Squarespace Inc DPO: a Website for Dummies

6 minutes for reading

Nowadays, a lot of representatives of small and medium-sized businesses face the necessity of building their own websites if they want to compete with major market players. Websites help to increase sales and increase the efficiency of their operational activities. Small restaurants, boutiques, workshops, confectioneries, and other representatives of offline commerce can be found on the internet. This process was boosted by the coronavirus pandemic when it became impossible to accept orders and sell goods in an old-fashioned way. The e-commerce sector exploded.

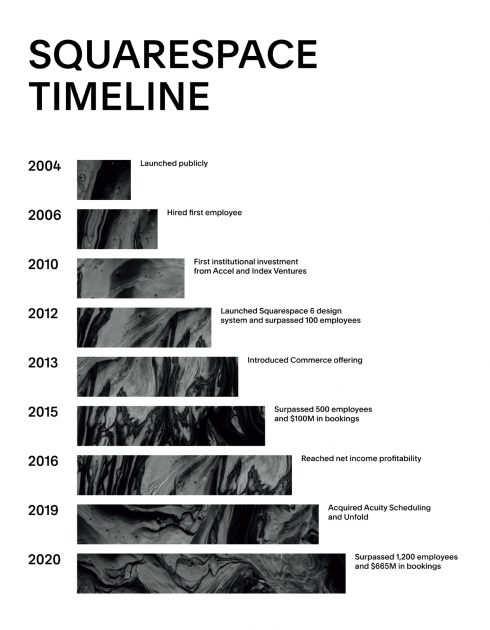

SquareSpace, the company that helps individual entrepreneurs to create websites, has filed for a DPO at the NYSE. The company’s shares will be traded under the “SQSP” ticker, while its DPO is scheduled for May 19th. Let’s discuss the company’s business.

SquareSpace business

SquareSpace was founded in 2004 and is headquartered in New York. It started operating as a Saas platform for creating websites but gradually added some extra features later. The latest global update to the platform was in 2012. As of now, SquareSpace’s offer includes:

- Tools for creating a comprehensive website.

- Blogging.

- Web hosting.

- Internet marketing, corporate e-mail, and SEO tools.

The platform is easy to use and helps millions of clients from 180 countries to create their own websites with unique designs without having any programming skills. The company mostly operates in the B2B segment.

The company’s clients have access to the following advantages:

- Presence on the internet. Clients of SquareSpace can create professionally-looking websites, buy domains, register social network profiles. The company invested in designer teams to develop innovative design patterns.

- Tools for commerce. The company’s services are popular with small online shops and marketplaces. SquareSpace offers the entire infrastructure for processing orders and accepting payments.

- Thanks to the company’s solutions, clients can email newsletters, communicate with users, and perform search optimization. Analytical tools from SquareSpace allow to manage sales, conversion, and traffic.

SquareSpace sells its services on a subscription basis. At the time of the DPO, the company has 3.7 million users and this parameter doubled in 2020. All these positive factors had a serious impact on the company’s financial performance and its market share. We’ll talk about this a bit later.

The market and competitors of SquareSpace

According to the survey of International Data Corporation, from 2016 to 2019, the Saas platform market tripled, up to $233.4 billion. By 2025, it may reach $456 billion. The key consumers in the company’s target market are individual entrepreneurs, who represent small and medium-sized businesses.

The Kaufman index says that 540,000 new entrepreneurs are registered every month in the USA alone. As estimated by SquareSpace, there are over 800 million entrepreneurs in the world, 46% of which, according to Clutch, are not present on the Internet at all.

The company’s platform is an excellent tool for creating your own online shop. In this light, a survey from Statista seems quite relevant as it says that the number of online buyers in the whole world may reach 2.1 billion people this year. Businesses will try to satisfy this demand, thus increasing the number of SquareSpace subscribers.

This is the reason why the company has a great potential for the exponential growth of its sales.

Major competitors of SquareSpace are:

- Shopify (NYSE: SHOP).

- Wix (NASDAQ: WIX).

Financial performance

Unlike many other tech companies, SquareSpace generates the net profit, that’s why we will analyze this parameter together with the revenue. In the S-1/A form, the company provided additional data for the first quarter of 2021.

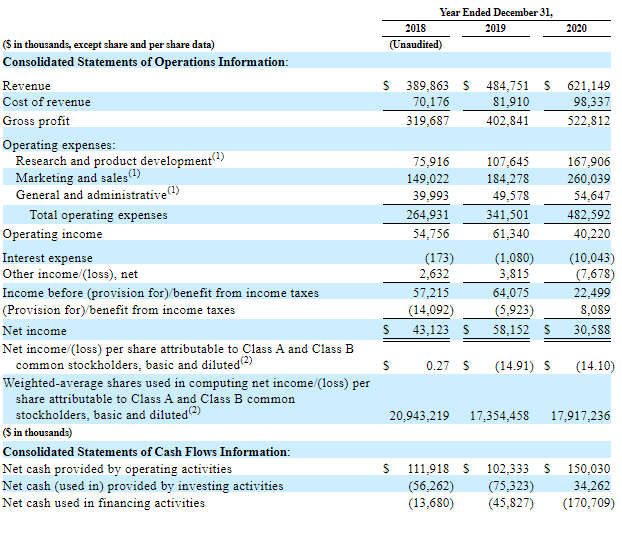

At year-end 2020, the net profit was $30.59 million and that’s a 47.39% decrease relative to 2019. In 2019, the net profit equaled $58.15 million with a 34.86% increase if compared with 2018. The net profit decline happened due to the rising scale of expenditures on marketing and researches.

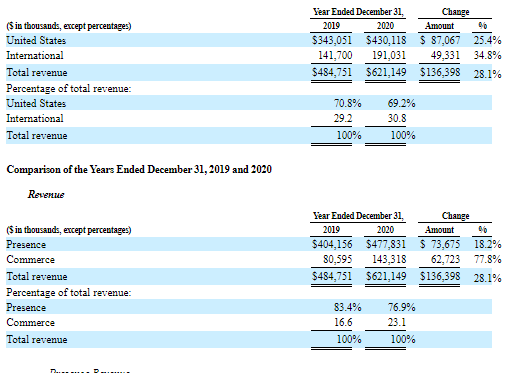

The company’s sales in 2020 were #621.15 million, which is a 28.14% increase relative to 2019. In 2019, this parameter reached $484.75 million and that’s a 24.34% increase if compared with 2018. The average annual revenue growth is 26.23%. As a result, we can categorize the company as a rapidly-growing. for such companies, the revenue is a more important parameter.

70% of the total sales volume is accounted for by the USA but the share of other countries in the company’s revenue increases with each passing year. If such dynamics continue, the USA share may decrease to 50%, thus helping to diversify the company’s business and increase its stability.

The gross profit of SquareSpace added 29.87% in 2020 relative to 2019, up to $522.81 million. In 2019, the company’s sales increased by 26.01% if compared to 2018, up to $402.84 million. If expenditures on marketing and new researches are cut, there is a high possibility of receiving the net profit. As we can see, the gross profit rises in proportion to the revenue.

Strong and weak sides of SquareSpace

After the company’s business model has become pretty clear, we may investigate all pros and cons of investing in SquareSpace shares. The following may be considered as the company’s strong sides:

- SquareSpace operates on a very promising market of Saas platforms.

- The company’s product is “all-in-one” and manages prospective customer needs.

- The revenue growth rate exceeds 25%.

- The company generates the net profit.

- Sound management.

- Transnational nature of business.

Risk factors of investing in SquareSpace shares are the following:

- Unstable net profit, the company pays no dividends.

- Strong competitors – any slight mistake may lead to a serious decline in the number of subscribers.

- The company’s business expanded due to the coronavirus pandemic and this positive effect will slowly reduce.

DPO details and estimation of SquareSpace capitalization

During the latest round of financing, the company raised $300 million. SquareSpace will go public by means of the DPO (Direct Public Offering) instead of a classic IPO, that’s why there is no price range here. SquareSpace is planning to sell 40.2 A-class shares. The last time the company sold such shares was in 2019 at $24.52.

Financial consultants of the DPO are Citizens Capital Markets, RBC Capital Markets, Goldman Sachs, Citigroup, KeyBanc Capital Markets, Mizuho Securities USA, Piper Sandler, and BofA Securities.

To assess the company’s potential capitalization, we use a multiplier, Price-to-Sales Ratio (P/S). Competitors of SquareSpace have an average P/S at 27.5. As a result, the potential capitalization may be up to $17.05 billion (27.5*0.62 billion).

Considering the growth rate and prospects of the company’s target market, I would recommend SquareSpace shares for mid-term investments.