How Should a Beginner Prepare a Trading Plan?

6 minutes for reading

In this overview, we will discuss preparing trading plans. A trading plan helps evaluate the current market situation and make the trader’s plans come to life.

What is a trading plan necessary for?

A trading plan is something like a road map for traders. Based on the trading strategy that you use, a trading plan formulates existing trading opportunities and promising trades. Promising trades are those that have a high probability of a success; they are made in the right place, at the right time, with a moderate risk and a good potential profit.

A trading plan must describe your trading ideas, your analysis of the current situation in detail. It makes a “picture” of your view on the market on paper (or in a file). On the whole, successful analysis and a correct opinion about the market do not guarantee good trading by themselves, however, your current thoughts can show you the field where you can look for trading ideas.

Having a clear and easy-to-understand trading plan, a trader stops making chaotic emotional trades. They are no more a helpless wood chip on market waves. They set their sails and starts off towards their profit, finding and closing promising trades. Thanks to the plan their trading becomes more efficient.

Preparing the plan

The process of preparation can be split in several steps: technical picture, fundamental factors, additional signals (indicators), risk control, taking the profit. Active traders make trading plans every day in the morning, bringing it to life during the day with necessary corrections and amendments.

Step 1: Technical picture

To evaluate the technical picture in an instrument, we use good old tech analysis. Open the chart of your financial instrument, check several timeframes (starting with larger ones and going down to smaller ones), and mark all the important factors:

- Trend direction, trend lines

- Support and resistance levels

- Tech analysis patterns

- Additional signals: Fibonacci levels, candlestick combinations, Price Action patterns, various original methods.

After you have marked everything on the chart, find suitable entry points on it by your strategy. Choose signals based on which you will open your position: a breakaway of or a bounce off an important level, exiting a price range, a complete tech analysis pattern, etc. Mark all the entry points and confirming signals in your trading plan.

Step 2: Fundamental factors

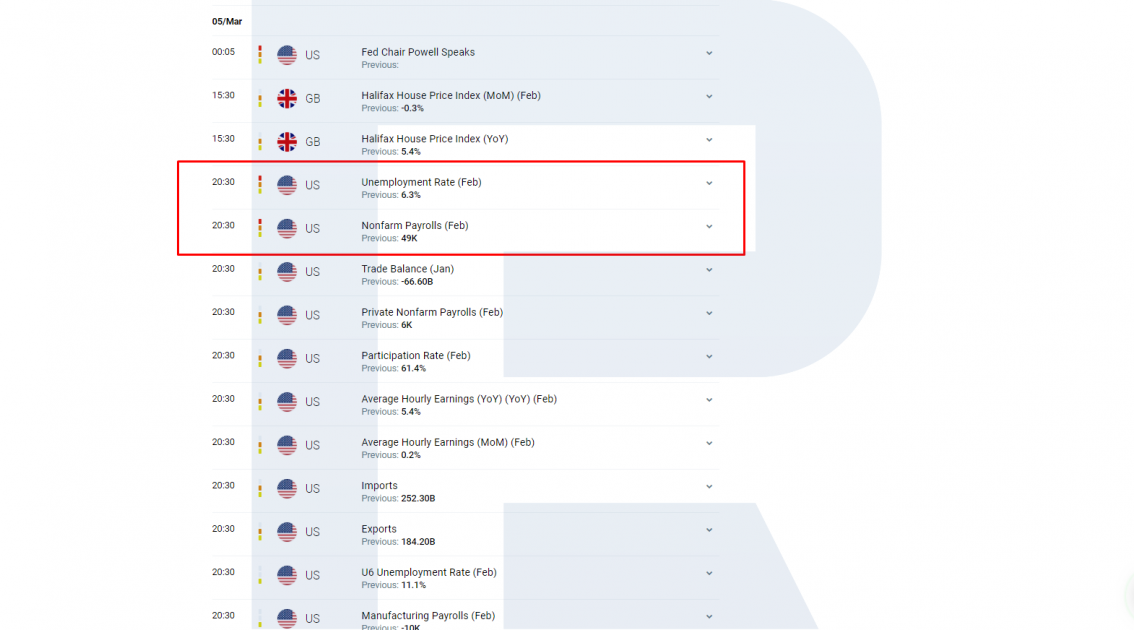

The main thing that pushes quotations in the market forward is fundamental news, such as decision on interest rates, publications of macroeconomic indicators, speeches of politicians, etc. Such news provokes volatility and gives guidelines for quotations.

To find out which news will come out and when, use an economic calendar. Open it in the morning and mark important events of the day. After some serious data emerges, a signal to open a position by your trading plan might appear – this is the gist of trading news. Or, on the contrary, you will have to close a profitable position or minimize risks (by pulling the Stop Loss closer) before some data appears.

Step 3: Signals from indicators

These days, there are plenty of indicators that help traders carry out holistic market analysis. Trading indicators are mathematical functions based on price or volumes. They not only help to analyze the market but can also give additional trading signals. Some indicators are good for trends, some – for flats, some are universal.

As a rule, traders use indicators as a supplement to tech analysis. Indicators can give confirming signals for opening positions; show the direction of the trend; give indications for placing Stop Losses and Take Profits. Write down the indicators you use and the opening and closing signal they give in the trading plan.

Step 4: Stop Loss and Take Profit

To limit risks in trading, you need a strict plan of closing losing positions and taking profits. When the market goes against your position, Stop Losses and Take Profits work as insurance, limiting losses and protecting profits. Hence, planning trades, you need to check a place for a technically correct SL and a way of taking your profit.

The SL to TP rate is extremely important; it can also be used as an additional filter for choosing trades. If it is 1:1, think twice. Choose trades where the ratio is 1:2 or more. These are what we call promising trades – when the potential profit is several times higher than the potential loss.

Following the plan

When your plan is complete, you will have a holistic picture of your possible actions in the market: where and based on what signals to prepare trades, what news can influence price dynamics, where to place an SL, where to take the profit. This looks as follows:

- You financial instrument, the current trend

- Signals (tech analysis, news, indicators, etc) to open positions

- Entry point, direction of trading

- Controlling risks – where to place an SL

- Where (or when) to take the profit

Then the trader must follow their plan rigorously. If there is a signal to open a trade – enter the market, if there is none – stay to the side and do not poke your nose at the market. Here, the trader’s discipline is essential: it is not enough to prepare a trading plan; the crucial thing is to follow it. With this, the basic psychology of trading might help.

Correcting your plan

During the day, depending on the dynamics of quotations, the plan might need certain corrections: additional signals might appear or, on the contrary, some of the signals might become irrelevant. This is absolutely normal, the market is influenced by multiple factors, including macroeconomic indicators. Make all the necessary corrections and go n following it.

At the end of the day, right down the results in your trader’s diary. This will show you if you have been following the plan or trading chaotically. Also, later you will assess the statistics, see the weak and strong points of your trading systems, and correct if necessary.

Closing thoughts

A trading plan is the trader’s main instrument and weapon. It is meant to evaluate the current situation in the market, plan and carry out promising trades. Having a well-prepared trading plan, the trader protects themselves from chaotic, emotional trading. Being disciplined and thorough about your trading plan, you will enhance your trading and your professional skills.