How to Use MyFxBook for Trading in Forex

7 minutes for reading

Not every trader analyzes their work, thus depriving themselves of a good way to improve their trading results. Experienced market players insist on scrutinizing every trade; however, this is hard to do without special programs.

Unfortunately, even MetaTrader 4 does not store the whole history of trades, though it would be quite useful to assess your profitability month by month on different stages of the market. Many make substantial money on the growing market, for example, while the falling market yields them less success.

MyFxBook is an online platform meant for mathematical and statistical analysis of the trader’s account. Results of analysis can later be shared.

In this article, I describe the opportunities provided by MyFxBook, as well as explain how to add the service to your trading platform and analyze your results.

Why is MyFxBook good for a trader?

First of all, by analyzing their trading history with a vast range of MyFxBook functions, the trader gets:

- An assessment of their overall profitability in percent. They can also assess their daily or weekly profitability depending on their needs, and set up a corresponding profitability chart.

- A drawdown assessment in percent with a chart, representing the periods of the deepest slumps.

- Additional indices of profitability, including average profit/loss of a period, the best/worst trade of a period.

- Other mathematical values of their trading activity.

After you register on the platform and log your trading account onto it, you may start analyzing trades. In your profile, you will see your daily and weekly profitability, the number of trades a day/week/month/year and their overall volume, the ratio of profitable and losing positions, your profit in points, etc.

More instrument on MyFxBook:

- Search for patterns on charts, with explanations and entry signals;

- Economic calendar;

- Currency correlation table;

- Backtest data;

- Indicators for different timeframes and instruments;

- COT report analysis.

There are plenty of instruments, indeed; however, the main task is to connect your trading account to it, evaluate your trading, and assess the results.

How to connect your account to MyFxBook?

First of all, you need to make sure that your broker is a MyFxBook partner. Otherwise, you will not be able to use the service.

Next, register on the MyFxBook website and connect your account to the platform. Then all your trading information will be reflected on the website, and you will be able to analyze your work. Roughly, you need to make the following steps:

- Register on the website

- Add a trading account to your profile

- Set up access to your trading information.

Now let us discuss the registration process in more detail.

1. Registering on MyFxBook

The process is super simple: to open an account, you only need an email address, a username, and a password. Confirm registration by clicking on a link that will be sent to your email address.

2. Adding a trading account to your profile

Upon registering and logging in, go to Profile and choose Add account. Then choose a synchronization option:

- MetaTrader (Auto Update) synchronizes your account and the website by entering your account id and password. This is the most comfortable and available option.

- MetaTrader (Publisher) synchronizes your account via the data transmission protocol, updating the information every five minutes. This option is considered less comfortable.

- MetaTrader (EA) synchronizes your trading account and the website via a special expert advisor. You will need to download it and install to your trading terminal, entering your MyFxBook username and password in the settings.

3. Setting up access to your account history

By default, the whole trading history is visible to the trader only. However, if you need to make your statistics public (to attract investors, etc.), do the following:

- Go to Accounts, choose Edit for the required account. In Admission choose Public and set up the parameters.

- To confirm your account, change your investor password for the one offered by the platform. Then the "Account must be verified" phrase will be gone.

How to use MyFxBook for trading in Forex?

Now to the meat of it: let us figure out how to use MyFxBook data in trading.

Trades

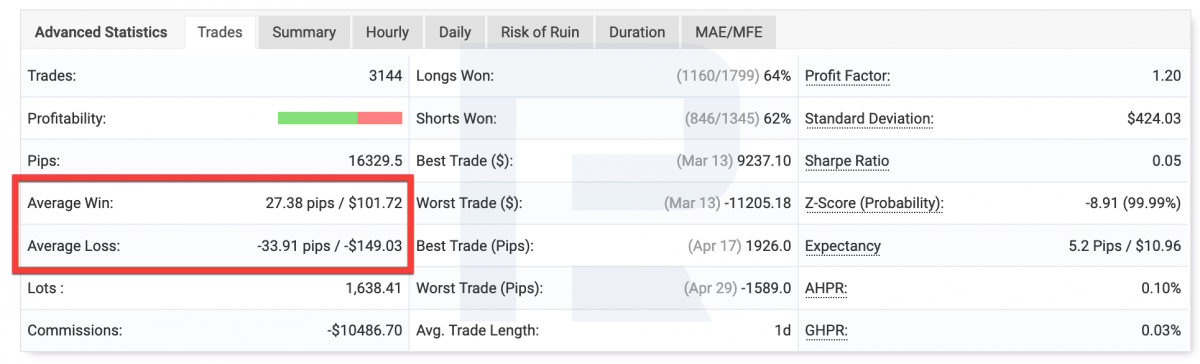

Average profit and loss

First of all, check your average profit and loss in points. As you know, by money management rules, your average profit must be higher than your average loss. A good ratio is 1:2 but a better one is 1:3. With such a ratio, one profitable trade will cover for several losing ones. But if you lose in one trade more than you earn, try revising your approach to trading.

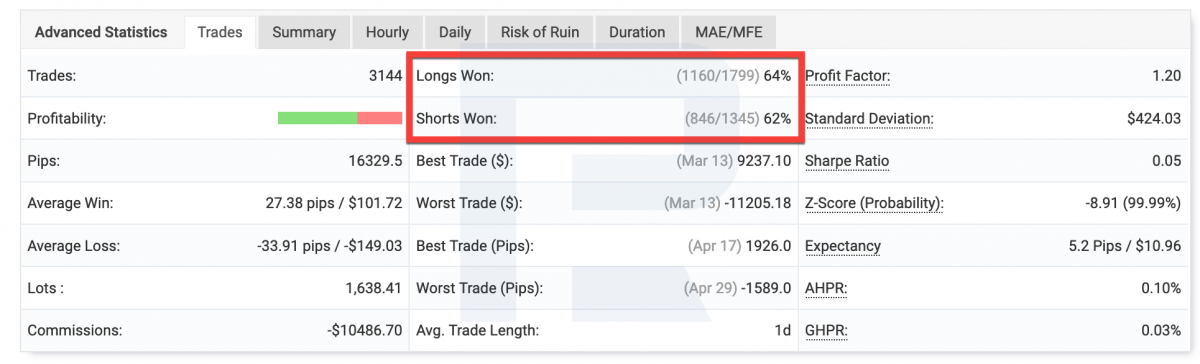

Number of profitable long and short positions

This parameter is also worth checking. Is this number is more or less equal, this means you work efficiently in the growing and falling market.

However, if there is significant imbalance towards either side, for example, there are only 20% of profitable long positions, while the remaining 80% of profitable trades are short, simply avoid buying. Your result will enhance noticeably.

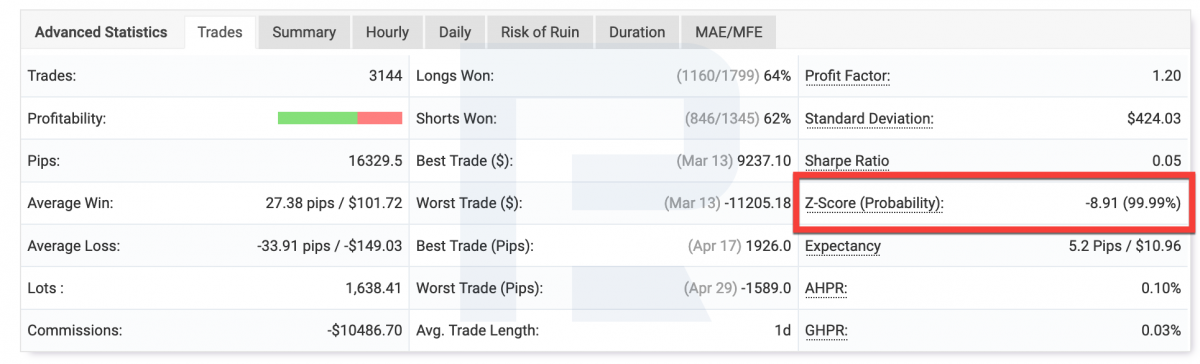

The ability to generate series of profitable and losing trades

A Z-account calculates the probability of making a profit/losing money in a series of trades, which shows whether your trading results are random or logical.

A 99.99% result means that after a profitable trade another one is most likely to follow, and the same with a losing one. This might stimulate you to increase trade volume in the case of a success or decrease it when losing. This way you will get the maximum from the market.

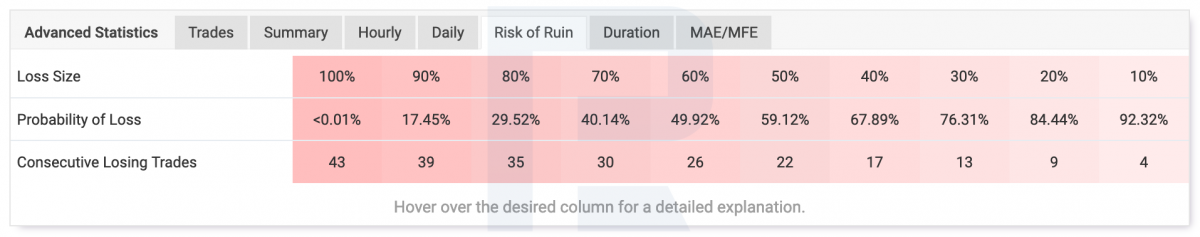

Risk of losses

Here, you can check how much you risk a part of your deposit in a series of losing trades.

For example, if your Loss Size is 10% and your Loss Probability is 90%, while your Subsequent losing trades value is 5, this means you might theoretically lose 10% of your deposit in a series of 5 losing trades. And the probability of this event is 90%.

Then you can conclude that to decrease risks you can trade two times smaller volumes, so that your Loss size will become 5%, which is quite comfortable.

Length

One condition of successful trading in financial markets is a high-quality trading system. You are fully responsible for sticking to its rules. You can evaluate how successfully you follow your trading rules in the Length part. In the example below, you see groups of green and red points grouped tight. This should mean that the trader prefers playing short and makes a profit in such positions only.

All trades out of this agglomeration are long-term and losing. The picture clearly demonstrates an attempt to wait until losses end, deviating from the rules of the trading system.

A small drawback of this chart is that it shows only the last 200 trades, hiding the rest of the history.

Closing thoughts

MyFxBook is a high-quality instrument for analyzing your trading. First and foremost, it helps the market player realize how well their trading system works and improve it after studying the statistics.

For example, analyzing their trades with currency pairs, the trader can see a lot of losing trades with NZD/CAD while with other instruments, the situation is much better. In such a case, try removing the pair from your set of instruments or revise your market entries.

Not everyone must be too keen on studying the statistics of their trading account; instead, many will use MyFxBook for sharing their results with the community and potential investors. Confirmed profitability on this service with a huge statistical base looks much more efficient than any statement from a trading platform.