News about Split Made NVIDIA Shares Grow

3 minutes for reading

We’ve heard that the US GPU and microcircuit manufacturer NVIDIA is planning a split of stocks. Let’s get into the details of what’s going on, how the quotations react, and what our leading analyst Maksim Artyomov thinks about it.

NVIDIA splitting shares

On May 21st, we heard that the board of directors of NVIDIA had decided to split the shares of the company at the 1:4 ratio. This means that the price of one share will decrease 4 times, while the shareholders will get three additional stocks per each they already have.

As you might now, the current share price of NVIDIA is about $600. After the split, each share will cost about $150, which will make the microcircuit manufacturer more available for investors.

However, the decision of the board of directors must be ratified at the meeting of shareholders planned for June 3rd. The shareholders will ask question, speak out their opinion, and vote. If they support the idea of the split, corrected shares will start trading as soon as July 20th, 2021.

NVIDIA shares grew

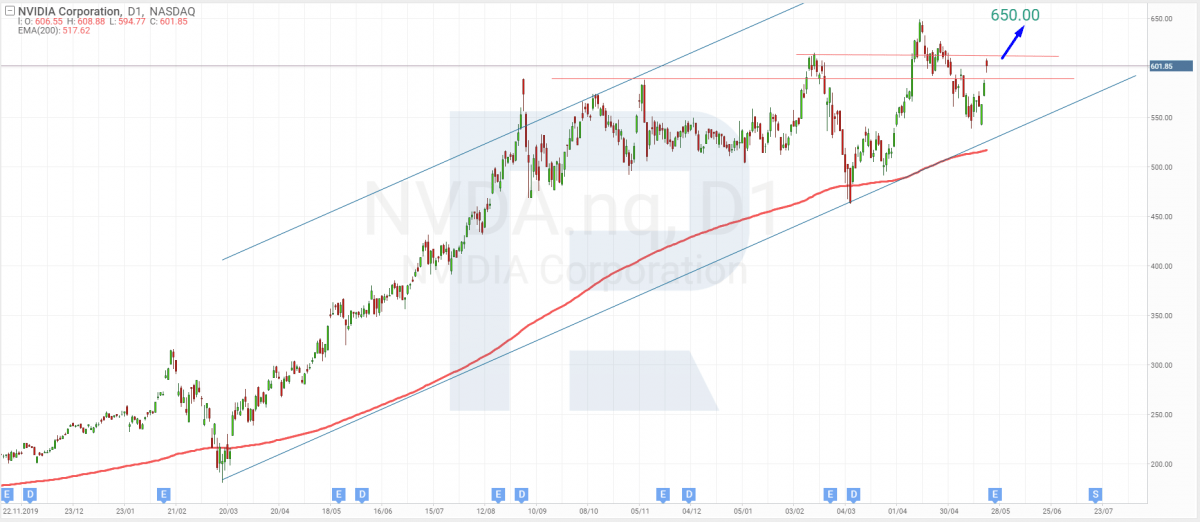

The share price of NVIDIA (NASDAQ: NVDA) has been growing for three sessions in a row. On May 19th, they grew by 0.36%, reaching $562.62. On the next day, growth amounted to 3.89% to $584.5. After the news about the split was published, the shares rose by 2.6% to $599.67.

Technical analysis of NVIDIA shares by Maksim Artyomov:

“On expectations of the split, the quotations keep growing. Bouncing off the support level, they are heading for the next resistance level. As long as the price is above 200-days Moving Average, it’s likely to renew the all-time high before the split.

The next goal of growth is $650. After the 1:4 split, the shares will become more available for investors, there will appear more people craving to invest in them, which will provoke further growth, in its turn”.

Waiting for the quarterly report

On May 26th, NVIDIA will report its results of January-March 2021. The consensus forecast of the stock price is $663.88. As for the revenue size, analysts expect $5.4 billion, while the forecast net return on stock reaches $3.28.

According to a KeyBanc Capital Markets expert John Vinh, the corporation can be called the leader in the spheres of AI, machine learning, and data processing software. That’s why he changed the target share price, raising it to $700, and left the recommendation to “buy”. A Raymond James analyst Chris Caso raised the target price to $750 from $700.

Summing up

A couple of days before the quarterly report, the board of directors of NVIDIA announced a 1 to 4 split of the company’s shares. The suggestion must be ratified at the meeting of shareholders. If they support the split, the corrected shares will start trading on July 20th. This made the quotations of the tech company grow by 2.6%.