Pfizer and BioNTech SE Won the Vaccine Race

7 minutes for reading

On December 11th, the US Food and Drug Administration approved BNT162b2, the vaccine against COVID 19, developed by Pfizer (NYSE: PFE) and BioNTech SE (NASDAQ: BNTX). It is the first vaccine to have been approved by the American regulator. Later on the same day, US President Donald Trump announced the start of vaccination in the USA.

The medication will be delivered by FedEx (NYSE: FDX) and United Parcel Service (NYSE: UPS). The vaccination procedure will be carried out in two stages three weeks apart from each other. Possible side effects are fatigue, shivers, headaches, and muscular pain. The medication has proved to be 95% effective.

The key problem in using BNT162b2 is its storage temperature, which must be below -70 degrees centigrade. Due to this, Pfizer developed innovative solutions in packaging and storing the medication.

The package includes temperature-sensing elements with GPS support, which allow to track the location of each batch and timely respond to any adverse changes in the vaccine delivery process.

As usual, market players are wondering – how can we make money on this? Both companies that developed the vaccine are traded on American stock exchanges and their shares may be considered as a “front-runner” for investments.

Pfizer Inc.

Pfizer is one of the world’s biggest companies, which develops vaccines. The company supplies its medications to 165 countries and produces over 200 million vaccine doses every year. Also, Pfizer is the biggest supplier of sterile injection drugs and produces more than a billion of them a year. The company has manufacturing facilities in the USA and Europe, that’s why its medications have no problems with accessing the European market.

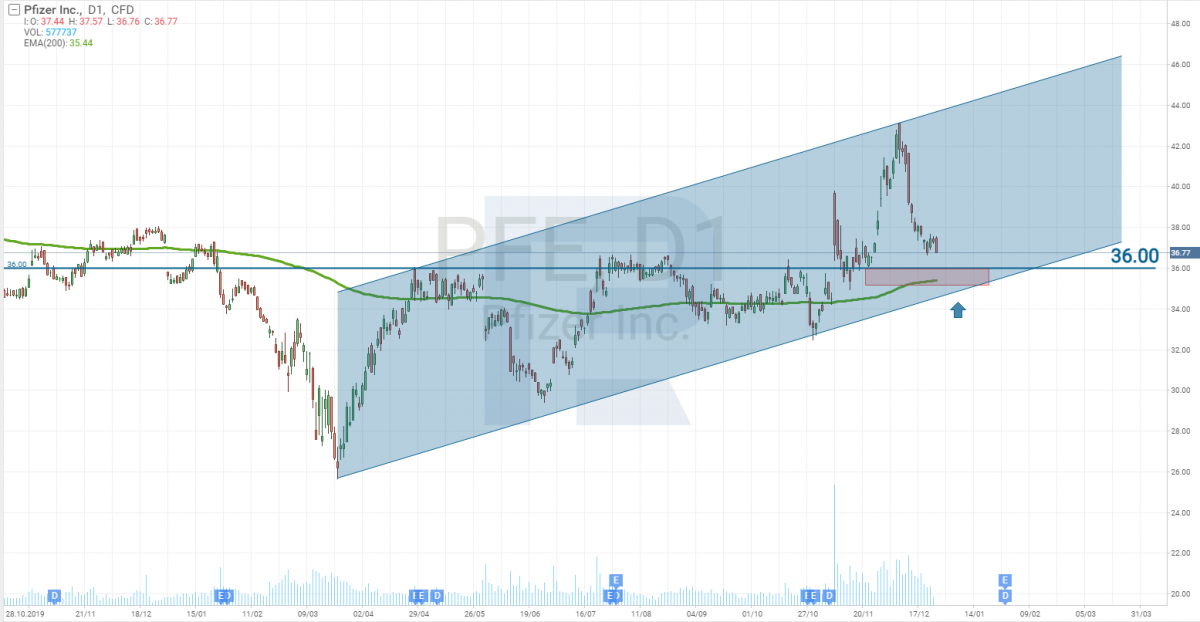

Over the last 9 months, Pfizer shares have risen from $26 to $43. However, after the American regulator had approved the vaccine, shares started getting cheaper and finally dropped 14%. “Buy the rumor, sell the fact”, pure and simple. Investors started taking profit and that resulted in the depreciation of shares. However, at the moment shares are expected to rise again because of the company’s profit from the vaccine sales.

US Government orders

As far back as July, Pfizer and BioNTech entered into an agreement with the US Government to supply 100 million doses after the vaccine was approved by the FDA. The government was to pay the companies $1.95 billion.

The vaccination of the American population started in December and on December 23rd, they announced the second agreement, according to which, Pfizer and BioNTech had to supply an additional 100 million doses. The total amount of 200 million vaccine doses must be produced and supplied by July 31st, 2021. In addition to that, the US Government reserved the right to order 300 more million doses.

The American population is 335 million people, the minimum age threshold for a vaccination with BNT162b2 is 16.

By the time of the latest presidential elections, they published information about the number of people, who have the right to vote – 239.2 million. As a result, the total number of citizens to be vaccinated is about 250-260 million people.

The vaccination procedure against COVID-19 will be carried out in two stages three weeks apart from each other. Totally, the entire high-risk American population will require at least 500 million doses. This is exactly the number which is described in the agreements between the US Government and Pfizer and BioNTech.

This indicates a special trust in BNT162b2, although a week later the FDA approved one more vaccine, produced by Moderna (NASDAQ: MRNA). However, there were no such big orders here.

Vaccine from Johnson & Johnson Inc and AstraZeneca Plc

In order to avoid accusations of bias towards some particular medication, the US Government is planning to order another vaccine from Johnson & Johnson Inc (NYSE: JNJ) and AstraZeneca Plc (NASDAQ: AZN) after approval by the FDA, which is expected in February 2021. However, according to research, the effectiveness of their vaccine called AZD1222 is about 70%, and in some cases, upon changing a dosage, 90%.

It is also reported that one of the side effects found during the trial period of AZD1222 was a rare inflammatory disease, transverse myelitis. It remains to be seen whether the demand for AZD1222 will be the same as for BNT162b2 from Pfizer – all we can do now is wait for the final results of testing AZD1222.

The Pfizer vaccine on the European market

In the early stages, Pfizer made a very wise move in choosing a partner for cooperation, which turned out to be a German company called BioNTech SE. As a result, the vaccine developed by these companies became the first one to have been approved in Europe. Soon, it will be sold in 27 countries, members of the European Union. The parties have already signed an agreement to supply 200 million vaccine doses in 2021 and the opportunity to order an additional 100 million. In European countries, the medication will be manufactured on facilities owned by BioNTech SE and a Pfizer factory in Belgium.

BioNTech SE

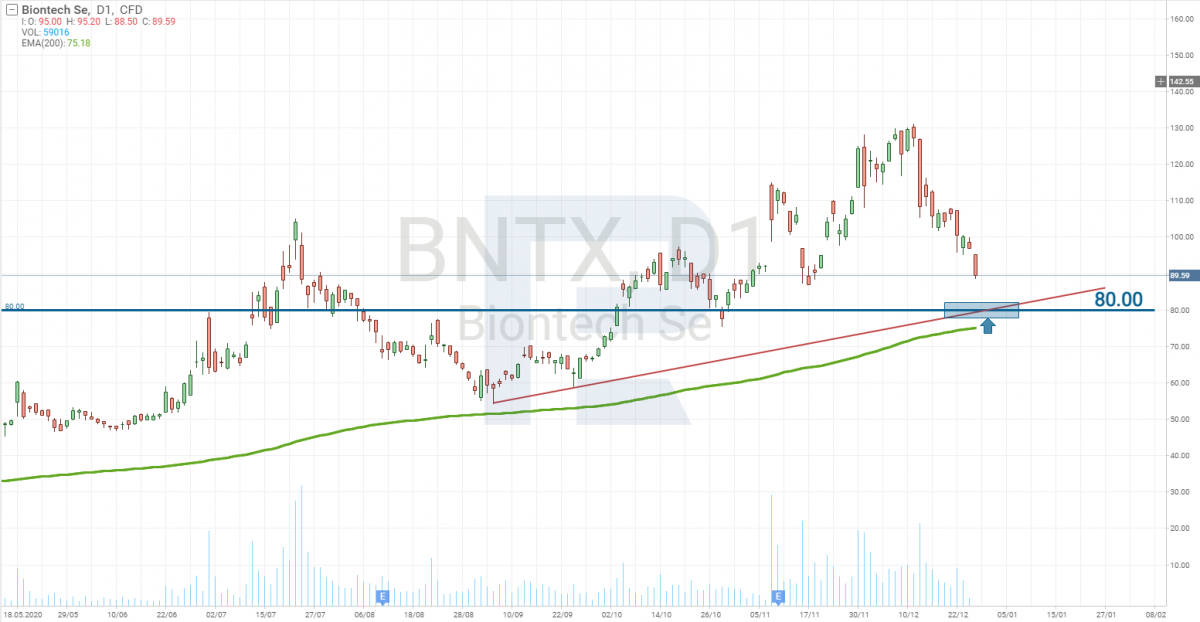

After teaming up with Pfizer to work on the vaccine, BioNTech SE found its shares correlating with Pfizer’s. However, since BioNTech SE is significantly smaller than Pfizer, its shares were much more volatile.

BioNTech SE is a German biotechnological company, which is involved in the development and production of immunotherapeutic agents for treating grave diseases.

It was established in 2008 by Uğur Şahin, Özlem Türeci, and Christoph Huber, who are medical professionals and still working in the company.

In September 2019, BioNTech SE signed an agreement with the Bill & Melinda Gates Foundation to develop vaccines and immunotherapeutic procedures for AIDS and tuberculosis.

For a long time, the company was known only in certain circles. However, everything changed after it started collaborating with Pfizer in the development of the COVID-19 vaccines.

At the moment, BioNTech SE is a loss-making company, just like a lot of other young biotechnological companies but vaccine sales may dramatically change things for the better.

Since the beginning of 2020, BioNTech SE shares added 192%. Here, the situation is similar to Pfizer: the price was falling in the previous months because investors were taking a profit. However, the major trend is ascending, which is confirmed by the 200-day Moving Average, that’s why the current decline should be considered as a correction.

BioNTech SE will have enough orders for the next several years, that’s for sure, thus increasing its profits. Possibly, the company’s shares will also continue rising slowly.

Risks

A new coronavirus strain found in the United Kingdom puts the effectiveness of vaccines, which have been developed since the spring of 2020, in jeopardy.

This new strain is spreading faster than the initial one and that may lead to the appearance of another mutation because the quicker it replicates the more opportunities to mutate it has. And if the vaccine from Pfizer and BioNTech SE can beat the new strain, then other mutations may be rather questionable and will require additional tests and trials.

Moderna and Pfizer insist that their medications will be effective in fighting the new coronavirus strain (and others in the future as well) because they are going for a spike protein on the surface of SARS-CoV-2. In order to bypass such “armor”, the virus has to change several protein segments simultaneously, which is highly unlikely and has never occurred with the other viruses.

Factual research says that the vaccine by Pfizer and BioNTech SE may be effective against 20 different versions of the virus.

Closing thoughts

Unfortunately, the coronavirus may become a seasonal disease, which means that onу may need to vaccinate every year. It’s very good for those who manufacture the vaccine because these companies will be secure with new orders for a long time.

Of course, sooner or later there will be more and more companies that develop and manufacture vaccines against the coronavirus, hence fierce competition. However, Pfizer and BioNTech SE will probably reign this market in the next few years. Consequently, shares of these companies might as well make a profit to those who invested in them.