Carmakers Start Plants: Which Stocks To Choose?

9 minutes for reading

Regardless of the quarantine, we have to go to work. No state can subsist its citizens for a long time. As a result, many countries start wrapping up the quarantine, start production - bearing in mind that markets are also dictating terms.

As I said earlier, the one who ends the quarantine first will win its part of the market. The first one to start 100% of businesses was the Chinese economy, so the remaining countries simply have to finish the quarantine, too, and start working.

Export from China has increased three times lately, which proves that the country used the situation very well. The Chinese government managed to localize the virus quickly, get the healthcare sector prepared, and set the rules of social distancing. We must also give credit to the citizens of China who took the situation responsibly and follow the rules of life and work during the pandemics.

As for the USA, regardless of being the richest country in the world, it failed to constrain the spreading of the virus. It is currently number one in terms of both the number of the diseased and dead from COVID-19. However, even in these circumstances, businesses have to start working to avoid bankruptcy and the Great Depression of the 1930s.

3 largest carmakers are starting their plants

Last week we got to know that three of the major carmakers - General Motors (NYSE: GM), Ford Motor Company (NYSE: F), and Fiat Chrysler Automobiles (NYSE: FCAU) - are gradually starting the plants.

Clearly, during the quarantine, the companies modernized the workplaces in such a way that contacts between the workers will be reduced to a minimum. Everyone who comes to work gets their temperature taken and fill out a special form meant for detecting first-level contacts.

Unemployment may reduce temporarily

I was worried about the wrap-up of the quarantine measures: there is no vaccine yet, employees will inevitably contact with each other, and this may lead to another surge of the disease at workplaces. Consequently, they will have to take sick leave, interrupting production and making it stay idle.

However, certain carmakers found a way to solve the problem. They started hiring temporary workers to replace those on sick leave.

It turns out that the end of the quarantine for businesses will lead to increased demand for workforce and a decrease in the official unemployment rate.

Those who keep an eye on the US economy will mistakenly think that it is beginning to grow because new workplaces will be created. In reality, nothing is created - it is just that for 100 workplaces employers now hire 150 people, but they have to pay wages to them all, which increases the financial load on businesses. Be careful analyzing the unemployment rate in the USA.

The demand for cars is growing

Now, let us think about what may happen to the demand for cars.

The coronavirus dropped the world demand for automobiles, however, the pandemics may soon lead to the restoration of the demand. The reason is obvious.

Social distancing means minimization of contacts with other people. Public transport is a place where it is very hard to stay away from others. As a result, driving a car seems optimal. This is why the demand for them may grow.

It might look like a coincidence but General Motors in its report for the first quarter specifies that the demand for cars in China not only restored but turned out 13.6% higher than last year. In the USA, some dealers announce that by the end of May they may have run out of cross-country cars: they are worried about not the lack of customers but their stocks of such models coming to an end.

General Motors

As for the financial results of the company in the first quarter of 2020, the company managed with dignity during the hard times when the work of plants all over the world was stopped. The net profit reduced 7.3 times, amounting to 294 million USD. The income declined by 6.2%, amounting to 32.71 billion USD.

Anyway, the company remains profitable and can even pay dividends, though the payments are put on a halt for now just in the case some unexpected spending emerges. This means General Motors has a cash stock.

Before the crisis, General Motors management seriously reduced expenses, closing a lot of plants all over the world and leaving only profitable enterprises.

General Motors vs Tesla

The company decided to rival Tesla (NASDAQ: TSLA) in the market of electrical cars and took an ambitious goal of creating a battery that will be enough for 1 million miles and reducing the production price of accumulators under 100 USD per one kilowatt-hour.

General Motors trusted by creditors

This rivalry requires money, and it turned out that General Motors can attract investments. On May 7th, the carmaker placed its bonds and managed to attract 4 billion USD and announced that it could use a credit line for 2 more million USD.

General Motors stock analysis

On the chart, the stocks managed to overcome the resistance area set at 24 and 25 USD per stock. Currently, we should expect further growth up to the 200-days Moving Average, which is currently at 30 USD per stock.

Ford Motor Company

Compared to General Motors, things are worse at Ford Motor Company. The first quarter of 2020 ended with a loss of 1.9 billion USD.

On May 20th, the carmaker had to close two more plants in the USA: one was shut down due to one worker being infected with the coronavirus and the impossibility of hiring new workers in the current financial situation; the second one lacked details for production because one of the suppliers also shut down temporarily.

Most likely, Ford will have to take up the way of General Motors and hire temporary workers. However, GM can afford it while Ford cannot, judging by its income. However, the general optimism in the car market pushes the stocks of Ford upwards to new highs as well.

Ford Motor Company stock analysis

There is a Triangle on the chart; its upper border has already been broken, which signals growth to the 200-days MA at 7 USD per stock.

Generally, Ford looks weaker than General Motors; however, this trade may be interpreted as speculative, because a long-time investment here may be threatened by another falling of the price.

Fiat Chrysler Automobiles

Now - to Fiat Chrysler Automobiles (NYSE: FCAU). The management decided to create the fourth larger carmaker in the world by uniting with the European PSA Group. In the end, the company will face antimonopoly regulators that may hinder this trade.

However, this is not the only problem of the carmaker. Fiat Chrysler Automobiles is an American-Italian company, and its stocks are traded on two exchanges.

On the American exchange NYSE, it is traded under the ticker FCAU. European representative Fiat Chrysler Automobiles N. V. is traded on the Italian exchange ISE under the ticker FCHA. It is the European company that Fiat Chrysler had trouble with due to the greed of its management.

Earlier, the Italian subdivision decided to pay to the stockholders special dividends amounting to 6.03 billion USD but a couple of weeks later it asked for financial help of 6.3 billion USD from the Italian government.

Of course, it caused a wave of resentment of the citizens and the government alike.

Lawsuits of car owners against Fiat Chrysler Automobiles

Apart from all this, car owners filed a class-action lawsuit against the company for conscious concealment of a dangerous defect in the car.

Automobiles with a 2.4-liter engine consume a lot of oil; the engine, thus, may run out of oil abruptly and perform an emergency stop on the go. Of course, drivers from the CIS are used to checking the oil level by a dipstick regularly and may never face such a problem, but European drivers are brought up differently and took the problem as huge.

The carmaker insists that the oil flow rate is normal. It is hard to say who will win. The cars might be called back to change oil sensors, anyway, the company will have additional expenses, which will affect the business of the company - and it already finished the first quarter with a loss of 1.7 billion USD.

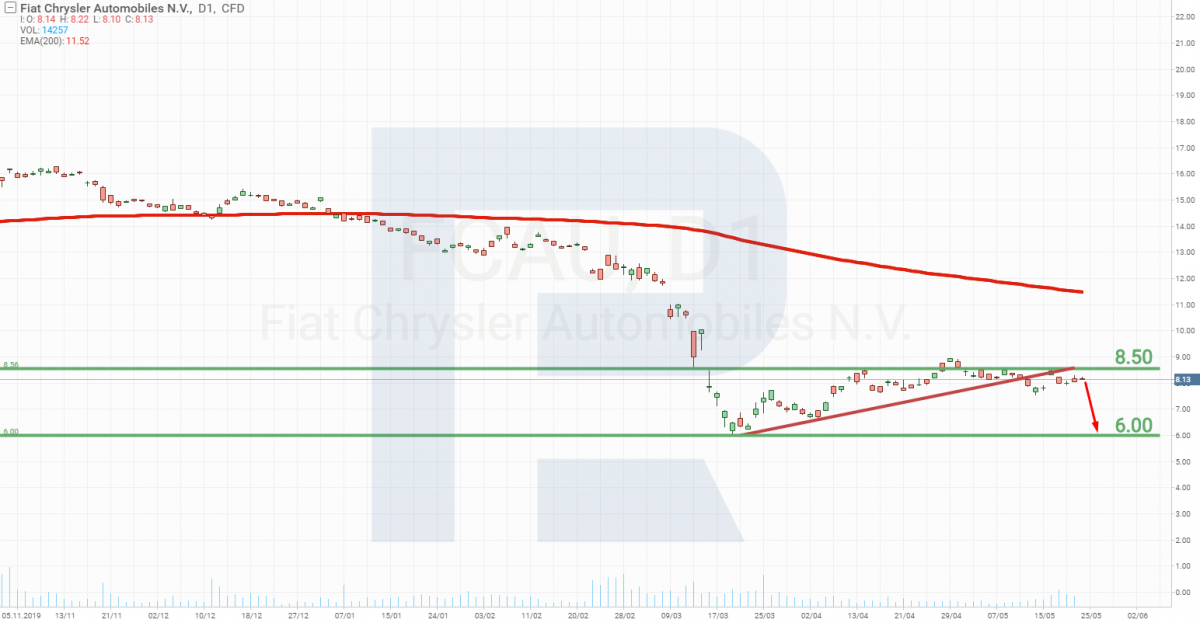

Fiat Chrysler Automobiles stock analysis

The stock chart looks as weak as the financial state of the company. The stocks failed to break away the resistance at the level of 8.50 USD, which might signal a further decline in the price. The aim might be at the low of 6.00 USD.

As you may see, fundamental and tech analysis are intertwined tightly. If the company's financial results are poor, the stock chart will also demonstrate a decline.

Alternative companies for investing

Naturally, investors got enthusiastic about the start of plants, and many rushed at buying cheap stocks. In such a situation, investors will buy everything and will start analyzing and assessing their chances for a profit only after calming down.

Currently, the strongest company is General Motors. Its stocks have all chances for growth.

However, if you cannot make up your mind about what stocks to buy, I might recommend you to pick a company of another type, nonetheless connected to car-making. I mean companies producing and selling ironstone that supply carmakers.

If the demand for cars increases, the first ones to make a profit will be crude material suppliers. In this case, I am speaking about Cleveland-Cliffs Inc. (NYSE: CLF). Its management is counting on the activization of the car industry. Having a substantial money stock, during the crisis, the management purchased a steel-rolling company AK Steel that dropped in price. Also, it retired its debts for 181 million USD with a 25% discount.

On the stock chart, we may also see a Triangle indicating possible growth. The signal of the growth will be a breakaway of 4.90 USD. The aim will be the resistance at 6.00 USD.

Bottom line

In the stock market, we operate probabilities and never know the future for sure. In this article, I have given my version of the list of the companies that might yield you a profit. However, the choice is always yours.