Financial Reports of JPMorgan, Citigroup, Wells Fargo, Bank of America, and Morgan Stanley

5 minutes for reading

Our favorite time has come — time for quarterly reports. This week, financial performance was reported by such large banks as JPMorgan Chase, Citigroup, Wells Fargo, Bank of America, and Morgan Stanley. Let's find out if the second quarter of 2021 was successful for them, and what our analyst Maksim Artyomov thinks about their stocks.

JPMorgan: financial report for Q2, 2021

On July 13th, JPMorgan Chase reported the results of Q2. Here are the main statistics compared to April-June 2020:

- Revenue: $31.4 billion, -7%, forecast: $29.95 billion;

- Net profit: $11.95 billion, +155%;

- EPS: $3.78, +174%, forecast: $3.09.

Significant growth of the net profit can be explained by the unprecedented volume of mergers and engulfings, as well as dissolution of reserves for possible debt losses. Nonetheless, on the day when the report was published, JPMorgan Chase (NYSE: JPM) shares dropped by 1.49% to $155.65

Tech analysis of JPMorgan Chase shares by Maksim Artyomov

"JPMorgan shares got out of a correction and keep recovering, staying inside an ascending channel. This time, the aim for growth is $160; a breakaway of this level will mean further development of the uptrend. The growth is confirmed by the 200-days Moving Average. In the medium run, the price might renew its all-time highs and test $175".

Citigroup: financial report for Q2, 2021

On July 14th, Citigroup shared its performance in April-June 2021. Main drawdowns happened in bond trades: performance dropped to $3.21 billion, which means a 43% decline compared to the performance of Q2, 2021. Most important results:

- Revenue: $14.47 billion, -12%, forecast: $17.61 billion;

- Net profit: $6.19 billion, +490%;

- EPS: $2.85, +650%, forecast: $2.01.

On the same day, the stock price of Citigroup (NYSE: C) dropped by 0.29% to $68.17. Note that a day before, the decline was deeper — by 1.54% to $68.37.

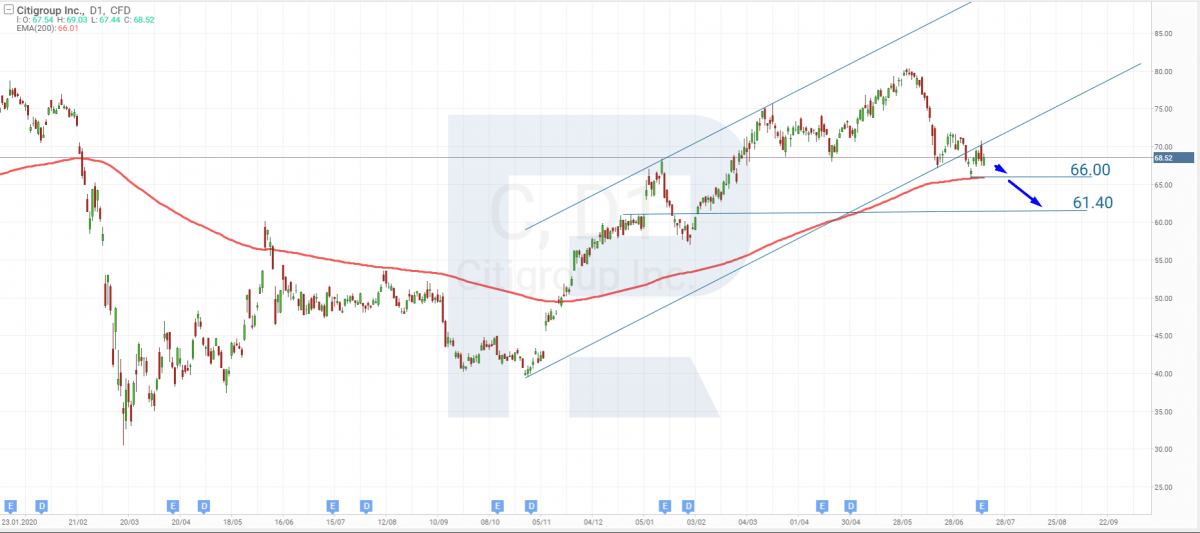

Tech analysis of Citigroup shares by Maksim Artyomov

*Citigroup shares keep moving in a flat at the support level. I suppose that, propelled by the report, it will break through the 200-days Moving Average. Later the stock price might keep declining to the next support level of $61.4. If things go right, the price might then bounce off the 200-days MA and continue the uptrend".

Wells Fargo; financial report for Q2, 2021

On July 14th, one more large representative of the banking sector — Wells Fargo — presented it's financial report. Bond trades in Q2 dropped by 41%, reaching $888 million. The main data are as follows:

- Revenue: $20.27 billion, +10.85%, forecast: $17.77 billion;

- Net profit: $6.04 billion, +256%;

- EPS: $1 38, +236%, forecast: $0.93.

Unlike the shares of the above-mentioned rivals, on the reporting day the shares of Wells Fargo (NYSE: WFC) grew by 3.98% to $44.95. However, on July 13th the quotations also demonstrated a decline by 2.11% to $43.23.

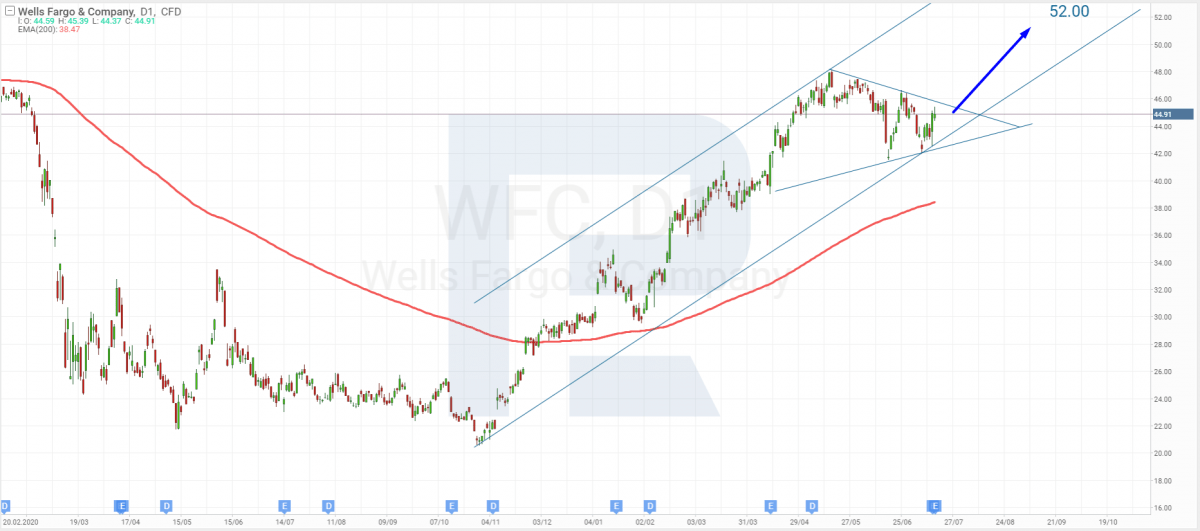

Tech analysis of Wells Fargo shares by Maksim Artyomov

"Wells Fargo shares are in a good mood and keep growing. They have formed a tech analysis pattern called Wedge and are testing the resistance level. The pattern might work in the form of further development of the uptrend, which is confirmed by the 200-days MA that rests under the price chart. The aim of further growth might be the resistance level of $52".

Bank of America: financial report for Q2, 2021

The number-two bank of the USA in terms of asset volumes reported its financial performance on July 14th as well. As with its counterparts over this article, the bond revenue in Q2 dropped to $1.97 billion by 38%. However, the revenue from stocks grew by 32.5% to $1.63 billion. The main statistics of the quarter:

- Revenue: $21.47 billion, -4%, forecast: $21.8 billion;

- Net profit: $8.96 billion, +173%;

- EPS: $1.3, +178%, forecast: $0.77.

Investors were unhappy about the decrease in the revenue, and on the same day the shares of the Bank of America (NYSE: BAC) dropped by 2.51% to $38.86. The stock price has been decreasing for three sessions in a row, by 4.4% total.

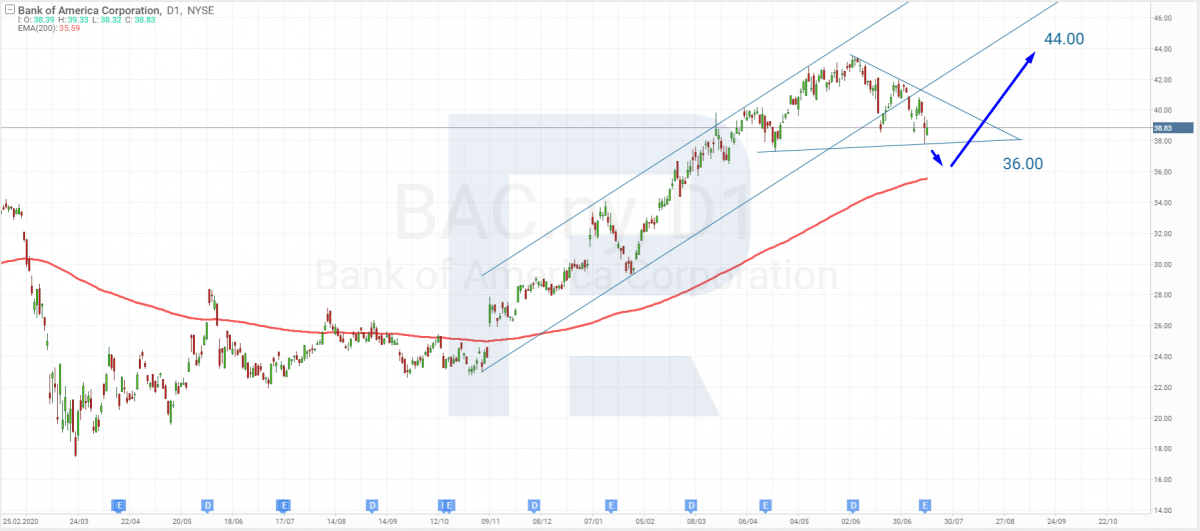

Tech analysis of Bank of America shares by Maksim Artyomov

"After the report saw the light, the shares of the Bank of America keep falling. Escaping the ascending channel, the price is testing the support level. On D1, there has formed a tech analysis pattern called Wedge. It might work as a false breakaway and falling to the 200-days Moving Average. The aim here is $36. Then the quotations might bounce off the Moving Average and continue the uptrend. The aim of growth is $44".

Morgan Stanley: financial report for Q2, 2021

On July 15th, Morgan Stanley presented the results of Q2, 2021, and they definitely exceeded the expectations of analysts. The company's representatives state that the high revenue and profit mean brilliant statistics in all segments and regions. Let's check out the sums:

- Revenue: $14.76 billion, +8%, forecast: $13.98 billion;

- Net profit: $3.5 billion, +10%;

- EPS: $1.89, -6%, forecast: $1.66.

The shares of Morgan Stanley (NYSE: MS) reacted by minor yet noticeable growth — by 0.18% to $92.63. This week, the stock price of the bank has grown by 2.5%.

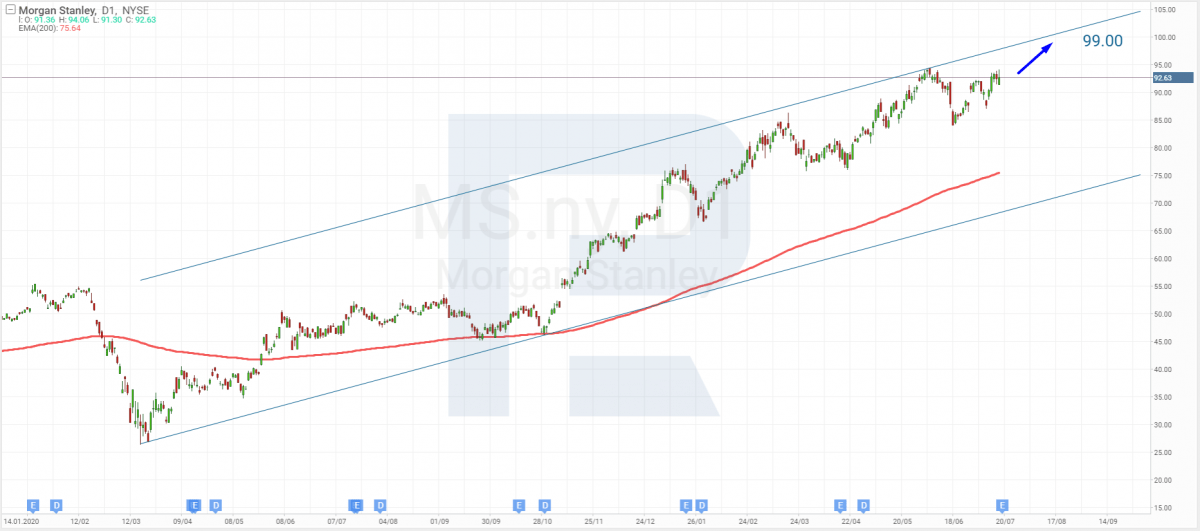

Tech analysis of Morgan Stanley by Maksim Artyomov

"Morgan Stanley keeps on with the uptrend. The quotations are trading under the resistance level that lies near the all-time high. In the future, the price might keep growing and renew the highs. The ascending dynamics are confirmed by the 200-days MA that is also ascending. The aim of growth in the future might be $99".

Summing up

This week, the largest US banks reported their performance in Q2, 2021: JPMorgan, Citigroup, Wells Fargo, Bank of America, and Morgan Stanley. They can all boast an increase in the net profit in April-July. Data shows that the banks reached such results mostly thanks to reserve dissolution by possible debt losses.