US Stocks: Airlines Pulling Boeing Download

7 minutes for reading

In the second half of July, airlines started presenting the results of their financial activity in the second quarter of 2020. It turns out that none of the largest US air carriers managed to make a net profit.

The pandemics noticeably cut down on the number of passenger flights, and now airlines have the only task to survive until the passenger flow restores.

All this entailed a cut-down on expenses, sending hundreds of airplanes to temporary storage, decreasing the cost of airplanes maintenance to a minimum – and canceling orders of new boards. Find more details about the situation in airlines in my previous article.

Air carriers were so desperate that they even asked the government for help. Obviously, the problem of these companies involves those that provide for them. Today, I mean The Boeing Company (NYSE: BA).

The reaction of investors to the quarterly report of Boeing

The Boeing Company is one of the largest suppliers of aviation, space, and military equipment. On July 29th, Boeing presented a financial report on the second quarter of 2020. According to it, the company’s losses amounted to 2.3 billion USD. The main losses arise from partnerships with commercial airlines. The orders and profits from the defense industry remained at the previous level, and this is what keeps the company afloat.

On the day of the report publication, investors started selling the stocks, which brought the stock price down by 6%. The next days, sales went on.

Now let us talk in more detail about what is going on in Boeing, whether it has a chance of increasing its profits.

Problems around Boeing 737 MAX 8

For Boeing, the current crisis began in the worst time possible.

On October 20th, 2018, a Boeing 737 MAX 8 crashed. Six months later, an aircraft of the same type crashed again. As a result, Boeings 737 MAX 8 were prohibited all over the world except for the US until the reasons for the accidents were made clear.

Later on, it was found out that the FAA extended the authorities of Boeing engineers for the time of testing Boeing 737 MAX 8, i.e. it let the company certify its product on its own, which made experts doubt about the results of the tests. In the end, the American regulator was the last one to ban this type of planes over the country’s airspace until Boeing gets all the certificates.

As a result, Boeing had to compensate airlines for the lay-up of 737 MAX 8 and pay penalties for exceeding the time limits of supplying these planes.

Expenses on 737 MAX 8 reaching 19 billion USD

All in all, the incident with 737 MAX 8 cost the company 19 billion USD and entailed stopping the production of the model, firing managers, a criminal investigation, and trials that are still on.

737 MAX 8 is currently at the final stage of testing, and the company is ready to supply its clients with the planes made earlier. It has about 400 747 MAX 8 in store.

Canceling orders a decrease in sales

However, another problem emerged. Being in financial trouble, airlines started canceling the orders made earlier or suggesting that Boeing should finance their purchase.

According to the report, in the second quarter of 2020, the sales dropped by 25% to 11.8 billion USD. The decrease was most prominent in the departments serving commercial airlines.

In the last 3 months, the company only sold 20 planes for civil aviation, while during the same period in 2019, it sold 90. In the second quarter, companies canceled 186 orders.

Cutting down on expenses

To make the financial load on the company lighter, the management decided to stop paying dividends and buying back the stocks. The production of the legendary series 747 was stopped, the 787 series production was decreased to 6 planes a month, the assembly line for series 787 to the North from Seattle is going to close.

Boeing rejected financial help from the government because it could not agree on the condition not to fire employees until September 30th. As a result, the company is already firing workers and planning to fire some 19,000 more, which is over 10% of the overall number of the company’s employees.

Boeing is trying to cut down on its expenses as effectively as it can because, according to the director-general of the company Davy Calhoun, the restoration of the sector may last until 2024. The results of the second quarter tell us in which state the company is now and what it is doing to make things better.

Investors had been expecting the trouble, so it is included in the stock price already. Before the crisis, the price of a Boeing stock was more than 380 USD, then it dropped to 100 USD, which means the stock became almost 75% cheaper. Now the stocks have restored a part of the decline and are trading at 158 USD each.

The current situation in the company is now being assessed and its further steps are being decided upon. However, every negative event has something to counter it.

Boeing perspectives

Indeed, the company now has fewer orders but in the current situation, this is not that bad. The corporation has over 4500 actual orders which are enough for the plants to carry on for years.

Branchy activity helps the company diversify its income. For example, the income from the defense sector remained without change, while the supply of aviation equipment even increased. During the last two months, the company has provided 44 pieces of aviation equipment to defense authorities, while last year it only provided 36 pieces. This branch smooths out the crisis in civil aviation.

The passenger flow on foreign flights remains feeble but on inner flights, it is restoring. The company is planning to start producing narrow-bodied planes mostly used for inner flights.

As long as inner flights remain half-empty, airlines have to use more modern and economical models of planes, among which 737 MAX is the most optimal. Out of 2500 planes older than 20 years, some 1000 planes have been discarded this year, which again confirms the readiness of companies to switch to more modern planes.

Of course, not all of those 2500 airplanes need replacement, but anyway, the demand for new planes will grow because they will make flights not filled with passengers more profitable.

What makes the situation better for Boeing?

The only thing that can make the situation better is vaccination but even when it starts, passenger flow will not restore at once because the income of a part of the population has decreased due to mass firings and the influence of the pandemics on business.

So, the stocks are now trying to find some balance of demand and supply so that the current troubles of the corporation will match the market stock price.

As long as the vaccine has not been invented yet, and the second wave of the virus is expected in autumn, investors will be afraid if buying Boeing stocks because further events are so unpredictable. Quite probably, the stocks may be declining in the nearest future.

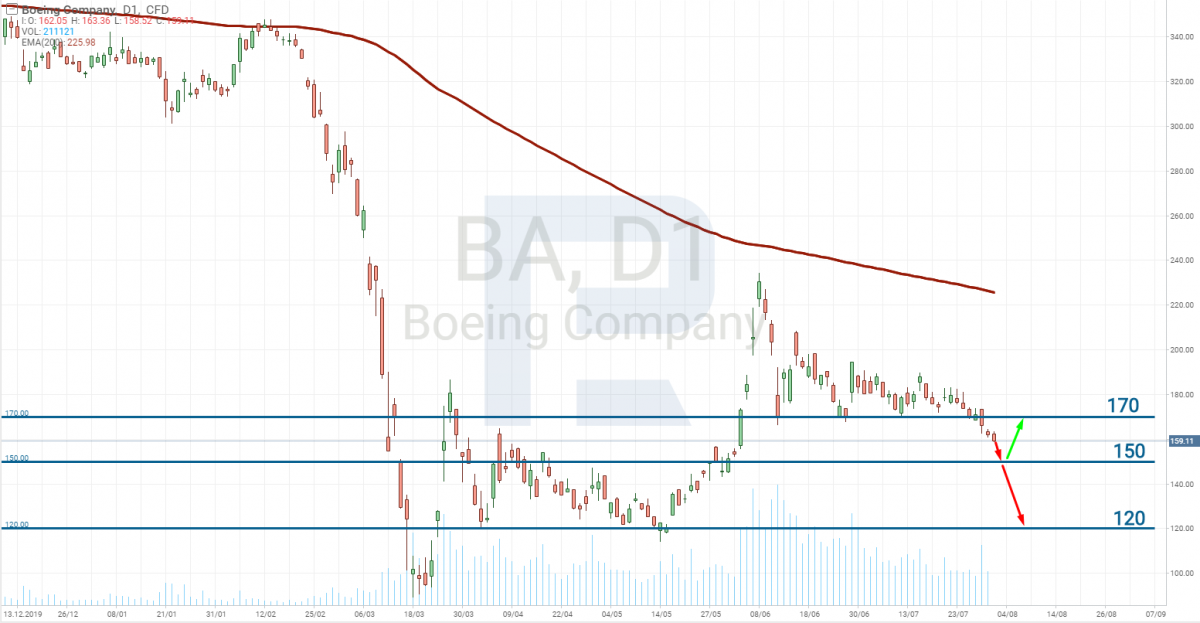

Boeing stocks technical analysis

Boeing stocks are trading under the 200-day Moving Average, which indicates a downtrend and a high probability of further falling. The nearest support level is 150 USD per stock. If it is broken away, the price may slump to 120 USD.

However, as long as investors had expected bad news by the end of the second quarter, the price might stop at 150 USD. The price might even try to rise to 170 USD.

Closing thoughts

Investors are always looking ahead and follow closely the forecasts of the management. And the Boeing management has made it clear that it sees no perspectives of clearing up in the nearest future. That is why the stocks went on declining after the report.

The profits of Boeing dropped due to partnerships with airlines, thus we have to keep an eye on the enhancement of the financial situation of air carriers.

The corporation also decided to help investors create new airlines that may enhance the demand for planes. They even issued a step-by-step guide on creating airlines from scratch. The program is called StartupBoeing, and the corporation consults and helps future owners of companies.

Of course, the business plan presumes using Boeing airplanes. However, even this project cannot increase the demand for airplanes abruptly; hence, it is too early to buy Boeing stocks, the price may become even more attractive.