NVIDIA Quarterly Report Made Its Shares Sky-Rocket

3 minutes for reading

If you thought that all interesting quarterly reports were over, you were wrong. This week, a financial report for Q3, financial 2022 was presented by an American company NVIDIA.

The company demonstrated all-time high revenue and a very optimistic forecast for this quarter. Do you want to know the details and the tech analysis of the chip-maker's shares? Make yourself comfortable, and let's get started.

NVIDIA report for Q3, financial 2022: income grows by 50%

Financial statistics of NVIDIA for August-October 2021 was issued on November 17th, after the main trades closed. Performance of the chip-maker and computation leader turned out above expectations of Wall Street analysts.

In August, I wrote that, by the report of NVIDIA for Q2, financial 2022, the revenue of the video card and micro chips designer reached its all-time high of $6.51 billion. And in Q3, the record was beaten, and the revenue reached $7.1 billion.

Important report details

- Revenue — $7.103 billion, +50%, forecast — $6.83 billion.

- Return on stock — $0.97, +83%, forecast — $0.89.

- Net profit — $2.464 billion, +84%

NVIDIA sales department-wise

Apart from general revenue, the corporation can boast all-time high revenue of certain segments. For example, the data-center department last quarter generated $2.94 billion of revenue, demonstrating growth by 55% compared to the same part of 2020.

From the gaming sector, the corporation received even more — $3.2 billion. August through October 2021, the revenue it generated grew by 42%.

The most prominent growth last quarter was demonstrated by the professional visualization sector. Sales grew by 144.5%, reaching $577 million. High-perfotmance graphics processors for professionals gained special popularity.

However, the department for car industry products failed to impress investors by its quarterly performance. It, indeed, demonstrated growth by 8% to $135 million against Q3, financial 2021. However, against previous quarter, there is a decline by 11%.

NVIDIA shares Sky-Rocket

On November 18th, on the next day after the report was issued, the share price of NVIDIA Corporation (NASDAQ: NVDA) closed with growth by 8.25% to $316.75. Over the trading session, the quotations reached the high of $327.31. As you know, the shares have grown by 143% since January.

Tech analysis of NVIDIA shares by Maksim Artyomov

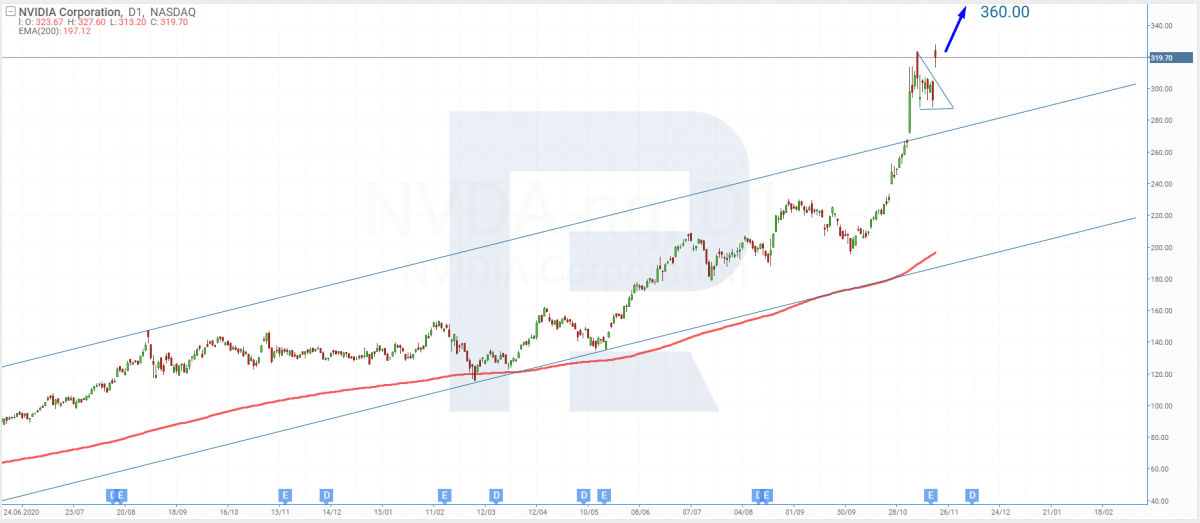

After the quarterly report, the shares of the company keep growing. Winding up the correction by a tech analysis pattern Pennant, the quotations started off by the signal. As long as the price renewed its all-time high again, the uptrend is likely to continue.

Another signal supporting the growth is the 200-days Moving Average that is also growing. As long as the profit of the company is also increasing, the quotations might reach $360 by the next quarterly report.

Summing up

This week, performance in Q3, financial 2022 was reported by Nvidia. The designer of graphics processors and microchips boasted all-time high revenue of $7.1 billion.

Moreover, the company voiced a very optimistic forecast for the current quarter. They expect the income in November-January to reach $7.4 billion, setting a new record. Also, the quarterly gross profit will reach 65.3%.

With such a report and forecast, the quotations of the company grew by over 8%. Experts say that even with such speedy growth that we have seen over the year, the quotations still have potential for further growth.