How the Rebalancing of the NASDAQ-100 Affects the Index's Newcomer Stocks

5 minutes for reading

In this article, we will explain how the NASDAQ-100 index changed on 19 December, try to analyse what happens to the value of the newcomers, and explain the criteria used to make the selections.

Summary of the NASDAQ-100 Index

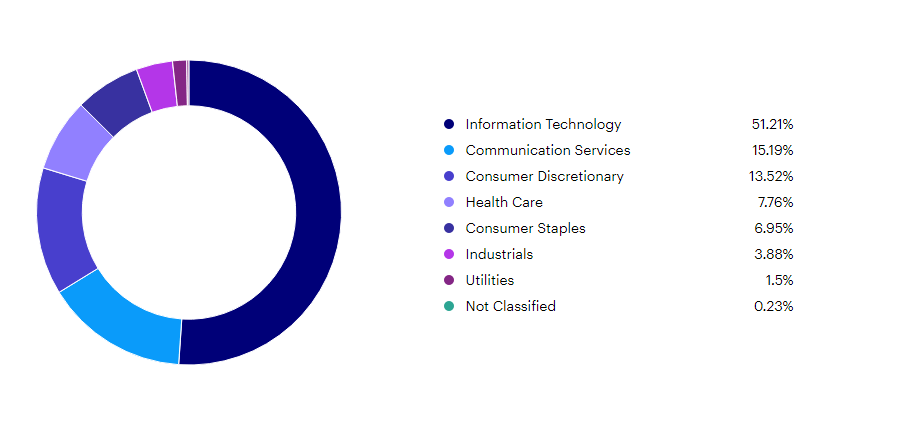

he NASDAQ-100 (NAS100) is a US stock index comprising the 100 largest companies by capitalisation, representing various sectors of the economy other than finance. Its history began in 1985. The index is broken down as follows: the technology sector accounts for 51.2%, the communications services sector for 15.2%, the consumer sector for 13.5%, and all the other sectors do not exceed 10%.

Criteria for selecting companies

- Listed on the NASDAQ exchange

- 100 largest companies by capitalisation

- The average daily trading volume over the last three months exceeds 200,000 stocks

- If the issuer is incorporated outside the US, the options on its stocks must be traded on a US exchange

- The selection process produces a list of 125 companies out of which 100 are included in the index, while the rest are on the waiting list

- Companies from the financial sector are not included

- Companies that have filed for bankruptcy are not included

NASDAQ-100 update in 2022

The index is rebalanced annually in December. If at any point an issuer becomes ineligible – for example, in case of a merger or acquisition, delisting from the NASDAQ, or bankruptcy – its stock is removed from the index and replaced with another company from the waiting list without waiting until the end of the year.

The NASDAQ-100 comprised 101 firms in 2022 with Constellation Energy Corp (NASDAQ: CEG) splitting from Exelon Corporation (NASDAQ: EXC) and remaining on the index. Seven issuers – VeriSign Inc. (NASDAQ: VRSN), Skyworks Solutions Inc. (NASDAQ: SWKS), Splunk Inc. (NASDAQ: SPLK), Baidu Inc. (NASDAQ: BIDU), Match Group Inc. (NASDAQ: MTCH), DocuSign Inc. (NASDAQ: DOCU) and NetEase Inc. (NASDAQ: NTES) – left the list on 19 December.

They were replaced by six companies – CoStar Group Inc. (NASDAQ: CSGP), Rivian Automotive Inc. (NASDAQ: RIVN), Warner Bros. Discovery Inc. (NASDAQ: WBD), GlobalFoundries Inc. (NASDAQ: GFS), Baker Hughes Company (NASDAQ: BKR) and Diamondback Energy Inc. (NASDAQ: FANG).

Market participants’ reaction to the rebalancing of the NASDAQ-100

When new companies are added to the index, index funds are obliged to buy their stocks. If we look at NASDAQ-100 newcomer stock charts, we can see an increase in the trading volume of their stocks during the rebalancing period.

NASDAQ-100 rebalancing in 2018

2019 returns on stocks added to the index companies:

- Advanced Micro Devices Inc. (NASDAQ: AMD): +141%

- Lululemon Athletica Inc. (NASDAQ: LULU): +104%

- NetApp Inc. (NASDAQ: NTAP:- +5%

- United Continental Holdings Inc. (NASDAQ: UAL): +9%

- VeriSign Inc. (NASDAQ: VRSN): +34%

- Willis Towers Watson Public Limited Company (NASDAQ: WTW): +37%

The return on investment in all six companies for 2019 is 55%, which is 10% higher than the return on the NASDAQ-100 index over the same period.

NASDAQ-100 rebalancing in 2019

2020 returns on stocks of companies added to the index:

- ANSYS Inc. (NASDAQ: ANSS): +40%

- CDW Corporation (NASDAQ: CDW): -4%

- Copart Inc. (NASDAQ: CPRT): +37%

- CoStar Group Inc. (NASDAQ: CSGP): +54%

- Seattle Genetics Inc. (NASDAQ: SGEN): +76%

- Splunk Inc. (NASDAQ: SPLK): +11%

For 2020, the return on investment in these companies reached 35%, while in the NASDAQ-100 it was 45%.

NASDAQ-100 rebalancing in 2020

2021 returns on stocks of companies added to the index:

- American Electric Power Company Inc. (NASDAQ: AEP): +7%.

- Marvell Technology Group Ltd (NASDAQ: MRVL): +100%

- Match Group Inc. (NASDAQ: MTCH): -19%

- Okta Inc. (NASDAQ: OKTA): -19%

- Peloton Interactive Inc. (NASDAQ: PTON): -70%

- Atlassian Corporation Plc (NASDAQ: TEAM): +50%

For 2021, the return on investment in these companies reached 7%, while in the NASDAQ-100 it was 27%.

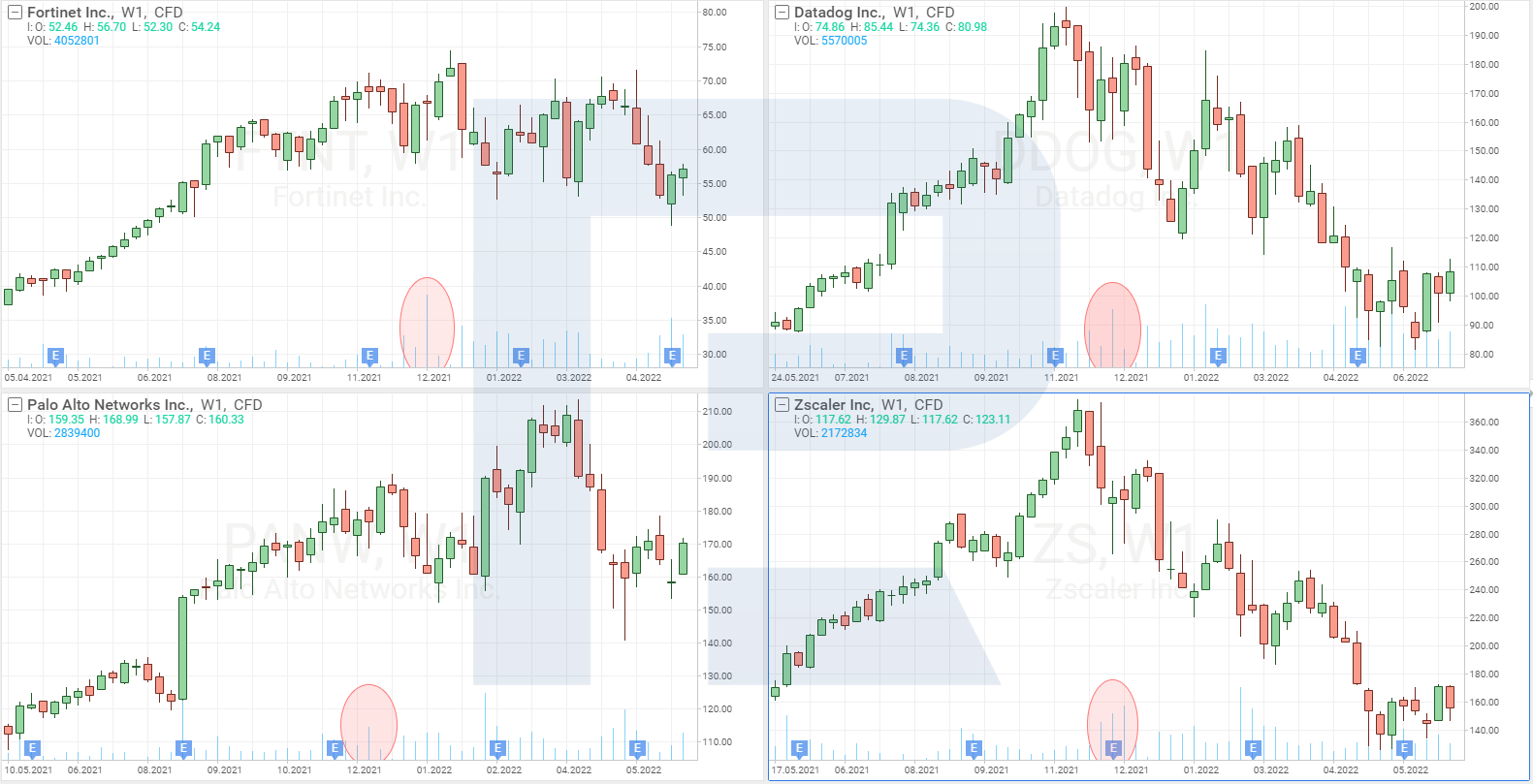

NASDAQ-100 rebalancing in 2021

Yield for 2022 on stocks of companies added to the index:

- Airbnb Inc. (NASDAQ: ABNB)” -49%

- Fortinet Inc. (NASDAQ: FTNT): -22%

- Palo Alto Networks Inc. (NASDAQ: PANW): -12%

- Lucid Group Inc. (NASDAQ: LCID): -80%

- Zscaler Inc. (NASDAQ: ZS): -62%

- Datadog Inc. (NASDAQ: DDOG): -55%

The cumulative return for 2022 of the above corporations was -46%, while the index return reached -31%.

Conclusion

From 2018 to 2021 inclusive, a quantitative easing programme was in place during which the US interest rate was lowered from 2.5% to 0.25%. This was a favourable business environment that, even during the COVID-19 pandemic, allowed stocks of firms added to the index to show positive returns.

However, in 2022, the Federal Reserve System (FED) began to raise the interest rate and launched a quantitative tightening programme. As it turned out, these decisions had a more negative impact on stock prices than the pandemic.

Of the periods discussed above, only in 2019 were the returns on investments in the newcomers to the index higher than the ones on the NASDAQ-100. In addition, the level of return on each of the stocks listed was not correlated with the index or the other stocks on the list.

It can be concluded that the inclusion of companies in the index does not have a strong impact on their stock price. Based on data from the last four years, it can be assumed that the Fed policy has been a key factor affecting stock prices.