IPO of Udemy, Inc.: A Coursera’s Competitor Is Going Public

5 minutes for reading

The best investment is the investment in yourself. Improvement of your professional skills and acquisition of new ones have always been very popular, while the coronavirus pandemic in 2020 gave a huge boost to these processes. Nowadays, experts from different industries and spheres are willingly sharing their knowledge and experience with beginners within the frameworks of the development of information marketing and networking. In this case, learners can study new professions or upgrade their qualifications without having to leave their homes.

Udemy, Inc., the company that developed a platform for online learning/teaching, submitted an IPO request to the Securities and Exchange Commission (SEC) by the SEC S-1 Form. The IPO date hasn’t been announced yet, that’s why we have plenty of time to dig deeper into the company’s operations. The IPO will take place at the NASDAQ, under the “UDMY” ticker. Let’s take a closer look at the specifics of the company’s business.

Business of Udemy, Inc.

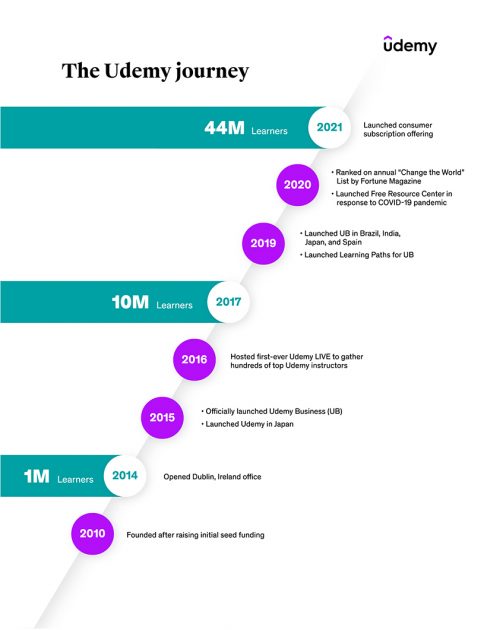

Udemy was established in 2010 with a headquarters in San Francisco, California, the USA. The company developed a specific platform for online learning/teaching. Udemy’s product is some kind of a marketplace of educational services. Using the platform, learners can get new knowledge necessary to be competitive in the global labour market. They can also choose the study timetable most suitable for them.

Experts in any professional or everyday sphere have the opportunity to register with the platform, start their courses, and monetize their knowledge and experience. Udemy doesn’t require verification of educational materials, that’s why it’s easier to become a mentor/teacher here than on other platforms.

With these simple moderation rules, users can easily find a short educational course for improving the most popular and required skills – these materials are the first to appear on the Udemy website. As for the online education market, the company operates in both B2B and B2C segments. Most of the company’s revenue is generated by payments for specific courses, as well as individual and corporate subscriptions for sets of courses.

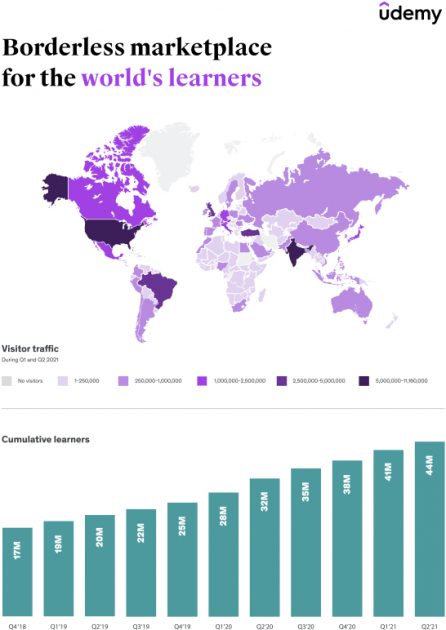

Over 10 years of its existence, the company’s clients were 50 million learners from all over the world. The platform offers over 100,000 different courses. Among Udemy’s corporate clients are Eventbrite, Pinterest, Volkswagen, Daimler, and Adidas. Below, we’ll discuss the market’s overall prospects and the company’s competitors.

The market and competitors of Udemy, Inc.

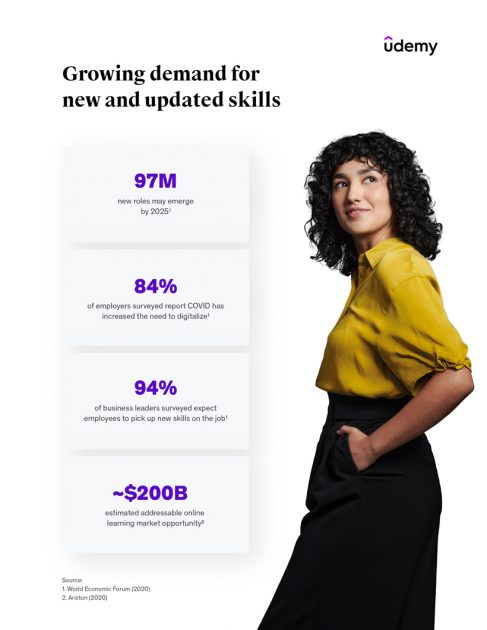

According to the research from Udemy, the global online education market in 2019 was $188 billion. By 2025, it is expected to reach $319 billion.

Among consumers of this service are the people who just want to learn something new at weekends. For example, the demand for creative courses added 326% in 2020, while the technical drawing lessons broke all records and expanded by 920%.

The company’s key competitors are:

- Skillshare

- Global KnowledgeTraining

- Degreed

- Teachable

- MasterClass

- Coursera

Financial performance

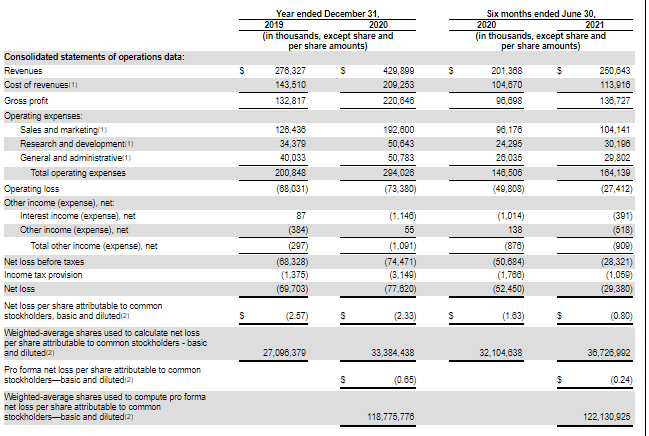

The company is filing for the IPO without generating the net profit, that’s why we’ll focus on analysing its revenue. According to the provided S-1 report, Udemy’s sales in 2020 were $429.89, a 55.57% growth relative to 2019. In the first 6 months of 2021, the company’s revenue was $250.64, a 24.47% increase if compared with the same period of 2020.

Over the last 12 calendar months, the revenue was $479.16. if the current growth rate continues, at the year-end of 2021, it is forecasted to reach $537.36.

The gross profit in 2020 was $220.65 million, a 66.13% increase if compared with 2019. In the first 6 months of 2021, the indicator was $136.73 million, a 41% increase if compared with the same period of 2020. The gross profit growth rate is higher than the revenue, which indicates an upward trend in the reduction of the net loss.

The net loss in 2020 was $77.62 million, an 11.38% increase relative to 2019. As one can see from the report, the indicator started reducing in 2021. In the first 6 months of 2021, the company’s net loss was $29.38 million, a 43.98% decrease if compared with the same period of 2020. Looking at these dynamics, we have grounds to assume that Udemy may get its first net profit at year-end quite soon.

Overall, we can conclude that the company is highly stable finance-wise and has excellent profit prospects in the future.

Strong and weak sides of Udemy, Inc.

How it’s time to make a mini-summary of Udemy’s upcoming IPO and identify its advantages and weak sides. I guess the company's advantages are:

- High revenue growth rates (over 20% annually).

- The gross profit growth rate is higher than the revenue.

- Reduction of the net loss in 2021.

- The target market growth potential is up to $319 billion by 2025.

- Leading positions in the online education market.

Risk factors of investing in Udemy shares are the following:

- The company is loss-making and doesn’t pay dividends.

- The industry is highly competitive.

IPO details and estimation of Udemy, Inc. capitalization

During 8 rounds of financing, the company raised $233.1 million. The underwriters of the IPO are Robert W. Baird & Co. Incorporated, William Blair & Company, L.L.C., Piper Sandler & Co. Needham & Company, LLC, KeyBanc Capital Markets Inc., Truist Securities, Inc., Jefferies LLC, Morgan Stanley & Co. LLC, J.P. Morgan Securities LLC, Citigroup Global Markets Inc., and BofA Securities, Inc.

As of now, there hasn’t been any information about the price or the number of shares to be sold during the IPO. Since the company is loss-making, we’ll use a multiplier, the Price-to-Sales ratio (P/S ratio).

A P/S value for the technological sector with such a rapidly growing market may be up to 40 during the lock-up period. As a result, Udemy’s capitalization may reach $19.6 billion ($479.6 million*40). Udemy’s closest competitor, Coursera, this indicator equals 12.52. In this case, Udemy’s capitalization may be up to $6.01 billion.

Bearing all these factors in mind, I would this company’s shares for long-term investments.