3 Shares with Dividend Yield Above Inflation in 2021

8 minutes for reading

Will they increase the discount rate or not? Is inflation under control, or has the Fed lost it? What is going on with bonds, is the yield growing or not? Investors in the stock market are in constant pain: the market is full of risks, their heads are bursting with news, one cannot relax for a split second. And they start thinking: apparently, the race after millions is useless. Isn't it better to buy shares of dividend companies and make quarterly profits?

In this article, I would like to draw your attention to dividend stocks. With them, you do not need to keep a close eye on the market all the time, trying to predict what will happen to the prices.

For such investments, choose large companies with a long and reliable history of dividend payments and good dividend yield. It must exceed inflation, otherwise your invested money will be deflating gradually.

Choosing dividend stocks takes time, but after you choose them, you can leave them in your portfolio for years. This means, your investment period is long-term, so pay attention to companies that expect growth in the future because this will also be a source of income for you.

Where to start from?

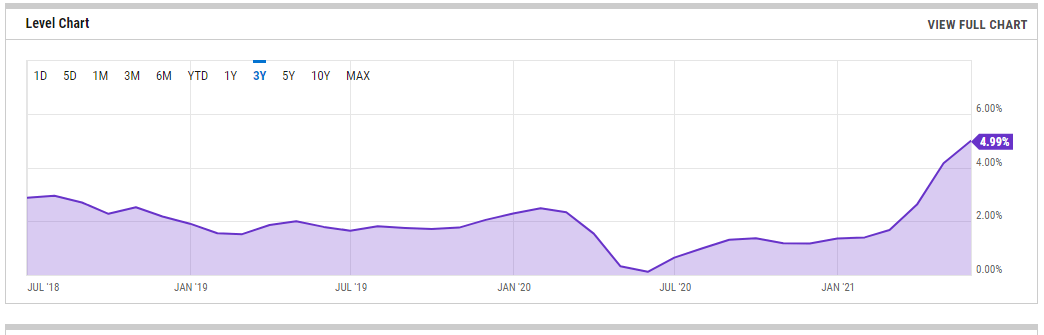

To get started, check the current level of annual inflation in the USA.

The diagram shows that current inflation is at its highs, which is 4.99%. This means you need shares the same or higher dividend yield. In the future, when the Fed lifts the discount rate, inflation will drop, so mind shares will dividend yield of 5% and higher. Normally, the Fed aims at 2-2.5% inflation.

3 companies with dividend yield above inflation in 2021

Now let us discuss those three companies that have dividend yield above current inflation in the USA.

Exxon Mobil Corporation

The first company on the list is Exxon Mobil Corporation (NYSE: XOM).

Exxon Mobil is a US multinational oil and gas corporation that appeared in 1999 via a merger of Exxon and Mobil.

In fact, this company belonged to famous John Rockefeller. It used to be called Standard Oil. The corporation was so large that it became a monopolist of the oil and gas market. This did not make the US government happy, and in 1911 the company was split into 34 small enterprises, two of them being Exxon and Mobil. 88 years later, they merged and became a global leader in terms of revenue.

Now the shareholders of Exxon Mobil include The Vanguard Group (8.15%), BlackRock (6.61%), and State Street Corporation (4.83%). These companies manage trillions of dollars.

Exxon Mobil Corporation has been paying dividends since 1999, and their size constantly increases. Currently, the dividend yield is 5.43%, or 3.48 USD per share a year, which makes 0.87 USD per share every quarter.

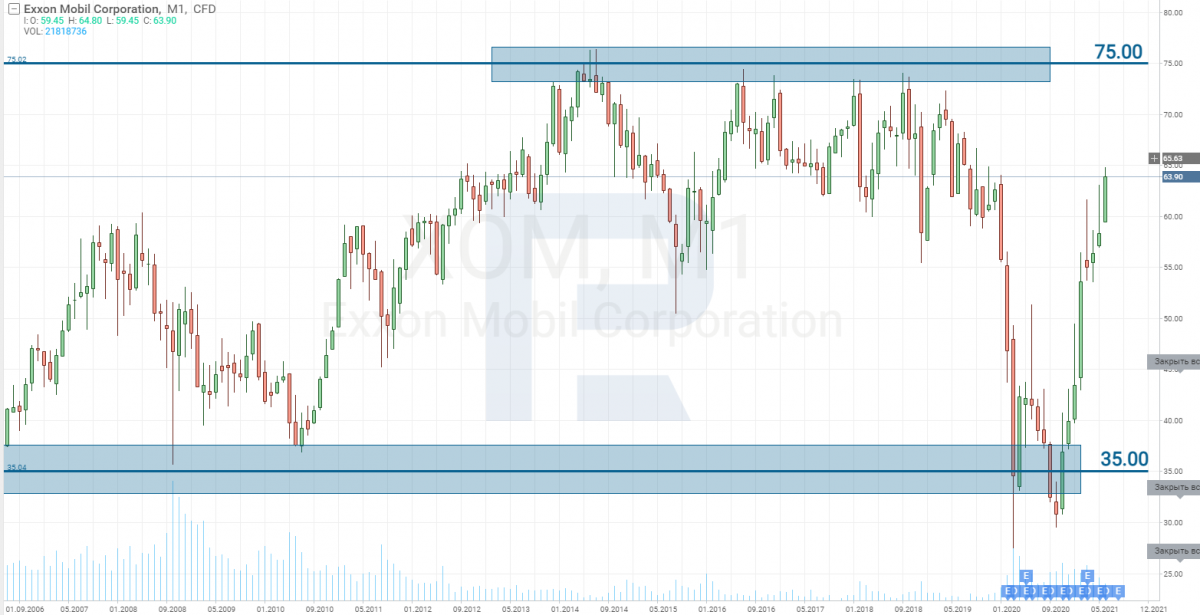

Buying dividend shares, make sure you wait for the best buying price. Exxon Mobil shares are currently traded at 64 USD each.

If the stock price starts growing and reaches 80 USD, the 3.48 USD of dividend payments will make 4.35% of dividends per annum. The higher the stock price, the lower their dividend yield.

Then, however, the company starts to increase payments not to lose investing attractiveness, and the dividend yield grows again. Hence, it is best to buy such stocks at a decline and hold them at growth.

Let us get to an example. In November 2020, Exxon Mobil shares cost 35 USD each, while dividend payments at those times of trouble remained at the level of 2019 - 0.87 USD per share. Hence, the dividend yield was 9.9% per annum.

The company increases the size of payments from time to time, so if you keep the shares in your portfolio long enough, the dividend yield can reach two-digit values.

Exxon Mobil shares have been trading between 35 and 75 USD for the last 14 years. This is very good for dividend stocks because you can check the size of a possible drawdown in advance, buying the shares at the upper border of the range, and buy them in parts while they are falling. Now the quotations are at 64 USD and tend to keep growing to the pre-crisis level of 75 USD.

AT&T Inc.

The next company on the list is AT&T Inc. (NYSE: T). It has also fallen prey to the antimonopoly legislation, and in 1982 it was split into 7 independent companies.

Today, AT&T is the world's largest telecommunication company and the number two provider of mobile and telephone services in the USA. In 2020, AT&T was a number 9 company on the list of US 50 largest corporations. It had a revenue of 181 billion USD.

AT&T is gradually gathering the split companies, and by now has gathered 4 out of 7 enterprises.

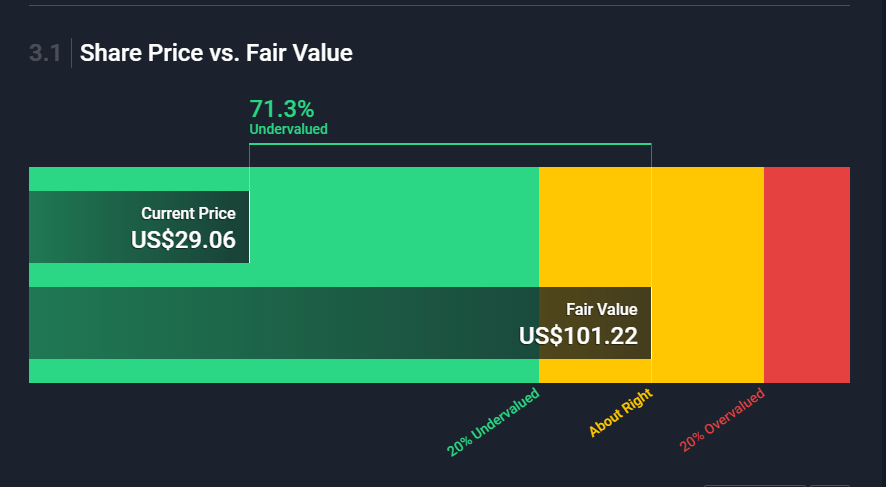

Now its shares trade at 29 USD but its financial performance shows that the true price must be 101 USD, which is +71% to the current price.

AT&T has been paying dividends for 30 years. Current dividend yield is 7.2% a year. This is extremely high for such a large company. For example, the leader of the telecom sector Verizon Communications Inc. (NYSE: VZ) that has a similar capitalization to AT&T, pays 0.62 USD per share, which is 4.4% a year.

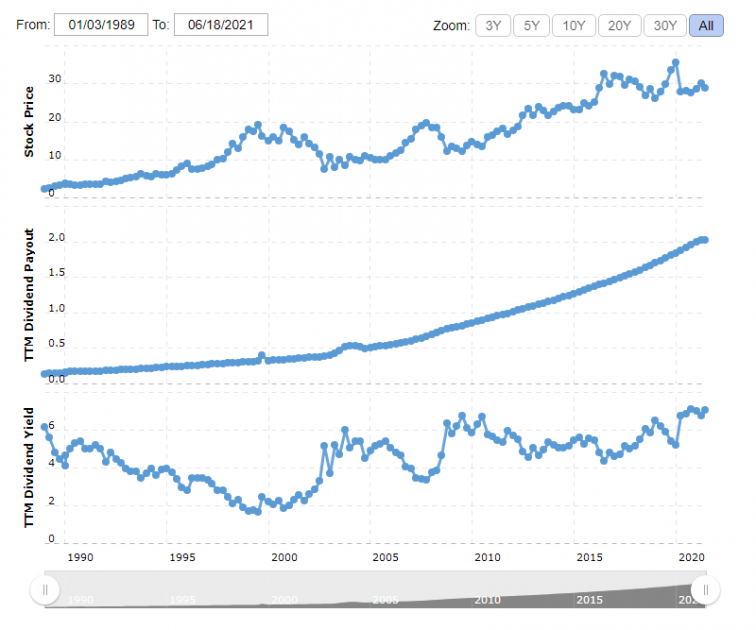

Also have a look at the chart of payment size. The company increases it all the time, and the profitability is now at its all-time highs.

In the last 30 days, the stock price of AT&T dropped by 15%, and are now trading at the 200-days Moving Average. Thanks to this decline, dividend yield has grown from 6.2% to 7.2%.

This is a great time to buy dividend shares.

The company's management also thinks so. May 18th through 20th, when the price was at the same level, director-general, vice-president, financial director, and a member of the board of directors started buying AT&T shares. The total sum of trades was 4.5 million USD.

British American Tobacco plc

The last but not the least is British American Tobacco plc (NYSE: BTI).

British American Tobacco is a British company that manufactures and sells cigarettes, tobacco, and other nicotine products. It was founded in 1902 when the British Imperial Tobacco and the US American Tobacco Company contracted to create a joint enterprise under the name British American Tobacco.

The company works in over 180 countries and is one of global leaders in terms of sales volumes. Its shares are traded in exchanges of Europe, Africa, and North America. Dividend yield is 7.51% annually. The only company in the sector with larger capitalization is Phillip Morris International Inc. (NYSE: PM) that pays dividends of 1.2 USD per share, which makes 4.8% of yearly dividend yield.

Buying shares for a long term, also check whether the issuer has potential for further growth of the revenue or at least remaining at the same levels.

As for the tobacco company, the number of cigarette smokers is falling but sales volumes of electronic cigarettes, nicotine packs, and other smokeless products are growing.

In terms of morals, this is not good news. But as for British American Tobacco, the company is gradually switching to new generation products. Hence, it may only lose its revenue in case rivals or certain governments work against them.

Tobacco companies pay special attention to lobbying their interests, so governments will impose certain restrictions but not in the manner that can change the situation overnight.

There are always risks on the side of rivals, but British American is one of the leaders of the sector. Such companies engulf rivals at their early stages of development, so we do not need to expect shocks here. Moreover, tobacco companies often become safe havens for investors because their business is predictable, and their shares are less volatile than those in other sectors, less prone to recessions.

The shares are now trading at 40 USD each. Their all-time highs are 30% higher than the current price, giving some room for further growth.

The chart shows that the stocks are now trading in the middle of a range, while in June, they broke through the 200-days Moving Average. This indicates possible development of an uptrend. Hence, you might make a profit not only on dividend payments but also on the growth of the stock price.

Closing thoughts

Sometimes looking for shares with high potential for growth, we rely on the wrong company because good financial performance does not guarantee price growth.

First of all, the company must be popular in the media and among investors. Sometimes the media play an even more important part in forming the stock price than the financial performance of the issuer. Nowadays number one influencers are social networks (hello Reddit) where things might go totally absurd: the shares of losing companies on the verge of bankruptcy sky-rocket by hundreds percent.

To avoid racing for the most discussed shares, you can calmly look for issuers that pay dividends. Such companies are already profitable, and if they are the leaders of the segment, this makes your investment even safer. The reward for your effort is the growth of the shares that you might have not thought about.