Providec Trading System: Simple Strategy for Beginners

5 minutes for reading

The Providec trading strategy is one of the simplest Forex strategies that I have ever seen: just two indicators than never close the price chart. The trading strategy suits any currency pair or any other instrument featured by the MetaTrader 4 or MetaTrader 5 terminal, be it futures, stocks, of CFDs. The timeframe may vary from M1 to MN.

If the timeframe is shorter than H1, open orders in the European or American sessions only. As soon as the American session is over, close all trades regardless of their results. Conversely, if you trade on H1 or higher, you may leave trades in the market for as long as you wish.

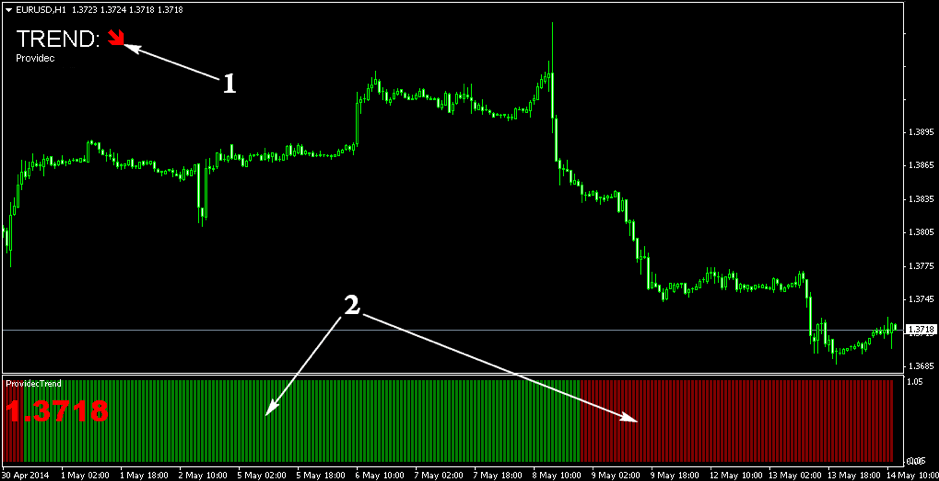

The Providec strategy desktop

Description of the desktop:

- The Providec indicator that gives direct signals to buy or to sell by the strategy.

- The ProvidecTrend indicator that filters the signals of Providec.

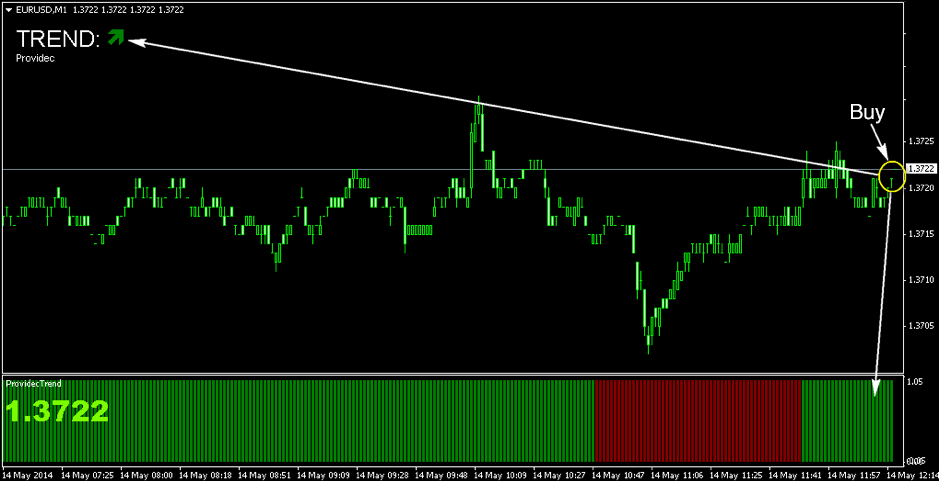

A signal to buy by the Providec system

A signal to buy needs several conditions to be met:

- The Providec indicator must show a green arrow aimed upwards.

- The ProvidecTrend indicator must be green.

- The green arrow of Providec must be the first green line to emerge after ProvidecTrend changed from red to green.

An example of a signal to buy by the Providec system

In the example, you can see that the trend has just changed, and a green arrow is signaling a buy. The place is good for entering because the price is at the same level where it was at the moment of the change in the ProvidecTrend color (red to green). Note that the signal is considered fully formed after the candlestick on which the green arrow of Providec formed, closes.

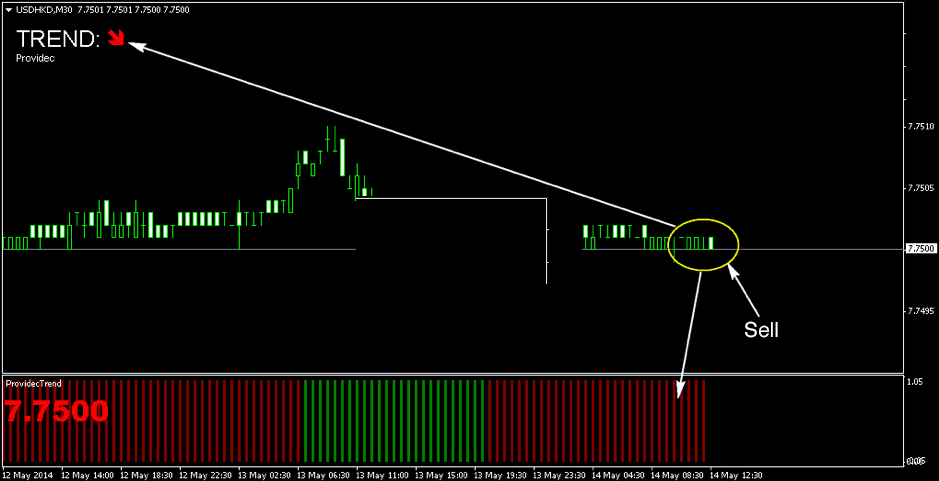

A signal to sell by the Providec system

For a signal to sell to emerge, the following requirement should be met:

- Providec must show a red downward arrow.

- ProvidecTrend must be red.

- The red arrow of Provide must be the first red arrow after ProvidecTrend changed an uptrend for a downtrend, i.e. green color to red.

- The candlestick on which the first red arrow of the downtrend appeared, must close.

An example of a signal to sell by the Providec system

In the example, the downtrend has started a while ago but the price has not moved from the place where the trend started. Meanwhile, Providec shows a red signal line - which means we may sell.

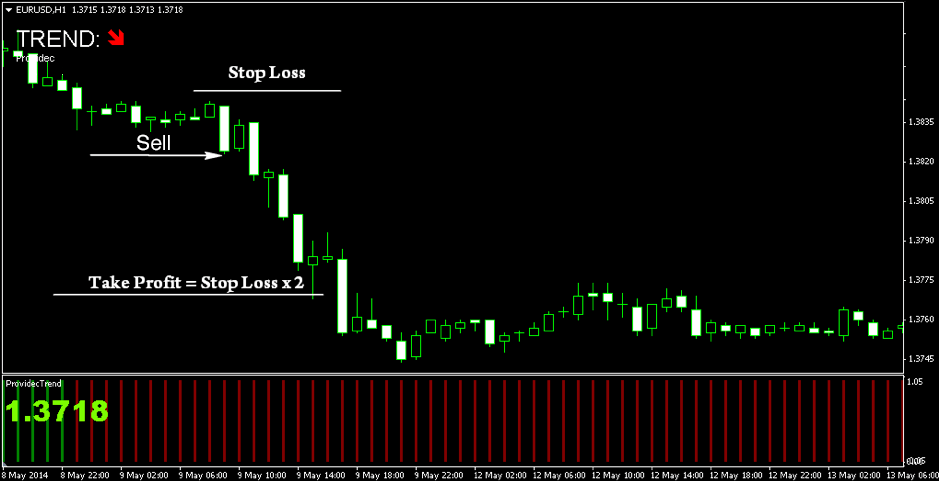

The Stop Loss and Take Profit in the Providec system

By this strategy, a Stop Loss is placed behind the nearest local low when buying and the nearest local high when selling. If the SL seems too large, abstain from entering the position.

In normal conditions, a Take Profit is placed at such a distance from the entry level that it is two times longer than the distance from the entry point to the SL. If the SL is too little, the distance from the entry point to the TP may be three times larger than that from the entry level to the SL.

When buying, follow the position by replacing the SL under new local lows; when selling, transfer it above new local highs. Also, note the spread when selling. To transfer the SL price to the breakeven, follow the above-mentioned rules.

Money management for the Providec system

When trading by the strategy, never be in more than one unprotected position. The risk per each position must remain within 1-2% of the current secured deposit. For example, if you have one open order that is not on the breakeven yet and a signal emerges for another currency pair, do not open a new order. Or, if for one order the risk has been decreased two times, you may open another one but with half of possible risk.

An example of selling by Providec

In this example, we did not even need to follow the trade. Such entries happen seldom. If an opportunity to decrease risks and protect the profit emerges - always use it. A world-famous trader Larry Williams started making money when he took up believing that each of his trades is more likely to become losing than profitable. Hence, he started using any opportunity to protect his positions - and began to make money.

The Providec trading system is so simple that it suits even beginners. However, they must know how to find local extremes, unless they will never repeat the experience of Larry Williams. The system is also handy in the sense that you need no more than a couple of seconds to analyze the trading situation on each chart. Hence, you may track several charts and timeframes easily. And if you trade on H4 or D1 even, trading will take no more than a couple of minutes a day.