US Largest Pipeline in Standby: What’s with Oil Prices?

4 minutes for reading

You must have noticed that this week, your feed is flooded by news about oil, Brent and WTI prices. I consider it my duty to figure out what’s going on in the world oil market, what the fuss is all about, and what consequences we should expect.

Colonial Pipeline work paused due to a cyberattack

On May 7th, Colonial Pipeline reported a cyberattack. To solve the problem, they had to shut down certain electronic control systems, which put the work of the US largest pipeline to a halt.

According to Bloomberg, the hackers (presumably belonging to the DarkSide group), hacked the company’s information system, stole almost a terabyte of its internal data, and required a ransom.

When I was writing this article, the pipeline wasn’t working normally yet. Official sources promise that things will get back to normal at the end of the week.

Important details about the pipeline

- It was constructed in 1964.

- It is 8,850 km long.

- It transports 2.5 million barrels of oil a day.

- And supplies 45% of oil products on the East Coast.

- It is directly connected to large airports from Atlanta to New York.

Analyzing oil price changes

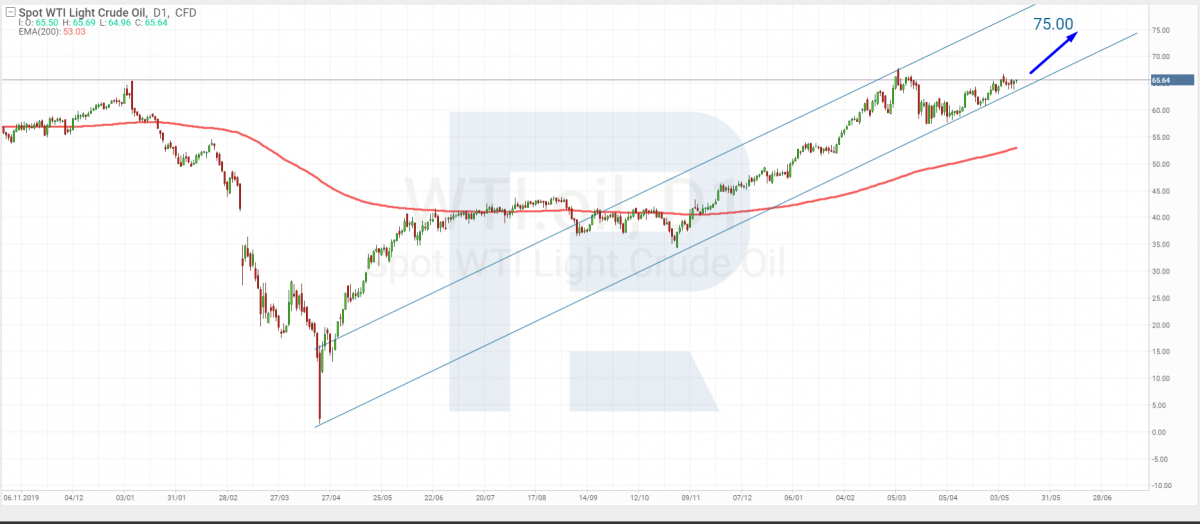

May 7th through 12th, when I was preparing this article for publication, the price of July Brent futures increased by 1.54%, from $68.09 to $69.14 per barrel. At the same time, the price of June WTI futures rose by 1.8%, from $64.71 to $65.88 per barrel.

Here’s what Maksim Artyomov, analysts, thinks about the future of black gold prices:

“On D1, Brent is trading above the 200-days Moving Average. This means the uptrend is continuing. Technically speaking, the price is testing the resistance level; if it breaks through it, the growth will continue. Currently, the aim of the growth is $76 per barrel; if the quotations overcome it, they will head higher. In the long run, after a series of pullbacks, Brent might reach $93”.

“As for the WTI price, the chart looks similar: the quotations are proceeding along the lower border of the channel, developing the uptrend. They are currently testing the horizontal resistance level, and if this is broken away, this might mean further growth. The 200-days MA remains under the chart, which means buyers are prevailing in the market. In the medium run, the aim of the growth might be $75, and growth to $90 is not impossible in the future”.

The consequences of interruptions in oil supply

On May 11th, the state governor of Florida Ron DeSantis declared a state of emergency due to the interruptions in oil products supply provoked by the problem with Colonial Pipeline. The state of emergency is imposed for 30 days and can be prolonged.

On the same day, US airlines reported a fuel shortage. Many airlines had either to cancel or alter long-haul flights. The situation was immediately reflected in the stock prices of the sector.

For example, the shares of American Airlines Group (NASDAQ: AAL) dropped by 1.95% to $21.57; the shares of Southwest Airlines (NYSE: LUV) – by $2.56 to $59.78; Delta Air Lines (NYSE: DAL) — by 2% to $44.52; United Airlines Holdings (NASDAQ: UAL) — by 2.46% to $52.7.

April OPEC report

- Oil production grew by 26,000 barrels a day to 25.08 million.

- Forecast demand for the 2nd quarter – 94.79 million barrels a day.

- Forecast demand for the 3rd quarter – 97.90 million barrels a day.

- Forecast demand for the 4th quarter – 99.74 million barrels a day.

Summing up

The US largest pipeline put its work to a halt due to a hacker attack. This provoked a fuel shortage on the East Coast and brought Brent and WTI futures up.

A pause in the work of Colonial Pipeline caused serious interruptions in the oil products supply. This resulted in problems in many airports and on airlines, and a state of emergency in Florida. The shares of airlines are falling.