How to Trade Crude Oil? Full Guide for Beginner Traders

8 minutes for reading

There are several ways of trading oil; an individual trader may choose from futures, CFDs, and options. Whatever type of contract you choose, you will have to analyze the chart of your asset and only then open a position: a buying one if you expect the crude oil to grow or a selling one if you think it will decline.

In most cases, the traders who work in MetaTrader 4 stick to currency pairs, leaving behind crude oil or gold. However, these instruments are especially interesting because they are "technical"; moreover, oil charts tend to react better to various graphic patterns than currency charts.

In this article, we will talk about the peculiarities of trading oil so that everyone could understand what is this asset like and how to trade it.

WTI and Brent: what is the difference?

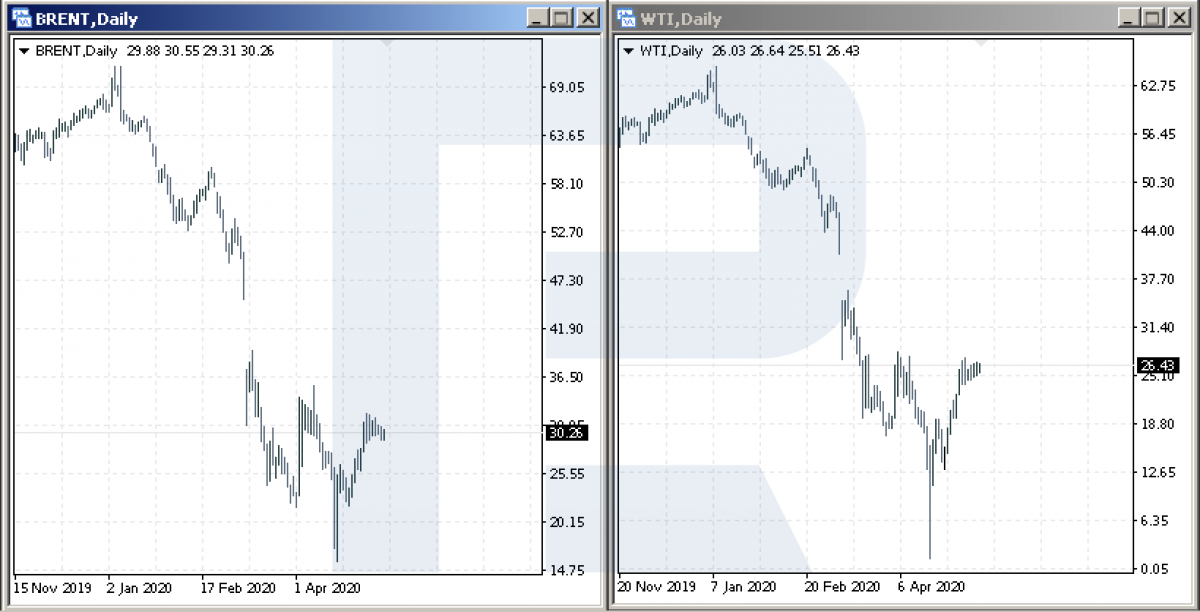

There are several types of oil coming from different oilfields and differing in the quality and other properties. Today, the standard of oil price is the crude oil named Brent; it is produced in the North Sea and sold in Asia and Europe. Futures for this crude oil type are most popular in the world.

WTI crude oil is produced in the USA, in West Texas and mostly sold in the Western Hemisphere. The Brent and WTI prices did not probably differ too much until 2011. Since then, the WTI price has become much higher due to expensive transportation; at the moment, the difference could reach $10 or more.

At present, the difference between the two prices amounts to $5. However, most contract with real supply is signed for the WTI brand - that is why the futures fell to -$40 at the moment when there was little demand. Another important difference is the fact that Brent is denser and contains more sulfur.

What factors influence the oil market?

If you crave for making money on oil, it is vital to know the factors that influence the oil market. They are as follows.

Demand and supply

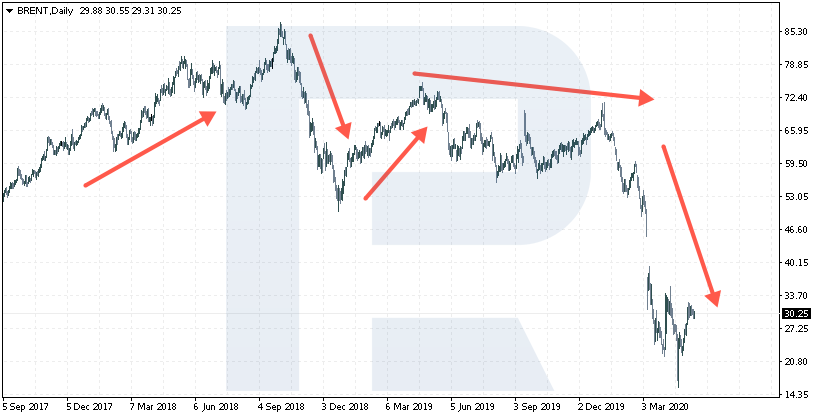

There is a viewpoint that it is the demand data that forms market trends; however, quality data on oil consumption and shortage is scarce. There are just the statistics of OPEC and Baker and Hughes. Anyway, it is clear that when the world needs oil and increases production, the price also goes up. In the current situation of the world pandemics and a decrease in production and consumption all over the world, oil prices fall. As soon as the market gets back to normal, the prices will be able to start quality growth thanks to an increase in demand.

Quotas for crude oil production from OPEC

Thanks to the decline in crude oil production by the agreements signed at OPEC meetings, oil prices grow. The aim of the organization is exactly keeping the prices stable. As you know, when Saudi Arabia and Russia failed to agree at one of the meetings, oil prices slumped. This was the market reaction to the price war between the two countries and their unwillingness to reduce production. However, the countries came to an agreement later, so there is a chance for a bullish trend in the market.

Changes in the crude oil stock data from the EIA

Every morning, EIA United States Crude Oil Stocks Change issue the data on the change in the crude oil stock, which influences not only the oil price but also the USD rate. When the volume increases significantly as in April 2020, the prices started declining and remained under pressure until the volume began to decrease. The growth of the stock means a decrease in demand, which puts pressure on the oil price, and the quotations fall. And vice versa, if the oil stock decreases, this indicates potential buys meant for replenishing the stocks to the necessary levels, which, in turn, pushes the prices upwards.

Geopolitical factors

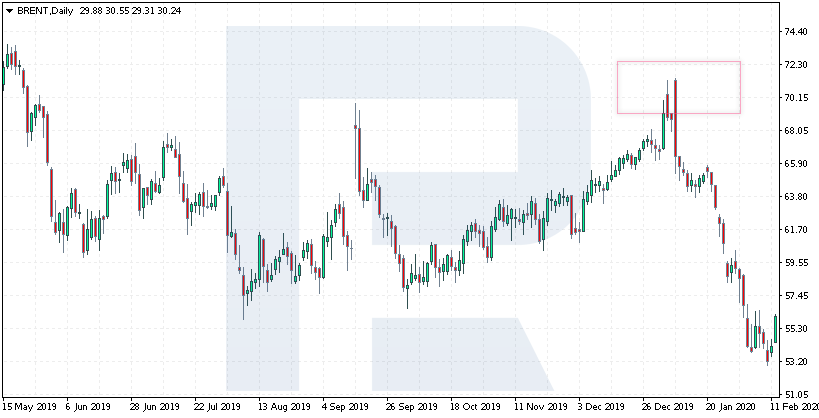

Military conflicts may also put serious pressure on oil prices. At the beginning of 2020, due to the aggravation of the conflict between the USA and Iran, Brent quotations rose over $70 per barrel. The tension was the result of the Iranian attacks of American objects, which indicated potential troubles with oil production and shipment and, in turn, pushed the prices up because investors anticipated a decrease in oil supply in the world market.

Climatic factors

The weather also influences the market. As a rule, the end of summer may become negative for US companies due to the expected hurricanes. The peak of this cataclysm in early autumn; oil-producing companies feel its influence: they decrease production, partially stop the work of certain oilfields, which decreases oil supply in world markets and pushes the price up.

Futures and options or day trading?

As mentioned above, you may either make money on the fluctuations of oil prices by trading futures and options - or switch to day trading.

Trading oil futures

This type of trading is thought to be meant only for large investors with access to the stock market. Futures are contracts for buys or sales that will be executed in the future.

When we buy such a contract, for a certain time we become the owner of an amount of oil bought by the contract. However, in most cases, such contracts fail to last to a real supply - the point is to make a speculative profit.

Futures are traded on special exchanges. The minimal sum of a contract is 1 lot, which amounts to 10 barrels of crude oil: if Brent costs $30 per barrel, the minimal sum for opening a trade will be $300.

Options for oil

This is considered to be the simplest way of trading oil. Both the profit and losses are fixed. The investor only needs to guess the direction of the rate and buy an option above or below the set price. If the investor was right, they make a profit regardless of how far the price has gone since the moment of buying the option.

Crude Oil CFDs

The third variant is to trade CFDs (or Contracts For Difference). Unlike with futures, you do not need to buy several barrels of oil, smaller volumes are available.

This variant is perfect for intraday trading because of the extreme volatility of oil: you may make money on the whole movement from the entry to exit point, and the profit is always fixed.

Many followers of tech analysis recommend to let the price grow and lock in the losses as quickly as possible. So, trading CFDs has a lot of positive moments, and thanks to leverage you may earn make a significant profit on small sums; however, you must always stick to your money management rules.

Risks of trading oil

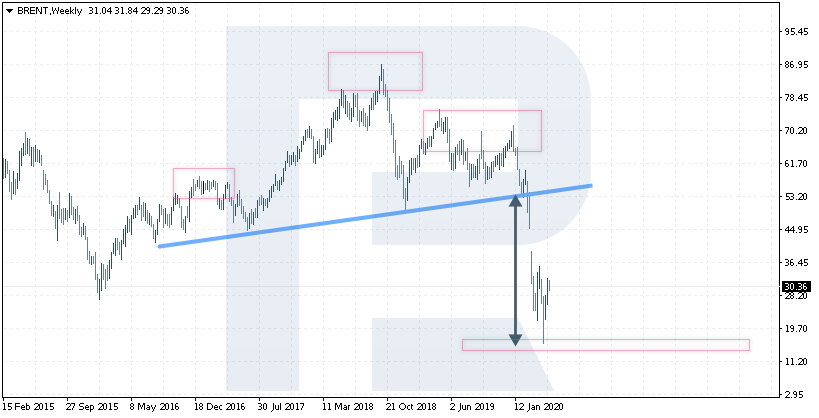

Oil is a very volatile trading instrument, moreover, it is prone to lengthy trends. The price stays in a flat very rarely, and in the times of world crises, it drops steeply due to a decrease in demand. So, risks will always be connected to the volatility; you always need to think in advance and limit your losses very strictly.

Always remember that the profit takes care of itself, i.e. the higher it is the better for us. On the contrary, if we miss a growing loss, it will only grow larger, deteriorating your position: like in the present situation, the losses may be huge if you are on the wrong side of the market.

Oil trading strategy

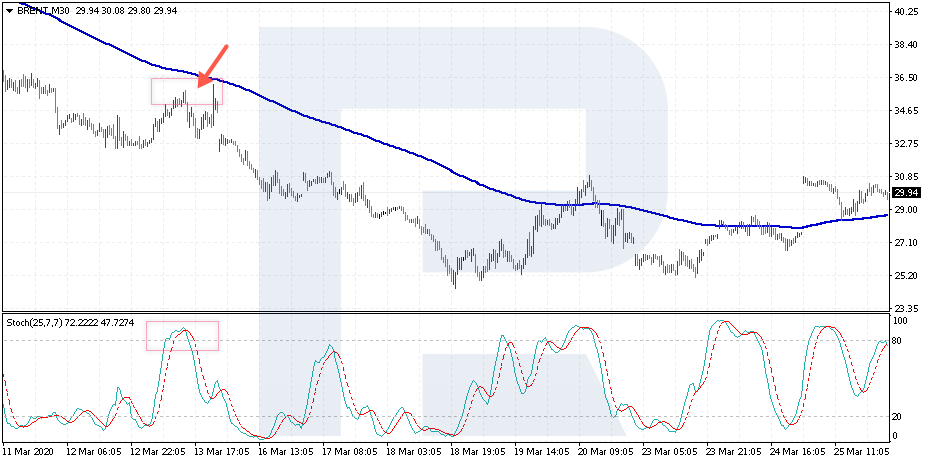

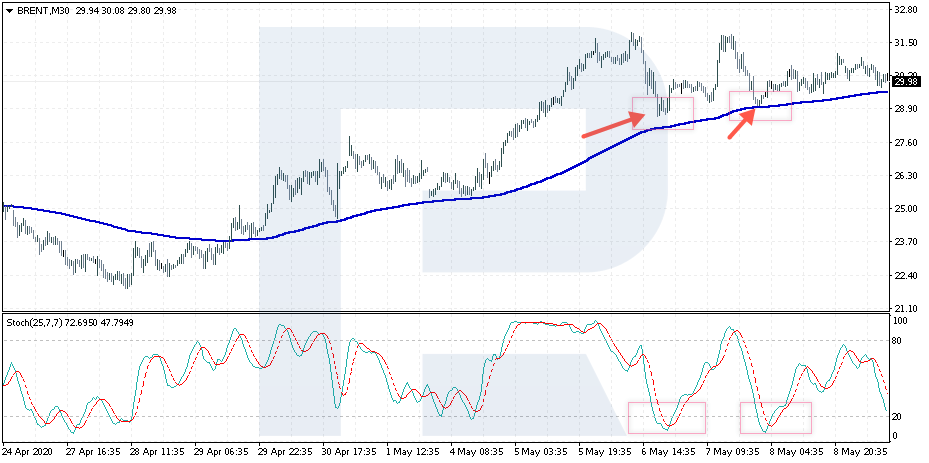

In the previous article, I offered a simple oil trading strategy that included an Exponential Moving Average with period 185 and the Stochastic Oscillator with periods 25, 7, 7. You may read all the details in that post.

Briefly speaking, on M30, the price falls below the EMA, and we just wait for a signal to sell from the Stochastic when its values are above 80.

As for buys, it is important to see the price grow above the EMA, then wait for the Stochastic to fall below 20 and a signal to form when the signal lines of the oscillator cross. The strategy is simple but efficient as we trade the trend.

Summary

Trading oil is the same as trading currencies. There are strong outer factors that may influence oil prices. As with currencies, the news may push the market, you only need to follow world events. Trading oil CFDs, the trader may trade WTI and Brent with leverage and small volumes, which does not require large investments.

Commodity markets are very volatile, so a good trading system may yield good results in the times of large movements, which will happen quite often. However, always follow your money management rules and control risks.