Fall of Stocks Lost Zoom the Biggest Deal in Its History

4 minutes for reading

In June, we reported that Zoom shares were plunging despite an excellent quarterly report. In September, we wrote that even record-breaking quarterly statistics wouldn’t save the company’s securities from collapse. At long last, today we’ll tell you how all these declines turned out.

Zoom was to acquire Five9

On July 18th, thanks to Bloomberg’s efforts, it became known that Zoom Video Communications arranged to acquire Five9, an American developer of cloud software solutions for call centres. The deal was to complete early next year.

The parties reached an agreement on the following conditions: Zoom offers investors of Five9 with 0.5533 of its common share per each share of the cloud services provider, while Five9 becomes a part of Zoom as a separate operating unit.

An important aspect of the agreement to note here: the whole deal was calculated using the Zoom Video Communications share price (NASDAQ:ZM) valid on July 16th, 2021, which was $361.97 per share. As a result, the total agreement sum was estimated at $14.7 billion.

Why did Zoom blow a deal worth almost $15 billion?

After July 18th, 2021, there were some trading sessions what shares of the popular video conference platform were demonstrating impressive growth: once the shares even reached $400.58. However, if we consider the overall trend, the above-mentioned cases were more of an exception.

The major movement of Zoom shares was decline: from the date when the agreement news first appeared to the date of the official press release on the Five9 website that said there was no longer any agreements, and it was September 30th, Zoon shares lost 28.1% and went from $361.97 to $257.41. According to the above-mentioned document, it was the main reason but Bloomberg said it wasn’t.

Established consulting companies, such as Glass Lewis and Institutional Shareholder Services, made no secret of their doubts that after the COVID-19 pandemic was over, Zoom Video Communications was going to have “bright prospects”.

In addition to that, one shouldn’t forget that the U.S. Department of Justice and Federal Communications Commission were closely following the deal. Many specialists responsible for the development and implementation of cutting-edge technologies into the video conference platform are not just outside the USA, they are located in China. That’s why government authorities were “scanning” the deal between Zoom and Five9: they were trying to assess possible consequences of foreign participation in operations and activities of the American company.

How did Zoom and Five9 shares respond to the collapse of the deal?

On September 30th, the date of the “cancellation” press release, Zoom Video Communications (NASDAQ:ZM) shares added 1.59% and reached $261.5. At the end of the next trading session, they cost $267.51 per share after adding 2.3%.

Five9 (FIVN) shares started growing only on October 1st but the daily growth was more impressive. At the end of the trading session, they added 4.71% and reached $167.26. We should note that before that they had been falling for 4 consecutive trading sessions and lost over 7% over this period.

Tech analysis of Zoom and Five9 shares by Maksim Artyomov

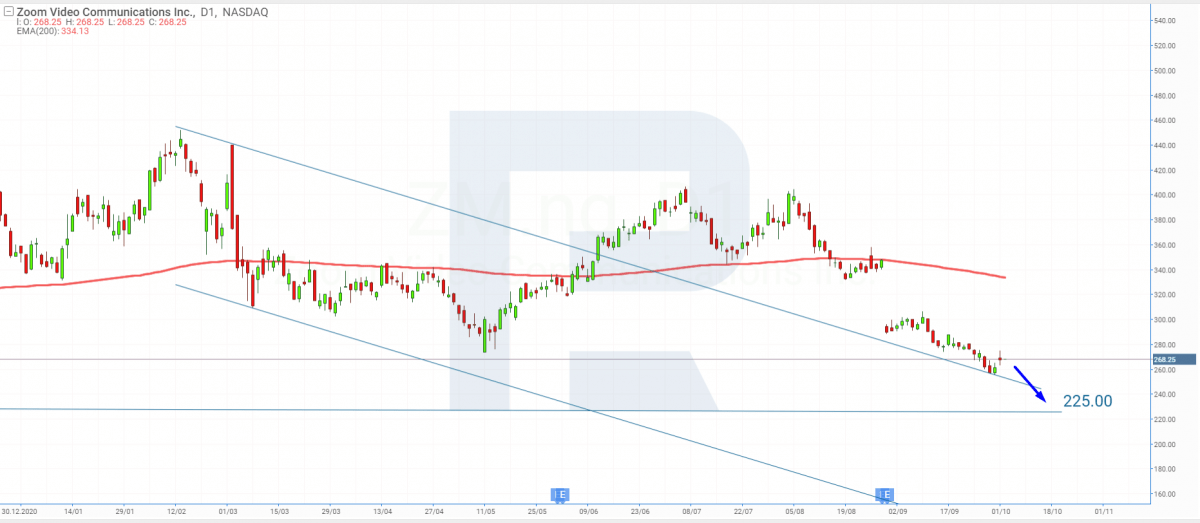

Zoom Video Communications

“The company’s shares continue falling. The previous trading session opened and closed with a small gap, which may be a signal in favour of a further downtrend. The price is trading below the 200-day Moving Average and heading towards the support level at $225.

After testing this level, the asset may break it and continue falling. At the same time, if the company can regain investors’ trust, the price may get a new positive momentum and recover. In this case, the upside target may be at $300”.

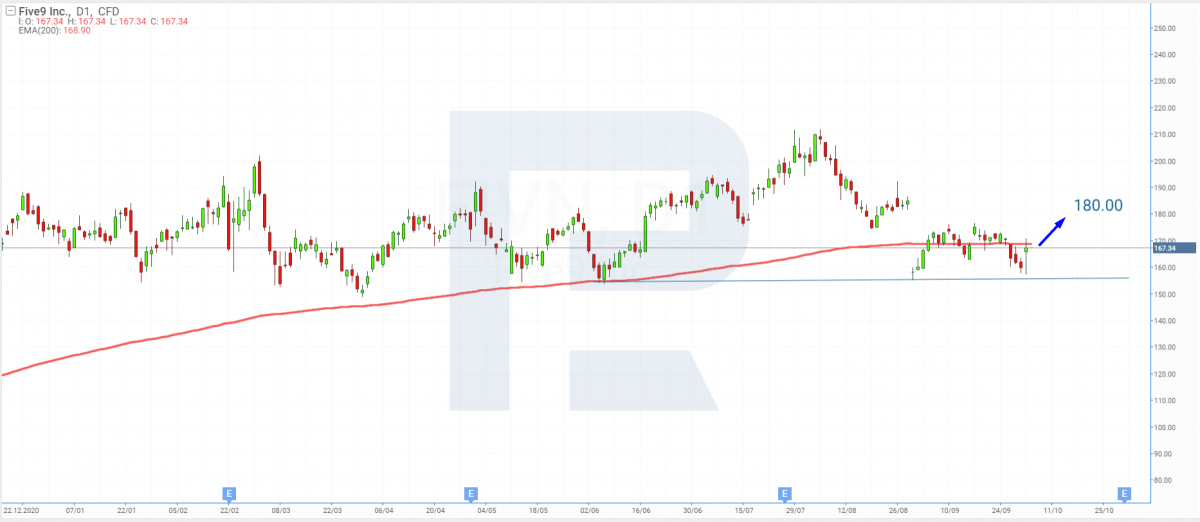

Five9

“The company’s shares continue moving sideways. Despite the cancelled deal, the price didn’t respond and is still trading close to the 200-day Moving Average. One shouldn’t expect any serious movements at this stage.

In the nearest future, the price may rebound from the support level and resume growing towards $180. However, one shouldn’t exclude a breakout of the support level and a further downtrend to reach $150”.

Summing up

The growth rate slowdown of the revenue and the number of users, which is confirmed by the latest quarterly reports of Zoom Video Communications, elevate fears and concerns of investors about the IT company’s future. As a consequence, its shares have been falling significantly – they have lost over 28% since July 18th, 2021.

These circumstances resulted in a situation where the American developer of cloud solutions for call centres cancelled its deal with Zoom. Yes, the deal worth almost $15 billion is no longer mean to be. At the same time, shares of both companies were positive in their responses to the news and have added 2.3% and 4.7% respectively since October 1st.