What is Scalping on Forex?

4 minutes for reading

Who in the world of trading hasn’t heard of scalping? Probably, you may know it as pipsing, but all traders surely heard a lot of different things about it, some of them tried it in practice, others are just going to, that’s why I guess it would be interesting to go into details of such thing as scalping.

Scalping definition

Let’s start with the definition. Scalping is a type of a trading strategy for trading on currency, stock and commodity markets. The distinctive feature of scalping is closing an order when the profit reaches several pips. This definition is offered by a lot of public trading-related web resources. In addition to that, some of they say that a scalping position is held from several second to several minutes. Under this approach to scalping, it may be regarded as an element of a high frequency trading.

How can scalping be used in case of big spread expenses?”

We can go deep in the theme and “lift the curtain” over scalping, which is considered by many traders as almost perfect and advanced method of trading.

The question above helps expand the concept of scalping as it is, because the period of holding an order is too small, the profit may be almost equal to spread expenses, and the risk level for a position may by far exceed the potential benefit. In today’s technology intensive world, computers are vastly superior to enthusiasts of manual trading, but this competition allowed traders to expand the border of scalping as a trading instrument.

One should realize that there is a difference between scalping on the Forex and stock markets. In case of the former, traders use additional tools, such as Time & Sales and Depth of Market. Some Forex brokers make concessions and reduce commissions for scalpers. However, efficiency of scalping on stock markets even with additional helpers is rather questionable. The key thing in trading is the market liquidity, while scalping can be used even during periods of low volatility and liquidity.

So, how practical is scalping as a trading method?

Scalping technique implies quickly snatching a “piece” of movements from current tendencies. However, most traders have no aggregate picture of how to scalp. First of all, a trader that wants to focus on scalping needs to be up for the idea to become a scalper, some kind of a surgeon in the world of trading, who is patient, accurate in making decisions and movements, cautious, and cold-blooded. Such traders know from the very beginning where exactly they may take profit or lose and they don’t regret losing possible income after closing a deal at the target point while the price continues moving in favorable direction. In their trading operations, scalpers usually use M1 or M5 timeframes, maybe M15, but more seldom.

Scalping strategies

Most scalping strategies are based on breakouts of support and resistance areas, for selling and buying respectively. Additional tools that are used by traders for determining support/resistance levels are line charts embedded in trading platforms (MT4, MT5, R WebTrader, etc), as well as fractal indicators, Parabolic SAR, and almost full range of Envelope-type indicators, which form mobile support/resistance levels taking into account volatility and averaged price movements per specified numbers of candlesticks.

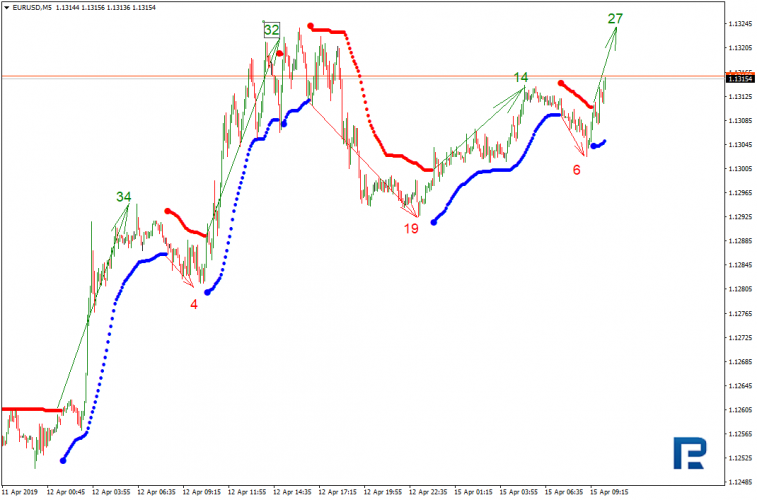

The figure shows an example of scalping strategy using the VoltyChannel_Stop indicator. The logic of this system is based on a breakout of the indicator’s endpoint as a signal to open an order. The price movement range after the control level had been broken was from 4 to 34 pips, which is quite enough for a scalper. The only thing that may raise questions is where exactly every scalper intends to close their order.

In other words, possible profitability can be calculated in some specific range. We should also note that scalpers use quite large parts of their deposits in trading, from 10% to 50%. Depending on the opening/closing strategy, a scalper opens from 5 to 50 orders in case of constantly being in front of a computer and trading very actively. Consequently, we can calculate that scalper’s daily profitability may vary from 2% to 100%, but it requires a lot of work without any breaks.

Closing thoughts

One example can’t provide comprehensive conclusions. If you want to have a stable and decent income in trading, you have to contribute a lot of time and pay a great deal of attention to your work, keep strictly to your strategy and risk management system. Even if you have little free time and your appetites are not insatiable, you can trade at odd moments using scalping techniques. The key point is to choose an optimal algorithm and practice until it becomes automatic.

Successful trading to everyone!