The News of the Addition of Moderna to the S&P 500 Caused Its Shares to Jump 10%

3 minutes for reading

It won’t be deceitful if we say that the American bio-tech company Moderna has been doing really great during the time of a storming coronavirus pandemic. After joining the S&P 500 index, the company’s standing will be even better. Let’s talk about what has happened, what kind of consequences we can expect, and what our analyst Maksim Artyomov is thinking about all this.

Moderna shares in S&P 500

On July 15th, it became known that shares of Moderna, the company the entire world learned about thanks to its anti-COVID vaccine, would join the S&P 500 stock index. However, no information has been announced yet about the company’s share percentage.

As early as July 21st, Moderna will replace another representative of the health care sector, Alexion Pharmaceuticals, in the list of the companies included in the stock index. Alexion Pharmaceuticals will be acquired by the British company AstraZeneca, which is also familiar to everyone.

What does the nearest future hold for Moderna?

Making the “bucket” of 504 other chosen public companies with the largest capitalizations traded on American stock markets has always been a positive driver for further development and growth.

Analysts believe that investments funds, which consider the S&P 500 index one of the key landmarks, will be more active in buying shares of the American biotech company Moderna. There goes an additional influx of funds.

Moderna shares added 10%

On July 15th, when the media released the news of the addition of Moderna (NASDAQ:MRNA) to the S&P 500, the company’s shares rose by 5.28% at the end of the trading session and closed it at $259.68. However, the next day they demonstrated even more solid growth and skyrocketed by 10.3%, up to $286.43.

It is noteworthy that shares of this firm have added 174.2% since the beginning of 2021, starting from $104.47 per share.

Tech analysis of Moderna shares by Maksim Artyomov

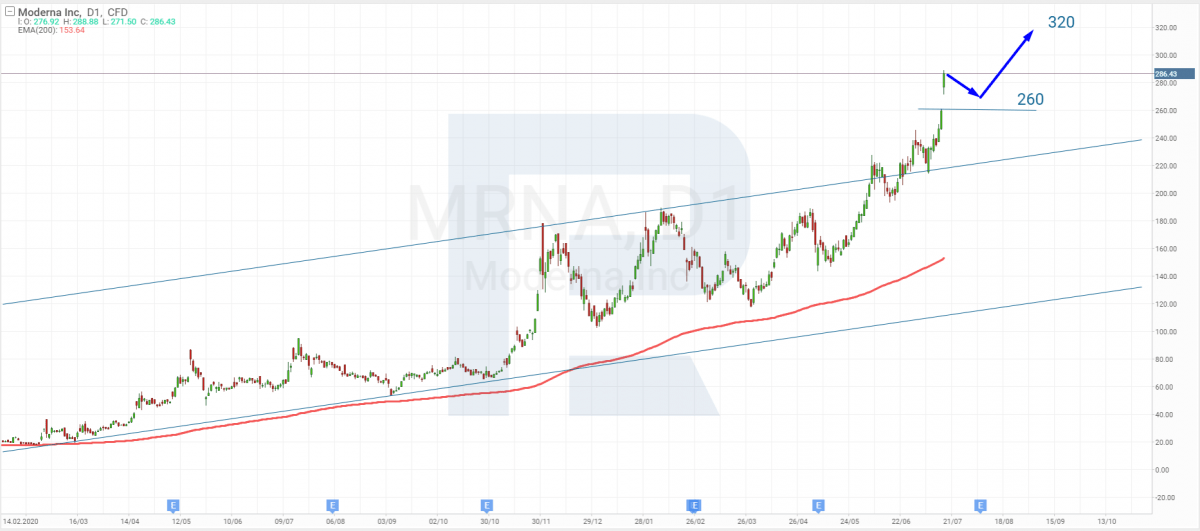

“In the daily chart, the asset continues moving within the rising tendency. Last trading session, the price skyrocketed influenced by the news. In the future, the instrument may correct towards $260, which it broke earlier.

After testing the support level, the price may resume its growth with the target at $320. Another signal in favour of further uptrend is the 200-day Moving Average, which is also moving to the upside”.

Summing up

On July 21st, Moderna will join the S&P 500 stock index basis. This news made shares of the American biotech company rise by over 10%. Experts predict further growth of this pharmaceutical industry representative’s share value.