FedEx: Still Heading for the Bottom

7 minutes for reading

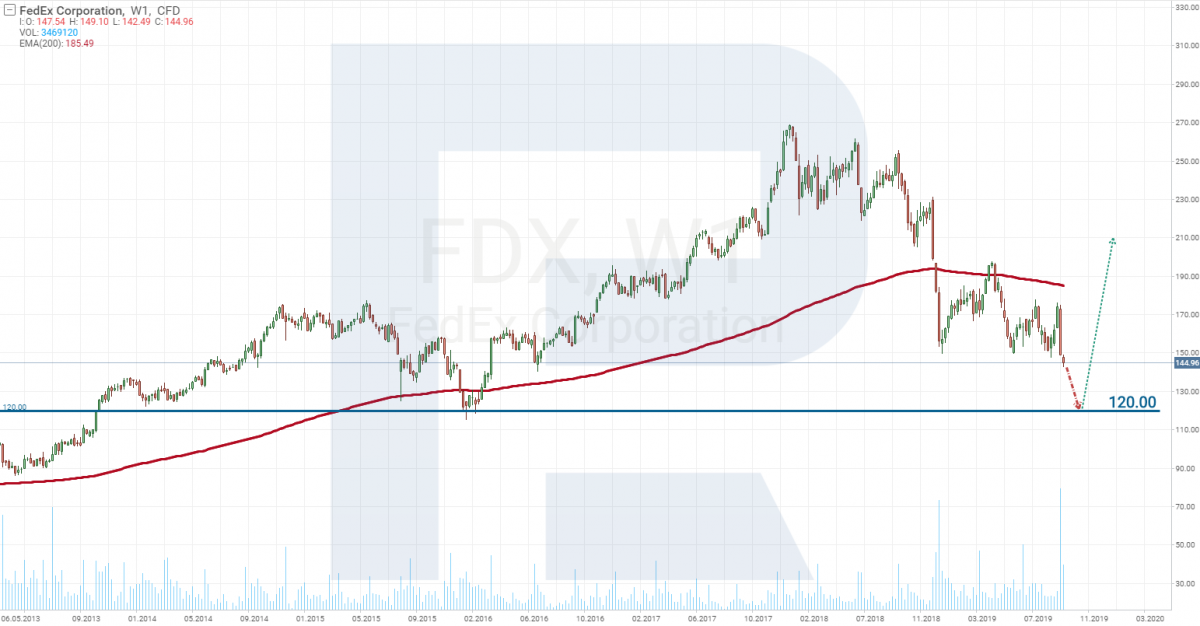

Last year I drew my attention to FedEx (NYSE: FDX). At that time, its stocks just started the decline that goes on till now. As a result, during the last 11 months, the stock price has dropped by almost 30%. The reason for the beginning of the decline became the actions of Amazon (NASDAQ: AMZN).

Amazon delivery service

In summer 2018, Amazon decided to launch a goods delivery service called Delivery Service Partners (DSP). In other words, the company has come to the delivery market. Investors reacted by selling the stocks of such mail services like FedEx or United Parcel Service Inc. (NYSE: UPS). And right they were to do so.

Amazon turned out to be serious about the development of their new service. Currently, it has 426 offices across the US, delivering goods all over the country. The offices are situated in such a way near cities and towns that the time of delivery is minimized. It has become a dangerous rival of FedEx or UPS.

FedEx did not extend the contract with Amazon

The FedEx management assured the investors that the profit generated by the cooperation with Amazon was no more than 2%. In summer 2019, the contract with Amazon expired, and they did not renew it, pretending this client to be rather unimportant.

UPS modernization for 20 billion USD

While the FedEx management was trying to convince everybody in the reliability of the company, UPS invested 20 billion USD in the modernization of the company that dealt with not only the equipment but also the staff. If a manager failed to cope with the speed of modernization, they were replaced by some other. UPS also broadened its cooperation with Amazon in the sphere of delivering goods to individual clients. It is a less profitable sphere than providing services to businesses but they are ready to work in this sphere as well in contrast to FedEx.

The result of the UPS modernization

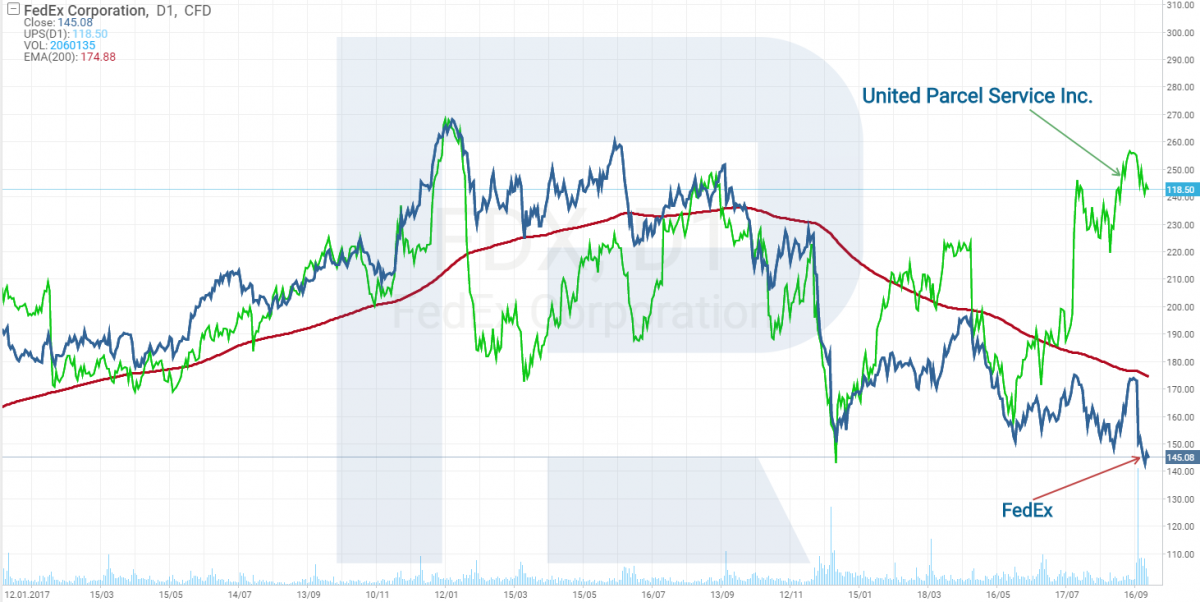

It all becomes clear if you have a look at the charts of FedEx and UPS. The modernization and cooperation with the giant of electronic commerce Amazon yield substantial income to UPS, though initially many doubted it.

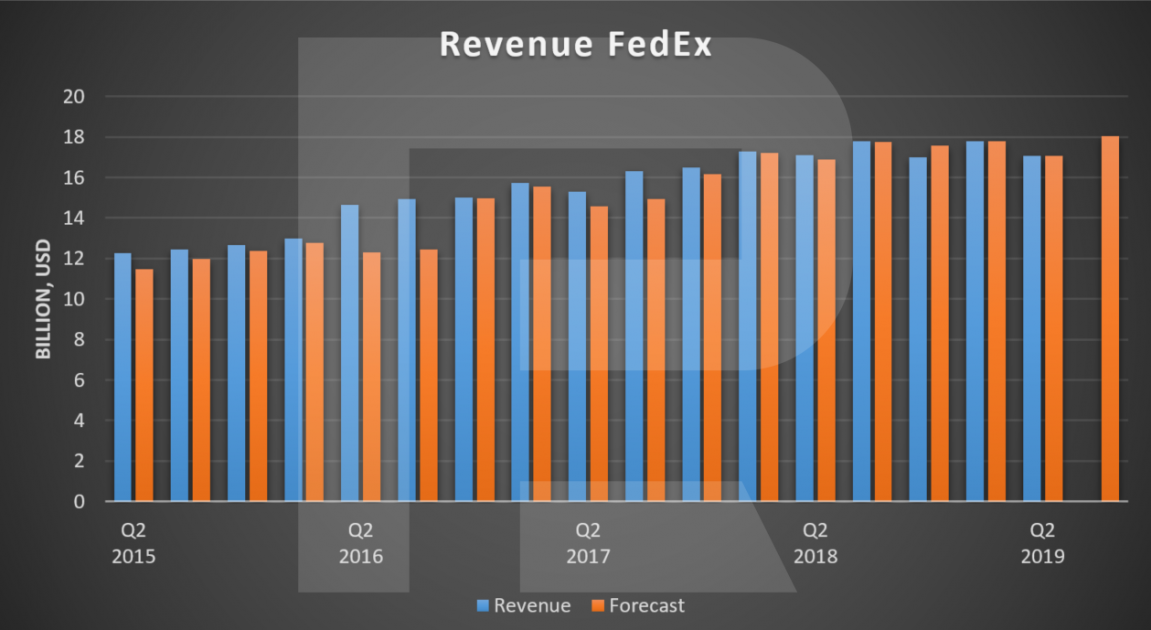

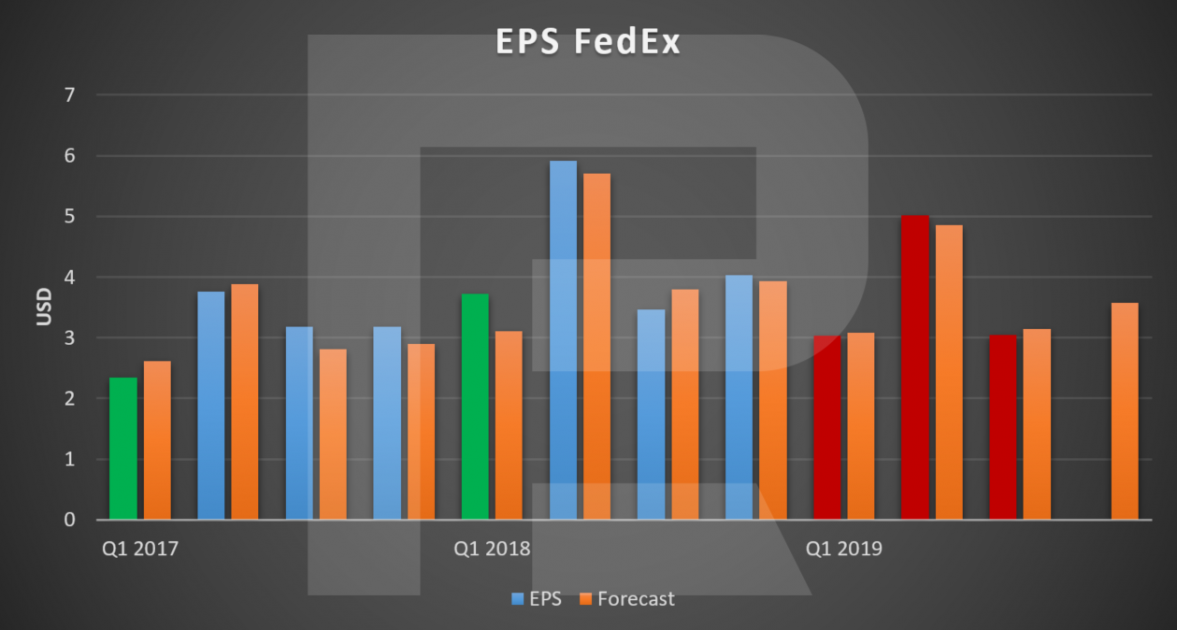

After Amazon decided to develop its own delivery service, the stocks of both mail companies dropped, but later UPS managed to find a way out of the situation while FedEx only worsened its position on the market. The investors' worries were confirmed by a decline of the return on the stock, what is more, the forecasts failed to come true the first time in 4 years.

And if the growth of income just slows down a bit, the Earnings Per Share literally started to fall.

This means that the company's expenses keep growing, and the loss of such a client as Amazon is going to influence the results of the third quarter of 2019, which, in turn, will entail a decline in the annual revenue. Of course, all this is expected and will be included in the price; anyway, by the end of the year, the dynamics of FedEx will not look too appealing.

As they say, everything known to the public has long been included in the stock price; we have to find out what other risks the company has and whether its stocks are currently trading at the very bottom. If so, we could buy them profitably.

FedEx risks

As we have figured out, at the end of the second quarter FedEx failed to meet the profitability expectations, and the return on share shrunk. FedEx explained this by the ongoing trade war between the USA and China. However, the war has been on for several years, and it has become an easy-to-find explanation of any failure; in reality, the problem must be somewhere else. One problem might be the general slow-down of economic development. It is confirmed by the recent decrease in the interest rate performed by the Federal Reserve System of the USA. Many countries have it near zero. Until 2019, the Fed had been increasing the rate gradually, which meant the economy was growing, while the rate was constraining it. The decrease of the rate signals a slow-down of the economy, and the Fed is trying to support it. However, the monetary authorities are planning to further decrease it, which is a clear sign of a slow-down of the world's largest economy.

FedEx is delivering goods; a decline in production will entail a decline in goods turnover, which, in turn, will mean fewer parcels sent. UPS has strengthened its positions in the sphere of delivering goods to individuals, while FedEx is relying on businesses, which is more profitable. In such a situation, FedEx looks more vulnerable.

Purchasing TNT Express

Another problem for FedEx turned out to be purchasing a Netherlands company TNT Express. The idea was that the merging should make FedEx a stronger rival for UPS on the European market. In fact, TNT Express turned out to be inferior to its European rivals, and its modernization became FedEx's responsibility. The purchase happened in 2015, and FedEx keeps spending money on modernizing this company, which deteriorates its financial results.

All in all, I would not recommend buying the company’s stocks in the nearest future: it seems to have not reached the bottom yet, and its problems are all on the surface.

FedEx may increase its income

However, strong sides of the company are also worth paying attention to: obviously, it has a few of them as it is one of the largest delivery companies in the world generating 17 billion USD income a quarter. Clearly, such a company has its ways to increase its profit, and it is going to use them to get out of the situation. In particular, an increase in the number of parcels shipped from FedEx Express and FedEx Ground has been noticed. FedEx Freight has increased cargo traffic. In the end, the company may insignificantly raise the price for these services, thus increasing the income as well. This is a dangerous measure as the rivals may attract clients by lower prices, but together with the planned decrease in expenses, this may help. Here, the time of delivery will be an important criterion of competitiveness: the company that moves faster will have the right to raise the price. However, fully counting on this is dangerous as there are no guarantees who will win.

Comparison with the rival

FedEx stocks turn out to be too risky to buy now (unless you are planning to get revenue from the dividends); but if you cannot buy, you can sell. However, selling, as we know, is considered a riskier way of trading; what is more, if you sell you will receive no dividends. So, it will be wiser to pay attention to FedEx’s rival UPS.

| Indicator/Company | FedEx | UPS |

|---|---|---|

| Stock price (USD) | 145 | 119 |

| Capitalization (billion USD) | 37.87 | 101.71 |

| Stocks in circulation (million papers) | 260.910 | 858.704 |

| Net profit (billion USD) | 0.745 | 1.685 |

| Operational income (billion USD) | 0.977 | 2.143 |

| Income (billion USD) | 17.05 | 18.04 |

| All commitments (billion USD) | 50.28 | 48.36 |

| All assets (billion USD) | 68.45 | 52.787 |

| P/E | 100.32 | 21.74 |

| Short Float (%) | 1.77 | 1.98 |

UPS looks stronger in comparison with FedEx. Judging by the P/E, UPS looks underpriced; what is more, the company has enhanced its income forecasts for the third quarter from 17.49 to 18.38 billion USD, while FedEx is decreasing the forecast values. The cooperation with Amazon will only enhance the position of UPS on the market: the UPS management was wise enough to make Amazon their partner instead of making it their rival, while the expiry of the contract with FedEx made the company Amazon’s rival.

UPS technical analysis

Tech analysis shows that UPS stocks are trading near their historical maximums. The 200-days Moving Average demonstrates an uptrend. A breakaway of 124 USD may open the way for the growth to 130-140 USD.

FedEx stocks are trading in a downtrend, and it is highly probable that soon we will see them testing 120 USD. It might happen somewhere around the end of the year when the company reports its financial results for the third quarter of 2019. After that, we should pay attention to the announcement of the management about the measures they will have taken to cut down on the expenses and raise the income. It will also be curious to know how the company will replace the lost income from the partnership with Amazon. If we see some progress there, the price of 120 USD will be quite attractive for a long-term investment. Perhaps this will be the very bottom that the stocks started searching a year ago.