How to Check the Stability of Your Trading System?

4 minutes for reading

In this overview, we will discuss such a property of trading systems as stability. The stabler the system remains under the influence of surrounding events, the stabler your trading by the system will be.

What is the stability of a trading system?

According to experienced traders and exchange gurus, a trader must not focus solely on the profit in separate trades. The main trading goal must be the stability of positive results that will lead to the sustained growth of your capital. The gradual growth of your capital without serious surges and losses is more preferable to a profitability chart full of peaks and slides.

To reach good results in all conditions, any trading system or strategy must be stable. The stability of a trading system is its ability to yield good results in various trading conditions. This means that when the conditions change, the system will be able to adapt to them and go on showing positive results.

A stable trading system must have a clear and understandable trading logic that is flexible enough to adapt to current market conditions.

There are several types of stability of trading systems: market phase stability, trading session stability, timeframe stability, instrument stability, and more. Let us focus on some of these types.

Market phase stability

The trader must make sure that the trading system performs equally well in different market conditions (phases). Markets change all the time from trend to consolidation and back. Supply and demand lose balance, and either of them starts dominating. Conditionally, there are four types of market phases:

- Accumulation

- Trend

- Distribution

- Opposite trend

Ideally, the system must work equally well in all market phases; however, few systems are so universal. Most often, trend strategies turn out to be helpless in flats, while those systems that work well in flats, lose efficacy in trends.

Hence, the main goal here is to determine the market phase that makes your system inefficient and abstain from trading in such phases in the future. In such cases, you can use other trading systems that yield good results in the current market phase.

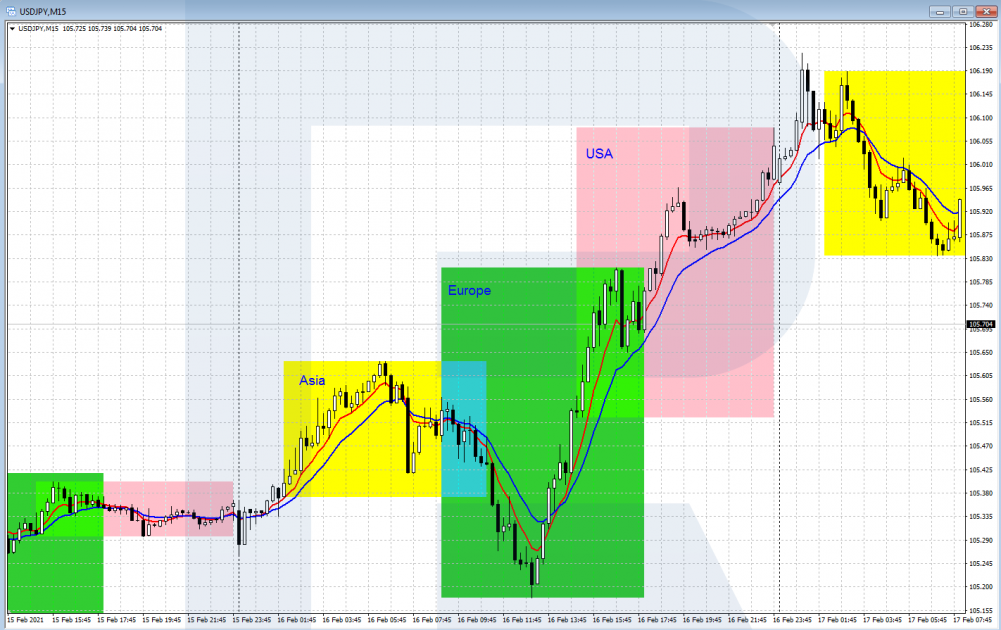

Trading session stability

Trading session stability is the ability to remain efficient regardless of the time of the day (whether it is night, morning, afternoon, or evening). As we know, markets are more volatile at one time of the day and less volatile at some other. This is explained by the time when the largest trading platforms in the world open.

There are four trading sessions a day (UTC+2, EET):

- Pacific (22:00-06:00)

- Asian (2:00-11:00)

- European (8:00-17:00)

- American (15:00-24:00).

Markets are most volatile during the European and American sessions. You need to check the statistics of trading in various sessions. Some systems need increased volatility, some work better in calm times (the Pacific or Asian sessions). For example, several years ago, scalping at night was popular.

Timeframe stability

This type of stability means that your system works equally well on different timeframes. The general agreement is that the smaller the timeframe, the more difficult it is to trade due to much market noise. Hence, all trading systems have the minimal timeframe where it remains efficient.

Single out the timeframes that are the best for your system and focus on them. Smaller timeframes give more trading opportunities, while signals on larger ones are more reliable. If your strategy works well on H1 and M15 but its performance shrinks on M5, you should not trade on timeframes under M15.

Assets stability

A strategy can be called assets-stable if it works well with a wide range of trading instruments. However, such universal systems are rare to be seen. As a rule, most systems are efficient with certain instruments but perform poorly or even lose with others: all instruments have different volatility, react to the news differently. Are influenced by seasons, etc.

Thus, if your system is not universal, decide on the list of instruments that make it most efficient. Check the statistics of various trading instruments: currency pairs, stocks, metals, oil etc. You can use several systems simultaneously, each one working best with a certain set of instruments.

Closing thoughts

Stability is an important property of a trading system that demonstrates its ability to remain efficient in different trading conditions. It is important to study your trading statistics well and determine the limits of your system’s stability – its strong and weak points. Knowing these peculiarities, you can trade in such a way that your system will show the highest efficacy.