IPO of Nu Holdings Ltd.: A Neobank From South America

6 minutes for reading

Any commercial bank offers its clients a particular set of banking operations using a mobile application. Alongside the development of internet banking, the number of “offline” bank offices and branches was reducing. In the 2010s, the process of the global banking system digitalization boosted significantly with the appearance of neobanks, the companies that don’t really have classic “offline” offices. Clients of such banks perform all banking operations in mobile applications, which make their lives much easier.

Nu Holdings Ltd., a developer of a digital banking platform, is going to have an IPO at the NYSE before the end of November. The company’s shares will start trading the next day under the “NU” ticker. In this article, we'll take a closer look at the company's business, its strong sides, and the risks of investing in its shares.

Business of Nu Holdings Ltd.

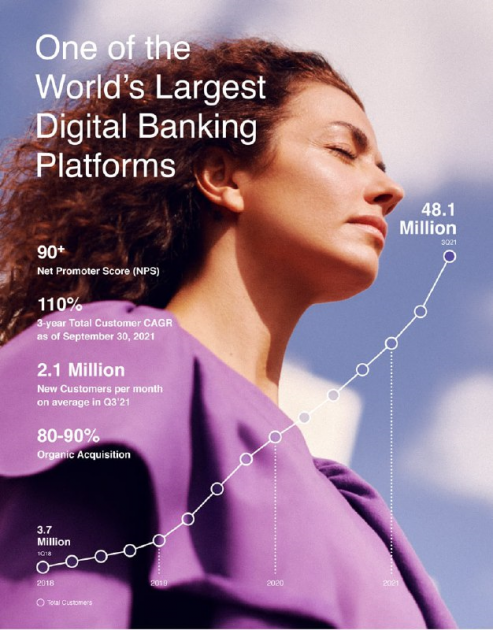

Nu Holdings Ltd. Was established in 2013 in the Cayman Islands. The company employs over 5,000 people. The banking platform is an absolute leader in Brazilian, Mexican, and Colombian markets. As of now, Nu Holdings Ltd. Has about 48 million clients all over the world.

The key drivers of the company’s growth are the following features implemented by the management:

- Technical and economic innovations.

- Improvement of tools for increasing client involvement.

- Customer support enhancement. The major focus is put on the development of robotic systems. The key goal is to make communication of customers with bots more comfortable than with real people.

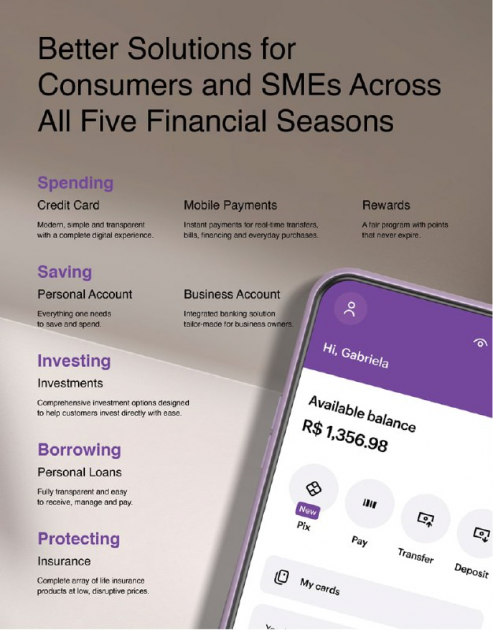

- Solutions for small and medium-sized businesses.

The goal of Nu Holdings Ltd. management is to create an ultimate user-friendly application for day-to-day use: spending, savings, investments, loans, and insurance. The company builds mutually beneficial, close, and friendly relations with its clients.

The company is preparing to enter European and North American markets; the business model is well-managed and has already demonstrated its scalability in different jurisdictions. As a result, onу can say that the company is quite successful and will gather pace when entering new markets.

For these purposes, Nu Holdings Ltd. has already opened relevant departments for expansion in the US, Uruguay, Argentina, and Germany. Now let’s discuss the prospects of the company’s target market.

The market and competitors of Nu Holdings Ltd.

According to Oliver Wyman Consultoria em. Estratégia de Negócios Ltda., the target market volume in the US (brokerage, banking, and insurance services) in 2020 was $99 billion. By 2025, it is expected to reach $126 billion with an average annual growth rate of 5%.

As mentioned in the same report from Oliver Wyman Consultoria, the company’s global market in 2020 was $186 billion. By 2025, it may reach $269 billion with an average annual growth rate of 8%. In this industry, Nu Holdings Ltd. will compete with both classic banks and other fintech start-ups. Now let’s take a closer look at the company’s financial performance.

Financial performance

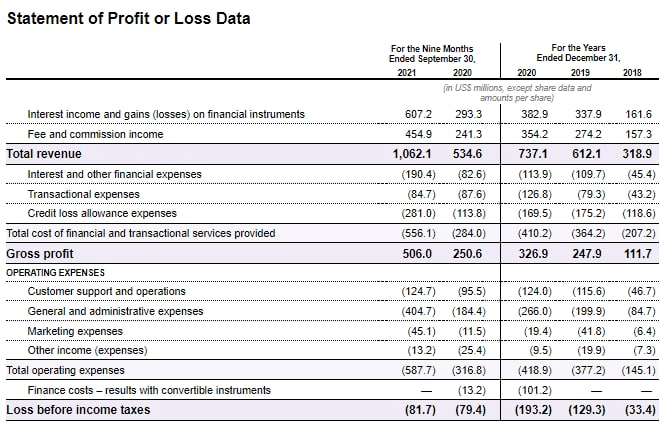

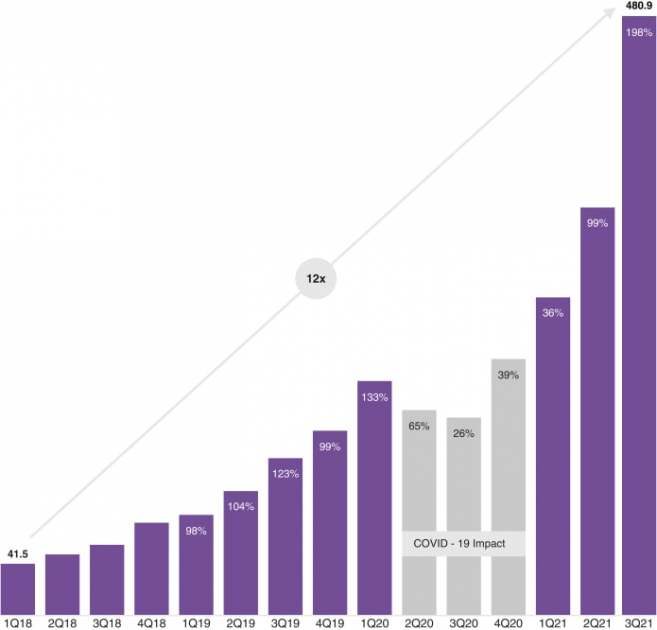

Nu Holdings Ltd. is filing for the IPO being loss-making, that’s why we’ll focus on analysing its revenue. The company’s sales in 2020 were $737.1 million, a 20.42% increase relative to 2019. In 2019, the revenue added 91.94% if compared to 2018.

According to the F-1 report, In the first 9 months of 2021, the company’s revenue was $1.06 billion, a 98.67% increase if compared with the same period of 2020. Over the last 12 calendar months, the revenue was $1.26 billion. As we can see, there is an “explosive” upsurge in the company’s business at this stage.

The net loss in 2020 was $193.2 million, a 49.42% increase if compared with 2019. Over the first 9 months of 2021, the net loss was $81.7 million, a 2.89% increase relative to 2020.

Considering the above-mentioned revenue growth rate, the company could have locked in the net profit. However, it didn’t happen due to an upsurge in expenses, more specifically administrative costs (+119.47%) because of the expansion into new markets.

Cash and cash equivalents on the company’s balance sheet are $13.95 billion, while its total liabilities are $169.91 million. As a result, the net cash position is $13.78 billion.

Strong and weak sides of Nu Holdings Ltd.

Now let’s highlight the strong and weak sides of Nu Holdings Ltd. I believe the advantages of investing in the company’s shares are:

- The company has been on the market for more than 9 years.

- An average annual revenue growth rate is 100%.

- The issuer enjoys a monopoly in the digital banking market in South America.

- The company’s application is actively used by over 48 million people.

- Flawless business reputation.

Among investments risk, I would name:

- The issuer is loss-making and doesn’t pay dividends.

- The company will have to invest huge money in increasing brand awareness in new markets.

- Western investors may not have trust in Nu Holdings Ltd. due to its offshore jurisdiction.

IPO details and estimation of Nu Holdings Ltd. capitalization

The underwriters of the IPO are Susquehanna Financial Group, LLLP., Sanford C. Bernstein & Co., LLC, Numis Securities Inc., Nu Invest Corretora de Valores S.A., Allen & Company LLC, HSBC Securities (USA) Inc., UBS Securities LLC, KeyBanc Capital Markets Inc., Citigroup Global Markets Inc., Goldman Sachs & Co. LLC и Morgan Stanley & Co. LLC.

During the IPO, Nu Holdings Ltd. is planning to sell 289.2 million common shares at the price of $10-11 per share. The IPO volume is expected to be $3.03 billion with a capitalization of up to $48 billion. It will be one of the largest IPOs in 2021.

Since the company is loss-making, to assess its capitalization we use a multiplier, the Price-to-Sales ratio (P/S ratio). A P/S value for the technological sector with such a rapidly growing market may be up to 40 during the lock-up period. The company’s P/S value before the IPO is 38.2. If underwriters do not revise the IPO conditions, then this investment may be considered a venture capital one.

Under favourable market circumstances, there is a strong possibility of an “explosive” surge in the company’s capitalization. That’s why I would recommend this issuer for short-term speculative investments.