The Honest Company IPO: a Healthy Lifestyle Movement

6 minutes for reading

Nowadays, an increasing number of adults realize that living a healthy lifestyle is important not only in childhood. It is now the thing to do sports, eat healthy food, avoid tobacco and alcohol, and choose only green cosmetics. Over several years, manufacturing and selling products for a healthy lifestyle became a powerful industry with volumes worth billions.

In 2012, a Hollywood celebrity Jessica Alba founded The Honest Company, which chose its mission to create a community of conscious consumers and change a lot of consumer commodities. On May 4th, the company will have an IPO at the NASDAQ. Its shares will start trading the next day under the “HNST” ticker.

The Honest Company business

The Honest Company actively promotes ideas of rational consumption. The company strives to use innovations when creating its products, which allows it to expand the range of the goods it offers. The Honest Company develops only sophisticated and ecologically safe products.

When promoting its goods, The Honest Company draws the attention of its customers to the things that are the most important for them – home, family, and health. The company works with people of any age and gender at every stage of their lives, regardless of where they are, at home or on the road.

The company is currently offering three categories of goods:

- Home products.

- Diapers and napkins.

- Personal hygiene and skincare products.

The company sells its products directly or through online channels, including its official website. The company’s other method to sell goods is a subscription and it was a pioneer in this area in the industry. More than half of the revenues come from online channels. The efficiency ratio of marketing expenses is 0.9., which means that every dollar spent on marketing yields a $0.9 revenue. This might be considered as the company’s growth area, which we’ll discuss in more detail when talking about its financial performance.

The Honest Company is working on expanding its product family because its target market is in an early stage of development. The key companies that invested in The Honest Company are Lightspeed Venture Partners, General Catalyst, Fidelity, and THC Shared Abacus. It would be better to review The Honest Company business through the lens of developing trends in its target market.

The market and competitors of The Honest Company

The company believes that the market of ecological commodities for childcare and personal hygiene reached $130 billion in 2019. An average annual growth rate until 2025 is expected to be 3%, which is confirmed by researches in the past. For example, according to Food Business News, in 2014-2017, this reading was 3.5%.

The share of “clean” products on this market will be about 5%, with growth potential. The reason for that might be changes in sentiments in society. According to a survey from Nielsen, 48% of consumers change their habits in favor of more healthy products. Notably, among the prevailing millennials generation, this number was 75%.

This market features companies, which earned their market niches. The biggest of them are:

- Johnson & Johnson Consumer

- Procter & Gamble

- Estee Lauder

- The Clorox Company

- Kimberly-Clark

- Pacifica Beauty

- L'Oreal

The company’s higher sales and profit margins directly depend on how quickly the tastes and preferences of its target audience change. The Honest Company decided to focus on the products people usually don’t save on. Let’s go deeper into the company’s financial reports.

Financial performance

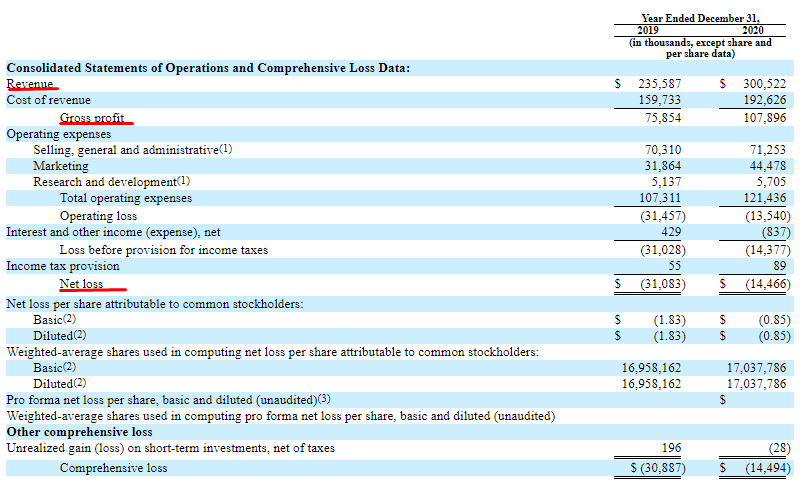

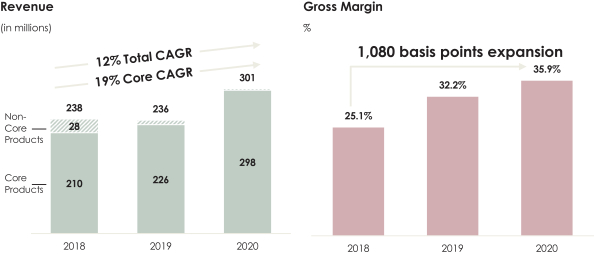

According to the S-1 report, the company doesn’t generate a net profit, that’s why let’s focus on the analysis of its revenue. Over 2020, The Honest Company’s sales volume was $300.52 million, which is a 27.56% increase when compared with 2019. If one compares 2019 and 2018, there wasn’t any growth in the indicator. The coronavirus pandemic made people be more careful about their health.

The gross profit in 2020 was $107.90 million, which is a 42.25% increase relative to 2019. As a result, the gross profit margin was 35.9%, which indicates the business’s efficiency growth and a possible net profit in the future. This idea is also confirmed by a net loss reduction speed.

The company’s net loss in 2020 was $14.47 million and that’s a 53.44% decrease if compared with 2019. If the company’s current development pace continues, it may generate a net profit by the end of this year.

Cash and cash equivalents on The Honest Company’s balance sheet are $63.68 million, while the total liabilities are equal to $38.43 million. In this case, its net cash balance is $25.26 million. As we can see, the company is safe from bankruptcy.

Strong and weak sides of The Honest Company

Now let’s assess the risks and advantages of investing in the company’s shares. I believe the strong sides of The Honest Company are:

- PR and promotion by a Hollywood celebrity.

- The revenue growth rate the last year increases by 25%.

- In 2020, the company’s net loss was reduced by over 50%.

- The target market is in an early stage of development.

- Sound management.

- A distinctive sales model on a subscription basis.

- Application of innovations when creating its product family.

Risk factors of investing in the company are the following:

- Strong competitors.

- Dependence on the personal taste of its target audience.

- The company is loss-making and doesn’t pay dividends.

- The revenue growth is not stable.

IPO details and estimation of The Honest Company capitalization

During several preliminary rounds of financing, the company raised $376 million. The underwriters of the IPO are Samuel A. Ramirez & Company, Inc., Citigroup Global Markets, Inc, Penserra Securities LLC, Loop Capital Markets LLC, C.L. King & Associates, Inc., Telsey Advisory Group LLC, Morgan Stanley & Co. LLC, J.P. Morgan Securities LLC, and Jefferies LLC, BofA Securities, Inc.

During the IPO, the honest company is planning to sell 25.8 million common shares at the price of $14-17 per share. if shares are sold at the highest price in this range, the company may raise ~$400 million with a capitalization of up to $1.4 billion.

Since the company is loss-making, to assess its shares potential, we use a multiplier, we use the price-to-sales ratio (p/s ratio). at the time of the IPO, p/s may be 4.67, while during the lock-up period it may reach 8. In this case, the upside for The Honest Company shares may be 70% (8/4.67*100%).

With all that said, I would recommend this company for mid-term investments.