Weak Forecast Dropped Moderna Shares

3 minutes for reading

Right after Pfizer reported its financial performance in Q3, 2021, another US pharma company – Moderna – presented its report.

The manufacturer of messenger RNA-based drugs reported growth of revenue in July-September by over 3,000%, but then its shares started falling rapidly. Let’s get into the reasons of this decline together.

Moderna report for Q3: revenue grows by 3,065%

On November 4th, a biotech company called Moderna reported its performance in Q3 that ended on September 30th. Below you can see the exact digits, and many of you will call this a success. However, Wall Street analysts have a different viewpoint. They were genuinely discouraged, and I’ll explain this later.

The main source of finance was sales of the anticoronavirus vaccine. In July-September, Moderna sold 208 million dozes. Sales of other drugs brought $4.81 billion, and the revenue from grants – just $140 million.

Important report details

- Revenue - $4.97 billion, +3,065%, forecast - $6.49 billion.

- Return on stock - $7.7, +1,405%, forecast - $9.13.

- Net profit - $3.33 billion, +1,529%.

Moderna forecast for this and the next year

You can see that the main financial results of Moderna in Q3 turned out inferior to the forecasts of Wall Street analysts. The difference is, indeed, substantial. However, according to Bloomberg, investors were even more worried about a different thing, which were the forecasts of Moderna management for this and the next year.

In the biotech company, they revised their expectations from 2021. They now suppose that the overall revenue from selling the vaccine will reach not $20 billion but $15-18 billion. The main reason for this is that the company cannot produce as many dozes as they previously thought.

The revenue of Moderna in 2022 is expected to be $17-22 billion.

According to the management of Moderna, in 2022, the income will reach $17-22 billion. They report already signed international contracts for the drug against COVID-19 for $17 billion. However, analysts expect that next year, the revenue will reach $20 billion and in 2024 – decline to $7.5 billion.

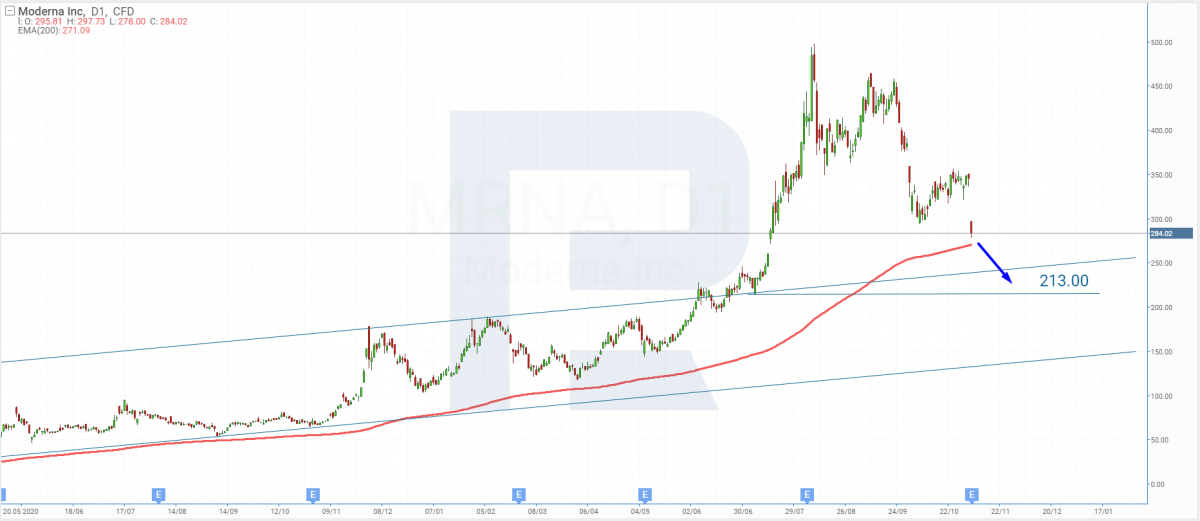

Such expected revenue and sales volume of the anticoronavirus vaccine provoked a decline of Moderna shares (NASDAQ: MRNA). On November 4th, after the report for Q3, 2021 was published, trades closed at $284.02, which meant a decline by 17.89%. This is the largest decline since the beginning of the year.

Tech analysis of Moderna shares by Maksim Artyomov

With all the rivalry, Moderna decreased its profits forecasts, which caused a negative effect on the stock price. Feeling the threat, investors started getting rid of the asset that could cause losses to them. This provoked a serious decline of the quotations on D1.

Currently, the price has broken through the support level at $300 and keeps declining. As long as investors and market players do not sympathize the asset, I presume the price will be going down. The first goal will be the 200-days Moving Average; a breakaway will signal further decline to the support level of $213.

Summing up

In the middle of this week, an American biotech company Moderna published its financial report for Q3, 2021. The statistics as inferior to the forecasts of analysts, while a weak forecast for this and the next year made the share price drop by almost 18%.

The situation becomes even worse because, unlike Pfizer, the company has not been allowed by the FDA to use the anticoronavirus drug on children.