False Signals in Forex: How to Detect and Avoid Them?

6 minutes for reading

Having opened a position, many traders ponder at the question: “Why did it close with a loss if I seemed to do everything right? Almost all signals by the strategy were there but in the end, the price went in the opposite direction”. The keyword in the question is “almost”. Sometimes the market makes movements that you cannot forecast or calculate, in which case indicators turn out virtually useless. What was the point? What went wrong? The answer is simple: the trading strategy gave a false signal, and the trade turned out losing.

Let us try to make it clear why such things happen and why false signals appear.

Why do false signals emerge?

The news

News is, perhaps, the most frequent reason for false signals. As you know, the market accounts for everything, and before some news is officially published, the quotations react and start moving in a certain direction. Normally, if some preliminary results turn out better than expected (such as the GDP reports), the quotations will grow. However, practice shows that the quotations start growing before the publication of the news itself, and at the renewal of the data, the market makes an abrupt reversal and starts a steep decline.

At this moment, Stop Losses trigger at the positions opened beforehand, and impatient market participants worsen the situation, craving for a swift and large profit. Several minutes after the publication of the news, the market calms down, and the price starts going in the correct direction.

Errors in the calculations of indicators

Another reason for the appearance of false signals is errors in the indicator calculations. Many traders tend to forget that after abrupt market movements the data they receive is heavily distorted, and their indicators make mistakes. Impatient traders decide that this is an entry signal and get a losing position.

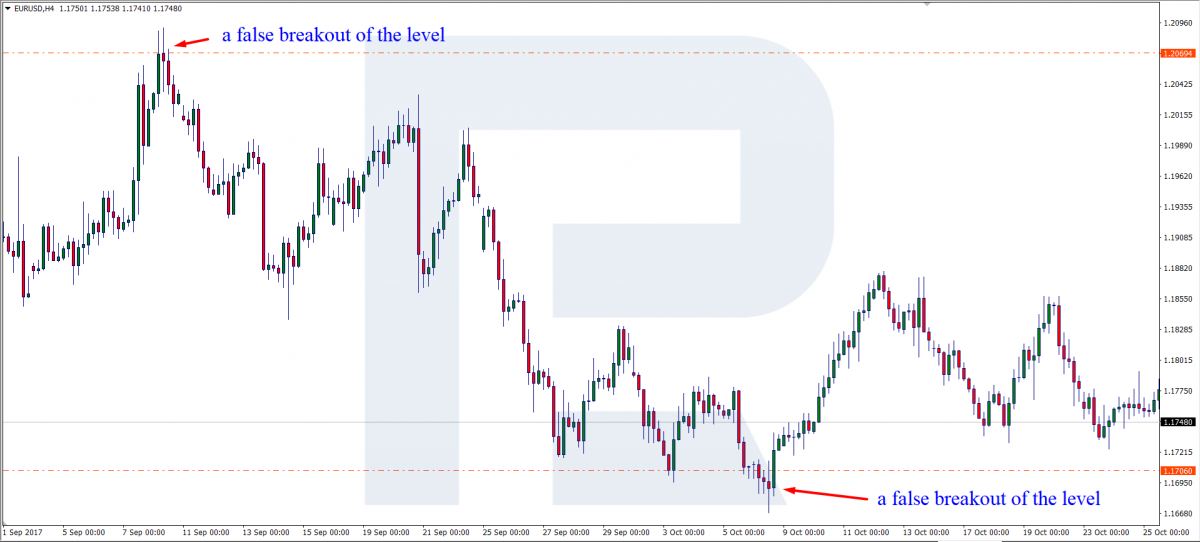

False breakaways of levels

In tech analysis, the most widespread false signals are false breakaways of levels. There are two options of trading support and resistance levels: to trade bounces off them or their breakaways. Here is where market players get mistaken.

Let us imagine trading bounces off the resistance level. The price reached the level, and the trade decided to open a selling trade. They placed the SL behind the level (in a safe zone) but the price broke the level away and close the trade by the SL.

What do impatient traders do in such cases? Normally, they open an opposite (buying) trade and get their position closed by the SL again. The conclusion is simple: impatience and hurry will never do you good in trading.

If you use candlestick analysis, things are almost the same. The trader hurries to open a position beforehand and ends up with a losing trade. To avoid losing positions or at least minimize their number, study the principle of the formation of Japanese candlesticks and opening signals in more detail.

How to avoid false signals?

As I have said above, you will hardly exterminate false signals altogether. But minimizing their number is available to almost any trader, just follow several rules:

When trading the news, check the history

Using fundamental analysis for trading, study the influence of some news on the market historically. Quite often, the market reacts to the same news in the same way, so you can forecast the reaction and make the right decision.

Do not hurry to open an opposite order

If your first position closed by the SL, do not rush at opening an opposite one. In most cases, the market will carry on in the direction of your initial position. Note that you usually open an opposite order not by the strategy but emotionally.

Use backtesting and demo accounts for checking your entry points

When using strategies with indicators, make sure to check your entry points by backtesting and using a demo account. After this, you will have a clear understanding of what signals your indicators give and which of the signals are primary and which are secondary.

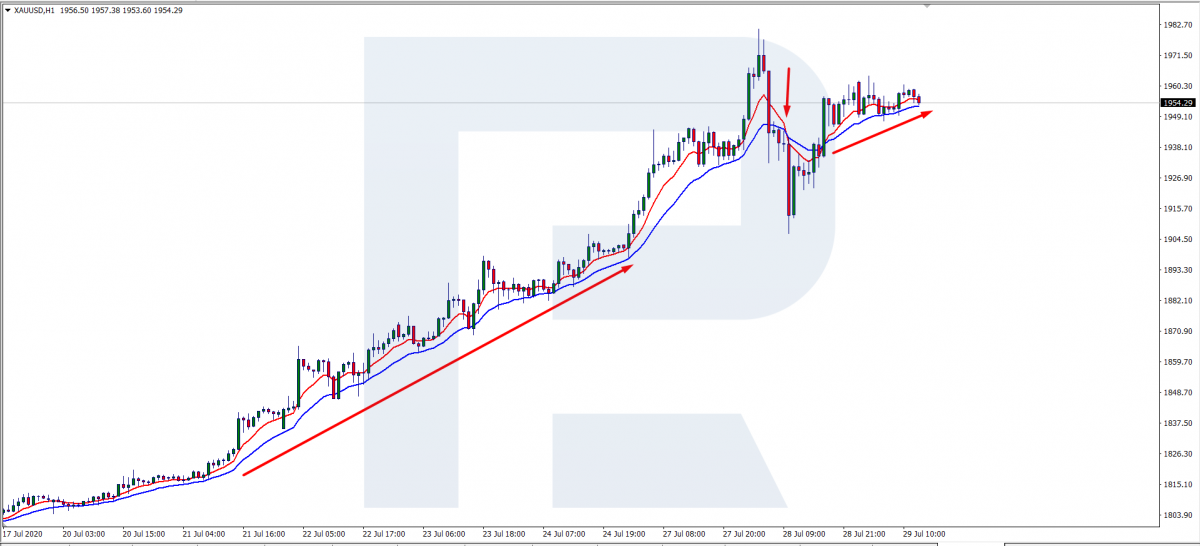

The Moving Average is really treacherous from this point of view. The thing is that the signal they give is their crossing but it remains unclear where and when the crossing is complete. Quite often, two MAs just touch and diverge; the trader enters a position, considering it a crossing, and loses money.

In such a case, an additional filter will be optimal: try Fractals or closing of the previous candlestick.

Choose your graphic analysis patterns for opening positions

When trading by graphic (chart) analysis, study the figures in advance and decide which ones you will use for opening positions. Practice shows that not all signals are equally good for everyone.

To avoid false entries at patterns, always be sure about the entry point. Quite often, after a breakaway of the neck of the Head and Shoulders pattern the price returns to the broken level and only then starts working off the signal for real.

Choose several clear patterns for Japanese candlesticks analysis

If you trade Japanese candlesticks, it is even more crucial to master the principles of pattern formation and backtest the signals. The best decision is to pick up several clear candlestick combinations and deselect the signals that are unclear to the trader in some dimension.

Each candlestick pattern has its peculiarities. For example, the Pin Bar pattern is based on perplexing market participants by an abrupt movement (say, growth) and an equally unexpected reversal. On the contrary, the Doji pattern is characterized by modest movements, as if the market were speculating about where to go next before reversing.

Bottom line

When trading by any system you must stick to your algorithm all the time. Do not correct the strategy on-the-go and never try to adjust it for the current situation. It works vice versa: the situation must suit your algorithm.

The key point here is: never rush. Of course, speed is the priority for scalping strategy but you must realize that these strategies would be a heavy duty for market beginners. A thought-out decision is a key to success.