Quarterly Reports Affect IBM and AT&T Shares

4 minutes for reading

It's time to speak about quarterly reports of two tech giants: IBM and AT&T. I give you the main financial results of both for July-September alongside interesting statistics and a no less interesting tech analysis by Maksim Artyomov.

IBM report for Q3, 2021: poor results drop the shares

IBM presented it's Q3 report on Wednesday, October 20th. In short, the results of the last quarter disappointed both the management of the company and Wall Street analysts.

Extremely weak growth of profit is explained by a decrease in revenue in Global Technology Services and Systems. In July-September, they dropped by 5% and 12%, respectively, reaching $6.2 billion and $1.1 billion.

Revenue from Cloud&Cognitive Software grew by just 2% to $5.7 billion. A more impressive result had been expected.

Over Q3, revenue from Global Business Services increased by 11%

Global Business Services brought IBM $4.4 billion, growing over the result of Q3, 2020 by 11%. Red Hat, a software developer bought by the corporation in 2019 for $34 billion, demonstrated a decent increase in the revenue — by 17%.

On the day after the report was published, the share price of International Business Machines (NYSE: IBM) dropped by 9.56%to $128.33. Note that the shares had been falling for four sessions in a row.

Important report details

- Revenue — $17.6 billion, +0.3%, forecast — $17.77 billion.

- Return on stock — $1.25, -34%, forecast — $1.27.

- Net profit — $1.1 billion, -33%.

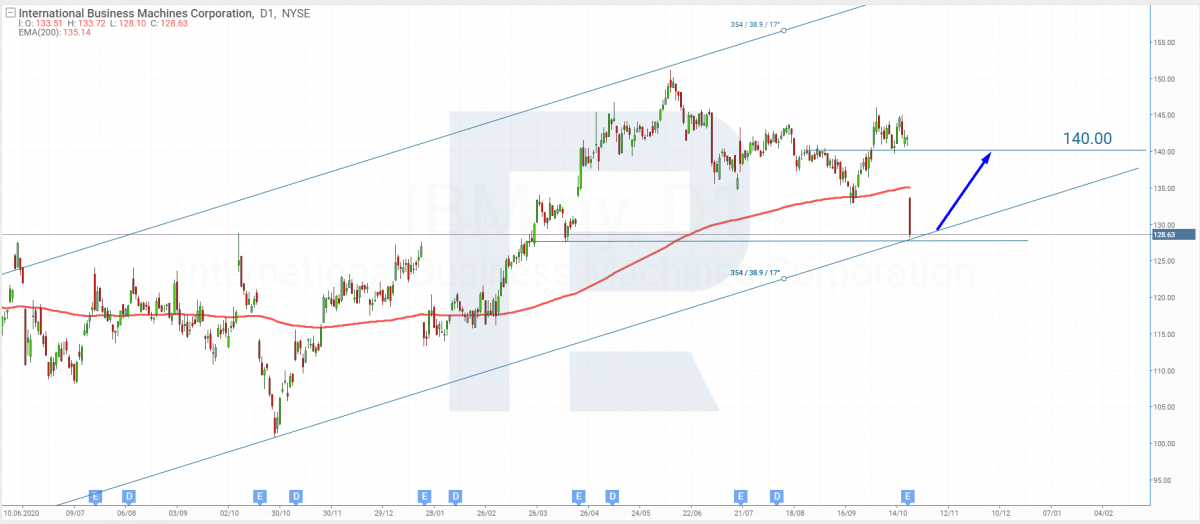

Tech analysis of IBM shares by Maksim Artyomov

Not all forecasts of market players coincide with the real performance of the company, and this is what's happened to IBM. It's shares opened the trading session with a gap and kept falling. Currently, the 200-days Moving Average has been broken, which might be a signal for a trend reversal.

The quotations have neared the lower border of the ascending channel. As long as the reports are in the positive zone, I presume that this impulse is a result of panic. Analyzing the D1, I couldn't neglect the fact that this year a new all-time high had been set and that the quotations were correcting.

Later, if investors feel confident again, there's a chance the quotations will bounce off the support level and resume the uptrend. The first aim of growth is likely to be $140, which will let the price cover up the gap.

AT&T report for Q3, 2021: profit grows by 111%

On October 21st, the results of Q3, 2021 were reported by the US telecom corporation AT&T. The main reason for the company to be proud is the growth of the quarterly profit by 111% against July-September, 2020. Analysts hadn't been so optimistic.

Over Q3, 2021, the number of HBO Max subscribers grew by 22% to 69.4 million people

Another result that was beyond expectations of Wall Street analysts turned out to be the number of subscribers of various company services. The number of HBO Max users increased by 22% to 69.4 million people, the number of postpaid subscribers — by 4.6% to 66.4 million people, the number of fiber optic subscribers — by 21.3% to 5.7 million people.

After the statistics were brought to light, the shares of AT&T (NYSE: T) closed on October 21st with a decline by 0.58% to $25.76. Waiting for the report, investors lifted the share price by 2.3% over 2 days

Important report details

- Revenue — $39.9 billion, -5.7%, forecast — $41.3 billion.

- Return on stock — $0.82, +110%, forecast — $0.79.

- Net profit — $5.9 billion, +111%

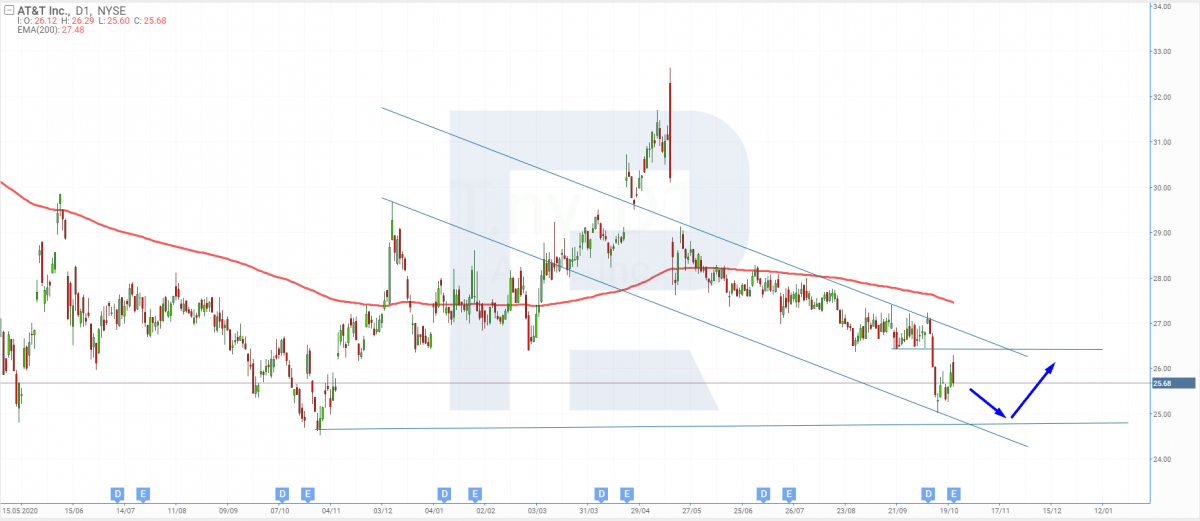

Tech analysis of AT&T shares by Maksim Artyomov

Regardless of the increased net profit, the shares of the company have completed a correction and keep falling. The aim of the decline might become the lower border of the channel and the horizontal support level at $25.

The decline is confirmed by the 200-days MA as well because it would not stop falling. After a test of the support level, the quotations might bounce off it and form yet another correction.

Summing up

This week, financial reports for Q3, 2021 we're filed by two tech giants: IBM and AT&T. The first one demonstrated quite poor results of July-September, and its shares dropped by 10%. The second company reported impressive growth of profit but this did not stop its quotations from falling by 0.58%.