Why Are Novavax and Moderna Shares Falling?

3 minutes for reading

At the end of last week, the shares of two American biotech companies – Novavax and Moderna – starting going down. Today I will speculate on the scale of this decline, the reasons for it, and try to predict the outcomes of this alongside Maksim Artyomov. Let’s get started!

Contents:

Novavax shares dropped by almost 20%

On August 5th, Novavax issued a press release saying that the company was putting off its application to the Food and Drug Administration. The purpose of the application was to be allowed to use a drug called NVX-CoV2373 for treating the coronavirus.

Novavax was to file the application in July-September, but apparently, it will apply in Q4, 2021. The reason is bringing production processes to the standards of the FDA. The Wall Street Journal spreads the word that the company has troubles with the supply of certain drug components.

This news didn’t make investors happy: on the same day, Novavax shares (NASDAQ: NVAX) dropped by 19.61% to $189.89, though for the previous 4 trading sessions, the quotations have been growing steadily, by 31.7% total.

Important details of the Q2,2021 report

- Revenue - $298 million, +728%, forecast - $388 million

- Loss per stock - $4.75, +1,483%, forecast - $3.63

- Net loss - $352 million, +1,855%

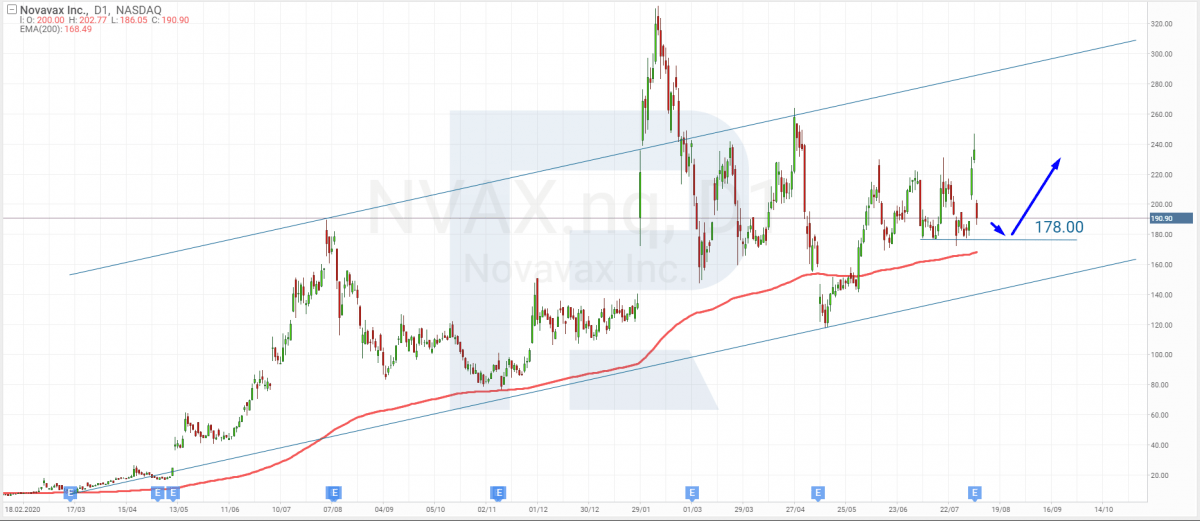

Tech analysis of Novavax shares by Maksim Artyomov

“On D1, the quotations finished the last trading session with a significant decline, closing the gap that had formed before. I presume that the decline will continue, aiming at the support level of $178.

In future, the 200-days Moving Average might act as an additional support level, and a bounce off it will be the beginning of a new wave of growth. If the quotations go on growing, they might reach the upper border of the ascending channel”.

Moderna: growth of profit and buyback of shares

On August 5th, another biotech company from the USA – Moderna – released a report for April-June, 2021. It surprised analysts with the presented statistics that exceeded their expectations noticeably.

Moderna representatives say that this year, the sum of contracts for supplying the vaccine to different countries amounts to $20 billion. For the next year, there are contracts signed for $12 billion. Apart from this impressive data, there is more news for investors: the company is planning a buyback of shares for $1 billion.

However, neither the report, nor the stock buyback plans saved the quotations from a minor correction. In August 5th-6th, the shares of Moderna (NASDAQ: MRNA) dropped by 1.3%, falling from $419.05 to $413.72.

Important report details

- Revenue - $4.35 billion, +6,392%, forecast - $4.2 billion

- Return on stock - $6.46, +2,183%, forecast - $5.96

- Net profit - $2.78 billion, +2,476%

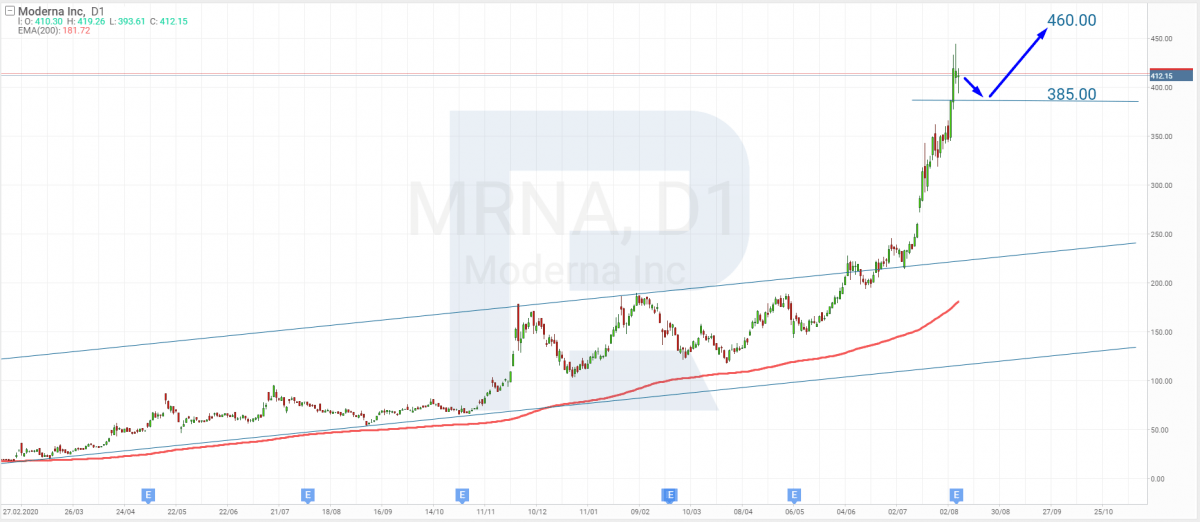

Tech analysis of Moderna shares by Maksim Artyomov

“On D1, the quotations have renewed the high and are now correcting in an uptrend, At the last trading session, the quotations dropped under $400 and then tried to recover.

In the future, the price might correct to the broken level of $385, and after it tests the support level, we may expect further growth. The next goal should be $460. Another signal supporting the growth is the 200-days MA that keeps demonstrating the ascending dynamics”.

Summing up

On Thursday, the shares of two US companies, Novavax and Moderna, started going down. This decrease can be expected by various reasons. In the case of the first company, the postponing of the application to the FDA and a weak quarterly report are to blame. In the second case, experts say that this is a natural correction after swift growth that has been going on for the last months.