Tesla: All-Time High Quarterly Report and $1 Trillion Capitalization

3 minutes for reading

Tesla and director-general of the company are definitely having a good time. Firstly, the company reported an all-time high profit in July-September; a bit later, their capitalization reached $1 trillion, and then Elon Mask became the richest person in the history of Forbes ratings.

I guess, you know how anxious I am to share the details with you. Let’s dig in, don’t let the freshest tech analysis of Tesla shares go stale.

Tesla report for Q3, 2021: profit grows by almost 400%

Even with the shortage of semiconductors, erratic supply of car accessory, and deliberately reduced power of plants, Tesla demonstrated all-time high growth of sales, revenue, and net profit. Note especially that the company has set a third record of quarterly profit in a row.

In July-September, they made 237,823 electric cars, which is 64% more than over the same period of last year. The number of sold cars increased by 73% to 241,391 vehicles.

Analysts forecast that in this quarter, 266,000 cars will be sold, and 900,000 total this year. However, financial director of Tesla Zachary Kirkhorn notes that things will depend on the stability of production and supply of accessory.

Important report details

- Revenue - $13.76 billion, +57%.

- Return on stock - $1.44, +433%.

- Net profit - $1.62 billion, +389%.

Tesla capitalization rising over $1 trillion first time in history

On October 20th, Tesla reported its performance in Q3, and right on the next day its share price grew by 3.26% to $894. However, real growth of the share price was caused by some other news.

On October 25th, a car rental service Hertz ordered 10,000 electric cars from Tesla, mostly Model 3. By the agreement, Tesla must have supplied the whole stock of cars by the end of next year.

Tesla shares grow by almost 13%, while its capitalization rises over $1 trillion.

The news about the largest order made Tesla (NASDAQ: TSLA) shares grow by 12.66% to $1024,86. This made market capitalization rise over $1 trillion. Welcome to the club of trillionaires alongside Apple, Microsoft, Amazon, and Alphabet, as they say.

Note that the share price growth of the car corporation continued through the next day. On October 26th, the quotations leaped up by 3.88% more, stopping at $1064.58.

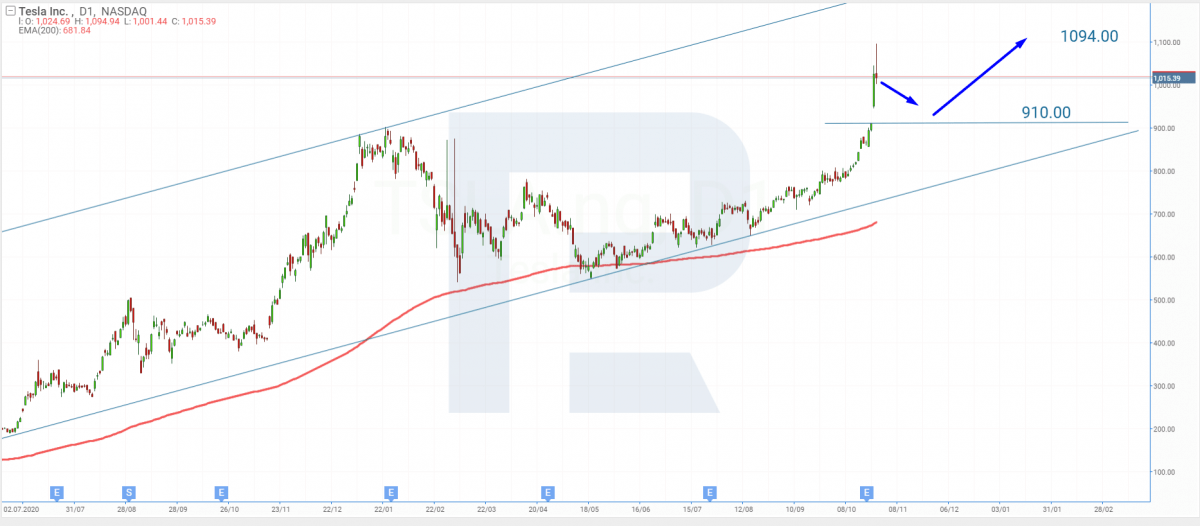

Tech analysis of Tesla by Maksim Artyomov

On D1, the shares grew rapidly inside the ascending channel and renewed the all-time high. Now, as it often happens after such growth, the price is correcting. The aim of the pullback might be a broken resistance level - $910.

Then the price might test the support level, bounce off it, and head for the high. An additional signal supporting growth after the correction is the 200-days Moving Average that keeps growing. In the nearest future, a breakaway of $1,094 will also signal the continuation of the uptrend.

Summing up

Tesla reports setting a new record of quarterly profit for the third quarter in a row. In July-September, it amounted to $1.62 billion, which means growth by 389%. Other statistics were also impressive: revenue grew by 57% and the number of sold electric cars – by 73%.

After the market heard that Hertz had ordered 100,000 electric cars, the shares of Tesla rose by almost 13% and its capitalization – over $1 trillion. Moreover, such a leap of the shares made director-general of the company Elon Mask the richest person in the history of Forbes ratings. As you know, the first rating of the journal dates back to 1918.

According to Forbes Real Time, at the time when the article was being prepared, the businessman owned $253.8 billion, while Bloomberg Billionaires Index says about $287 billions.