Testing Omega Trend Expert Advisor: Advanced Settings

5 minutes for reading

Welcome to the RoboForex blog! Today, we will discuss quite an interesting expert advisor Omega Trend. This is a trend trading robot equipped with three built-in strategies and dynamic Stop Loss levels that, taken together, maximize your profit in Forex.

There are several versions of this expert advisor in the market. Note that the Omega expert advisor and Omega Trend are the same, so this review will make sense in both cases. We will focus on setting up the robot correctly and optimizing its parameters.

The principle of Omega Trend

The main task of the expert advisor is to detect the beginning and direction of the trend as fast as possible and enter the market maximum close to the beginning.

Another important factor is the time of holding the position because different types of markets require different approaches. Some trends last for hours while others – for days or even months. For the expert advisor to be more profitable, it was equipped with an additional strategy that helps detect the current state of the market, entry, and exit points. On the whole, Omega Trend incorporates three trading algorithms that work in symbiosis and help each other reach their common goal, which is profit.

Omega Trend is equipped by an indicator with the same name that defines price channels and entry and exit points to/from them. These points will serve as entry signals.

In the second strategy, you will find an algorithm that detects current market trends and reversal points where one trend changes abruptly for another.

The third strategy uses dynamic SL and TP levels. The levels are dynamic because the developers think that the use of static levels eats up a considerable part of profit while dynamic levels and Trailing Stop can increase the overall profitability of the system.

At the end of the article, find attached a link to an archive with Omega Trend files and a whole range of additional information. In the archive, there are two versions of the expert advisor, their initial code, the Omega Trend indicator and useful libraries and pre-saved files with optimized settings.

Thanks to the comprehensive approach, many traders highly appreciate the expert advisor and give positive feedback on it. That is why the robot has become so popular.

Setting up Omega Trend

- NFA_Rules: settings for US dwellers;

- Max_Spread: maximal spread. If this parameter is exceeded, trades are blocked. The parameter is obligatory for floating spread;

- Max_Slippage: maximal slippage (price fluctuation at the triggering of requoting);

- AutoGMT_Offset: setting up terminal time automatically;

- ManualGMT_Offset: setting up terminal time manually as the size of the deviation from GMT;

- DST_Usage activates summer time.

- Indicator_TimeFram: the timeframe for the indicator, in minutes;

- Action_TimeFrame: lagging after a trading signal and before making a real trade, in minutes;

- Volatility_Period: the parameter for calculating volatility;

- Smooth_Factor: the size of smoothing for trendlines;

- Max_Width_Pips: the maximal width (in points) for the deviation of the price from the indicator line;

- Min_Follow_Pips: the minimal deviation of the price from the trendline (in points);

- TrendLine_Level, PivotLine_Level: is the size of the change of trendlines;

- Bar_Acceleration: the sensitivity of the indicator after each closing bar;

- Profit_Acceleration: increases the sensitivity of the indicator at the increase of profit;

- Signal_1 (1, 0, -1): managing the main trading signal: 1 – enable; 0 – disable; -1 – hide the SL and TP from the broker;

- RecoveryMode_1: increase the lot after a loss until it is fully played back;

- Fixed_Lots_1: the size of the fixed lot;

- AutoMM_1: activates money management (if 1, Omega Trend will open 0.01 lot per every 100 of balance units);

- AutoMM_Max_1: the maximal lot when automatic money management is used;

- Magic_1: the identifier of the orders of the first strategy;

- Signal_1_TakeProfit: the Take Profit of the first strategy;

- Signal_1_StopLoss: the SL of the first strategy;

- Signal_1_StrongPips: the level where the channel has been broken away at the market entry, in points;

- Hour_Filtering: activate trading by hours for the Omega expert advisor;

- TradeHour [1…9]: set the hours when trading is allowed;

- Swing_Filtering: use a Moving Average as an additional filter;

- Swing_MA_Period: the period of the MA;

- Swing_Impulse: the distance from the price to the MA;

- NoTradeDay: prohibit trading on certain days of the week (where 0 is Sunday);

- TargetFactor: the factor for calculating the goal by profit;

- Signal_2_Exit_Profit: the exit point by the second strategy to reach the required profit in points;

- MinStop: minimal SL;

- IgnoreSmallStopTrades: ignore a short-time breach in the connection with the server.

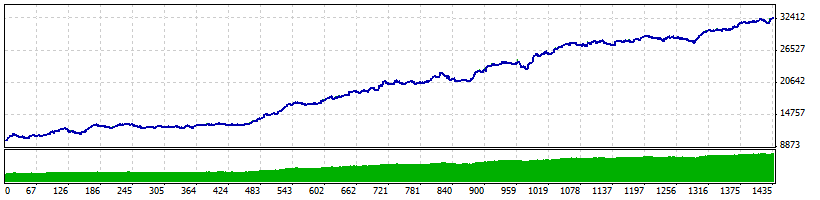

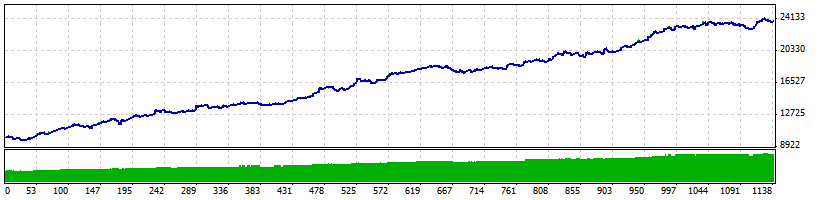

Optimizing Omega

This robot has a whole range of settings but some of them repeat each other. Those who have at least once optimized an expert advisor in MT4 know how much time it takes. Hence, limit yourself but just the list of those parameters that influence the results more than others.

In our case, the list is as follows:

- Indicator_TimeFrame;

- Action_TimeFrame;

- Volatility_Period;

- RecoveryMode_1;

- Signal_1_TakeProfit;

- Signal_1_StopLoss;

- Signal_1_StrongPips;

- Hour_Filtering;

- Swing_Filtering;

- TargetFactor;

- Signal_2_Exit_Profit.

As we have said, Omega Trend has many parameters, and these are not the only ones that influence its work. For obvious reasons, I cannot show you a full optimization process but below, you will find an archive with the expert advisor itself and optimization templates that will save your time, and help you do without full optimization.