DoorDash: US Largest Food Delivery is Planning IPO

6 minutes for reading

Some 15 years ago, most people preferred to go to a cafe or restaurant to have their favorite food. Nonetheless, the pace of life was becoming tougher, and step by step, delivery services allowed us to enjoy restaurant meals at home. The latest events – self-isolation and quarantine – have sped up the development of delivery services. In the USA, the leader of the segment is DoorDash.

At the end of October, DoorDash announced that it was planning an IPO. In the middle of November, the company sent in the S-1 form to the SEC. The IPO was postponed due to the Covid-19 pandemics; anyway, we can now look closer at the company. The IPO will happen in the NYSE under the ticker DASH.

McDonald’s at home

DoorDash was founded in 2013 in San Francisco. This is the largest food delivery service in the USA and Canada that delivers goods from local restaurants and supermarkets. You can order via the website of the company and its mobile app. For restaurants, profit is obvious: DoorDash helps them save up on organizing their own delivery services. Moreover, any person can become a partner of the company – a dasher (or delivery person) – and make some money.

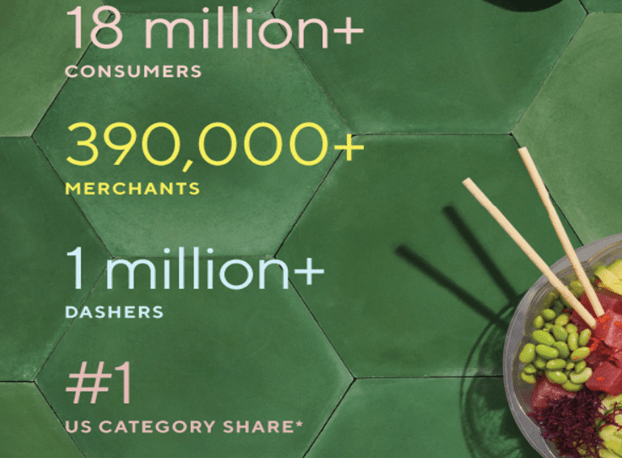

The company employs 1 million people and provides its services to over 18 million clients. There are over 5 million paid subscribers: they can just pay 9.99 USD regularly and never pay for delivery extra.

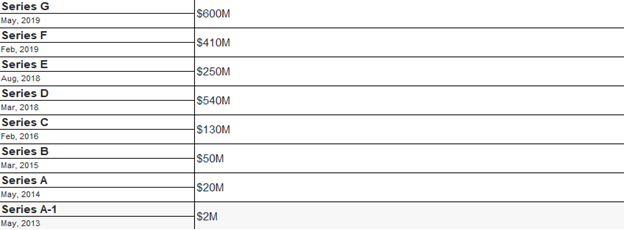

By rounds of venture financing, the company attracted over 2 billion USD from DST Global, Sequoia Capital, the Softbank Vision fund, Coatue Management, Dragoneer, and Temasek Capital Management.

DoorDash works with small shops and giants like Walmart, McDonald’s, etc. alike in 4,000 locations in the US and Canada. With the help of the DoorDash Drive service, the company also delivers goods and commodities to the same large networks.

Strategy of development

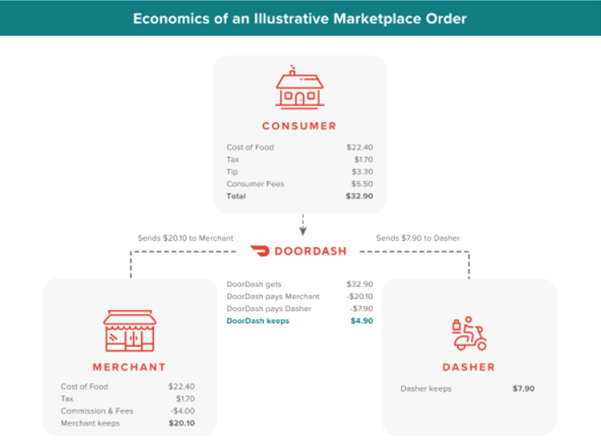

The company extends the network of partners, actively hires dashers, and thus increases the number of orders and the speed of processing them. The delivery fee is distributed as follows:

At the beginning of November, California started arguments around the employment of dashers. The sides agreed halfway: the company started treating their dashers as contractors, thus saving on unemployment insurance and paid vacations. DoorDash is sometimes sued for their peculiar system of rewards for dashers: for example, recently has started an investigation of their “tip system”. Clients thought their tips directly went to dashers but they were accumulated in the minimal wage fund. Frequent lawsuits are a risk factor, which the company mentions in the prospectus.

Market share of the DoorDash

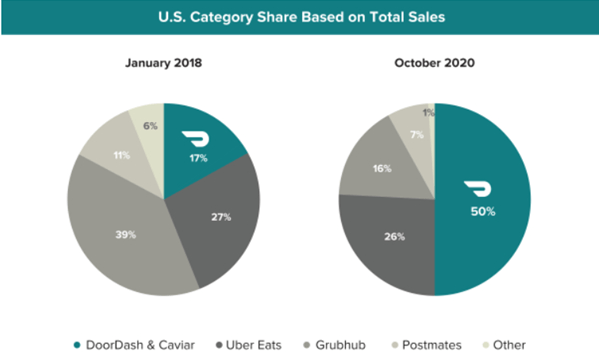

The food delivery market was nearly the only one to demonstrate growth during the lock-down. Today, the main rivals of DoorDash are UberEats, Postmates, and Grubhub.

DoorDash takes up 50%, 50%, UberEats - 26%, Postmates - 7%, and Grubhub — 16% of the market. As we can see, the have been almost no small delivery services in the market since 2018.

Even apart from the pandemics, the company is conquering the market quite actively. In 2019, various services delivered goods for 8 billion USD. In the same year, Americans spent 302.6 billion USD total on restaurants. Thus, the company has a bright perspective on the growth of revenue.

One of the secrets of its success is the decision to start working in small towns and suburbs. DoorDash simply had no competitors there because no company wanted to deliver to such remote locations. During the pandemics, this played a key part in the current results of DoorDash, see the exact digits below.

DoorDash financial performance

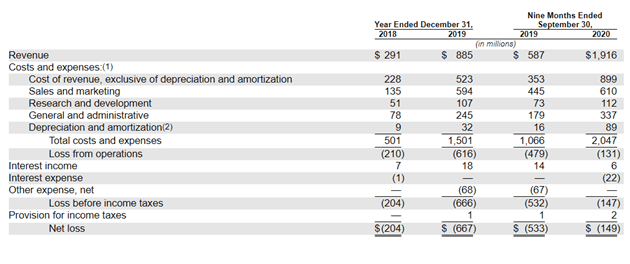

DoorDash has not begun to generate profit yet but it is reducing losses actively. So, take a look at how quickly the revenue of the company is growing:

In the first 9 months of 2020, the revenue amounted to 1.916 billion USD, which is 226.40% more than during the same period of 2019. The total revenue for the last 12 months is 2.214 billion USD.

In 2019, the revenue increased by 204.12%, compared to 2018. The net loss of the first 9 months of 2020 reached 146 million USD, which is 72.04% lower than in 2019. However, in 2019 against 2018, the digits grew by 226.96%.

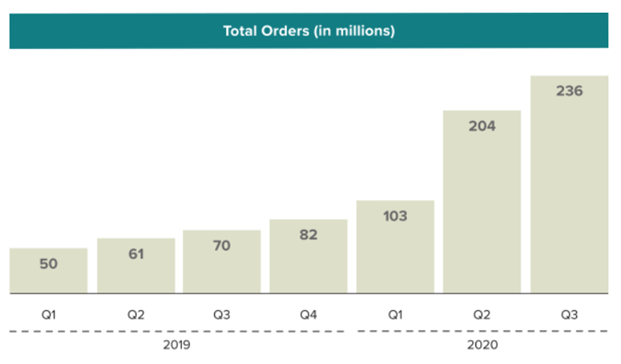

Hence, the pandemics have, no doubt, done good to the company, and the management has been smart enough to grab the chance. The dynamics of orders speaks for itself. It is clear that after cafes, malls, and restaurants get back to normal, we will witness this segment slow down or even fall. Hence, the growth zone for the company will be the market shares of its rivals.

In 2021, DoorDash might start generating a profit, as in the second quarter of this year, the positive result was 23 million USD. The company is planning to develop its network in Canada, Australia, and Puerto Rico.

Evaluation of the company and IPO details

With the current level of revenue, the capitalization of the company might reach 10.5-11 billion USD. This estimation is the lower border of the range, and the upper limit of the capitalization after the lockup period will amount to 22-25 billion USD. Growth might also be triggered by a new quarantine that has been imposed in certain states already.

We can also use comparative analysis for the evaluation. The closest rival Grubhub is currently estimated at 6.5 billion USD, making up 16% of the US market (which is 3.125 times less than DoorDash). Hence, 20.31 billion USD looks like a fair estimation for DoorDash (3.125 times more than Grubhub).

The underwriters are Oppenheimer&Co. Inc., PiperSandler&Co., WilliamBlair&Company, L.L.C., GoldmanSachs&Co. LLC, J.P. Morgan Securities LLC Barclays Capital Inc, Deutsche Bank Securities Inc., RBC Capital Markets LLC, Needham & Company, LLC, JMP Securities LLC, Mizuho Securities USA LLC, and UBS Securities LLC. The application mentioned plans to attract some 100 million USD, but closer to the UPO date, the sum may grow significantly.

The company offers stocks of 3 types: A, B, and C. They differ in the number of votes at general shareholders meetings, and the last type gives no vote at all. Possibly, if DoorDash starts paying dividends in the future, their size will depend also on the type of stocks.

Keeping in mind all said above, I recommend this company for short-term investments.