EUR/USD Forecast: Analysing the Trends of 2023 and Future Prospects

12 minutes for reading

At present, the United States Dollar (USD) stands as the most highly sought-after currency in the global economy, also serving as a reserve asset for international trade and finance. In this article, we will examine the key factors influencing EUR/USD currency pair trends, analyse growth prospects in the current environment, and delve into expert projections and EUR/USD forecast for the immediate future.

You can visit the RoboForex Market Analysis webpage for the latest EUR/USD forecasts.

Understanding the USD

The USD (United States Dollar) is the official currency of the United States of America and functions as a global reserve currency in international trade and financial markets. The USD is represented by the symbol $ or US$ to distinguish it from other currencies with similar names. The Federal Reserve System, functioning as the central bank of the US, holds the authority to issue currency.

The USD's status as the world reserve currency was officially established at the United Nations Monetary and Financial Conference in 1944. In the same year, the Bretton Woods currency system was approved, which was based on equating USD to gold and limiting the emission of money within the bounds of its own international reserves. A fixed rate of 35 USD per troy ounce of gold was set.

However, the rapid expansion of the USD supply exceeded the capacity of its own gold and foreign currency reserves, leading the US to abandon the Bretton Woods agreement. In 1976, developed countries adopted the Jamaican Monetary System, under which currency exchange rates are determined by the market rather than governments. The new rules allowed the Fed to print as many dollars as necessary. At present, the USD's value is governed by market mechanisms.

Today, the US stands as a leader in the global economy, with the USD regarded as the benchmark currency and the most widely used asset in transactions worldwide. It also functions as the official currency in many territories beyond the US, while numerous other countries use it alongside their own as an unofficial currency.

The USD is traded mainly against the Euro and the EUR/USD is the most popular currency pair on the market.

Key factors influencing the USD

The USD, as the most traded currency in the world, is influenced by several factors, including economic and political ones. Among the most significant is the current monetary policy of the US Federal Reserve System (Fed), the central bank of the US. Decisions regarding interest rate changes significantly influence the value of the USD.

The Bureau of Labour Statistics publishes data on unemployment and nonfarm payrolls (Nonfarm Payrolls), typically on the first Friday of each month. Traders closely monitor this data, as it can dramatically increase the volatility of the USD and, of course, affect currency pairs in which it takes part.

Key indicators of US economic development that impact the USD include:

- The Federal Reserve's monetary policy: changes in interest rates, quantitative easing (QE) or tightening (QT) programmes

- Unemployment Rate

- US job creation data (Nonfarm Payrolls)

- GDP growth rate (GDP)

- Inflation indices (CPI, PPI)

- Industrial Production (Industrial Production index)

- Retail Sales

- Trade Balance

- Consumer Confidence Index

- Business Sentiment Index (ISM)

Prominent political factors affecting the USD:

- Presidential elections

- Public speeches of political leaders, particularly the president and the head or representatives of the Federal Reserve

- Rising government debt, debates, and decisions about the debt ceiling

Recent trends impacting the EUR/USD

The US Federal Reserve has recently been actively combating inflation by tightening its monetary policy. Since 2022, the interest rate has been gradually raised from 0.25% to 5.5% – the highest in 22 years. The rate hike cycle has had a noticeable impact on USD quotes, which have managed to significantly strengthen against numerous global currencies during this time.

Recent statements from Jerome Powell, the head of the regulator, suggest that the Fed is preparing to conclude the interest rate hike cycle. Experts are forecasting euro to US dollar a maximum of two more rate hikes in 2023. Subsequently, the rate is expected to remain steady for a specific duration, and there is even the possibility of a decline if economic conditions call for it.

The policy of raising rates is putting significant pressure on the US economy. High inflation and slowing economic growth, combined with concerns about the sustainability of the banking sector, could contribute to the conditions for the onset of a recession – a significant and prolonged economic growth slowdown.

Fitch recently announced that it had downgraded the US sovereign credit rating by one notch to AA+. The agency explained that the downgrade of the credit rating by one notch to AA+ reflects "deteriorating governance," as manifested in repeated disputes over the national debt limit and last-minute decisions. This is because, due to domestic politics, the US faces the prospect of defaulting on its national debt every few years.

EUR/USD performance in 2023

The performance of the EUR/USD in 2023 is characterised by significant volatility, attributed to various global economic shifts and policy changes. Economic recovery from the lingering effects of the COVID-19 pandemic, coupled with inflationary pressures from expansive fiscal and monetary policies, have significantly influenced the currency's trajectory. The EUR/USD faced initial pressure in the first half of the year due to the Federal Reserve's cautious stance on interest rate hikes. However, the potential initiation of a tightening cycle in response to elevated inflation contributed to the USD's appreciation in the second half of 2023. This bolstered the USD's attractiveness as a global safe-haven asset and fuelled its robust performance in currency markets.

US Dollar Index

The US Dollar Index (USDX, DXY) measures the value of the USD against a basket of foreign currencies. DXY was established by the Fed in 1973 following the termination of the Bretton Woods agreement. The index was created with a base of 100, and its values have been counted from that base ever since. It is currently maintained by ICE Data Indices, a subsidiary of Intercontinental Exchange (ICE).

US Dollar Index Live Chart (DXY)

The DXY is calculated as a weighted average of the USD exchange rate against six key currencies: the Euro (EUR), Japanese Yen (JPY), Canadian Dollar (CAD), British Pound Sterling (GBP), Swedish Krona (SEK), and Swiss Franc (CHF). The euro holds the largest share of the index, accounting for 57.6% of the basket of currencies.

In 2023, the DXY exhibits a complex sideways trend following a notable rise in 2022. From the start of 2023 to the beginning of August, the DXY shows a slight decline despite starting the year near 103.50 and peaking at 105.88 before dropping to 99.57. Current quotes are near 102.70.

EUR/USD

The EUR/USD pair is categorised as one of the major currency pairs (majors). It has high liquidity due to the inclusion of the two most popular currencies in the world: USD and EUR. The EUR/USD currency pair accounts for approximately 20% of the total daily trading volume on the Forex market.

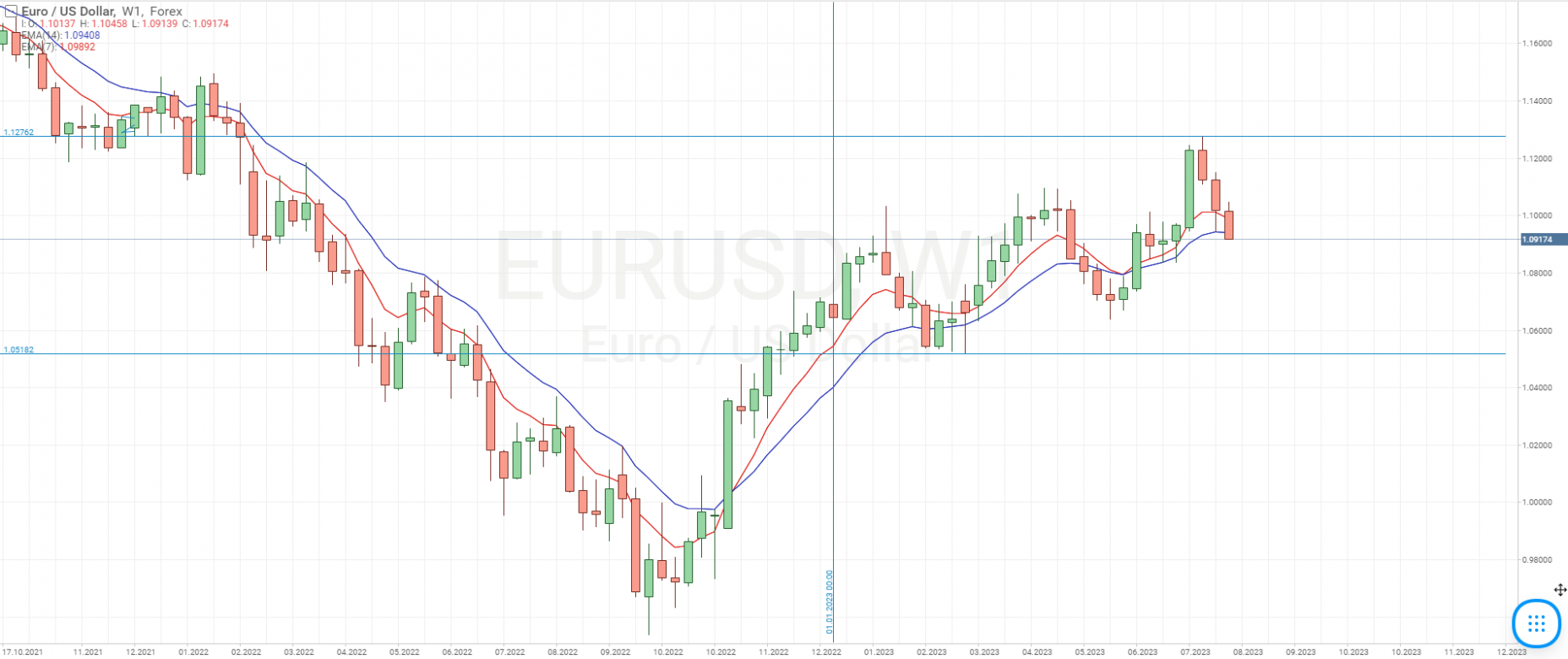

EUR/USD Live Chart

Fluctuations in the EUR/USD pair function as an indicator reflecting the relative conditions of the US and EU economies. If the US economy is growing steadily, while the EU is experiencing challenges, EUR/USD will decline. Conversely, if the US growth slows down and the Eurozone performs well, EUR/USD will increase.

In 2023, the EUR/USD pair, like the US Dollar index (DXY), has a difficult sideways dynamic, starting the year around 1.0688 and reaching a low of 1.0516, followed by a rise to 1.1275. As of the beginning of August 2023, quotes are hovering around 1.0900, indicating a slight decline in the EUR/USD pair from early 2023.

EUR/USD technical analysis and forecast in 2023

In 2023, EUR/USD exhibits considerable confidence, given the efforts of both the European Central Bank (ECB) and the US Federal Reserve to counter rising inflation through key interest rate hikes. The rate was raised to 4.25% at the ECB's last meeting in July. The significant rate adjustment offers substantial support to the European currency.

On the daily chart, EUR/USD is trading within the boundaries of the daily ascending channel. There is a local downward correction now after the quotes formed a maximum at the upper boundary of the price channel. The strong support area is at 1.0750, where the lower boundary of the price channel and the 200-day Moving Average is located.

Based on the presence of a strong support area, we can assume two main variants of possible dynamics of this pair: if the support level is breached and the closing prices firmly settle below 1.0750, we may witness a further decline towards the 1.0500 area; but if the support holds and the quotes reverse upwards forming a local minimum – this will open the way for reaching new highs in the area of 1.1275.

Factors impacting forecasts of the EUR/USD currency pair

- Monetary policy of central banks: Fed, ECB. Any changes in the central banks' policies can have a strong impact on currency pairs rates

- Macroeconomic statistics. Regularly published important indicators of economic development in the EU and US

- Geopolitical situation. Geopolitical conflicts, sanctions, military actions

- Political events within countries. Elections of political leaders and heads of central banks, resignations, appointments, scandals, and others

- The situation in the world financial markets. During times of crisis and stock market downturns, the USD, as the world reserve currency, often displays strength

Expert sentiment on the EUR/USD in 2023

Looking ahead, analytical viewpoints on the euro to US dollar forecast are primarily shaped by macroeconomic factors and geopolitical reasons. The focus is on the direction of the Federal Reserve’s monetary policy, with any acceleration of the tightening cycle likely to further support the USD. Now, let us look at the opinions and forecasts for the EUR/USD rate in 2023, as provided by financial analysts and major banks.

EUR/USD forecast: will the USD strengthen against the euro?

- Goldman Sachs has adjusted its EUR/USD predictions to 1.0700, 1.1000, and 1.1200 for 3, 6, and 12 months respectively, compared to the previous estimates of 1.0500, 1.0500, and 1.1000. The updated EUR/USD forecasts still anticipate the year-end estimate to reach the level of 1.1000, but they point to reduced downside potential in the short term and a more prolonged recovery of the Euro against the USD following the peak

- JP Morgan’s sentiment is bearish on the European currency for the latter six months of 2023, expecting the EUR/USD to reach the level of 1.0800 by the end of the year, followed by a recovery to 1.2000 in 2024

- Morgan Stanley predicts the EUR/USD exchange rate to fall to 1.0200 by year-end, driven by investor bias and slow local growth in the Eurozone. This trend is somewhat mitigated by the ongoing shift in capital flows

Long-term EUR/USD forecast (2024-2025)

- Foreign exchange strategists at HSBC believe that the USD is presently overvalued and will revert to fair value over five years due to declining US yields and the growth of equity markets. HSBC assumes that the USD will somewhat weaken by mid-2024 and expects the EUR/USD exchange rate for Q2 2024 to reach 1.1500. The 2028 year-end rate is projected at 1.1800.

- Specialists at the Economy Forecast Agency (EFA) predict the EUR/USD rate to reach 1.1100 by the end of 2024, 0.9970 by the end of 2025, and 1.0730 by the end of 2026

- In its 2023 outlook for the USD, the Wallet Investor portal, based on forecasting algorithms, envisions the USD index growing to 107.14 by year-end. The five-year forecast for the DXY index suggests it will reach 134.91 in May 2028, aligning with a long-term bullish trend

Conclusion

The recent downgrade of the US sovereign credit rating by one notch to AA+ from the Fitch agency underscores the concern of escalating national debt, which requires attention. The Fitch downgrade is certainly not fatal for the EUR/USD and is unlikely to have a significant impact on the short-term and medium-term dynamics of the US currency. These dynamics will largely depend on the Fed’s monetary policy and macroeconomic data reflecting the country’s economic growth rates.

The liquidity, size, and safety of the US financial markets suggest that the USD is likely to remain the world’s primary reserve asset in the short term. Currently, no currency can match the advantages of the USD (demand, liquidity, convertibility, etc.). While the euro and Chinese yuan are potential competitors to the USD, this perspective remains a long-term one.

Analytical agencies and economists from major banks do not yet foresee conditions for significant weakening or strengthening of the USD against major currencies. Short-term and long-term EUR/USD forecasts suggest moderate growth or decline in the USD. However, the actual outcome will depend on the economic situation both in the US and the global economy at large.

FAQ

Why is forecasting the USD important?

Forecasting the USD is important for strategic planning and risk management, helping investors in predicting market movements.

What methods are used to forecast the Euro to USD currency pair?

Commonly employed methods for EUR/USD forecasting include fundamental analysis, technical analysis, and sentiment analysis

How accurate are EUR to USD forecasts?

While forecasting methods have their advantages, they are not entirely reliable. Unpredictable factors can always have unforeseen impacts on the USD and EUR.

What are the risks in USD forecasting?

The primary risk is that global and economic events are impossible to predict. Changes in these factors can significantly affect the value of the USD.

What potential future events could affect the EUR/USD?

A range of events, including the emergence of cryptocurrencies and geopolitical shifts, could potentially affect the future trajectory of the EUR/USD.