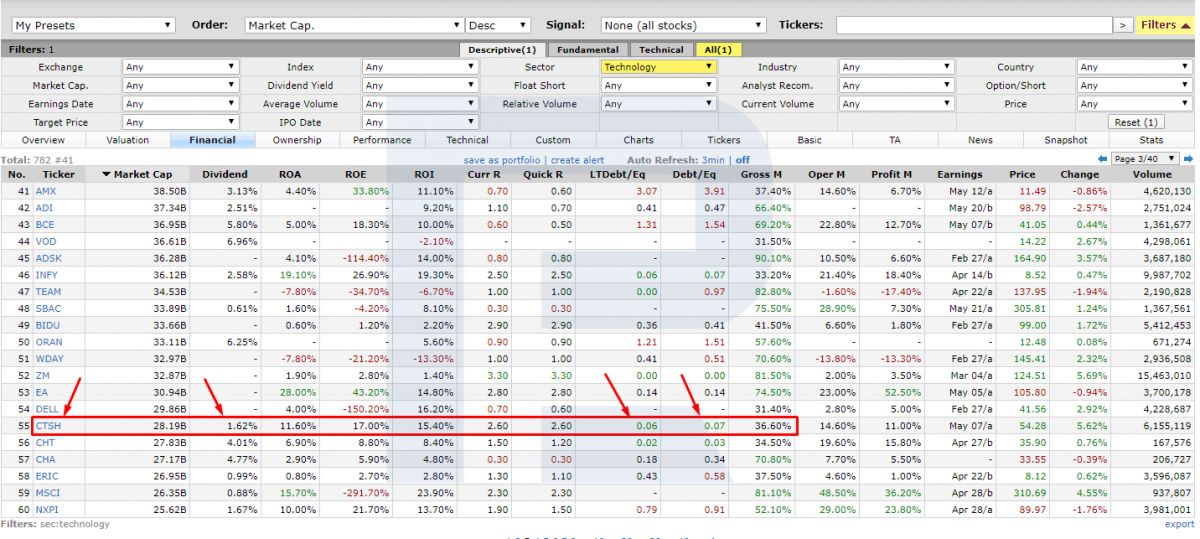

The next company that meets our requirements is Cognizant Technology Solutions Corporation (NASDAQ: CTSH).

This is a large American corporation that provides IT services to commercial clients. Its quarterly net profit reached 395 million USD. The free cash volume amounts to 3.424 billion USD, and its dividend profitability is at 5.5% per annum. Short Float is no higher than 2%, which means that investors do not try to make a profit on selling the socks of the company.

So, by our method, we have singled out three companies:

- NVIDIA Corporation (NASDAQ: NVDA)

- Accenture Plc (NYSE: ACN)

- Cognizant Technology Solutions Corporation (NASDAQ: CTSH)

Now, we use tech analysis to find entry points to positions.

3. Find entry points

Tech analysis of NVIDIA Corporation

The quotations of the stock are trading above the 200-days Moving Average, which means the uptrend presumes. During this last month, the stock played back 70% of its decline, and currently, a breakaway of 280.00 will signal further growth.

Tech analysis of Accenture Plc

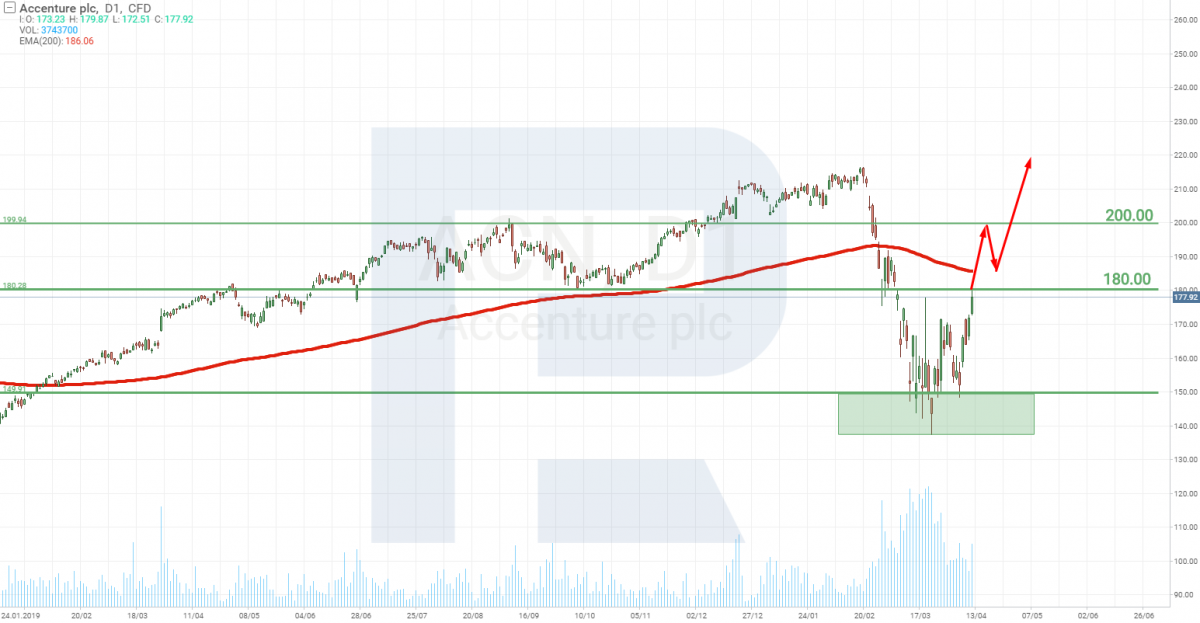

Presently, the stocks are trading under the 200-days Moving Average, which makes investing in the company at the current level risky.

We must wait for a breakaway of the resistance at 180.00 and securing of the price above the 200-days MA - the probability of growth will then be higher.

Tech analysis of Cognizant Technology Solutions Corporation

Tech analysis indicates a breakaway of the resistance level at 50.00, which is the first signal of growth. A test of this level will provide another opportunity to enter the stock at a lower price. The next signal of growth will be a breakaway of the 200-days MA.

The initial aims of the ascending movement are 65.00 and 70.00.

Information sources

We used the following information sources:

Finviz.com

- Market cap

- Dividend

- Debt/Eq

- Profit Margin

- Short Float

Macrotrends.net

- Cash on Hand

- The long-term statistics of financial results

Closing thoughts

By simply checking on Screener, we got a list of the largest companies, including Alphabet Inc (NASDAQ: GOOGL) and Facebook, Inc. (NASDAQ: FB). As we see, this method of searching for companies for long-term investments is working. You can analyze each sector of the economy the same way and thus comprise your portfolio.

You can buy the stocks of the companies on the R StocksTrader platform. For long-term investing, the best account type will be the one with leverage 1 to 1: it is free of Swaps for transferring the position to the next day. As a result, you pay just for opening and closing the position, and your profit consists of the growth of the stock and the dividends paid.