How Did They Heal Trump? What Future Awaits Saviors’ Stocks?

8 minutes for reading

As we have heard, President Donald Trump did fall prey to the coronavirus but recovered. For us traders, it will be crucial to find out the drugs of which companies were used for healing Trump.

President is supposed to receive medical services of the highest class and get the most up-to-date drugs administered to him. This means that the drugs used for Trump will enjoy increased demand, and if they have not passed the tests yet, they will most probably be approved.

In such a case, the stocks of the companies that produce those drugs are likely to grow in price, which makes them an attractive investment.

Luckily, Trump’s treatment regimen is no secret, and his attending physician Sean Conley revealed the information about the drugs to the public. In this article, we will discuss the medicines and the companies that produce them.

Remdesivir (Gilead Sciences, Inc.)

The first drug approved by the FDA for treating COVID-19 was Remdesivir by Gilead Sciences, Inc. (NASDAQ: GILD). It was permitted to use in adults and children with suspected or confirmed COVID-19 regardless of how grave the illness is.

Initially, Remdesivir was meant to cure the Ebola fever but then scientists found out it could suppress the replication of the coronavirus.

After the drug was urgently approved for use in the cases of COVID-19, the US government bought out almost all of the world stock of it alongside 90% of the production planned by Gilead Sciences for August and September.

As for the effect of the drug, things are quite complicated here. On the one hand, it is declared to speed up the recovery of patients; on the other hand, it is suspected to provoke acute kidney conditions. Moreover, in several countries, the drug has not passed the tests yet.

Then, the World Healthcare Organization announced (based on some research carried out in China) that Remdesivir had failed to improve patients’ condition or prevent death. However, later this information was deleted from the website of the WHO for no obvious reason.

On Monday, October 5th, the quotations of Gilead Sciences stocks opened with 2.5% growth but the next day, the price reversed to the lows of the previous Friday. On the whole, Gilead Sciences stocks trade in a downtrend, which is confirmed by the 200-days Moving Average.

Recently, the support at 62.00 USD appeared on the chart; however, the controversial results of testing do not make this company trustworthy. The situation with Trump might change the situation and reverse the trend, anyway, this is hard to believe.

Famotidine (Johnson&Johnson)

In his written statement, the president’s physician specified that supplementary medication was used for treatment. Among those drugs, there were zinc, aspirin, melatonin, vitamin D, and Famotidine. The latter was the most prominent one; it is sold under the trademark Pepcid.

Famotidine is used for treating acid indigestion, dyspepsia, gastric and duodenal ulcer. Research showed that Famotidine can also be used for curing the coronavirus.

It is noted that Famotidine decreases the chances for death or the need for rescue breaths to times. Also, it works in light cases of COVID-19, speeding up recovery.

With patients whose conditions did not require admission to the hospital, Famotidine decreased the symptoms significantly 24-48h after it was first administered.

Scientists do not exclude the idea that the improvement was just a natural part of recovery. The drug, though sold, is not officially recommended for the coronavirus treatment. It is now on phase 3 of testing, and the results will be known on October 30th.

Famotidine is produced by a world-famous company Johnson&Johnson (NYSE: JNJ). This is a very large company that sells a whole range of products, and even if this drug is approved, this will not have any significant influence on the company’s income. However, this will enhance its reputation and attract the attention of investors, which, in the end, may affect the stock price.

Currently, the stocks are trading in an uptrend, and the news about the use of Famotidine in treating COVID-19 raised the stock price from 2 USD to 148 USD.

The stocks are trading near their all-time highs; the resistance is near 150.00 USD. A breakaway of this level may signal further growth of the price.

If you invest in this company, you will receive additional income in the form of dividends, which currently amount to 1.01 USD per stock.

REGN -COV2 (Regeneron Pharmaceuticals, Inc.)

Trump tried another drug by Regeneron Pharmaceuticals, Inc. (NASDAQ: REGN) - REGN -COV2.

It is an experimental drug, not yet approved by the FDA. It is an “artificial cocktail” of antibodies meant for making your body resistant to the coronavirus and prevents the virus from getting into cells. Current research shows that REGN-COV2 decreases the virus load on the organism and speeds up the process of healing.

This drug is also connected to Ebola fever.

Regeneron is now testing REGN-EB3 (a cocktail of three antibodies) that decreases the death rate of patients with Ebola. The drug is expected to be approved on October 25th. REGN-COV2 was created on the same platform, thus the success of the first drug might mean the success of the second one.

The stocks of Regeneron were the ones to react the most to the news. They grew by 8%. On the chart, we might notice a strong uptrend that started at the end of 2019 and pulled the price from 270 to 600 USD.

The stock price is rather high, and most small investors can buy just a tiny portfolio. Also, it is unlikely that the profitability will reach two-digit numbers at the end of the year because the reaction to the news increased the volatility only slightly.

However, on the whole, we may still count on the growth, judging by the trend, capitalization, and the size of the company. There is another factor in favor of Regeneron. The company has signed a contract with the US government for 450 million USD. This sum will be allocated for buying the drug if it is approved.

Dexamethasone

Also, for healing Trump, they used Dexamethasone, but this drug is produced by many companies, including Pfizer and Merck, and for us, this is not interesting as we do not know which company to invest in.

All in all, the picture is as follows: with Remdesivir, there are more questions than answers; Famotidine is already on sale and has no significant influence on the income of Johnson&Johnson. The only drug and, hence, the company left in the “Trump’s scheme” is REGN-COV2 and Regeneron, respectively.

Sorrento Therapeutics, Inc.

However, if we think a little, we will find an alternative to Regeneron. This is not going to be so reliable, but if everything goes smoothly, the potential profit might be over 100%. I am speaking about Sorrento Therapeutics, Inc. (NASDAQ: SRNE) and the drug COVI-SHIELD.

The company generally specializing in treating cancer and painkillers. These days, every more or less large pharmaceutical company tries to bite off its piece of the coronavirus pie.

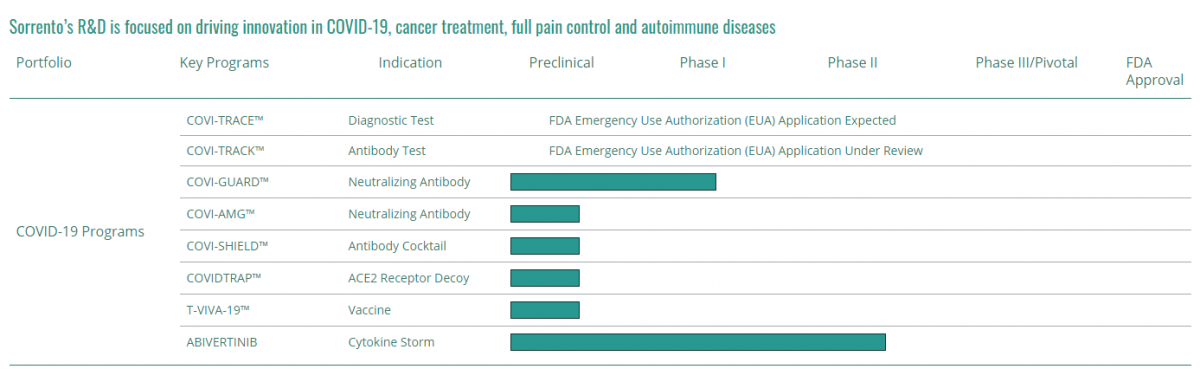

Currently, the company has two tests that have passed the trials and are waiting for the FDA final decision.

The first test is meant for detecting COVID-19, the second one – for detecting the antibodies, i.e. singling out those who have already recovered from the coronavirus. Also, the company is working on the vaccine and, most importantly, the cocktail of neutralizing antibodies (like that administered to Trump). All in all, the company has 6 drugs against COVID-19 undergoing tests.

Waiting for the FDA decision on the antibody cocktail

So, if the FDA approves of REGN-COV2 by Regeneron, this will mean that antibody cocktails can be successfully used for treating the coronavirus.

Sorrento is already working on a similar treatment, and it cocktail COVI-SHIELD has all chances to be approved by the FDA.

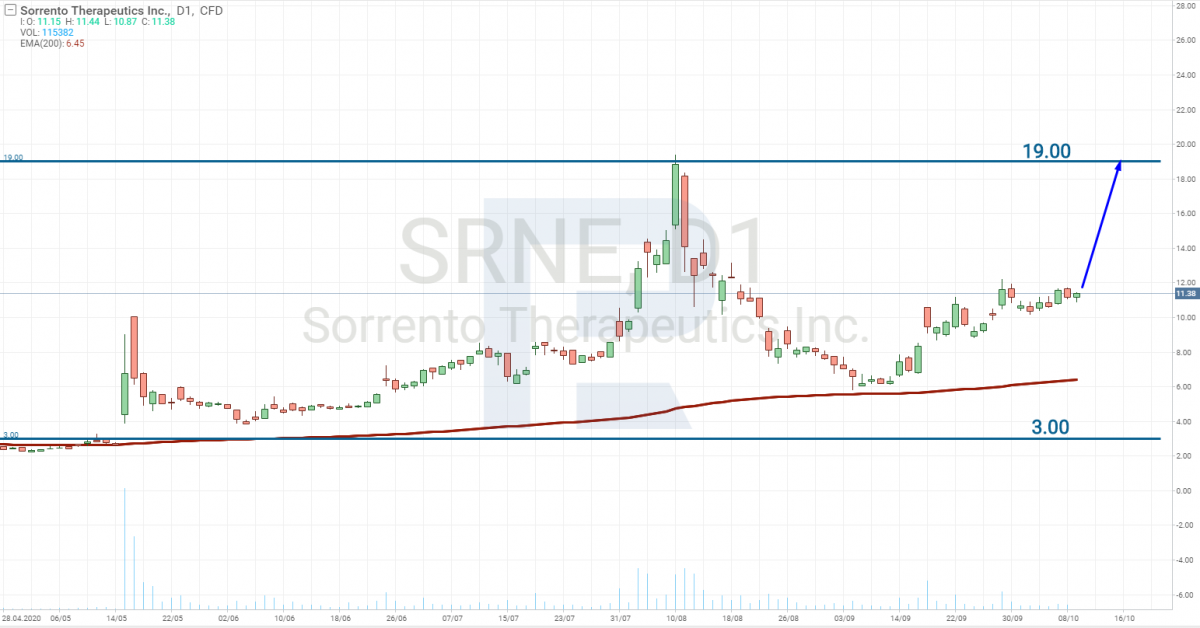

A single piece of news about REGN-COV2 being approved will be enough for investors to start buying the stocks of Sorrento. The chart shows how active investors might be. This means we do not need to wait for the final results of testing COVI-SHIELD.

Currently, the stocks cost slightly over 11 USD each. However, in May, they hardly amounted to 3 USD. The information that the company had started fighting with COVID-19 brought the stock price up, and at some moments it reached 19 USD. Currently, the stocks are quite cheap, and any of the approved drugs may influence the income of the company significantly, which will bring the stock price up. In the end, the profitability might be over 100%.

The MA demonstrates an uptrend. A breakaway of 12 USD might signify further growth of the price. The aim, in this case, will be the all-time high of 19 USD, formed in August. Anyway, in the long run, the stock price may grow even higher.

Summary

The second wave of the coronavirus is already here, and the attention of investors will be glued to biopharmaceutical companies. The drugs enumerated above may get into the center of events, which will bring the price of the stocks up. Hence, keep a close eye on those companies.

The stocks of Sorrento look most attractive.