How to Invest in Stocks of Cannabis Producers?

9 minutes for reading

Here is a joke. Imagine traders rushing back and forth in the exchange. Each has three cell phones in their hands. Everyone is yelling:

- Buy! Sell! Five down!

Suddenly, a trader falls silent and looks out of the window. It is wintertime, the world is white and glistening.

- Guys, look, - he says, - the snow is falling.

The hall mutes for a second. Then someone shouts:

- Sell!

After marijuana (cannabis) was legalized in Canada in 2018 traders behaved as in the joke above, only instead of selling, they bought, and the conversation could go as follows:

What does this company work with?

Cannabis.

Buy!

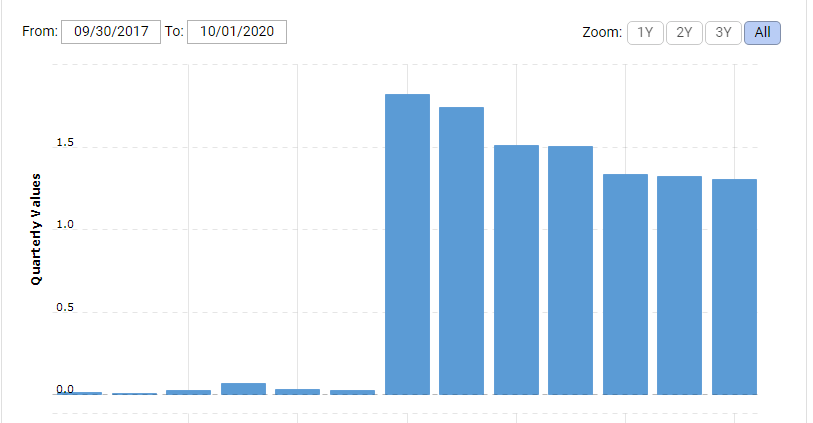

For example, the stocks of a Canadian cannabis company Tilray (NASDAQ: TLRY) grew from 25 to 200 USD in a month. No one cared what this company was like if it generated any profit or at least had any perspectives for it. “It is growing – we buy”.

When the “dust settled”, and investors looked closely at the stocks they had bought, it turned out that the financial performance of the company did not comply with the stock price. As a result, the stock price of Tilray headed downwards and is now trading below 10 USD per stock.

The cannabis boom touched upon all the companies working in the sector. However, initially, the stocks grew on pure emotions and excessive optimism, while now investors estimate the potential of what they buy with more care.

The cannabis market is expected to grow

According to the report of Grand View Research, Inc., the market of legal marijuana will have reached 73.6 billion USD by 2027. The legalization of cannabis for both medical and recreational purposes will increase demand in the market. Also, the market for marijuana-based smoking products is expected to grow fast.

Pharmaceutical use of marijuana lets the medical segment take up 71% of the overall revenue of the sector. Cannabis is approved for treating such serious diseases as cancer, arthritis, Parkinson’s disease, Alzheimer's disease, and other neurological diseases.

Legalize in the USA

In 2020, the stocks of companies working with cannabis, so to say, hibernated. Their papers traded in small ranges at lows and no animation was expected. However, the presidential election disturbed the stock prices.

President elected Joe Biden supports the legalization of marijuana all over the country. As a result, directors-general of cannabis companies relied heavily on the soon passing of bills allowing for wider use of this product in the USA. And their hopes came true.

On December 4th, the House of Representatives passed a bill lifting the federal ban on cannabis.

The UN excluded cannabis from the list of dangerous drugs

Be it a coincidence or not, two days before the voting in the Congress, the UN Commission voted for excluding cannabis used for medical purposes from the list of dangerous drugs. The preponderance of votes was minor: out of 53 member countries, 27 voted “for”, 25 - “against”, and one country abstained from voting.

This event will not entail instant softening of international control measures over marijuana. It is still up to each country whether to legalize marijuana on its territory, yet the trend has kicked off.

What’s the result?

US president Joe Biden supports the legalization of marijuana in the country, which means the market will be growing.

The UN has excluded cannabis from the list of dangerous drugs. Hence, other countries can also legalize marijuana-based products in their territory. This means that the international market for cannabis will also swell. Now we need to find the beneficiaries of this growth.

First and foremost, I suggest looking at a company that provides services to producers of cannabis.

Innovative Industrial Properties

Innovative Industrial Properties, Inc. (NYSE: IIPR) is an investment trust that owns and lets out specialized industrial property. In particular, the company specializes in buying, constructing, managing, and letting out real estate necessary for growing marijuana.

Unlike marijuana producers, Innovative Industrial Properties is a profitable company (in the second quarter, its net profit reached 19.2 million USD) and pays dividends with profitability of 3% per annum.

Since 2018, when marijuana was legalized in Canada, the stocks of Innovative Industrial Properties have been growing. They have grown from 12 to 160 USD per stock and keep trading near their all-time highs. Currently, the stocks look overbought, which is indicated by the 200-days Moving Average, and in the nearest future, the price might drop to 130 USD.

Innovative Industrial property is situated in the USA. The legalization of marijuana at the federal level might lead to an increase in the demand for the industrial real estate of Innovative Industrial, increasing the company’s profit. Hence, the stocks of the company are the number one candidate for a long-term portfolio if you want to invest in the growth of the marijuana market.

Producers of marijuana

Then we will consider those who directly produce and sell marijuana.

This segment is large but I have singled out three companies with the largest capitalization.

Canopy Growth Corporation

The leader in terms of capitalization is Canopy Growth Corporation (NASDAQ: CGC). To enter the US market, the company spent 300 million USD on acquiring the right to buy a cannabis-producing company Acreage Holdings Inc.

Factually, the merging with Acreage has not happened yet because Canopy Growth waited for the results of the voting over the ban on marijuana in the USA. The ban was lifted, and this means that in the nearest future Canopy Growth will enlarge thanks to the merging.

Cronos Group Inc.

Number two is Cronos Group Inc. (NASDAQ: CRON). It concentrates on selling oils, skincare cosmetics, and food supplements – all based on the cannabis it grows. Cronos Group is supported by a tobacco company Altria Group (NYSE: MO) that invested 1.8 billion USD in the development of the business of Cronos Group in North America.

As a result of this investment, Cronos Group now owns 1.3 billion USD, while its quarterly spending remains below 40 million USD.

The financial report for the third quarter again shows a net profit of 69 million USD. To compare, it finished the previous quarter with a loss of 31 million USD.

Aurora Cannabis Inc.

Last but not least, Aurora Cannabis Inc. (NYSE: ACB). It is also one of the world’s largest producers of cannabis, working in 25 countries on 5 continents. It produces up to 625,000 kilos of marijuana a year. The company deals with not only growing the plant but also with genetic research, breeding, wholesales, and retail sales of cannabis.

In November 2019, the company opened its flagship store sized 1022 square meters, which made it the largest cannabis shopping center in Canada.

To enlarge its business, Aurora Cannabis, as well as canopy Growth, buys other companies. In particular, it bought MedRelief, which allowed it to triple its producing powers and enter the market of South America.

There are other companies producing marijuana, such as:

- Tilray, Inc. (NASDAQ: TLRY)

- Aphria, Inc. (NASDAQ: APHA)

- HEXO Corp. (NYSE: HEXO).

Biopharma companies

The legalization of marijuana will bring about the research of this product, and this means, that there will appear more medicines based on the plant. Research and drug development is usually the job of pharma companies that can also benefit from the growth of the legal marijuana market.

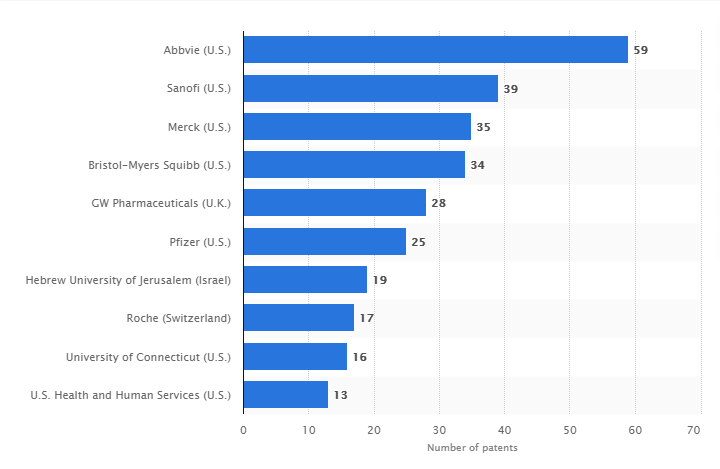

For example, one of the largest pharma companies AbbVie Inc. (NYSE: ABBV) has already registered 59 patents on medical cannabis.

Sanofi (NASDAQ: SNY), Merck (NYSE: MRK), Pfizer (NYSE: PFE) also joined in. However, the stock price of the companies above cannot grow as fast as that of marijuana producers because their income is diversified, and marijuana will make just a minor part of it.

As for GW Pharmaceuticals (NASDAQ: GWPH), it specializes in medicines with marijuana. Its main drug that is already on sale is Epidiolex. It is meant for treating epilepsy in children, Drava syndrome, and Lennox-Gastaut syndrome.

In the third quarter, the sales of the drug grew steeply, which drove up the stock price. Since the beginning of November, it grew by 50%.

Cara Therapeutics, Inc. (NASDAQ: CARA) can also make a substantial profit on the legalization. It specializes in pain-killers based on cannabis.

ETFs investing in marijuana

There are quite a lot of companies working with marijuana, and investing in each of them would require quite a substantial sum on the deposit. However, you can always go another way and invest in ETFs. In this case, you invest not in a single company, the choice of which could be wrong, but in a whole segment, and you will need much less money than if you bought the stocks of those companies one by one.

The world’s largest ETF investing in marijuana is the ETFMG Alternative Harvest ETF (NYSE: MJ). The fund invests in companies that grow, produce, and sell cannabis. It also includes pharma companies that develop and sell marijuana-based drugs. The lift of the federal ban will allow investing in US companies of the segment. Since November, the stock price of Alternative Harvest has grown by 45%.

Here is a list of other companies dealing with marijuana:

- AdvisorShares Pure Cannabis ETF (NYSE: YOLO).

- Indxx MicroSectors Cannabis ETN (NYSE: MJJ).

- Cannabis ETF (NYSE: THCX).

- Global X Cannabis ETF (NASDAQ: POTX).

- Cambria Cannabis ETF (AMEX: TOKE).

- AdvisorShares Vice ETF (NASDAQ: ACT).

- Amplify Seymour Cannabis ETF (NYSE: CNBS).

Risks

The number of new spots selling marijuana grows swiftly. For example, in Colorado, they have outnumbered Starbucks (NASDAQ: SBUX) cafeterias. The legalization will speed up the development of the network and the growth of the companies’ profit.

As a result of such speedy growth, there will emerge many new companies attempting to take their place in the market. This will cause tough competition where the strongest survives. Hence, in this segment, it is safer to invest in large companies.

Another risk is the overpriced state of the stocks. As long as the whole segment will be growing, even losing companies will enjoy demand for their stocks. Choosing the issuer, check its financial performance.

Bottom line

The first wave of growth of cannabis stocks ended in 2018. Now investors are more careful with what companies they invest in.

Yes, the marijuana market is indeed forecast to grow, so now is the best time for investments. The growth is likely to be slower than before but now you can buy the stocks at a very low price.