Facebook Accused of Monopolizing. Investors Get Thoughtful

10 minutes for reading

Since the beginning of the year, the stocks of Facebook (NASDAQ: FB) has grown by 34% to 275 USD and keep trading in an uptrend. However, in spring, the pandemics drove the stock price deep down to 140 USD, which made investments in the social networking system significantly more affordable.

The influence of the pandemics on Facebook

The influence of the pandemics on Facebook turned out less drastic than investors feared: Facebook is not an industrial company but a social network that users can access at any time and place, be it their homes or offices.

Advertisers give Facebook the silent treatment

Well, there was a risk that the income from advertising will drop because of, firstly, the losses that advertisers suffered due to the pandemics, and secondly, the boycott given to Facebook by Starbucks, PepsiCo, Coca-Cola, Diageo, Unilever, and Verizon. However, the companies joining the silent treatment and trying to persuade Facebook to be more accurate with false information and hate language got lost among 8 million other advertisers that use Facebook for promoting their goods and services. The company’s financial performance in the second quarter was proof.

Facebook finished the second quarter with a net profit of 5.1 billion USD, which is practically two times more than in the same quarter a year ago. This was a totally unexpected event for market players: Facebook stocks grew by 9% to 255 USD, and a couple of days later, the price leaped up by 25 USD more.

The companies were ready to carry on with the boycott but Zuckerberg assured the investors that the silent treatment will have little effect on the company’s income.

Facebook picks up electronic commerce

The pandemics forced a lot of governments into quarantine measures, from which the service sphere and offline retail sales suffered. Meanwhile, the income of those companies that worked in the electronic commerce sector kept growing. Facebook also decided to join in and in May, it launched an online platform called Facebook Shops. Next, on August 25th, the company announced its partnership with Big Commerce meant for launching an Instagram option that will let users order goods remaining logged in the application. As a result, the stock price rose above 300 USD, and analysts revised their forecasts, moving the goal of the stock price growth to 330 USD.

All in all, from March through August, the investors of Facebook got mostly good news, and the stock price growth carried on, seemingly unstoppable.

Elections in the USA

The situation changed when the election race in the USA entered its active phase. Social networking systems are used widely as platforms for political advertising. This imposes certain risks on the company that might later be accused of supporting a certain candidate. As a result, Zuckerberg announced that he would ban political advertising a week before the actual voting. This is a step made by the company to prevent interference with the election and supporting any candidate.

In 2016, Facebook already fought back critics connected to its attitude towards the election race won by Donald Trump. In particular, they said Russia used the platform for spreading false information. The day Zuckerberg imposed a ban on political advertising, the stock price of Facebook dropped by 6% and kept declining smoothly. It seemed like investors decided to avoid risks and wait until the end of the election race.

The voting took place on November 3rd, and on November 4th, Facebook stocks started growing. It took them three days to grow by 12% and approach 300 USD per stock. Joe Biden’s victory was other good news for the company because it entailed softer regulation of social networks – or, at least, it was supposed to.

A lawsuit against Facebook

However, a month later, Facebook got sued by 48 attorneys general of the USA and the Federal Trade Commission (FTC). The social network was accused of violating anti-monopoly legislation. The stumbling rocks were Instagram and WhatsApp – the plaintiffs insist on Facebook selling these apps.

It is stated that by buying Instagram and WhatsApp at their early stages of development, Facebook was getting rid of future competitors. This viewpoint is supported by an insider letter by Zuckerberg from 2008, where he writes that it was better to buy than compete. And after Instagram was bought, he noted that Facebook could always afford to buy promising startups to avoid rivalry in the future.

In his defense, Zuckerberg claims that Instagram and WhatsApp became popular thanks to the integration in Facebook.

The trial is just beginning, and there are plenty of sessions to follow. However, what is important here is the very interest of regulators to technological giants.

Two months earlier, the US Department of Justice sued Google, accusing it of suppressing competition by its predominance in the market.

Such proceedings were instituted against AT&T (NYSE: T) in 1974 and Microsoft (NASDAQ: MSFT) in 1998.

A lawsuit against AT&T

As a result of the lawsuit of the US Department of Justice against AT&T in 1974, the company, accused of monopolizing the telephony sphere, split into 7 regional companies. As a result, competition in the telecommunication market grew, while the price for such services dropped. This pushed the branch forward in its development. After the split, the capitalization of AT&T decreased from 150 billion USD to 34 billion USD.

AT&T got some questions about its business as early as 1910, but, as you see, trials took decades, and the plaintiffs had to wait really long for some palpable results.

A lawsuit against Microsoft

Microsoft was once accused of monopolizing the software market as well. The corporation required PC producers to install its browser Internet Explorer (IE) in exchange for a Windows 95 license. An ordinary user, I was totally surprised to know that there are other browsers apart from IE. However, nowadays we have got used to choosing a browser for Windows.

Will the split happen?

Investors have opposite views on the consequences of the lawsuit against Facebook. Some think that the split is not too probable, and their arguments are quite serious.

Others insist on the FTC convincing the federal judge in the intentions of Facebook to eliminate rivals by buying potentially “dangerous” startups. The result might be the split.

Firstly, note that the mergers with Instagram and WhatsApp were approved by anti-monopoly regulators. A split will now deteriorate the trust in the actions of anti-monopoly institutions. This way, we can cancel any other trade.

WhatsApp and Instagram are fully integrated with Facebook, they do not function as separate departments. User statistics, ads statistics, etc. are published for the whole Facebook, not just these services. Hence, it is not easy to take these apps away from Facebook.

There were cases of splits but they only involved departments that functioned separately, having just common finance with the rest of the company.

As an example, let us recall General Electrics. One department produces airplane engines, while the other one builds power plants. Both departments function under the same brand but their quarterly reports are separate and their businesses differ.

Another argument that supports Facebook is that there still is competition in the market. The rivals of the social network are other ones, such as Twitter, Tik Tok, Snapchat, Pinterest, etc. Facebook does not control the market, only leads it. Any user has the choice of where to register an account.

As a result, investors that do not believe in the split, get prepared for lengthy trials leading to a fine. Anyway, this will have little influence on the size of the market share taken by Facebook.

The supporters of the split think that the plaintiffs will convince the federal judge in Facebook trying to suppress rivalry by mergers with startups at the early stages of their development.

They have the insider letter by Zuckerberg and the testimony of the former owner of Instagram.

Moreover, the government is scared of Zuckerberg’s huge “power”. Facebook has 2.7 billion active users a month. One person should not have such power: today they are benevolent but tomorrow, they might start a war, deceiving users.

However, the main reason for the trial is away from Facebook. This lawsuit indicates the escalation of governmental pressure on technological companies. It started at the time of Donald Trump and is likely to continue at the presidency of Joe Biden.

The plaintiffs will go through any pains to win and make it clear for other companies that monopolizing the market will do no good.

What might selling WhatsApp and Instagram result in?

If the court makes Facebook sell WhatsApp and Instagram, this will harm the income and stocks of the company noticeably. Some investors will decide to take the profit while others will try to make money on the problems of Facebook. Both things will drive the stock price deep down. Facebook pays no dividends, hence price growth is the only source of income for those buying Facebook stocks. And stocks can only grow if investors see any potential for it.

At the early stage of Facebook development, the potential was seen in the growing number of new registrations. When this number stopped growing, Facebook replaced it with the number of active users in its quarterly reports. Hence, we can say that Facebook is close to its limit of new registrations, it needs new sources of income, and that is why it took up electronic commerce.

However, there is another way, which is splitting the company. Then they will have to start from scratch, and the growth potential will be huge again. But will Facebook manage to become number one among social networks again? Will investors believe in Zuckerberg one more time, or will they prefer Instagram without Facebook?

By the way, in 1999, Internet Explorer took up 90% of the browser market, and now it takes 4.71%. The Department of Justice did its job well. Other browsers came to the market, a rivalry began, which is good for the development of the market, and for users who now have a choice. Time will show if Facebook shares the fate of IE.

Facebook stocks tech analysis

The trial has just started, and it is too early to make any conclusions. However, tech analysis might give some answers. It is really important to watch the behavior of investors in the stocks.

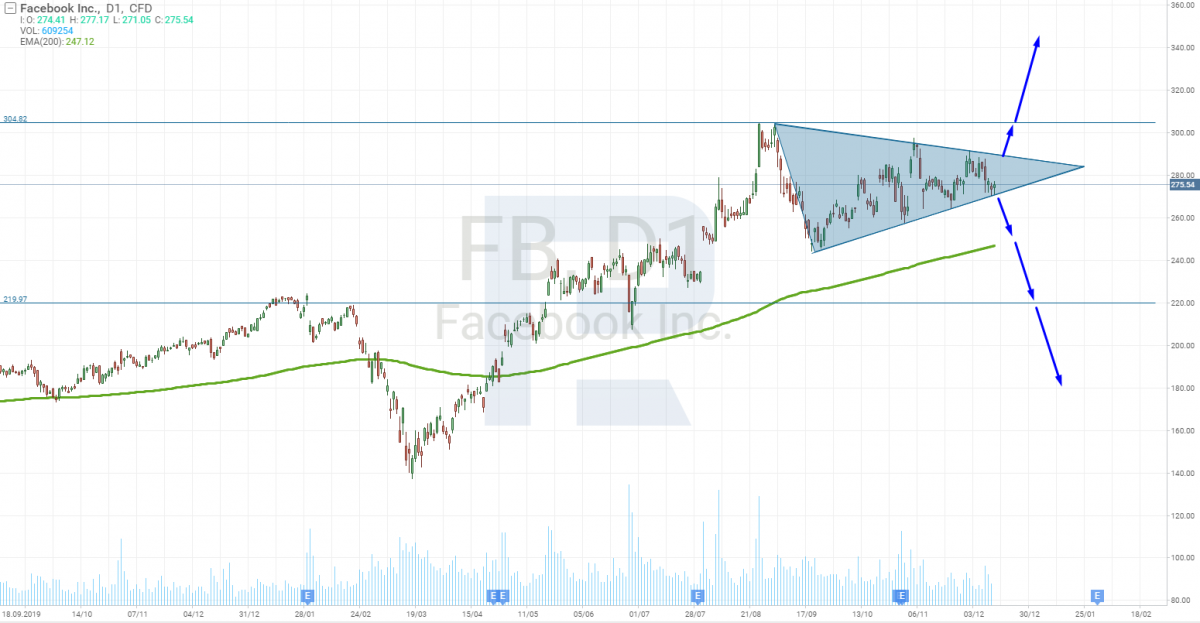

Strange as it might seem, tech analysis also gives vague results. On D1, there is a Triangle, which might mean either stock price growth or falling depending on which line of the pattern will be broken.

Currently, the growth potential is higher because the 200-days Moving Average hints at it. If the quotations succeed in breaking through the upper border of the Triangle, this will mean that investors are optimistic about the development of Facebook in the field of electronic commerce.

A breakaway of the lower line of the pattern will be an alarm signal for long-term investors, while a subsequent breakaway of the 200-days MA might even entail a downtrend. In this case, investors will be considering a possible split.

Closing thoughts

In the short term, Facebook stocks will enjoy demand while its quarterly reports are good but the news about the trial will persuade investors to take their time. And this is what I advise you.