GameStop. Short-Squeeze. Trading System

9 minutes for reading

2021 took a cheerful start in the stock market. Stock indices were growing, US regulators kept pouring money into the economy and even promised support to the business as long as inflation remains under control. Things were calm and easy to forecast: one could buy stocks and wait for their profit.

All in all, things were boring, with the only exception of Elon Musk disturbing the stock market with his tweets. He added the hashtag of Bitcoin to his account, inducing steep growth of the cryptocurrency; at the presentation of the new design of Tesla Model 3, he “forgot” to close the intro of The Witcher 3 game on the dashboard, which made the stocks of the developer, CD Projekt SA (OTC Markets: OTGLY), grow immediately. Such a peace-breaker and merry-maker!

Reddit and GameStop

Out of the blue, investors switched their attention from Musk to a small, never before noticed group for traders in Reddit, the members of which decided to do better than Musk in influencing stock prices.

One user noticed a small company called GameStop Corp. (NYSE: GME) that sells DVDs, game consoles, and accessories for computer games. The company has been reporting losses for two years, and its income started declining as long ago as 2015. Nothing was interesting in the company in terms of buying stocks – except one tiny detail.

Short Float

A Reddit user noticed that there were too many short positions opened in those stocks – over 70% (over 120% now).

Selling the stocks of a company that had financial trouble and risked becoming a relic alongside other offline stores, seemed logical. Try to recall the last time you actually went to a shop to buy a movie on DVD. These days, we can watch even the latest releases online on a subscription or for a single payment.

To cut the long story short, Reddit users got an idea to scare off sellers, making them close their positions. In other words, they decided to provoke a short squeeze.

Short-squeeze

A short-squeeze means forced buying of short positions, i.e. the sellers of a stock become its buyers, which leads to an increase in the stock price. Keeping in mind the number of short positions in GameStop stocks, their price was doomed to sky-rocket.

An example of short-squeeze in Tesla shares

In fact, the idea is as old as the stock market itself, and short-squeezes happen almost every week.

Have a look at the stocks of a world-famous company Tesla (NASDAQ: TSLA). There were also short-squeezes there because for 9 years (from the moment it carried out an IPO) the company remained losing, threatened by bankruptcy. Many Wall Street analysts recommended selling Tesla stocks, and investors played short carelessly.

There were plenty of short-squeezes in this stock. The brightest one happened in February 2020. In three days, the stocks grew by 67%. According to certain data, short positions in Tesla stocks lost over 5 billion USD then.

All in all, traders have always been using this method, only that social networks have made it easier for them to find each other and coordinate their actions. As a result, they shook the prices of many stocks worldwide. They pay major attention to companies with a lot of short positions open.

How to find such stocks?

Any trader can use this method, there is no secret to it. All you need is to open Finviz.com and choose Short Float above 30% in the scanner. On the list of companies, choose those with the highest Short Float.

Many traders got scared and started closing their selling trades, so there is hardly a company that did not react by growing in price. I will give you just several examples.

Firstly, the stocks of AMC Entertainment Holdings, Inc. (NYSE: AMC). Several brokers closed trades in it due to the current market events. Its Short Float is over 41% now. Since the end of January, the stock price has grown from 2 to 20 USD, i.e. by 1,000%.

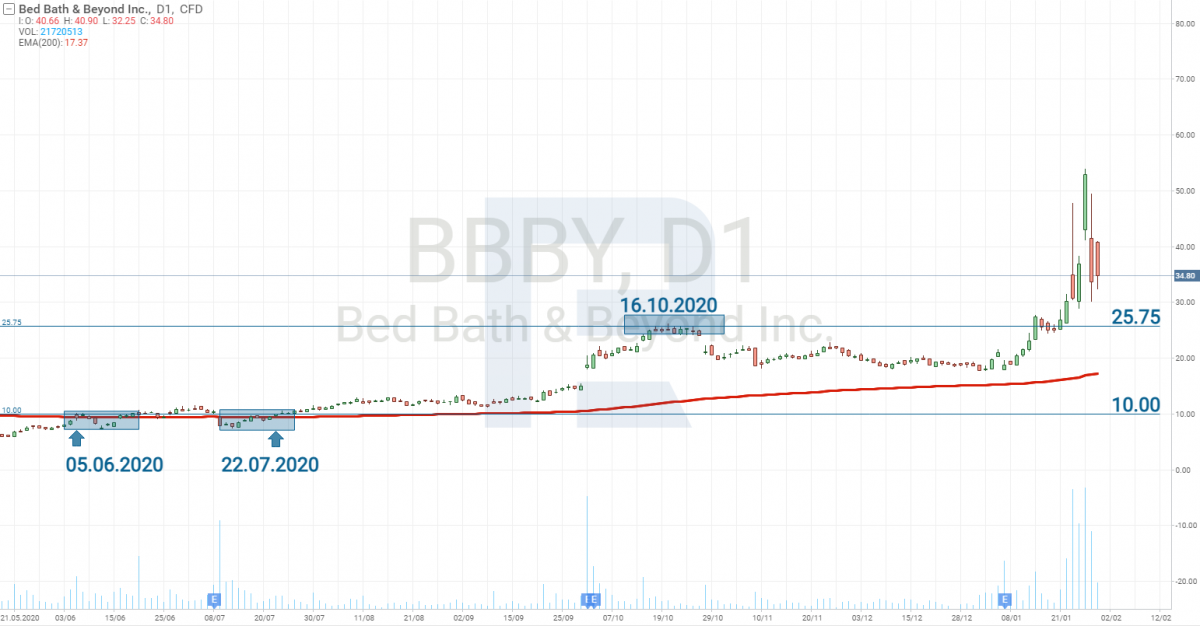

Secondly, the stocks of Bed Bath & Beyond Inc. (NASDAQ: BBBY). Reddit users actively called for buying them. The Short Float is over 65%; the stock price has grown from 30 to 50 USD.

And, of course, the stocks of GameStop, now known by everyone, with the Short Float over 120%. We have a real war between bulls and bears here. The media, brokers, and various communities are also in, some calling the buyers “extremists”, others close trades, and others attack those who publicly recommend selling GME stocks on the Net.

The situation with GameStop stocks is becoming absurd. There are over 100% of stocks played short now, which means the very same stocks get sold at different brokers more than once. The stock price surges by over 200 USD during a trading session. For the stocks of such a company, this volatility is crazy.

Sometimes, closer to the end of the trading session, bears seem to be winning; however, the next morning, trades start 100 to 200% higher than the closing price. All in all, this is no place for delicate souls and those who prefer making their money calmly.

The result of all this fuss has been known from the start – the stock price will fall back to 20 or even 3 USD – which means the very lows because the company remains losing, and its future is vague. GameStop can get some chances for success if it presents a new full-scale development plan or, better even, gets merged by a larger company.

When do we buy?

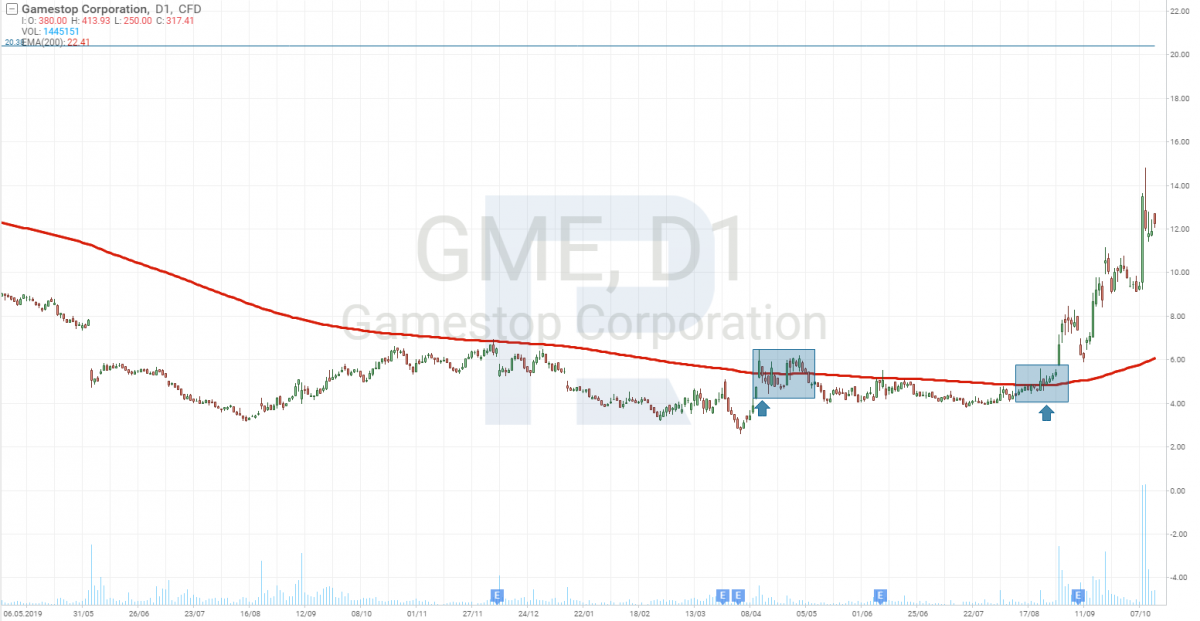

Finding stocks with too many short positions is easy. It is trickier to catch the moment when it is time to buy. Of course, there are signs you can check. I will show you this on the example of GameStop stocks.

The stocks were in a downtrend starting in 2015. The profit of sellers grew alongside the descending of price, simultaneously increasing the number of those who wanted to make money on the further falling of the price (this is the only explanation of such a lengthy downtrend). The situation resulted in a colossal Short Float. What is next?

Next, it is time to take the profit, i.e. sellers need to close their positions, which means to buy the stocks. In other words, regardless of the attention of Reddit users, the stocks would have still grown in price, though not impressively but anyway.

This is exactly what happened. Since August 2020, GME stocks have been growing in price (in Reddit, the stocks were first mentioned in November 2020). To buy stocks in advance, before they start growing, you can use a simple and well-known indicator – the 200-days Moving Average.

This way, a breakaway of the MA by the price will give you the signal. Before Reddit users came, GME stocks had grown in price by 200%.

With the stocks of Bed Bath & Beyond Inc. (NASDAQ: BBBY), the situation was similar. The stocks started growing long before the agitated demand, and the profitability of investments in this company got over 100% in quite calm circumstances.

The stocks of AMC Entertainment Holdings, Inc. (NYSE: AMC) broke through the 200-days MA for the first time in August 2020 and for the second time – a couple of days before the hysterical demand appeared.

Summing up

To increase your chances for buying stocks with upcoming short-squeeze, look for stocks with Short Float over 30%. The more short positions there are in the stock, the higher the probability of a short-squeeze.

To guess the moment to buy, use the 200-days Moving Average. An upward breakaway of the line will give you the signal.

It is hard to predict up to which level the stock might grow. However, if the quotations grow fast and open with gaps, this means the high is near, so it is time to take the profit.

Several days after a short-squeeze, in 90% of cases, the stock price starts falling to get back to its initial levels. This attracts the attention of even more investors craving for an easy profit, who open short positions.

Let me warn you once and forever that making money on stocks is extremely risky. Just see what is going on with GME stocks. However, certain strategies do exist; you can read about one of them in my article about Pump and Dump.

Bottom line

Initially, the whole story with GameStop stocks was presented as a crusade against the rich for the sake of the poor. As if small traders united to buy out the stocks that hedge funds traded short. In reality, those who started the game bought the stocks at the very start and needed other people to keep buying them to make the price grow. Moreover, they did that before sellers started to close their positions.

Sellers started closing but in Reddit, they recommended buying GME stocks even when the price was over 400 USD, explaining it by the perspectives to rise to 5,000 USD.

There is such a probability but it is tiny. By the screenshots in Reddit with millions of profit, it becomes clear that the game was started not by poor traders at all. The stock did grow by 2,000%. To earn millions, one had to invest 100,000 USD, and when the stock rose above 200 USD, it became clear that it was then being bought by traders with hundreds and thousands of USD on their accounts.

Unfortunately, they will never have the stock cost 5,000 USD. There is nothing Robinhood-like in this story. Some bought at the start and agitated others – and those who risk jumping into the last car.

Hence, the safest way to make money on such stocks is to use the method described above.