Stocks of Which Airlines May Go on Growing?

7 minutes for reading

September is already coming to an end. When the month ends, the airlines that have received some help from the US government will be allowed to start headcount reduction. For some, this autumn may become not only a time of summer memories but a time of memories about their lost workplaces.

During these four months, I have raised the topic of airlines quite often in all sorts of articles: from those about possible bankruptcies of certain airlines to the recommendations to buy the stocks of certain companies. This time I am attracting your attention to this industry again.

Airlines stock charts

Let us have a look at the charts of certain stocks and single out those that still may grow. First, have a look at the charts of those airlines that I have already mentioned in my articles.

I have always insisted on the 200-days Moving Average being a crucial indicator of tech analysis in the stock market as it allows us to define the support and resistance levels and the current trend.

In this case, the MA indicates the stocks of which airlines enumerated above enjoy the largest chance for growth.

Southwest Airlines Co.

Well, what do we see? The stocks of Southwest Airlines Co. (NYSE: LUV) have broken the 200-days MA away and are now trading above it. Currently, we interpret it as a signal of a trend reversal and subsequent growth.

Southwest Airlines is a large US company; the most important thing is that it is the largest low-end airline in the world. Another advantage of the company is the fact that quite often it takes the first place in terms of the number of transported passengers on domestic US flights.

As we all know, the pandemics closed most borders, affecting international flights. The number of domestic flights also shrank, but those who used to be the leaders there managed better. Nonetheless, we have to admit that this summer, the load on the companies was much lower, under 35%.

Southwest Airlines planes still cannot be filled because earlier, the company decided to ban the booking of places in the middle row. This creates the necessary social distance, attracting more passengers to this company.

According to the latest data, the load on the planes is growing gradually from 30-35% o 45-50%, and the management announced that the loss in the third quarter will be lower than forecast. Also, the company managed to reduce its daily expenses to 17 million USD a day, which is 3 million USD less than in the previous quarter.

However, the main event for the airline will be vaccination. Naturally, in such a situation, investors will not wait for quarterly reports to realize that the passenger flow has started to increase; they will work for the future, considering which stocks to buy right now.

The chart shows that the best stocks are Southwest Airlines.

Short Float results

Apart from the results of tech analysis, we can have a look at the number of short positions.

In May, in my previous article "Airlines on the Verge of Bankruptcy: Should We Sell Stocks?" I already drew your attention to this index but then I used it to find out which company had the highest risk of bankruptcy. Now when we hope that the situation may get better, this index may point at a strong company.

If you plan to use the information about short positions, later on, try to compare it to the index of other companies in the sector.

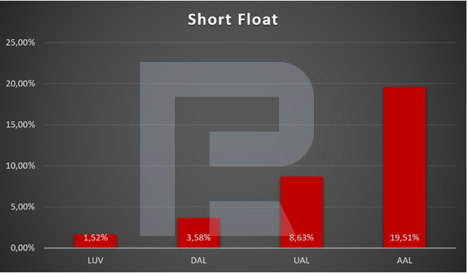

So, in May 2020, only 1.52% of the company’s stocks were in short positions. To compare: American Airlines Group Inc. (NASDAQ: AAL) had 19.51% of its stocks played short. Hence, AAL was much closer to bankruptcy.

In the end, the stock price of this company dropped most crucially, and now it looks the weakest on the chart.

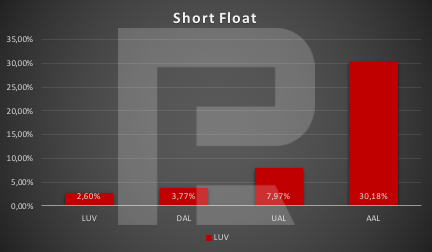

Today, 2.6% of Southwest Airlines stocks are on sale; however, as I have written above, this criterion must be compared with that of other companies. Look at the picture with the most recent data.

The Short Float of Southwest Airlines is still the lowest, while the situation in American Airlines has worsened: 30% of its stocks are on sale.

Hence, we may expect the stocks of Southwest Airlines to grow with a higher probability.

Delta Air Lines, Inc.

The second place is taken by Delta Air Lines, Inc. (NYSE: DAL). In my previous article it was the company the stocks of which I recommended for buying.

The reason was the free money amounting to more than 15 billion USD that the company had: with the daily expenses of 27 million USD, the company could last on it until the end of the crisis.

At the end of July when the article was published, the stocks of the company cost 25 USD each. Currently, the price has reached the 200-days MA, amounting to 35 USD.

This month, it has become known that the company is planning to attract 6.5 billion USD more as investments, already having enough money. Currently, Delta may merge with other airlines or invest in smaller and new ones.

Delta stocks remain attractive. If the price breaks away the 200-days MA, this will be another signal of growth.

Financial help from the US government

We cannot say the trouble is gone; it is just that each airline solves it in its own way. As I said at the beginning of the article, in September the protection of employees from firing expires, which means in October, we may expect massive sacking.

However, things are not that simple in America. They have independent trade unions that protect the rights of employees; they insist on prolonging the protection until June 2021. Which entails additional expenses on wages.

Well, you can find the money if you try your best – but why bother if you can ask it from the government. This is just what has happened. On September 17th, air carriers asked the US government for another tranche of financial support sized 25 billion USD.

Thus, we are back at the situation that we had in May. Again, we need to look for a company that promises to be the luckiest.

The Short Float data and the charts show that United Airlines Holdings, Inc. (NASDAQ: UAL) and American Airlines Group remain outsiders.

The news about the financial help led to a slight decrease in the stock prices, and further decline is not excluded in the nearest future. However, the expectation of this help finally coming will now become the catalyst of growth; the next stimulus will be the very tranche. Last time, investors reacted to financial help by buying the stocks of the airlines, and this time this may happen again.

Bottom line

The larger the company, the more difficult it is for it to overcome the crisis. However, the government comes to their rescue because such companies employ dozens of thousands of people. However, the process of overcoming the crisis takes longer than in smaller companies.

Among the companies enumerated in the article, the largest one is American Airlines, the second largest is United Airlines, then goes Delta Airlines, and then Southwest Airlines. It is clear that the stocks of Southwest Airlines have the biggest chances for growth.

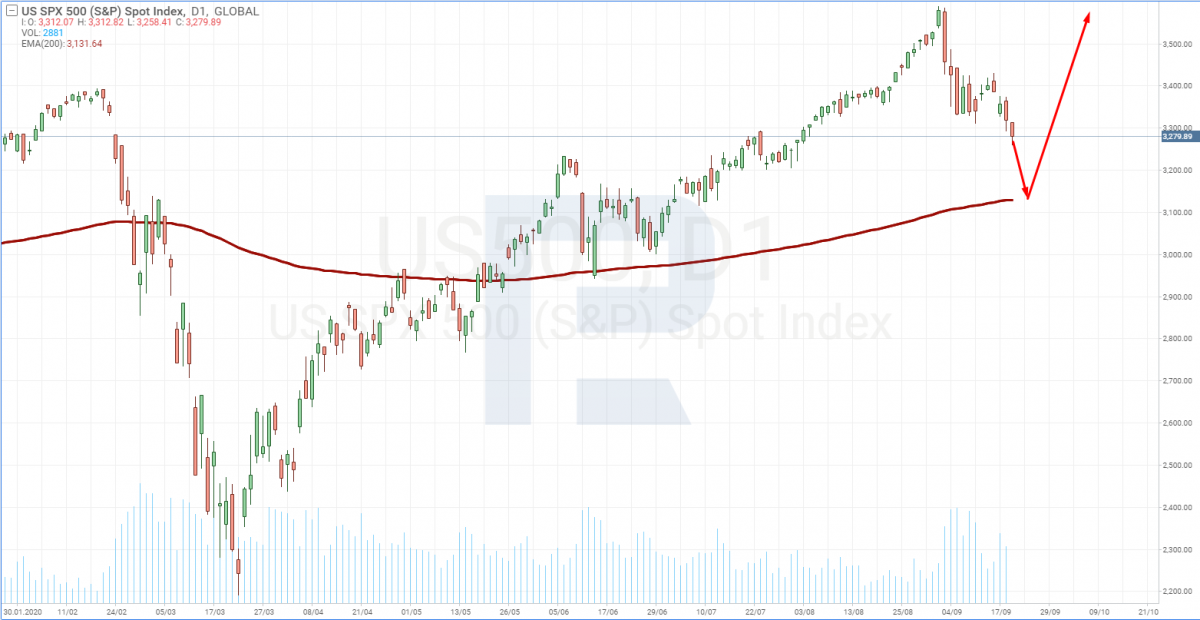

However, be careful: the S&P 500 gives rather bad signals. After its price reached all-time highs, it dropped abruptly.

The index did not restore during the last 10 days: it keeps renewing the lows. This means that the index may go on falling, and so will the stocks of the airlines do. Keep a close eye on the recuperation of the S&P 500 and only after it consider buying the stocks of the airlines.