How to Trade on Forex? Ultimate Guide for Beginners

18 minutes for reading

What are financial markets – exchange and Forex?

When an uninitiated reader encounters the collocation "financial market", they discern no difference between such terms as "stock market", "exchange", "Forex", "equity market", "bond market", "currency market", "derivative market", etc. So, I think there should be an explanation what the financial market really is. First of all, understand and remember that the financial market is not just a place for trading, but the entire system of the economic relations, which appeared in the process of exchanging different goods and recourses.

The financial market is an environment for mobilization and aggregation of capital, for loaning, exchanging currencies, and investing in the industrial sector. Balance of supply/demand for borrowed funds forms the global financial market. The global financial market can be classified according to types of goods that are traded. There are following types of financial markets:

- The currency market (Forex). The basic asset here is currencies, which are bought and sold by brokerage companies, banks, and investment funds.

- The stock market. This is the place where they trade securities (stocks, bonds, bills, derivatives).

- The commodity market. Among assets that are traded here are oil, metals, farm produce.

- The precious metals market is often considered as a part of the commodity market, but it should be classified as a separate market due to significant trade turnover growth. As a rule, precious metals often serve as safe haven assets.

Another classification that may be used for financial markets is the trade procedure:

- Stock exchanges. Stock exchanges are independent trading floors where they trade standardized contracts. Every stock exchange specializes in some particular market segment, for example, metals, energies, farm produce. Stock exchanges operate only at the specific time (trading sessions). To perform any buying/selling transaction, there has to be an official counter party (representative) on the trading floor.

- Over-the-counter (OTC) markets. These are markets, like Forex for instance, which have no specific place for trading. Trading operations are performed via the Internet or by phone. Trading on the Forex market doesn’t depend on the place of trade, but is very often influenced by trading sessions in different parts of the world at different times, the Asian session (begins with the Sydney open and ends with the Tokyo close), the European (London) session, and the American (New York) session. Thanks to this, trading operations can be performed almost 24/7, because sessions are fading one into another. This makes the Forex market more liquid and available to any trader.

Trading procedures on Forex

Since the Forex market is an OTC market, it doesn’t imply actually buying or selling currencies like they do in exchange offices.

A lot of people ask themselves a question: "How do I become a trader and start trading on financial markets?" Let’s try to track the career path of a future "big boy from Wall Street" step by step. Early stages in trading on Forex and other financial markets are pretty similar. Let’s take a closer look at this process by the example of the currency market.

First of all, a trader-to-be chooses a broker and decides on the trading platform they are going to use for trading. A variety of trading terminals available on the market allows to choose one that meets all their requirements and preferences. After choosing the platform, they have to decide on a trading account type. As a first step, it’s better to go for a standard demo account, which helps to learn how to open and close positions, place Stop Loss and Take Profit levels, and use charts and indicators.

Stop Loss is a protective order placed by a trader to limit possible losses in case of negative market situation. The order level is defined on basis of the current market situation, risks that a trader can afford, and their trading strategy.

Take Profit is an order to close a position when the instrument quotes reaches some specific price level. The order parameters are set by a trader based on their forecasts or according to their trading strategies. Take Profit orders can be placed not lonely at the position opening, but later as well. Also, there are methods of trading without Stop Loss and Take Profit levels, when a trader closes each deal manually after evaluating the current market situation.

Point (pip, tick) is the minimum distance covered by the currency pair quotes in case of the price change.

As a rule, there are no restrictions on the duration of open positions on the Forex market.

How to trade on demo account?

Let’s assume that a trader chooses MetaTrader 4 terminal, opens a demo account with 10,000 virtual USD, and decides to trade EUR/USD positions of 1 lot. In this case, a trader opens positions using virtual money and if they lose it, no real financial losses will be incurred. Any trader has an opportunity to open several demo account with the same broker and trade any amount of virtual funds.

After that, it’s time to learn how to open positions. After opening the EUR/USD chart, a trader sees that the price may rise in the future (we’ll later discuss what reasons this conclusion is based upon). To open an order, we choose "New order" tab, specify the volume (by default, 1 lot), set Stop Loss and Take Profit levels, and add comment to the order if necessary.

Then we click "Buy by Market", that is sending an order to open a position at the current market price. As a rule, one doesn’t have to constantly monitor their open positions in case there are protective orders – the position will close automatically when the instrument price reaches one of the values set by a trader. If a traders doesn’t set Stop Loss and Take Profit level for one reason or another, the can close their positions manually at any moment. Long positions are opened in the same way, by clicking "Sell by Market".

Let’s calculate the [profit received by a trader by the example of EUR/USD. A trader opened an order and bought 1 lot (100,000 units of the base currency, EUR in this case) at 1.1250. Some time later, the price went up by 20 pips and reached 1.1270. With 1 pip being worth 10 USD, a trader gets the profit of 200 USD.

How transactions are performed?

The market always features a lot of both buyers and sellers, and each of them has their own perception of what is currently happening on the market. Traders and investors open and close a lot of positions every minute. To perform a transaction on the financial market, one has to send an order to a broker to open a position.

How to open a position on Forex

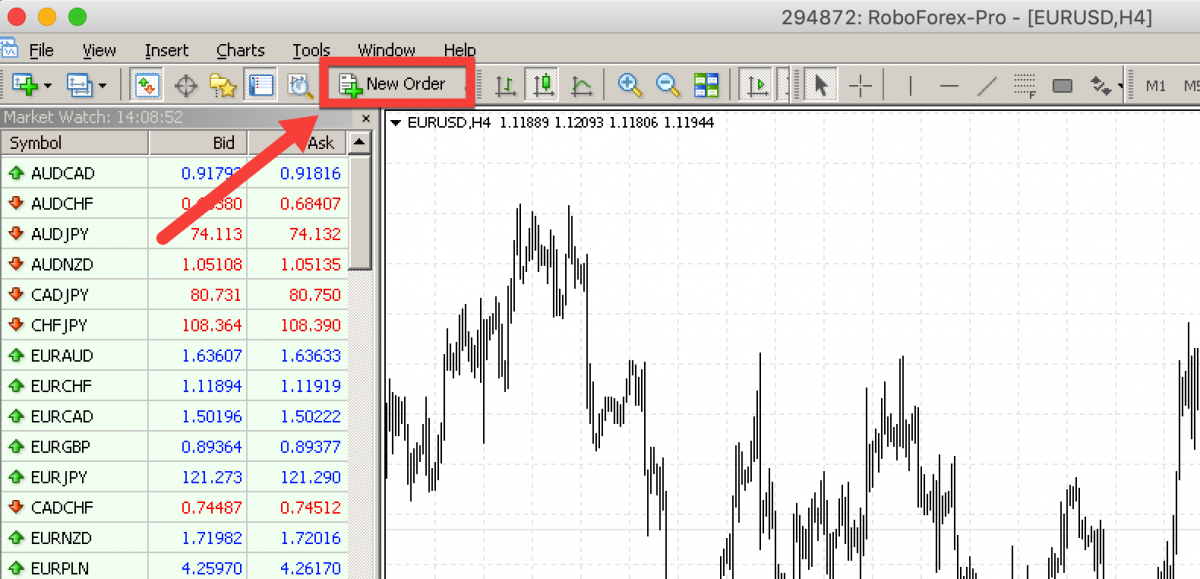

As a rule, such orders are sent through trading platforms and imply buying or selling a financial instrument (for instance, EUR/USD) at the current market price. To do this, you need to choose "New order" in your MetaTrader 4 trading terminal.

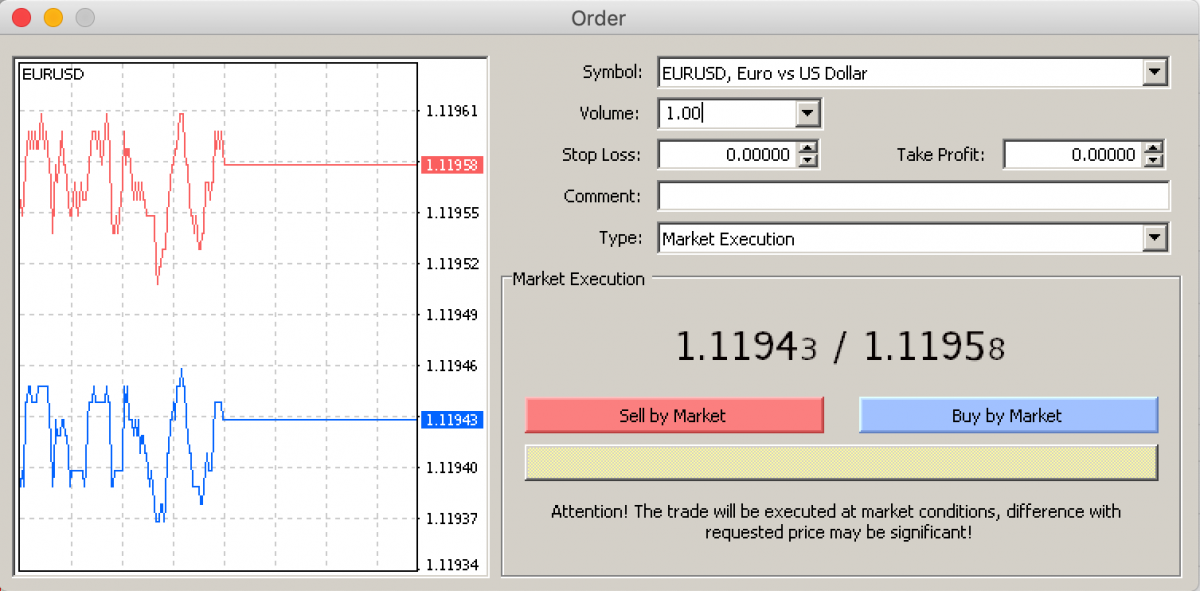

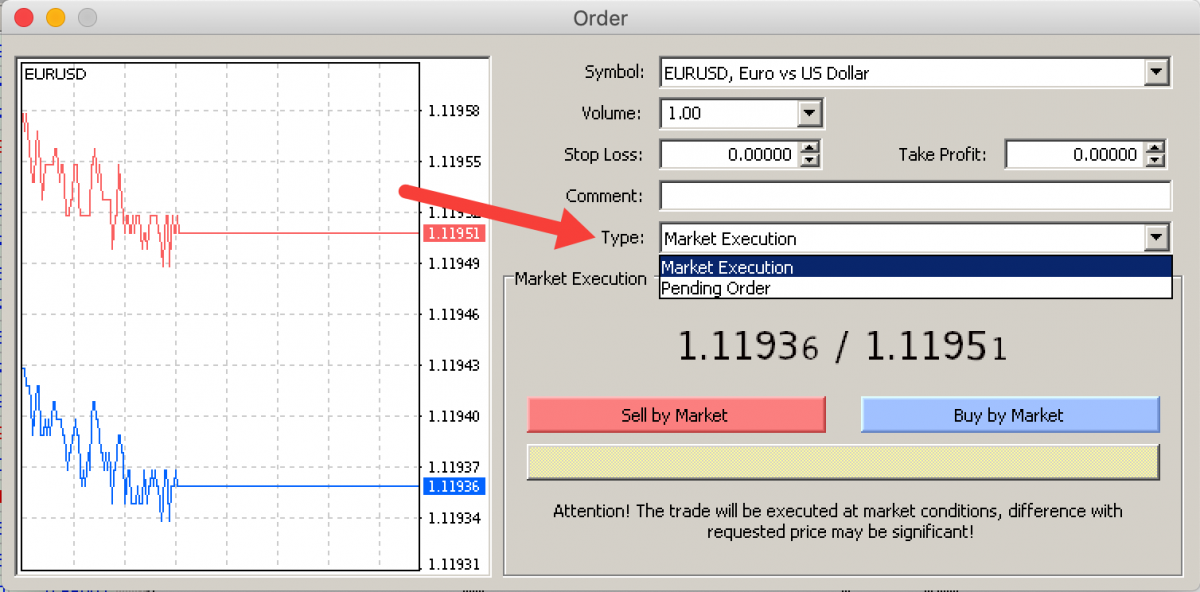

By clicking "New Order", you will open a new window with different parameters for the order you want to open. After choosing the required ticker from "Symbol" dropdown list box, you will see current Ask and Bid prices. In our case, EUR/USD can be bought at 1.12641 or sell at 1.12627. The difference between Ask and Bid price is called Spread.

In the same window, we can choose the volume of our position, which will influence the future profit, and set levels for Stop Loss (the position will be automatically closed at a loss when the price reaches this level) and Take Profit (the position will be automatically closed at a profit when the price reaches this level). In "Comment", you can describe your order, but in most cases, this field is empty. After specifying all parameters of your order, click either "Sell by Market" (if you expected the instrument to fall) or "Buy by Market" (when the instrument is predicted to rise). "By Market" execution mode will open a position at the current market price in both cases.

After your order is opened, it will be displayed on the chart. In our example, it was a sell order in EUR/USD of 1 lot with Stop Loss at 1.1295 and Take Profit at 1.1175. Stop Loss is an order sent to a broker to close the current position when the price reaches the specified value. As a rule, this type of order is used to minimize possible losses. Take Profit, in its turn, is another order sent to a broker, but to close the current position at an expected profit.

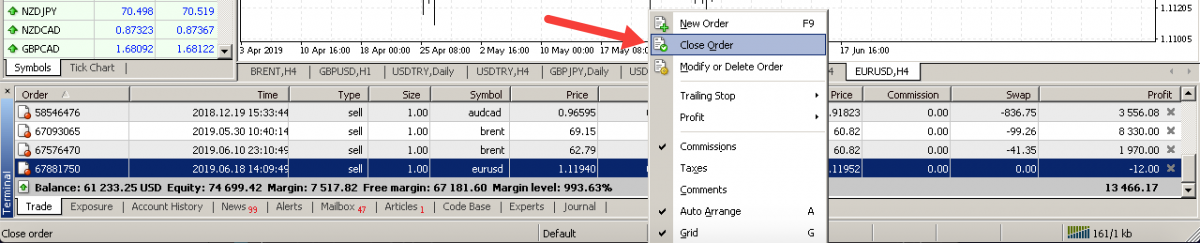

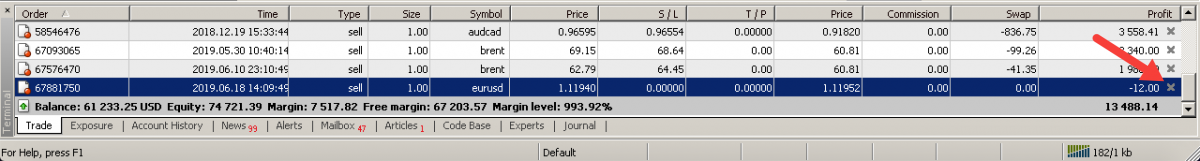

All open positions will be displayed in "Trade" tab of "Terminal" section. Here you can see numbers of orders, the time of opening, types (Sell means a short position, Buy – a long one) and volumes (numbers of lots). SL is short for "Stop Loss", TP – for "Take Profit". "Price" shows the current asset price, while "Profit" indicates a financial outcome.

When placing Stop Loss levels, remember that it should be above the current market price in case of selling and below it in case of buying.

Take Profit orders also have their nuances: if a trader sells, the level should be placed below the current price. Otherwise, the order should be above it.

To close your order, you have to right-click the required positions and choose "Close Order". After that, your position will be closed and moved to "Account history" tab. Another way to close your position is to click the cross next to the number in "Profit" tab.

How to set a pending order

However, there are situations on the market when you can’t open a new position at the current price. For such cases, terminals offer a special type of orders called "Pending order". They are orders to buy or sell an instrument above or below the current market price.

To place a pending order, you have to choose "Pending Order" from "Type" dropdown list. After that, 4 types of pending orders will be available to you.

Buy Limit is a pending order to buy below the current market price. For example, a trader wants to buy EUR/USD at 1.1100, but the current price is 1.1275. To buy the pair at 1.1100, a trader has an opportunity place a Buy Limit without waiting until EUR/SUD moves downwards. After being placed, this order will be automatically activated as soon as the Ask price reaches 1.1100.

Sell Limit is a pending order to sell above the current market price. For example, a trader wants to sell EUR/USD at 1.1400, but the current price is 1.1275. To sell the pair at 1.1400, a trader has an opportunity place a Sell Limit order without waiting until EUR/SUD moves upwards. After being placed, this order will be automatically activated as soon as the Bid price reaches 1.1400.

Buy Stop is a pending order to buy above the current market price. For example, a trader wants to buy EUR/USD at 1.1355, but the current price is 1.1275. To buy the pair at 1.1355, a trader has an opportunity place a Buy Stop order without waiting until EUR/USD moves upwards. After being placed, this order will be automatically activated as soon as the Bid price reaches 1.1355.

Sell Stop is a pending order to sell below the current market price. For example, a trader wants to sell EUR/USD at 1.1155, but the current price is 1.1275. To sell the pair at 1.1155, a trader has an opportunity place a Sell Stop order without waiting until EUR/USD moves downwards. After being placed, this order will be automatically activated as soon as the Ask price reaches 1.1155.

Basic types of forex trading strategies

Prices on the Forex market may go either up or down – as the say, "there is no third option here". However, sometimes the price starts moving in some specific range with support and resistance levels formed before.

Thus, we can distinguish 3 basic types of trading systems:

- The first system is a trend trading strategy, which shows entry points in the direction of the current trend.

- The second one is a flat trading strategy, which shows borders of the range the price is moving in.

- And if the trend has the beginning, it will surely have the ending as well, that’s why there is the third system, which is called counter trend trading strategy, which shows the end of the current trend and the beginning of a new one.

So, trend systems can be of two types:

- The systems that use chart analysis.

- The systems that make decisions on basis indicators.

Trend lines trading

First off, let’s talk about trading systems that are based on chart analysis, specifically – formation of trend lines. However, in order to trade using trend systems, one should understand what a trend is.

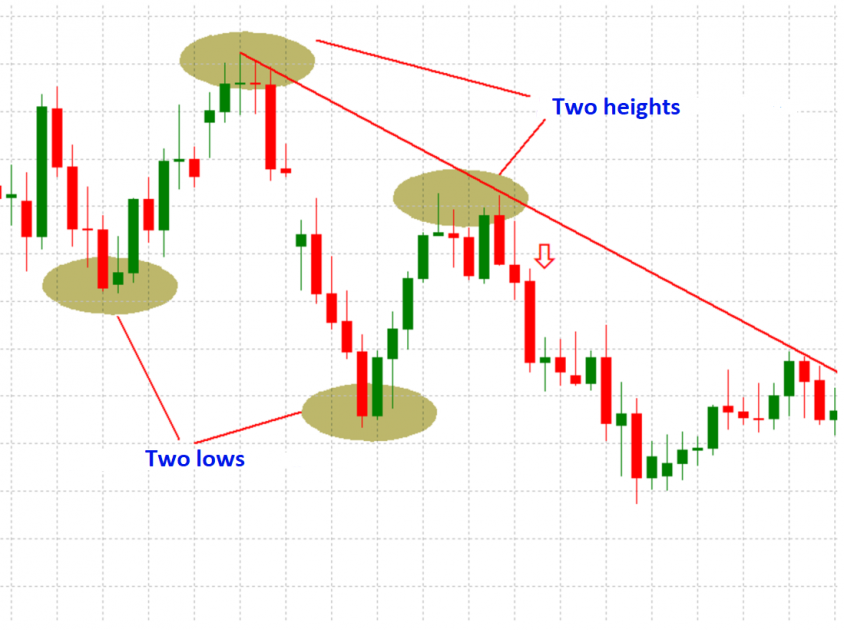

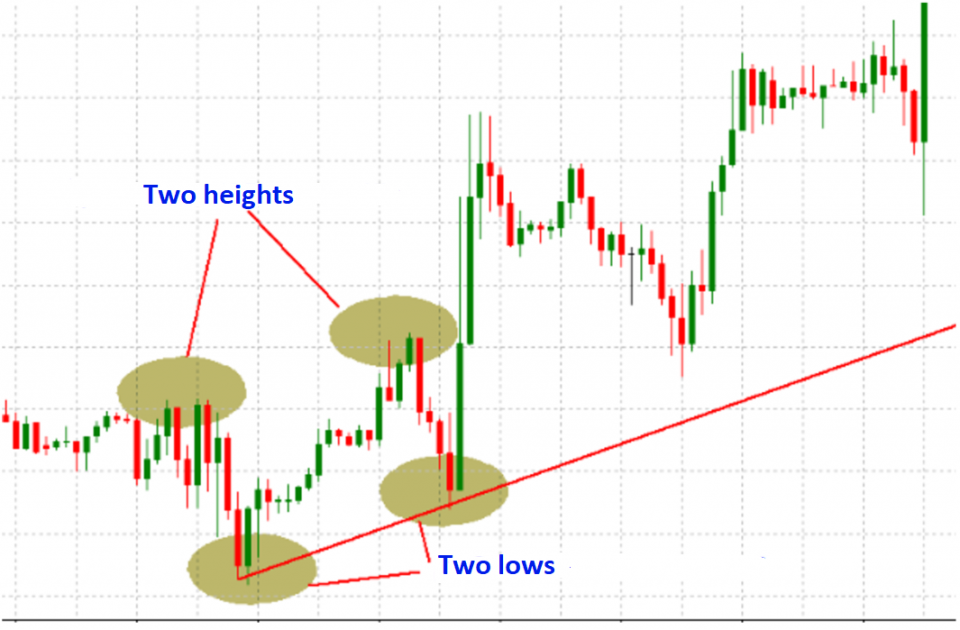

The Forex market defines a trend as a stable price movement is some particular direction. Trends can be ascending (uptrend) and descending (downtrend).

- A trend is considered ascending when every next high is higher than the previous one and every next low is also higher than the previous one.

- A trend is considered descending when every next low is lower than the previous one and every next high is also lower than the previous one.

As a result, to identify the current trend, one requires 4 key points, 2 of which are the minimum price values on the current timeframe, while other 2 are the maximum price values on the same timeframe.

The chart shows it in the following way.

These 4 points help us to form the trend line and decide on its direction. To find an entry point, we must form the trend line based on lows in case of the uptrend and on highs in case of the downtrend.

The third contact of the price and the trend line may be considered the simplest and most efficient entry point in the direction of the trend. Consequently, it’s quite easy to find an entry point. The most serious problem on the market is to find an exit point, i.e the price to take the profit. In this trading system, an exit point to close a position is the channel’s line parallel to the trend line on highest and lowest price values (depending on the current trend).

We’ve just discussed a trend trading system based on chart analysis. Now, let’s turn to an indicator trading strategy.

Indicator trading strategy

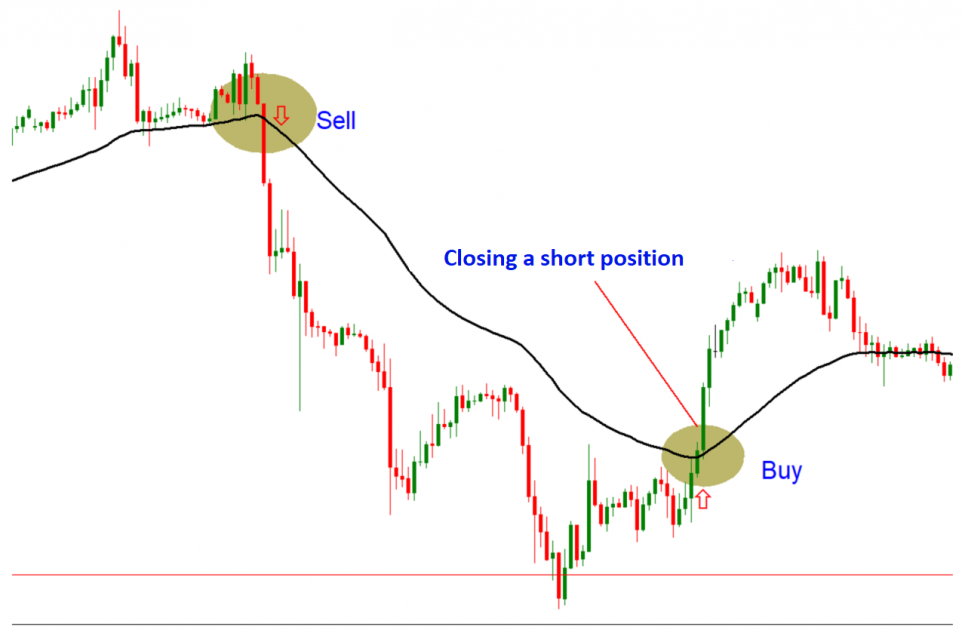

The most popular trend indicator is Moving Average. This function is the basis for almost 60% of all indicators used on the market. This particular trading system is very simple. First of all, you should lay one Moving Average on the chart. When choosing its period, remember that the shorter the period, the more false signals the indicator may give. However, in case of longer periods, the indicator will be significantly lagging in defining entry points, which may result in higher risks and loss of some part of your profit. The period of Moving Average should be defined individually for every currency pair by analyzing available historic data.

To define an entry point using Moving Average, you should wait until the price breaks this indicator’s level. Breaking it to the upside will indicate a long position, otherwise it will signal a short one. A signal to close a position will be a reverse breakout of Moving Averages.

We’ve discussed simple, but quite efficient trend systems. Now, let’s talk about flat trading systems.

Flat trading systems

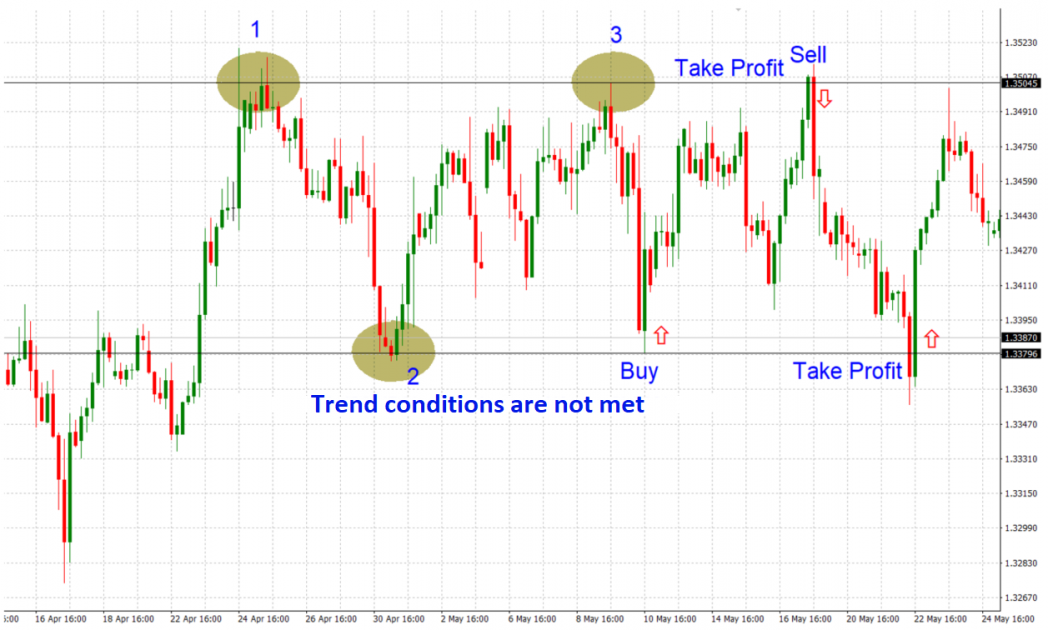

To identify a flat on the market, we should define key levels, between which a currency pair is moving. In other words, find the resistance and the support. As a rule, there should be at least three key points, which may help to understand that the price is currently trading sideways. And, of course, it’s important to see that there are no signs of an uptrend or a downtrend on the market at that moment.

After finding the resistance and the support, all we have to do is to wait until the price reaches them and rebounds. At the same time, a signal to close a long position will be the price’s reaching the resistance, while a Take Profit order for a short position should be placed at the support.

When working with a flat, you should understand that the price can’t move in this range all the time, that’s why the most secure deals are the ones with the first rebounds from the channel’s borders after it was defined as a flat. With each next rebound, risks of loss significantly increases.

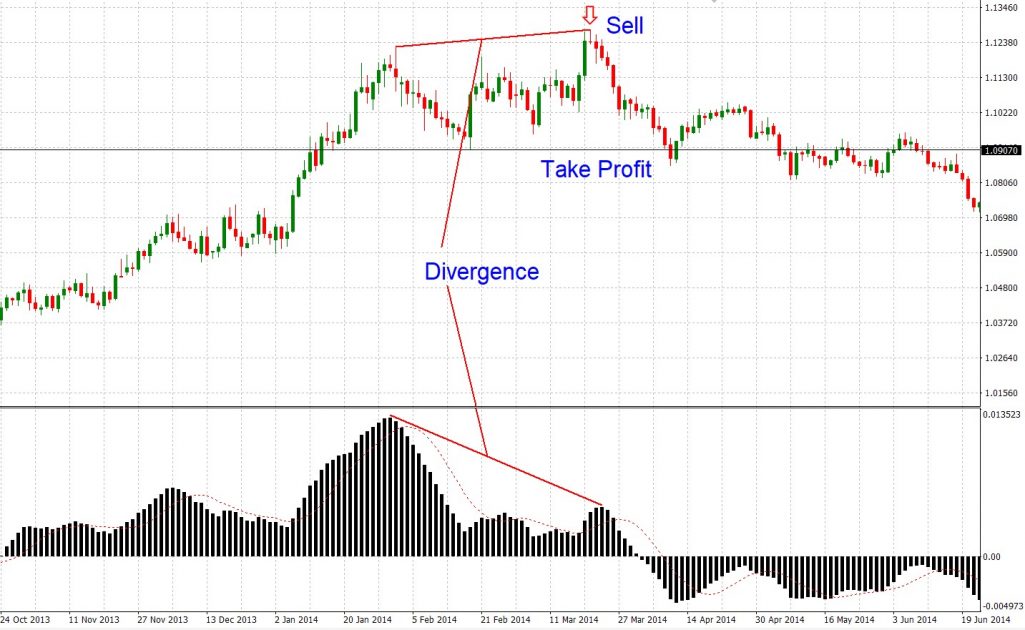

Countertrend trading system

And now let’s talk about the most risky strategy, which shows entry points against the current trend. The strategy uses MACD (Moving Average Convergence/Divergence) indicator, which is a version of Moving Averages, and all it does is measuring the distance between two of them with 12- and 26-day periods. This distance indicates the strength of the current trend and when the distance is getting smaller, it is considered as the first signal that the trend is weakening and may reverse. It is not very convenient to perceive this visually on Moving Average indicator, that’s’ why MACD indicators is considered more useful for such purposes.

So, a signal to open a position against the current trend is a movement of MACD lines in the direction that is opposite to the price. In other words, if the highs are getting lower on MACD, but are getting higher on a usual price chart, it’s a sign of a divergence and a signal to sell.

If the lows are getting higher on MACD, but are getting lower on a usual price chart, it’s a sign of a convergence and a signal to buy.

In this system, closest supports and resistances may be used as exit points.

Tips for beginners

Trading is a job, which requires years of getting knowledge and working hard. As a rule, engineering sciences take from 3 to 5 years at universities, medical profession – 5-6 years plus at least 3 years of medical residency. In process of training, future specialists get knowledge, master their skills, and gain experience. The same happens in trading – to receive efficient trading skills, you must read a great amount of books written by different acknowledged authorities of the financial world and spend a lot of time on learning fundamental and technical aspects of event that are happening in the industry.

At the same time, there are a lot of strategies, which may be used "manually". In addition to that, you have an opportunity to gain experience by trading on demo accounts or by implementing trading robots to make profit.

But why are there so much different strategies, if we need the only strategy, but a profitable one? Explanations are very simple, "so many men, so many minds" or "one man's meat is another man's poison."

Conclusions

- Advice No. 1. Learn all strategies you see in the Internet. Choose the one that satisfies you requirements mostly and "shares" your vision of the market.

- Advice No. 2. Focus on one system and learn it back and forth. Adapt to the "rhythm" of this strategy and adjust some aspects of it to you. Every trading system has its specific features, a detailed study of which will help you to benefit from its advantages and minimize disadvantages.

- Advice No. 3.Create your rules how to apply the strategy exactly as you understood it and in the way it should produce profit. Do not keep everything in mind. Make a clear plan how to apply the system and stick to it in any given situation.

- Advice No. 4.Learn from your mistakes. Carefully analyze everything that is happening on the market, the things that went wrong, and correct your mistakes quickly.

- Advice No. 5.In all cases, place Stop orders. And after one of them is activated, make sure to make a pause in trading for a couple of days. Some mistakes occur due to common fatigue. Just have some rest.

- Advice No. 6.Trade tendencies. Pay particular attention to H4 charts, because they are usually the most profitable.

- Advice No. 7.Be sure to monitor the correlation of major currency pairs.

- Advice No. 8.Think of trading as a job and withdraw some part of your profit every month. Consider this money as your salary.