IPO of Procore Technologies, Inc.: Digitalization of the Construction Industry

7 minutes for reading

In the 21st century, almost all sectors of the heavy industry are actively implementing digital technologies and everyone understands that the key goal of these changes is the improvement of performance. The construction sector, which still employs a lot of manual labor, however, stands apart.

In addition to that, a nagging problem of the entire sector is a failure to meet facility completion deadlines due to the lack of cooperation with subcontractors. This, in its turn, often leads to the escalation of expenditures on building residential and commercial property. Construction companies feel the compelling need for the digitalization of the communication process with suppliers.

Procore Technologies created a SaaS platform for managing the construction of facilities of any complexity. The company’s IPO will take place on May 20th at the NYSE, and its shares will start to be traded the next day, under the “PCOR” ticker. Let’s provide insight into Procore Technologies’ business model and how interesting this issuer is for investments.

Business of Procore Technologies

Procore Technologies was founded in 2003 and is headquartered in California. The company employs 1,911 people led by the founder and CEO Craig "Tooey" Courtemanche. Before that, he was in charge of a consulting company called Webcage, which provided expert services in the field of software. The company’s key investors are ICONIQ Capital and Bessemer Venture Partners, which own 44.3% and 14.9% shares respectively.

In the construction industry, the pace of labor efficiency growth is about 30% below average in other spheres. This is the price paid for the lack of up-to-date planning and coordinating tools. According to the report from Deloitte, construction companies invest in IT half as much as companies from other industries. Over 50% of all changes in plans are caused by a deficiency in communication with contractors. Moreover, according to the United States Department of Labor, about 20% of deaths at the workplace occur in the construction industry, therefore the sector badly needs improvement from the management perspective.

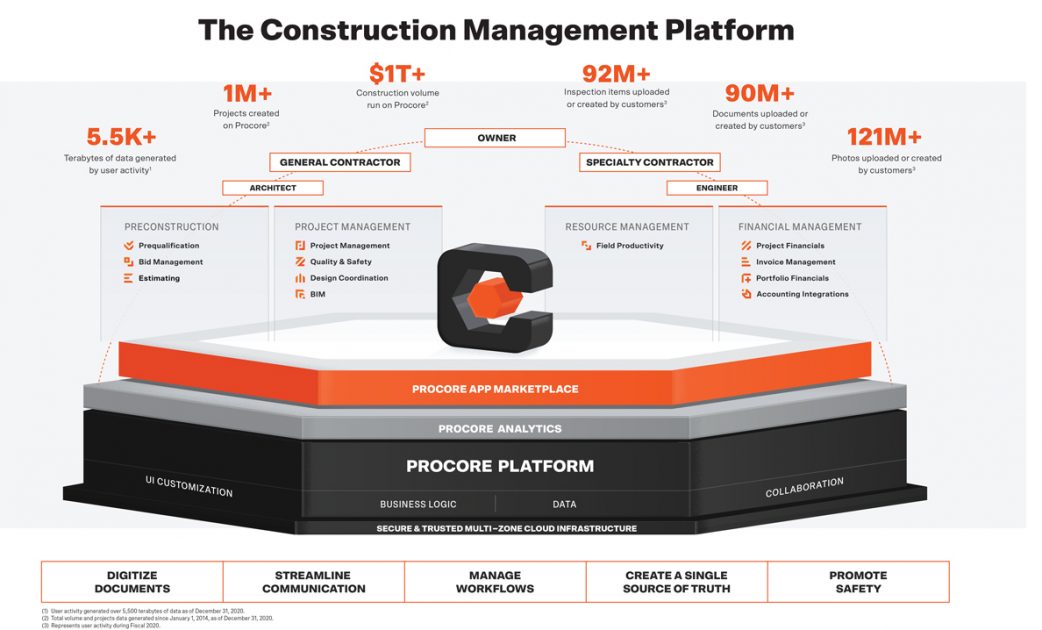

Procore Technologies created cloud software to manage building a residential, commercial, and special-purpose property. The product offers a comprehensive solution for the above-mentioned issues that construction companies often have. The platform is available on smartphones, laptops, and PCs. The head of a construction firm can use their gadget to control the construction process and negotiations with suppliers. For convenience, we can single out the following modules of the platform:

Procore Quality & Safety. A feature for the highest quality build in the safest environment.

Procore Bid Management. A tool to help bid managers to reduce turnaround time with a single platform for creating bid packages, finding the strongest possible bids, and converting bids to subcontracts.

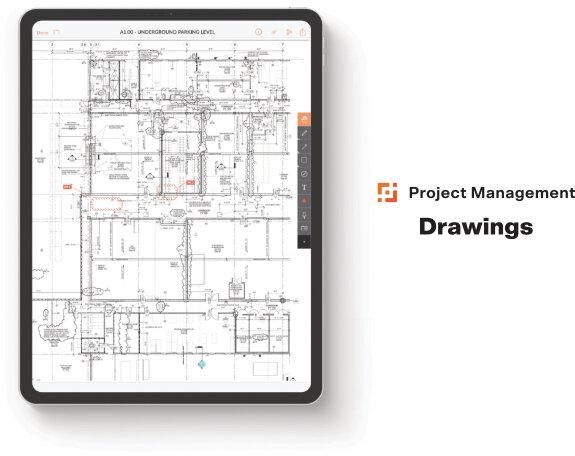

- Procore Project Management. A module to help architects to keep track of design phases and introduce changes to particular drawings.

- Procore Design Coordination. A tool for designers that helps to take into account all changes in order to avoid any redesigns upon customer request in the future

- Procore Field Productivity. A module for subcontractors with the key purpose of avoiding interruption in construction materials deliveries.

- Procore Capital Planning. A module intended for the management of construction companies, which are involved in strategic planning.

- Procore Portfolio Financials. A tool for accountants for controlling construction estimates and budgetary compliance.

- Procore Analytics. A module for financial planning and linking data on all construction objects into sinпle databases.

The company’s platform has an open API, which allows to integrate it into consumers’ software (supports 180 applications), that’s why among the company’s clients there are both small construction firms and large real estate developers.

In 2019, the platform had 1.3 million users. Each subscriber can promote the company’s product at a new workplace, thus enabling “word-of-mouth” advertising. This is the reason for such a hasty growth of Procore Technologies’ client base. From 2017 to 2019, the number of clients went from 4,310 to 8,506 – that’s a relative growth of 97.35%. The number of users with an average check of over $100,000 increased from 230 to 655 over the same period. in 2019, the company received a prestigious award, Forbes Cloud 100 Pledge 1% Impact.

Considering the construction market volume in the USA, which badly needs a significant digital upgrade to raise productivity, the company’s product will surely find its clients.

The market and competitors of Procore Technologies

According to research from Frost & Sullivan, the company’s target market is $9.4 billion. Deloitte believes that by 2024 construction and repair companies will spend up to 1.5% of their expenditures on IT technologies. In this case, the target market may increase to %15 billion.

The urbanization process is gathering pace in developing countries and it may increase the company’s market share.

Procore Technologies’ major competitors are:

- ComputerEase

- Foundation

- Trimble (TRMB)

- Autodesk (ADSK)

- Jonas Software

Financial performance

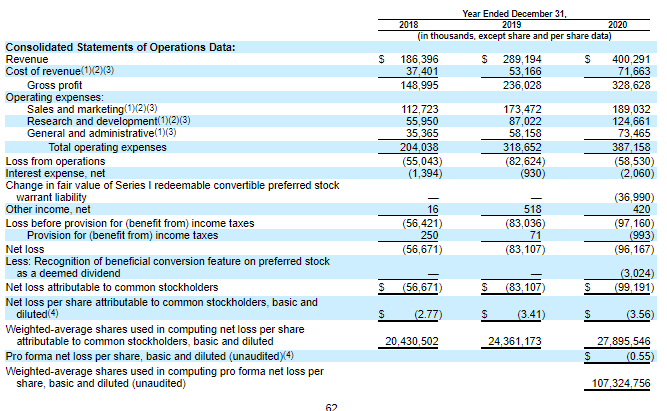

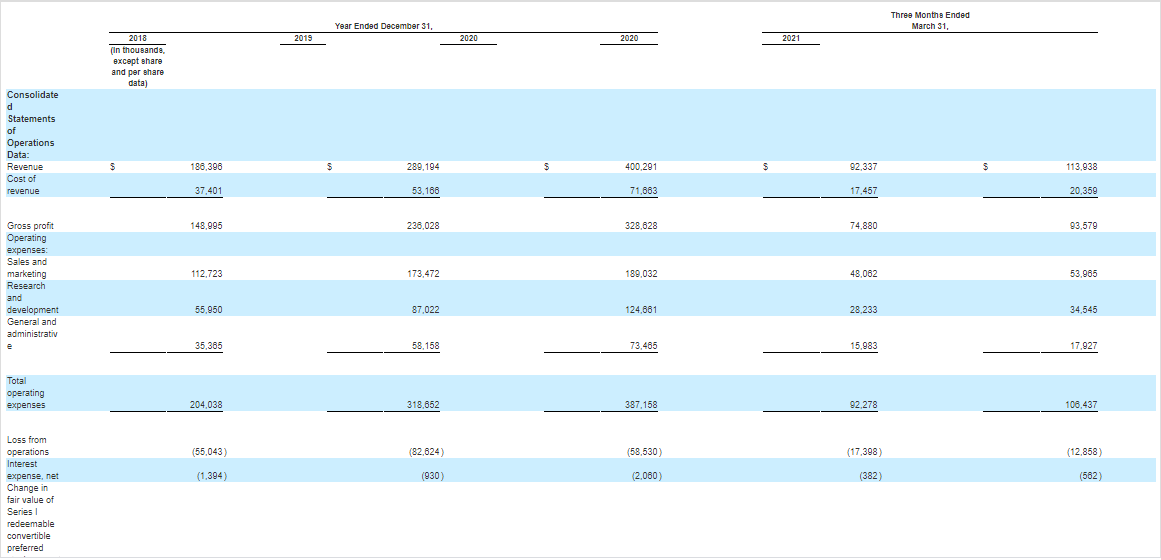

The company doesn’t generate the net profit that’s why we’ll focus on analyzing its revenue. Procore Technologies has provided several financial statements and the S-1/A form has details on the first quarter of 2021.

Over the last 12 months, the company’s sales were $ 421.89 million. In 2020, this parameter equaled $400.29 million, which is a 38.42% increase relative to 2019. In 2019, the revenue was $289.19 million, a 55.12% increase if compared with 2018. As a result, the average revenue growth rate is 46.77%.

In the first quarter of 2021, sales were $113.9, a 23.4% relative growth in comparison with the same period of 2020. If this rate doesn’t change, the total revenue by the end of 2021 maybe $520.61 million.

In the first quarter of 2021, the gross profit increased by 24.97% if compared with the same period of 2020. The net loss reduced by 26.1%. If these dynamics continue, this parameter maybe $42.73 million by year-end. The company may become profitable in the next five years.

Strong and weak sides of Procore Technologies

Now we can analyze the strong and weak sides of Procore Technologies. Let’s start with positive aspects and specify the advantages of investing in this stock:

- By 2024, the company’s target market volume may reach $15 billion.

- The revenue growth rate increases by 40%.

- Its client base has almost tripled in the last three years.

- Procore Technologies’ product offers its target audience a comprehensive solution.

- Solid management. ICONIQ Capital has a successful IPO experience.

- The company’s net loss is reducing.

Risk factors of investing in Procore Technologies are the following:

- The company is loss-making and doesn’t pay dividends.

- Strong competitors.

- The sales growth rate is decreasing and very unlikely to remain the same in the next 3-5 years.

IPO details and estimation of Procore Technologies capitalization

During the previous rounds of financing, the company raised $648.9 million. The underwriters of the IPO are Stifel, Nicolaus & Company, Incorporated, William Blair & Company, L.L.C., Piper Sandler & Co. Oppenheimer & Co. Inc., Goldman Sachs & Co. LLC, Canaccord Genuity LLC, KeyBanc Capital Markets Inc., J.P. Morgan Securities LLC, Barclays Capital Inc., and Jefferies LLC.

The company is planning to raise $592 million by selling 9.5 million common shares at the price of $60-65 per share. If shares are sold at the highest price in this range, the company’s capitalization may be up to $8.9 billion.

Since the company is loss-making, to assess Procore Technologies shares upside, we use a multiplier, Price-to-Sales ratio (P/S ratio). At the time of the IPO, P/S may be 17.45, while during the lock-up period it may reach 25-35 for developers of SaaS platform. In this case, the upside for the company’s shares may be 43% (25/17.45*100%).

With all that said, I would recommend this company for mid-term investments. However, taking into account the current market situation, it would be wise to enter this position in small “batches”.