3 Stocks that Can Grow This Autumn

9 minutes for reading

The stock market cannot live without tart topics; investors always need something to anticipate. An increase in the interest rate? Uncertainty is really tiresome. Inflation? Jerome Powell told us not to worry, and we shall not for the time being.

What is left? Well, autumn is coming, and this means the number of respiratory diseases will become more frequent. And this, in turn, means COVID-19, only the Delta type.

More people go to hospital in the USA

People’s fears about the new coronavirus type are rather fair. On August 2nd, 10,000 people were put to hospital just in Florida and Louisiana, which is the absolute high since the beginning of the pandemic. This did not lead to a new quarantine yet, but wearing masks is now a must. Healthcare workers also fall ill, and this makes things even more complicated because there is a personnel shortage in healthcare institutions. The government is calling for total vaccination.

If earlier there used to be more elderly people among those put to hospitals, these days younger people, i.e. the active part of the population, fall prey to the virus more often. This might turn out to be a bad influence on business.

Should we wait for a crisis in autumn?

Will lockdowns of last year repeat themselves? I quite doubt this. What would they need vaccination, otherwise? Will they admit that it was a waste of money?

It would be too simple. Stocks would fall by 50-80% again. Investors would rush at buying them, knowing what was to follow, and absolutely everyone would make money. Like fun.

Each new crisis goes by a scenario that never came to life before, and the repetition period is much longer than a year.

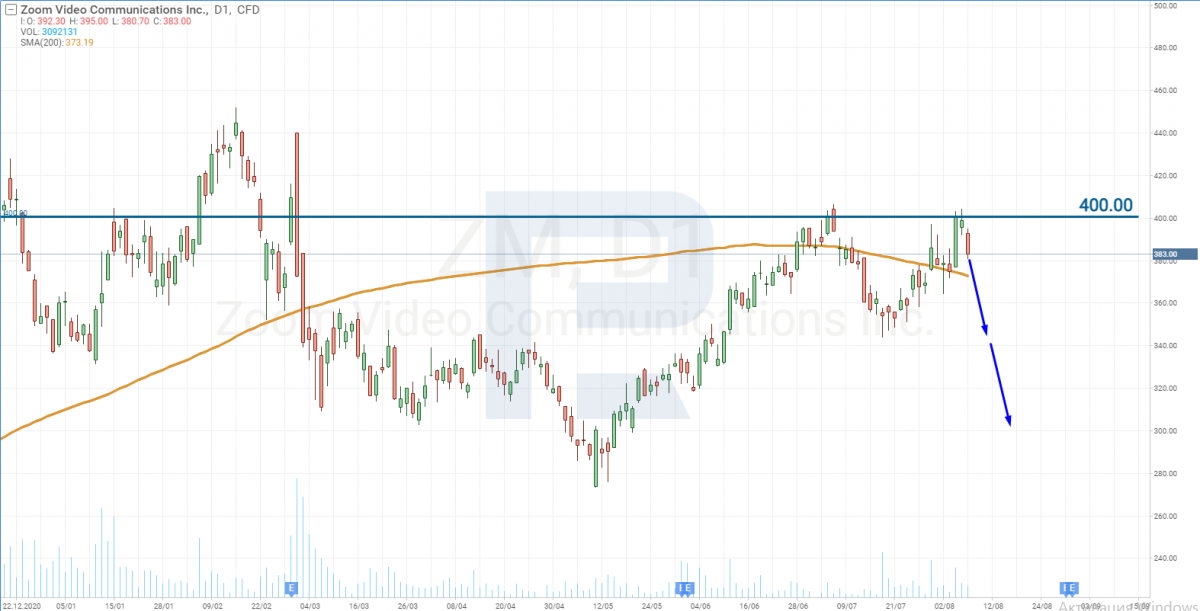

Zoom Video Communications shares are growing

So, do investors indeed fear a new wave of COVID-19? Yes, they do. The media are speculating on this all the time, making market participants nervous.

The most prominent beneficiary of COVID-19 in 2020 was Zoom Video Communications, Inc. (NASDAQ: ZM). The last steep growth of its stocks from 350 to 400 USD was propelled by the expectations that the company’s services would become popular again with a new quarantine.

Stocks of airlines are falling

Another confirmation that investors are scared of the Delta strain is the fact that they have started selling the stocks of airlines. The shares of American Airlines Group Inc. (NASDAQ: AAL), Delta Air Lines, Inc. (NYSE: DAL), United Airlines Holdings, Inc. (NASDAQ: UAL), and JetBlue Airways Corporation (NASDAQ: JBLU) were only declining between July 29th and August 4th.

However, not all market players are panicking with others. Some, on the contrary, use the chance to buy cheap shares. This became quite obvious on August 5th, when airlines played back over 50% of the decline over one trading session.

Thus we may conclude that there is no consensus about the COVID-19 situation, and its consequences for the stock market are somewhat exaggerated, being the result of the agitation in the media. However, you will only benefit from having a look at companies that might profit from the new wave of COVID-19.

We might not experience a new quarantine, but people will remain cautious about their health. Hence, they will minimize contacts with others, preferring online purchases. And this is why delivery services will become in demand.

3 stocks that might grow this autumn

There are three leaders in this segment: United Parcel Service, Inc (NYSE: UPS), FedEx Corporation (NYSE: FDX), and Expeditors International of Washington, Inc. (NASDAQ: EXPD).

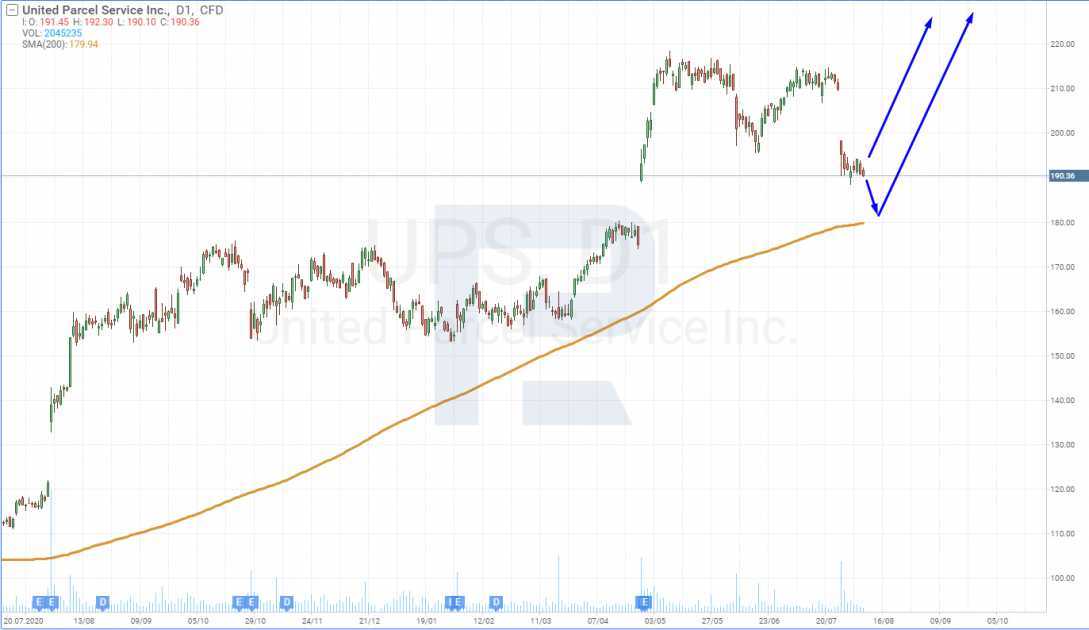

United Parcel Service

After a quarterly report was issued, UPS shares started falling and are nearing the 200-days Moving Average, which is a strong support level. From this, price is likely to bounce off and start growing.

The quarterly report demonstrated perfect results. Return on stock turned out to be above forecasts, reaching 3.06 USD. The company's revenue renewed all previous records and amounted to 23.4 billion USD. Why did the shares fall then? The thing is that investors have got used to such strong reports this year and have started looking into the detail.

It turned out that in the B2C (business to client) segment revenue has dropped. That is why investors got disappointed and sold some stocks.

The management was ready to the decline in this segment but did not care too much about it because other segments generated record revenue. For example, in the first half of 2021, UPS managed to get a free money flow of 6.8 billion USD. Previously, the company never managed to get such results over a year. This money can be allocated for maintaining debts, buying back stocks, paying dividends, extending business, etc.

After publishing the quarterly report, the management decided to allocate 5 billion USD for buying back stocks and continue paying dividends.

Both decisions are good news for UPS shareholders. The buyback will create demand for the shares and increase their cost, while dividends will stimulate investors not to sell stocks.

FedEx Corporation

FedEx is publishing it's quarterly report on September 21st, but by the performance of its rival UPS we can suppose that the revenue of FedEx is also beyond the expectations of analysts.

Another catalyst of further growth of the revenue of both companies is the vaccination campaign. Both UPS and FedEx deliver vaccines worldwide. If the COVID-19 situatipn gets worse, governments will be pushed towards obligatory vaccination, while citizens will actively seek for getting vaccinated themselves. Hence, the demand for vaccine delivery will remain high.

FedEx shares are trading at the 200-days MA, which means the correction is over, so the shares might start growing from the current levels.

Expeditors International of Washington

This is a less-known company compared to the two above but is operates in the markets of North and South America, North and South Asia, Europe, the Near East, and Africa. In other words, the company works worldwide. It delivers goods by air, ground, and sea.

On August 4th, Expeditors International published a quarterly report, where the return on stock exceeded the expectations of experts, reaching 1.84 USD, which is 68% higher than in the same period last year. The revenue was also above the results of earlier years, reaching 3.61 billion USD.

The management claims that the demand for delivery services will remain high because delivery companies sometimes experience supply failures, shortage of workforce, containers, or vessels. Hence, the price of delivery will stay high, presumably until the end of 2021.

Hence, in Q3 and Q4, the company will either increase its revenue or leave it at the current level. The management forecasts further growth.

Out of the three companies mentioned, the shares of Expeditors international demonstrated the least correction and are trading far away from the 200-days Moving Average.

This situation can be looked upon from two sides:

- On the one hand, this means that the company is strong, and its shares are in demand. Investors believe that the price will go on growing and are not eager to take the profit.

- On the other hand, there is a temptation to take the profit and wait for the papers to correct. At the current levels, those who bought the papers earlier have already got a good profit that might fade away if the shares decline. Every decline is like a gust of wind for a tightrope walker: the shares might fall at any second.

Looking at both sides, the first one seems more realistic, yet there is still a risk of correction in the case of something unexpected.

Is it worth buying Zoom shares?

This question is anything but simple. Everything depends on how serious the COVID-19 situation will be and whether it will result in a quarantine. If people will not be l imited in transportation, and a part of employees will return to their offices, Zoom client base will be growing slower. This will be enough for the clients to start thinking that the company has reached its ceiling.

Zoom needs to diversify its income, which is now the main concern of the management. However, in this case the influence of the coronavirus will be eliminated, and the company will require studying from quite a different viewpoint, considering the new market segments.

Tech analysis does not make things simple either. The shares are again trying to secure above the 200-days MA, but they have the resistance level of 400 USD to face that the quotations have failed to break through. This means they are likely to return under the MA or fall even deeper.

Closing thoughts

Information hurricane around the Delta strain will only speed up, and market players will sometimes pay attention to the issuers that have experienced a positive influence of lockdowns.

The worst scenario is a new quarantine imposed, in which case companies that have gone deeper in debt will be threatened bankruptcy, and airlines are most vulnerable here. In autumn, avoid companies deeply in debt and with a small free money flow.

As for delivery services, they have enough money to pay off their debts, buy back shares, and pay dividends. There is always a risk, of course, but there it is minimal.