Practical Application of Elliott Wave Theory in Trading

7 minutes for reading

Just in case if you missed the previous two parts of "Elliott Wave" articles, you can find it below.

If you start trading on a financial market and have chosen Elliott Wave Theory as your auxiliary method of analysis, you must understand that this is not a strategy but a way to assess possible movements of market trends. In other words, the Theory is a collection of observations rather than a set of rules or 100%-valid forecasts of further price movements.

Elliott Wave analysis is among the most complicated methods of forecasting market movements on financial markets. To master it, you may need several years. However, for successful trading, just the basics of this analytical method may be enough. You will need to detect the most widespread patterns and understand at what conditions you may open trades.

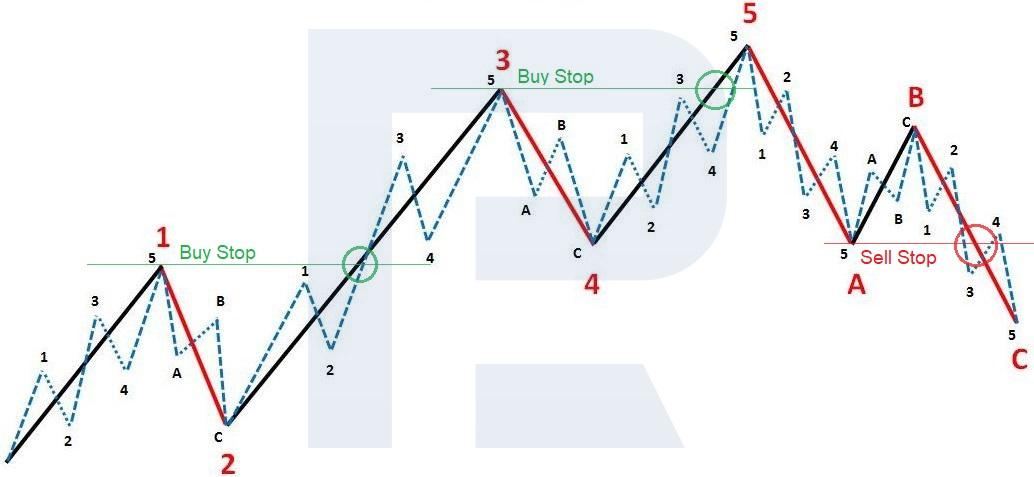

In other words, if we know that in the bullish phase the first, third, and fifth waves are ascending, this must be interpreted as a signal to buy. In the second and fourth waves, you should sell. Hence, the task of a trader-analyst will be to detect the end of the preceding bearish phase and the beginning of the actual bullish phase.

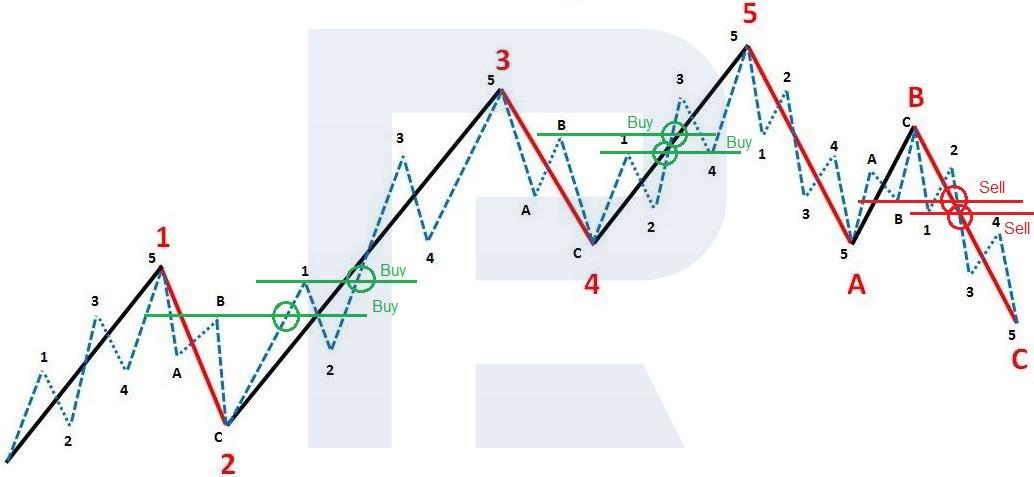

A primitive example here will be the following:

To buy, you only need to place pending Buy Stop orders above the peaks of the first and third waves. And to sell, you need a Sell Stop under the end of wave A.

Many will notice that in this illustration, the potentially profitable movement after entering the trade is not enough or even too weak. So, the next recommendation will be to deepen the analysis of the market wave structure, i.e. to switch to a lower level to track and find more advantageous entry points.

Switching to a lower level means searching for the peaks between the end of wave B and the beginning of wave C in the second and the fourth correctional waves to place Buy Stop orders above them. Also, this switching requires searching for the fractal peak of subwave 1 of waves 3 and 5 of a higher level. The same tactics may be used for finding entry points for sales on wave C after a breakout of the low of subwave B inside wave B and a breakout of the end of wave 1 in the impulse wave C.

Conservative way of trading patterns

A conservative approach to trading presumes that the trader executes only motive impulses in the direction of the main movement. To find optimal entry points to the market, we must wait for one of the correctional formations to appear on the chart.

ZigZag pattern

ZigZag is the most widespread correctional pattern, seen on charts more often than others. Its structure is rather simple – just three waves A, B, and C. ZigZag can be distinguished from other patterns not by the shape but also by the structure of its consistent parts. Waves A and C are 5-wave impulses. As a rule, the linking wave B is a smaller ZigZag, sometimes formed as a Flat or a Triangle. After a ZigZag is formed, we must wait for an impulse in the direction of the trend to form.

Triangle pattern

A Triangle can be identified by linking the highs and lows of the pattern by two lines. All waves constituting a Triangle are ZigZags (each has a 3-wave structure). Below, you can see a part of a chart with a Triangle and an entry point marked.

The main peculiarity of this pattern is the fact that it only forms in waves 4 or B of a ZigZag. You may only trade after all the three parts of the pattern are formed – waves A, B, C, D, and E. After the price bounces off the lower border of the Triangle, you may buy (in an uptrend), and after it bounces off its upper border – you may sell (if the pattern is formed in wave 4 of a descending impulse).

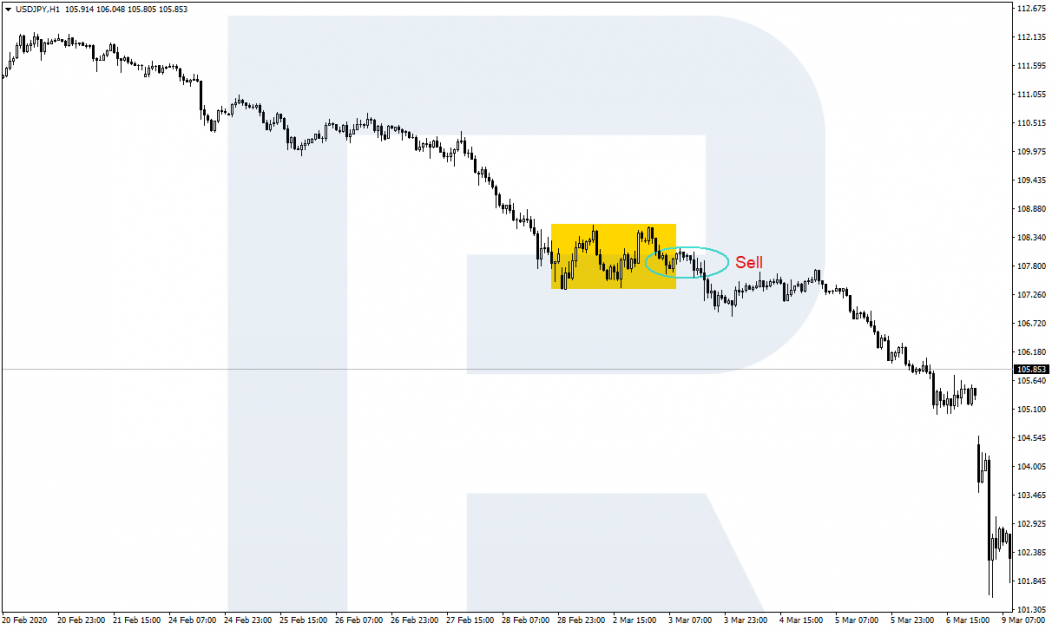

Flat (Range)

The pattern has a 3-wave structure. In it, wave B always exceeds the range of the previous impulse. This is why many traders are wary of Flats, as wave B is often mixed up with a smaller wave of the impulse. Trades must be opened only along with the trend and only after the completion of wave C inside the Flat or a test of its lower border.

Trading Elliott Waves counter the trend

Wave traders have the following gold rule: you may only trend a global or local trend. However, there are situations when you may trend counter the trend without increased risks.

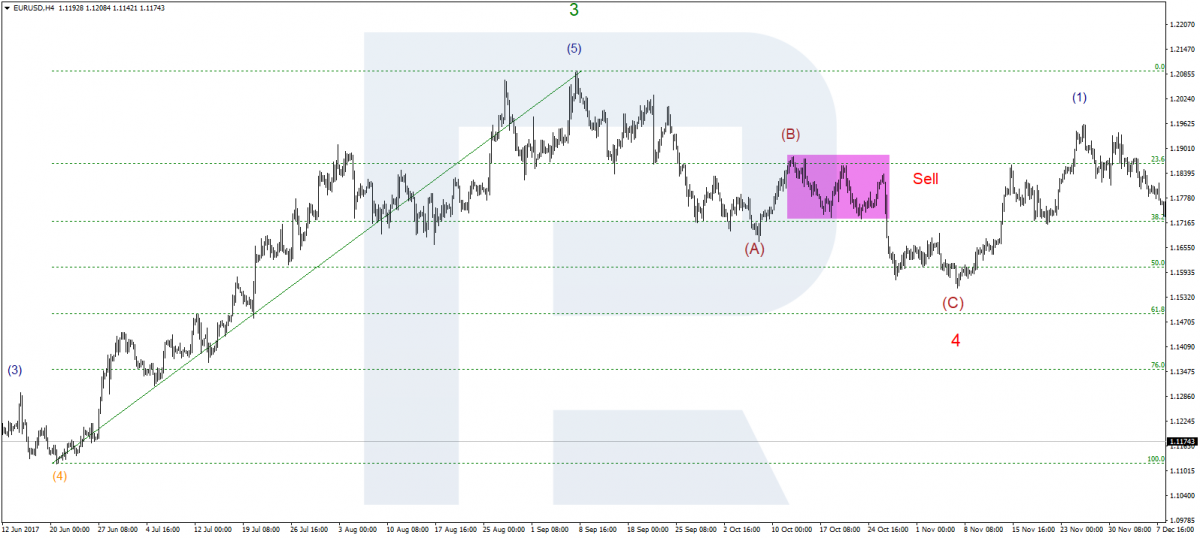

Trading wave C

The ZigZag pattern has an important peculiarity: in this pattern, wave C normally has a similar amplitude to wave (A) and usually ends at 50.0% or 61.8% Fibo of the amplitude of the previous impulse. These details may be used for the trading counter the trend.

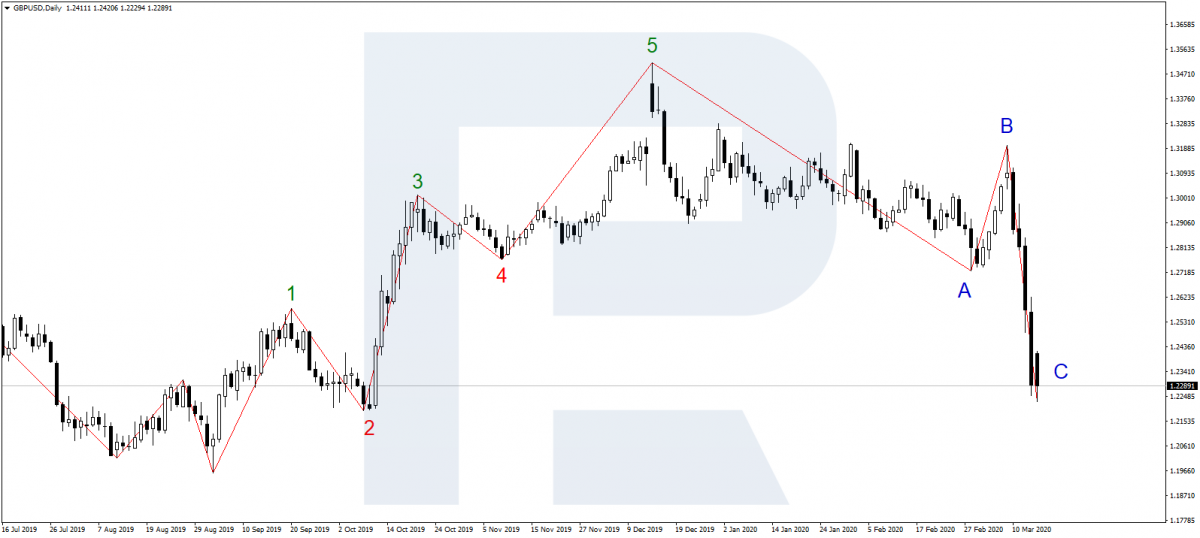

Trading at the end of a Wedge

A Wedge is a pattern that appears solely in wave 5 and signals the end of an impulse. It is a wave pattern consisting of ZigZags only – this is the difference between a Wedge and a classical impulse. Also, wave 4 of the Wedge always enters the range of wave 1, which never happens in simple 5-wave structures.

After all waves of the Wedge form, a counter-trend trade is opened in hope for a correction of amplitude comparable to that of the preceding 5-wave impulse.

Indicators helping to trade Elliott Waves

One of the first indicators that can help a beginner trader is ZigZag. With it, finding your way among the extremes will be easier. However, the more experienced the trader gets, the less useful it may seem because the results of the indicator are strongly influenced by its entry parameters, which might make the analysis inexact.

Another important and popular indicator for wave trading is the Awesome Oscillator by Bill Willams. This is a variation of the MACD, so all other variations of the letter may be applied to wave trading. Its main characteristic and rule of work are looking for divergences and convergences between waves three and five.

Fibonacci levels as the signals of the end of waves

Fibonacci levels play an important role in trading Elliott waves.

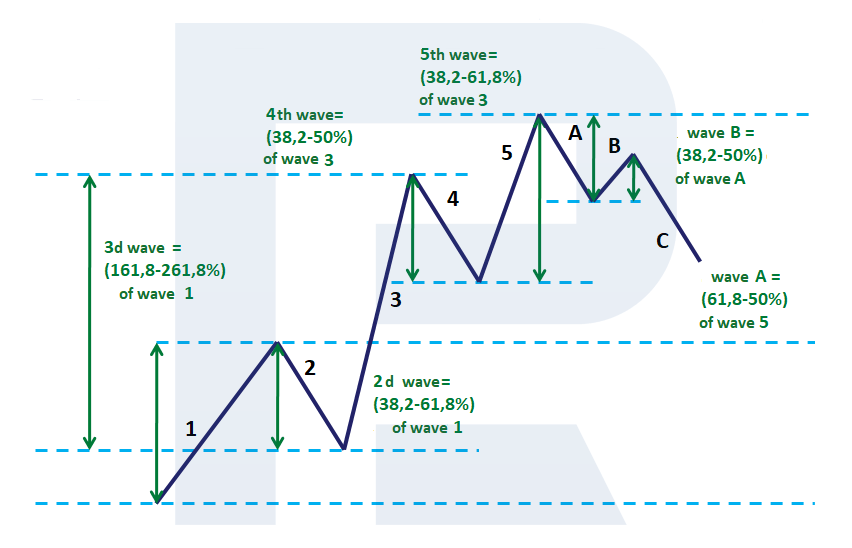

Using well-known Fibo levels of 38.2%, 50.0%, 61.8%, and 161.8%, traders may project the length of the wave, its depth and extension.

Elliott Wave Theory - Waves 1 and 2

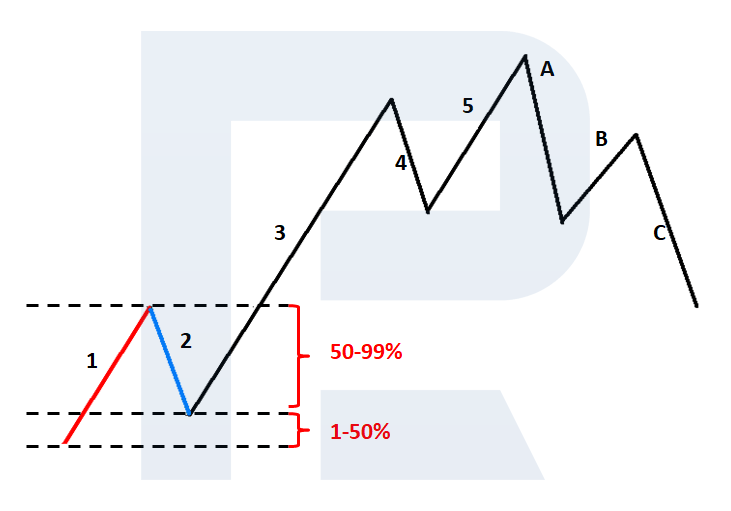

The first impulse wave is used not for trading but for analyzing wave 2. Wave 2 never overlaps with the beginning of wave 1. Wave 2 normally corrects wave 1 for 50.0-61.8% Fibo. Very rarely, such a correction may reach 98-99%.

Elliott Wave Theory - Wave 3

Wave 3 is never the shortest out of the impulse waves 1, 3, and 5. Normally, it is the longest wave, it is prone to reach 161.8% of wave 1. If it exceeds 161%, its next goal will be 261.8% and, rarely, 423.6% of wave 1.

Elliott Wave Theory - Wave 4

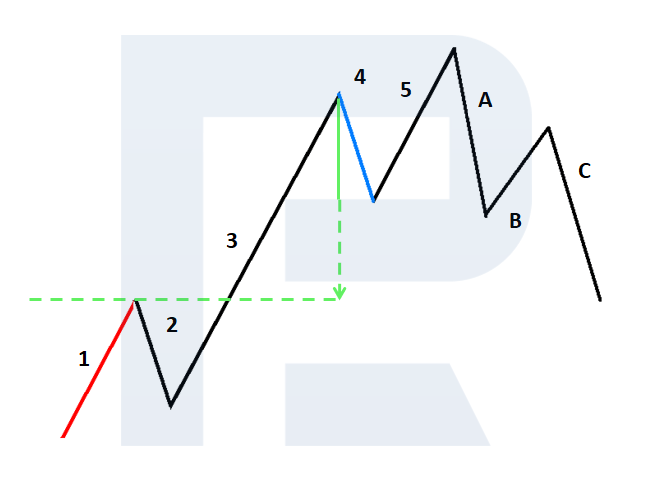

In wave 4, many traders lock in profit, while many others are ready to trade counter the trend. A pullback happens slowly, takes a long time, and normally reached 38.2%, more rarely 50.0% of wave 3.

Elliott Wave Theory - Wave 5

Wave 5 reaches 61.8% of wave 1. If wave 3 reached 161.8% of wave 1, then the goals of wave 5 will be 100%, or 161.8%, or, rarely, 261.8% of wave 1.

If wave 3 does not reach 161.8% of wave 1, then wave 5 will often reach 61.8%, 100%, or 161.8% of wave 1 + wave 3.

Summary

Elliott Wave Theory is a unique and independent analytical instrument that, with certain experience, yields impressive results. However, the Theory has not been formalized yet, does not have a shape of a trading system, hence, the result depends on the subjective interpretation of the analyst-trader. If you want to understand the market better, Elliott Wave Theory will help you – if your approach to studying and using it is decent. Moreover, it may become the basics of your trading strategy.

Good luck with trading!