Facebook Stocks: To Buy or to Sell?

8 minutes for reading

It turns out that 2.5 billion people all over the world cannot live without visiting their profiles in social networks at least once a month. Today, we will discuss Facebook stocks and the perspectives of the Company.

Facebook (NASDAQ: FB) is a social network that currently has 2.5 billion active users, who visit their profiles every month. The company used to report the increase in users every quarter but after the number of registered users exceeded 2 billion people, the speed of increasing dropped down significantly: the whole population of Earth may not, apparently, register on Facebook as not everyone has Internet access.

However, investors need to see some statistics demonstrating the company’s potential for growth. In the end, the company’s management, namely Mark Zuckerberg, decided to provide information on active users instead of newly registered users, i.e. the number of those who visit their pages at least once a month.

Due to the pandemics, it was a bomb. While in December 2019, the number of those logging in the network reached 1.66 billion people, by the end of the first quarter of 2020, this number has reached 2.5 billion people. No surprise that the stocks of Facebook are trading at their all-time highs.

Does Facebook reach its peak?

However, the number of new users has a limit never to be exceeded.

Meanwhile, the number of active users depends on the world situation, thus it will change constantly, for better and worse. In other words, the number of active users also reaches its limit and gets stuck in a range.

In our situation, investors will react to the information on active users at the moment of its publication only, which will increase the volatility of the stocks but never create a long-term trend.

Another indirect proof that the company has reached its peak of development is the growing number of lawsuits from various governments that fine Facebook and limit its activity on their territories, implementing new rules of work.

Growing debts also indicate the slow-down of the company’s growth. Facebook had always had very small debts compared to its own capital; in 2016, there were no debts at all. However, in 2019, the company started taking loans abruptly: while at the beginning of 2019 it was free of debts, by the end of the year, they reached 9.5 billion USD.

For Facebook, such debt is “tiny”. Its assets exceed 138 billion USD, and any investor would eagerly become its creditor. However, the problem is elsewhere.

What does it need the loans for?

Of course, we may find thousands of reasons for making such a step; however, if we reject all excuses, one thing becomes clear. The company has reached its peak, and the money it generates is not enough for the management’s plans.

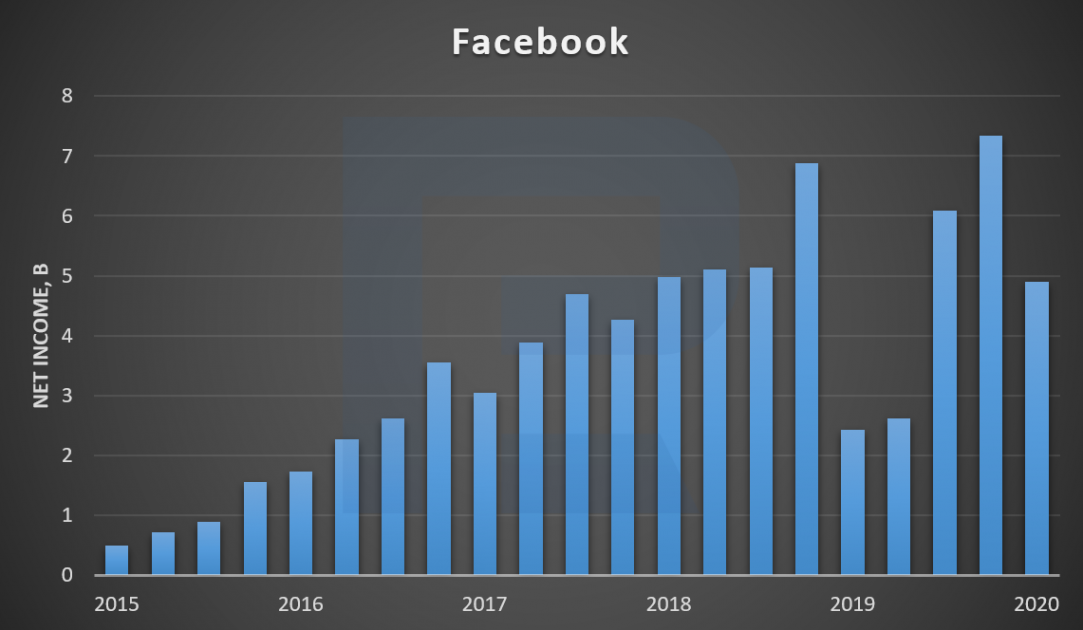

Look at the chart of the net profit. Its growth has stopped. This confirms my idea that the company has neared a slow-down in its development.

Should we sell Facebook stocks?

It seems that the time has come to sell Facebook stocks or open short positions. However, things are not that simple.

The management has long been prepared for the current situation. In 2014, Facebook started buying companies that had become popular; now it has 51 subsidiaries, including WhatsApp, Oculus, and Instagram.

Facebook venture capital fund

This year, the company has made another step forward. It has created a multi-million venture capital fund to acquire startups before they become popular. In June, the management announced that they had found a manager for the fund; however, they have not revealed the name yet.

Calculations are simple here. Facebook spends a lot for M&A of technology companies to integrate them into its ecosystem. You may recall that Facebook spent $20 billion on the purchase of the Whats App and Instagram. Yes, these companies were far from startups and this was due to their high cost. Therefore, the calculation of investments in venture and further development within the Facebook ecosystem will be able to bear fruit not only in terms of the development of fresh technology companies, but also in terms of financial returns from the subsequent increase in the capitalization of startups.

Such an approach may save billions of dollars which Facebook spends on buying already popular companies because their price grows rapidly. Also, it will decrease the unnecessary attention of antitrust institutions because merging at the early stage of development does not require their approval.

Facebook shop

Another source of income is the shops. Facebook now lets companies open shops on Instagram and Facebook networks without rent. This will decrease the dependence of the company on income from advertising. Currently, analysts are just evaluating the profitability of such a decision but obviously, during the pandemics, this will yield a substantial profit.

Here are the drivers of the future growth of Facebook.

Boycott to Facebook and a decrease in the expenses of advertisers

Naturally, Facebook has several problems to solve. For example, advertisers are boycotting the network for not removing Trump’s twit about shooting the looters during the protests after the death of George Floyd.

Other companies decrease their spending on ads due to pandemics, which may lead to a decrease in the profits in the second quarter.

The US report about the number of infected by COVID-19 growing. Due to this, in Texas and Florida, the launches of plants were postponed. In the nearest future, a wave of bankruptcies of small enterprises is expected. Three months have passed since the implementation of the quarantine measures, businesses are running out of money, but there is no end to the pandemics, so bankruptcies are inevitable.

All this will definitely affect Facebook income.

Facebooks’s strong sides

However, Facebook owns 60 billion USD of free capital, which will help it survive the hard times easily. Moreover, these are not the first troubles of the company, and investors use negative news only for buying the Facebook stocks at a lower price.

With the scandal around Cambridge Analytica in 2018, it was the same: the stock price dropped to 150 from 185 USD per stock but several months later, the stocks traded per 210 USD each.

Of course, the current situation is not to be compared with the scandal around Cambridge Analytica. However, look at the results of Facebook for the first quarter: both its income and the number of active users have grown. The shops launched by the company in the social network will also yield a profit because the pandemics make online commerce develop.

In the worst case, the income will drop; in the best one, they will remain at the current level or grow. Anyway, the company will survive a drop in the income thanks to its free money. Also, note that Facebook does not pay dividends or buy back its stocks from the market, which helps save substantial sums.

Facebook stocks price tech analysis

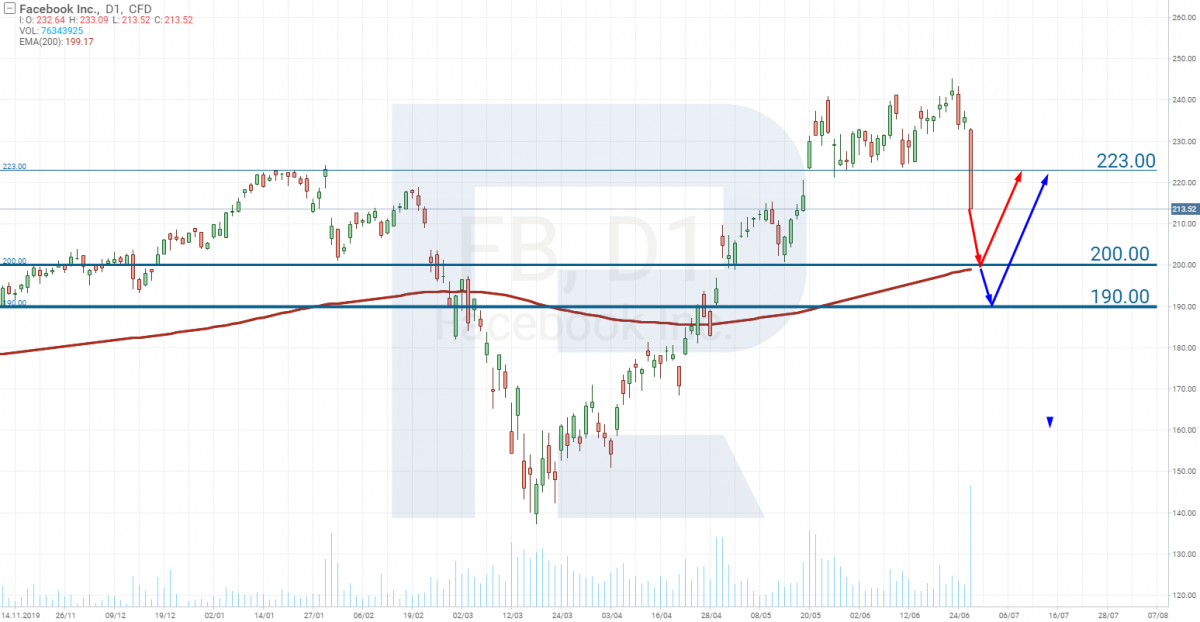

The Facebook stocks are now trading above the 200-days Moving Average, which indicates an uptrend. However, the latest steep decline of the price indicates a high probability of testing the MA at the level of 200 USD per stock.

This level will act as the support level for the price, where you may try buying the stock. However, to be absolutely sure, wait for a bounce of the price off the level.

If 200.00 USD is broken away, the next support will be at 190.00 USD.

Summary

On the whole, I look at Facebook stocks as an opportunity to speculate with an investment period of several weeks to several months. The company does not pay dividends, so the only profit is generated by the growth of the stock price.

The highs at which the stock is trading now were formed in 2018. Twitter (NYSE: TWTR) does not pay dividends either, and the stocks of this social network are now trading under the highs of 2018.

Comparing Facebook stocks to, say, the stocks of Apple (NASDAQ: AAPL), which does pay dividends, Apple stocks are trading 132 USD higher than the highs of 2018. This means Apple stocks should be held even when they are not growing. With Facebook stocks, things are different.

When the company was developing, its stocks were constantly growing in price. By now, there has formed a range between 140 and 220 USD per stock, in which the stocks have been trading for the last two years.

So, there are just these tactics: buy as close to the lower border of the range as possible and take the profit at the upper border of the range.

However, if you are ready to risk, count on Facebook shops. They might become the driver of the growth of the company’s income, generating a long-term uptrend in the stock price.